Taxpayers rejoice – Republicans pass $2.4 billion income tax cut, the largest in state history

Average savings for a Wisconsin family – $1,111 over next 2 years

The march to a fairer and more equitable flat tax continues

Once again, responsible Republicans jettison Evers’ huge tax increases and all of his policy disasters

Republicans’ budget taxes less, spends less, borrows less and reduces taxpayer-financed government positions

Republicans remove the overturn of Act 10, the repeal of Right to Work, the legalization of marijuana, the elimination of uniform early voting, the cap on School Choice, the push towards government-run health care and every other foolish wish of liberal extremists

Assembly and Senate pass budget on a rare bipartisan vote

Will Gov. Evers, set to run for re-election next year, cave to pressure from far-left base to veto the tax cut? Would Evers veto the entire budget as he has threatened?

Executive Summary

The 2021-2023 Wisconsin state budget has passed with a bipartisan vote in both houses of the Legislature. Now we wait to see if Governor Tony Evers will sign the budget in full, line-item veto out certain provisions while signing the majority of the budget document or if he will veto the entire state budget as he has threatened to do. Gov. Evers has until this Friday to take action on the budget bill.

Before we launch into our analysis of the Legislature’s proposal, which received the support of every Republican and seven Democrats, we would be remiss if we didn’t take time to remind taxpayers of just how awful Gov. Evers’ original budget proposal was.

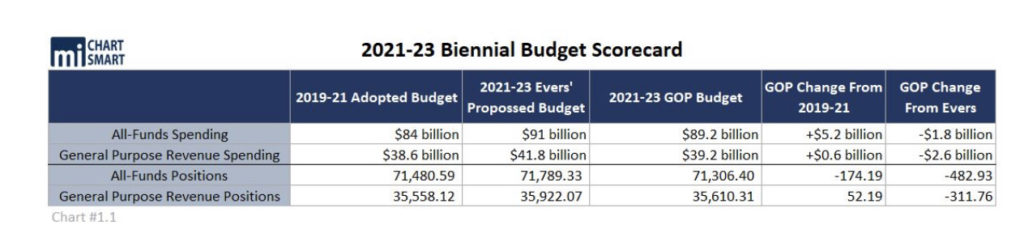

Governor Evers originally proposed a gigantic $91 billion spending plan that, according to the Governor, would help Wisconsin recover from the ill effects of COVID-19 and his shutdown of the state’s economy. Just like the Governor’s first budget, his 2021-2023 budget sought to meretriciously increase the size, scope, reach and cost of state government. The Governor sought to increase spending by an eye-popping $7 billion dollars, raise taxes by $1.6 billion on the many in order to hand out aid to the select few, add 300 more state employees to our already superabundance of taxpayer-financed bureaucrats, borrow a record-setting $3.6 billion in bonding, allow all local units of government to increase property taxes by at least 2% and create dozens of new initiatives to address critical race theory, white supremacy, equity and global warming.

Using the virus as his justification, the Governor attempted to jam dozens of new policy initiatives into the tax and spending plan that had nothing to do with the pandemic. The Governor’s laundry list of progressive and ultra-liberal policy initiatives would:

- Overturn Act 10 and the $14 billion in taxpayer savings (see below) it has provided

- Move the state towards a government-controlled, single-payer health care system

- Legalize marijuana

- Repeal work requirements for childless adults to receive Medicaid benefits and FoodStamps

- Repeal work search requirements for those on unemployment

- Repeal Right to Work protections for the Wisconsin worker

- Eliminate uniform statewide early voting protections and allow an expired college ID to vote

- Dictate that schools teach global warming

- Make it easier for counties and cities to increase the local sales tax

- Impose a new local business property tax based on income rather than value of property

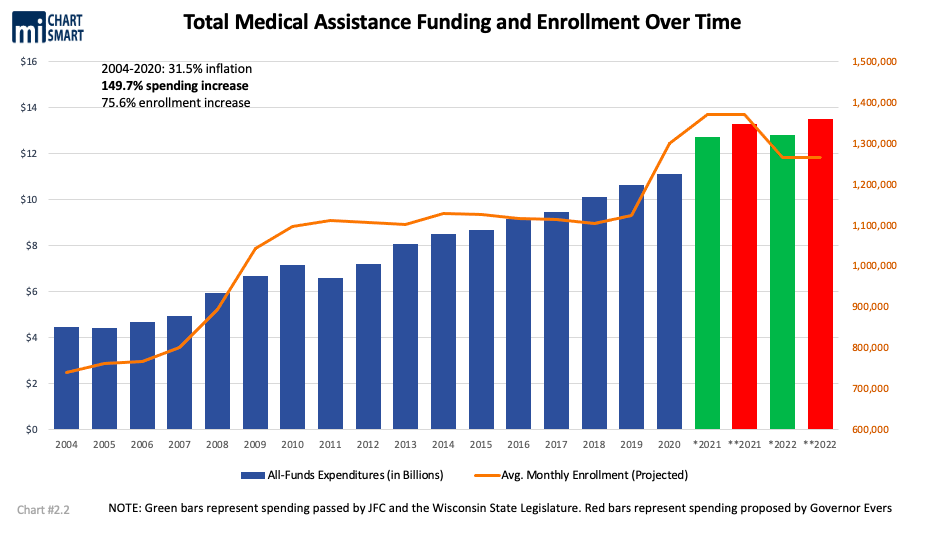

- Expand welfare by accepting temporary assistance from a federal government drowning in debt to unnecessarily grow the Medicaid population

- Prevent the building of new reliable and inexpensive coal plants in Wisconsin by injecting the “social cost of carbon” into the decision-making process

- Require background checks on private gun sales

- Increase the cost of government building projects by requiring they pay artificially-high wages

- Create a new cabinet-level Chief Equity Officer

- Create a new office of environmental justice

- Permit county sheriffs and local police chiefs to “hire noncitizens as officers”

When you lay out all of the bad fiscal policy with all of the radical and far-left program initiatives, it hits you smack dab in the face just how bad a budget this was. It also makes it easy to see why the Evers’ proposal was an unserious, unsustainable budget from the most fiscally reckless Governor in state history.

Assembly Democrats tried yet again today to expand Medicaid to capture additional federal dollars. @repborn points to the state’s $5.5 billion surplus and asks how much money does government need? #WIright #WIbudget pic.twitter.com/s8iLyVJr0L

— MacIver News Service (@NewsMacIver) June 30, 2021

.@SenMarklein explains why it was important for JFC to eliminate the personal property tax in Wisconsin in the 2021-23 state budget. #WIright #WIbudget pic.twitter.com/gdWRU7QTMQ

— MacIver News Service (@NewsMacIver) June 18, 2021

Thankfully, Legislative Republicans quickly realized how much damage the Governor’s budget would do to the Wisconsin economy and our families. They immediately discarded almost 400 different budget items and tax increases, essentially starting their deliberations based off of the last budget.

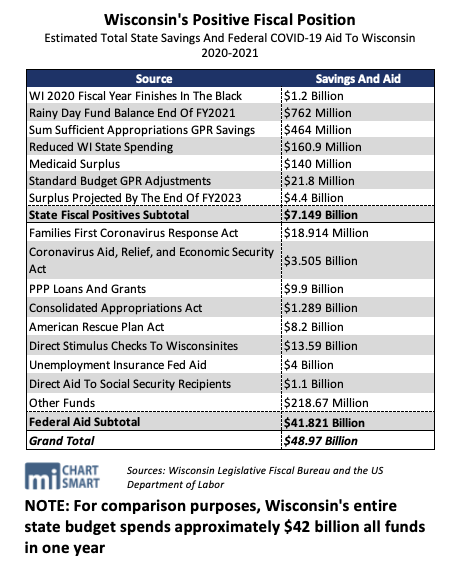

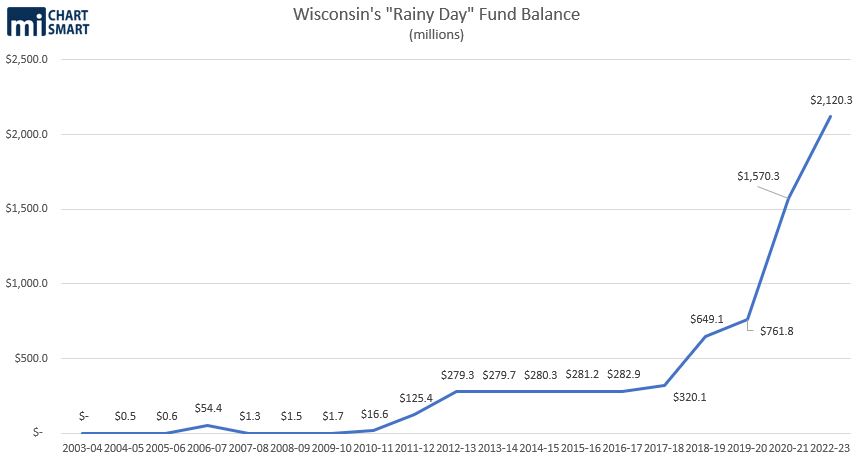

We would also be remiss if we didn’t remind readers again about the unprecedented and unimaginable amount of federal aid that has flooded into Wisconsin in the last 16 months or so. As you can see from the table below, government in Wisconsin and Wisconsinites have received over $41 billion in just over a year to combat COVID-19 and stimulate the economy. For comparison purposes, the entire state budget for the State of Wisconsin spends roughly $42 billion a year. We have received enough federal aid here in Wisconsin to replace an entire year’s worth of spending by state government. So, any politician or bureaucrat that tries to argue that state or local government doesn’t have enough of your tax dollars already is just plain lying.

Even before you consider the gigantic tax cut, in just about every way you look at this budget proposed by Republicans, it is a dramatic improvement from what Governor Evers proposed. Taxes, spending, bonding and government employees all were made better by Legislative Republicans.

When you add in the gigantic tax cut to the analysis, it is clear that this is the best work Legislative Republicans have done in some time.

Letting taxpayers keep more of their money and giving government less of our money is always a good thing. Always.

Not only will this tax cut keep taxpayers’ money where it should be, in their wallets, this tax cut will dramatically reduce the amount of taxpayer money available to fund state government. Let that sink in for a moment.

And in many ways, by rejecting outright over 400 horrible policy ideas contained in Evers’ original proposal, wiping a tax completely off the books or adopting the largest tax cut in state history, Republicans did outstanding and exemplary work to make this budget taxpayer-friendly and something all conservatives can be proud of.

CLICK BELOW TO JUMP TO MACIVER’S ANALYSIS OF

- THE K12 BUDGET

- THE TRANSPORTATION BUDGET

- PROPERTY TAXES AND SHARED REVENUE IN THE BUDGET

- THE HEALTH SERVICES AND MEDICAID BUDGET

- THE DNR BUDGET, AND CLIMATE CHANGE AND ENVIRONMENTAL POLICY

TAXES: THE LARGEST TAX CUT IN STATE HISTORY

The question of taxes provides perhaps the starkest difference between Governor Evers’ budget and the budget adopted by Legislative Republicans.

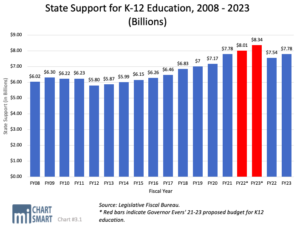

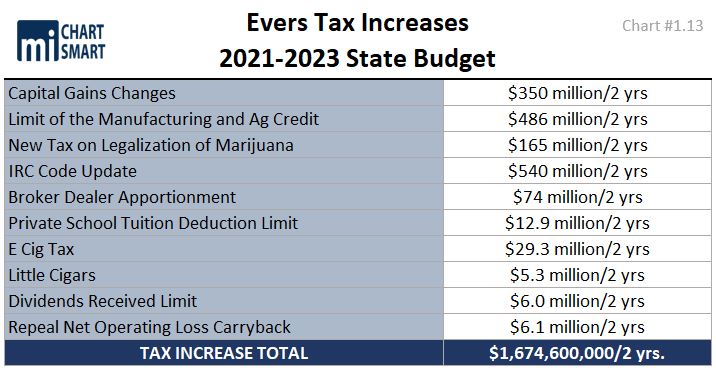

Gov. Evers proposed over a billion dollars in income tax increases and a significant increase in property taxes – at least a 2% annual increase for most local units of government for the next two years. The Governor proposed this massive tax increase despite receiving a massive spending increase of almost $8 billion dollars in the last budget and the state running a surplus recently.

The Governor proposed increasing taxes on businesses, parents with children attending a private school, job creators trying to get our economy back on track, the successful and the majority of the public who have investments in the stock market (see the entire list above). For someone who is counting on the sale of their original home or a long-held stock to fund his or her retirement, the Governor’s tax increase would have been a cruel financial blow that robs their nest egg.

The Legislature, instead of following Governor Evers’ lead to dramatically increase taxes, decided to cut taxes. In fact, the Legislature has proposed the largest tax cut in state history.

On behalf of all Wisconsin taxpayers, we say thank you.

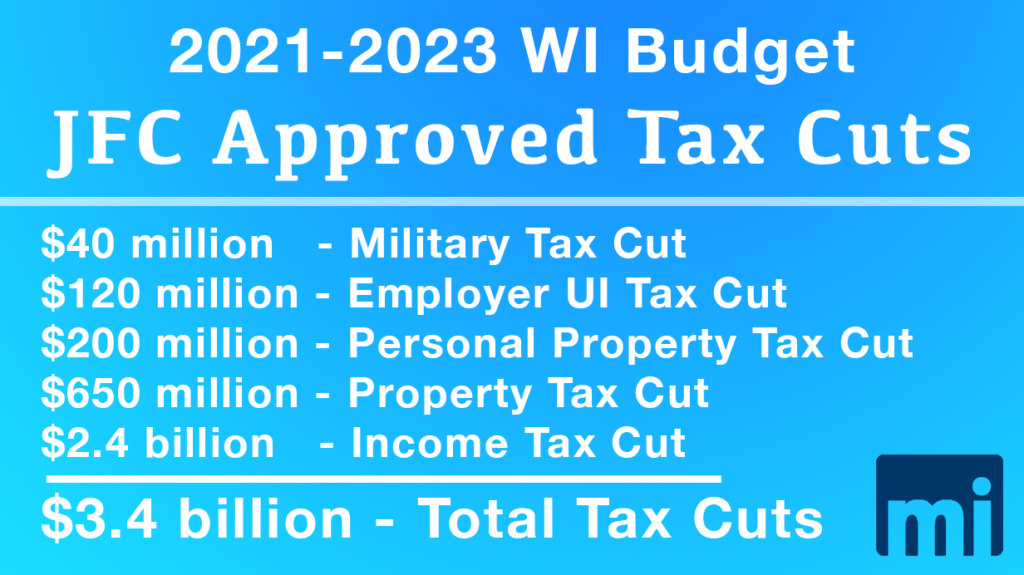

The contrast of Gov. Evers’ $1.12 billion TAX INCREASE compared to the Legislative Republican’s $3.4 billion TAX CUT shows you a fundamental difference in his approach to government.

If Gov. Evers is unwilling to forgo a large tax increase when the state is flush with unexpected revenue, more than enough revenue to pay for critical and vital government services, then his push for higher taxes really isn’t about raising enough revenue to pay for those services. Gov. Evers’ push to raise taxes is about punishing success and targeting certain taxpayers.

We shouldn’t be too surprised by Evers’ vindictive proposal, his far-left radical base has talked for years about the rich paying their “fair share” even though the top 1% of taxpayers pay almost 40% of all the taxes paid.

The Legislative Republicans’ tax cut proposal will lower the third income tax bracket rate from 6.27% down to 5.3% on income between $24,250 a year and $266,930 a year. This will save Wisconsin taxpayers an eye-popping $2.4 billion. Reducing the tax rate on such a large swath of income means that this tax cut will help almost every taxpayer, from the working poor to the successful. This is real, substantial and permanent tax relief that will forever change the state.

Here again, we see a stark difference between the philosophy of Gov. Evers and Republicans. Gov. Evers’ used his billion dollar tax increase on the many to turn around to hand back some smaller tax credits to the select few. Evers’ proposed tax cuts were not true tax cuts at all, but instead a tax shift. Increasing taxes just so you can hand out political favors to your base is wrong. Plain wrong. Dramatically reducing income tax rates rather than tinkering with credits is a much more effective, direct way to fix Wisconsin’s outdated and unfair income tax structure.

Republicans’ effort to cut a tax rate, and such a large cut in that tax rate, for so many actual Wisconsin taxpayers, is real and just tax reform.

Legislative Republicans also eliminated an entire tax, the personal property tax. The personal property tax is levied on businesses for their furniture and other equipment. Politicians eliminating a tax altogether rarely happens and when it does, it needs to be applauded. This is meaningful tax relief for Main Street businesses which operate on thin margins and cannot afford the time and money wasted trying to comply with this archaic tax. The elimination of the personal property tax will save businesses approximately $200 million.

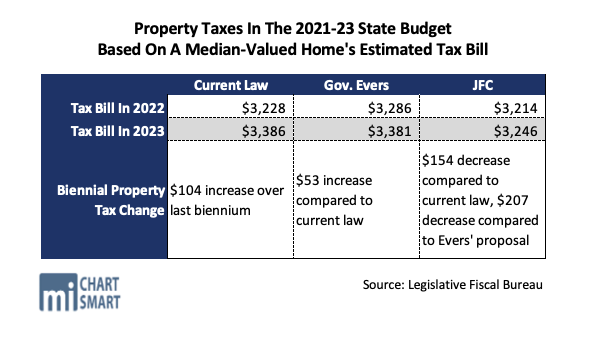

Finally, Legislative Republicans improved upon Gov. Evers’ budget when it comes to property taxes. Gone are the property tax freeze days under Gov. Walker when it was assumed property taxes would be held in check. Gov. Evers is more concerned about making sure local units of government can raise your property taxes than he is about your checkbook. As you can see from the table below, however, Legislative Republicans have trimmed $214 on average off your property tax bill compared to current law and $207 on average compared to Gov. Evers’ proposed budget.

SPENDING: WHY LARD MORE GOVERNMENT SPENDING ON TOP OF MORE GOVERNMENT SPENDING?

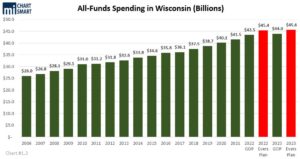

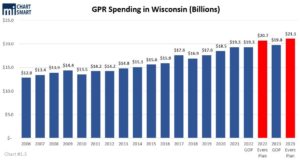

To understand the government spending contained within the 2021-2023 state budget, you need to actually start by looking at the government spending passed in the 2019-2021 state budget.

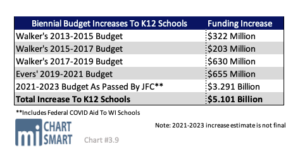

In his first budget, the 2019-2021 state budget, Governor Evers introduced the single largest increase in state government spending ever. Evers proposed increasing spending by a shocking and unimaginable $10 billion dollars. In one budget. For comparison purposes, the budgets signed into law by Gov. Walker generally averaged about a $2 billion increase every two years. Gov. Evers proposed a spending increase five times that average, all in one budget. Thankfully, the Republicans did not agree to that spending level. Unfortunately, Republicans agreed to a $8 billion increase. When you look at spending levels in the 2021-2023 budget, knowing that the last budget contained a historic increase in spending gives the current debate context.

Not deterred in his zealous and continual quest to explode government spending, Gov. Evers only proposed a $9 billion increase in spending this time around. Not a record, but again a staggering amount of new spending.

Again, thankfully, Republicans rejected Gov. Evers’ original spending increase. And Republicans are adamant that this time, they passed a budget with very little new spending.

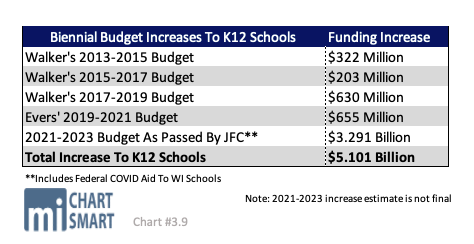

Republicans added about $3 billion for Medicaid cost-to-continue, $650 million to K12 education that becomes property tax relief, $2.4 billion to “pay” for the income tax cut and some other various smaller spending increases. While the overall spending increase of approximately $5 billion is still too high, it does appear that Republicans did very little new or increased spending in general, certainly when compared to the 2019-2021 version of the budget.

To achieve this goal, Legislative Republicans adopted a common sense, taxpayer-friendly approach to spending in this budget: wherever possible, use the massive amount of one-time (hopefully!) federal COVID-19 and economic stimulus aid to fund government operations.

From the taxpayer’s perspective, it doesn’t matter if your federal tax dollars are funding state government or if your state tax dollars are funding state government, state government is being funded either way. Democrats and their special interest allies, of course, wanted to pile “normal” state government funding on top of the mammoth federal funding, which would have just larded more state government tax dollars stacked on the federal government dollars.

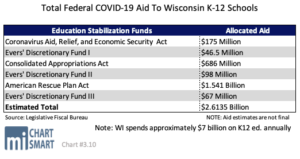

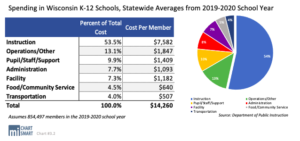

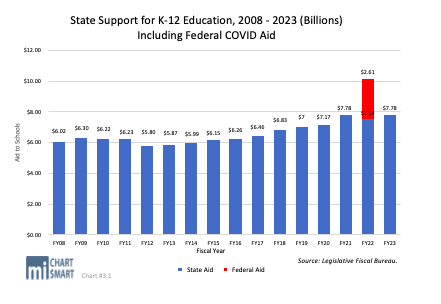

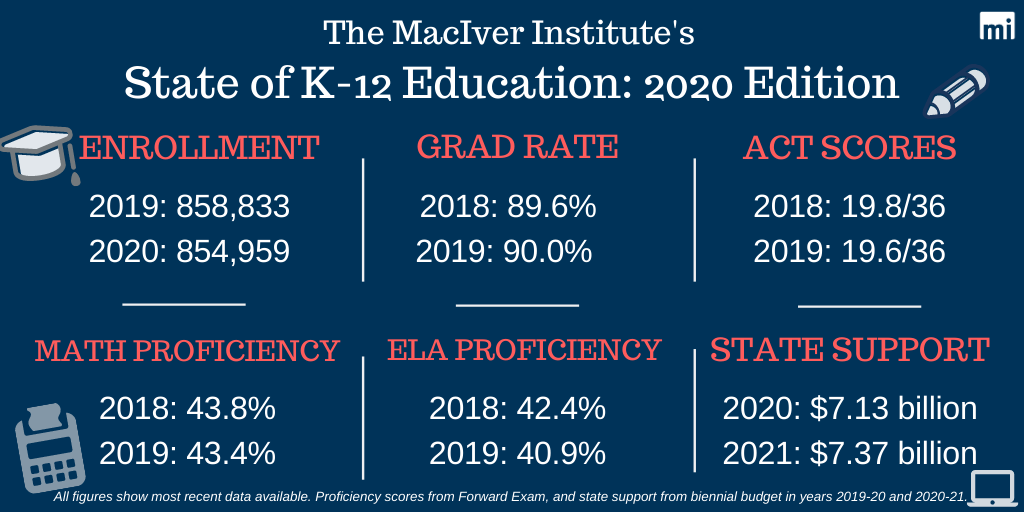

School District Administrators and the education establishment have screamed the loudest about this common sense approach. They object to the use of $2.6 billion in federal COVID money to increase K-12 education spending by 17% to an estimated $17.9 billion over the next two years. They object because they see a once-in-a-generation opportunity to use the virus as the reason to astronomically increase school funding. They object because they would like the state to add on top of that massive amount of federal aid, a “normal” increase of state funding. While they claim that schools can only spend COVID aid on certain expenses, if you look at the plan submitted by the Department of Public Instruction to the federal government, DPI believes that it can be used for “addressing learning loss among pupils, using high-quality assessments to accurately assess pupils’ academic progress and assist educators in meeting pupils’ academic needs, and implementing evidence-based activities to meet the comprehensive needs of pupils.”

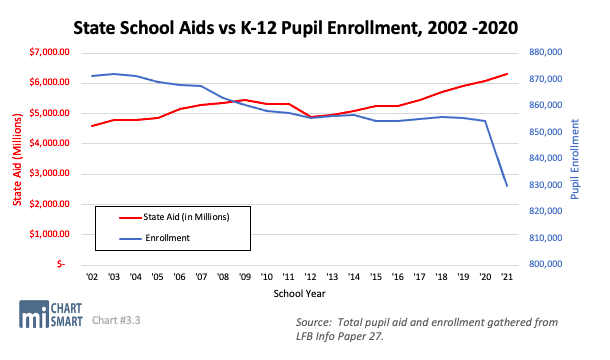

The federal funding amounts to $2,159.23 per student per year, by far a record amount since total student enrollment in Wisconsin’s K-12 schools has been steadily declining for two decades.

If Legislative Republicans had pursued such a irresponsible approach, K12 education funding would have been increased by over $3 billion dollars in this budget alone, even though public school enrollment declined by almost 4% this year and has been flat for years.

Thank God for common sense.

BONDING: HOW MUCH STATE SPENDING ARE WE PUTTING ON THE STATE’S CREDIT CARD?

Gov. Evers proposed general and revenue bonding (borrowing) totaling $3.617 billion. In the 2019-2021 budget, Gov. Evers proposed $2.44 billion in total bonding and the Republican Legislature approved just $1.915 billion. In this budget, the Legislature did even better.

They shaved almost $2 billion off the Governor’s proposal and agreed to $1.676 billion in bonding, a 12.50% reduction compared to last budget and a 54% reduction compared to the Governor’s original proposal.

The less borrowing, the better for taxpayers.

STATE POSITIONS: HOW MANY BUREAUCRATS DO TAXPAYERS’ NEED TO EMPLOY?

Gov. Evers once again proposed a dramatic increase in the size of the government workforce, paid for by you, the taxpayer. In the 2019-2021 budget, Evers sought to add 701 government workers. Ultimately, the Republicans signed off on adding 482 new positions, bringing our total government workforce here in Wisconsin to 71,480. My goodness, 71,000 state government workers.

In the current budget, Evers wanted to add 308 new positions. Republicans instead rejected the 308 new positions and eliminated 170 currently authorized positions, for a net reduction of over 400 government positions. While not nearly a big enough reduction, it certainly is a step in the right direction.

All this is not to say that this budget is perfect. In fact, we laid out specific ways we believe the Republican budget should be improved.

We, too, would have liked to have seen language added that addresses the radical left’s attempt to push Critical Race Theory in our schools, in government programs and in our daily lives.

Or language that would have made it clear that partisan third-party groups with an agenda should have no role in the administration of our most basic right, fair and free elections.

Or language that, given how many of our kids are failing in a traditional school setting and how many parents were frustrated by mandatory virtual “learning”, would have changed the K12 funding formula from one that funds school districts and buildings to one that funds the actual education of the child, no matter where he or she decides to receive that education. Public, choice, private, charter, virtual, open enrollment – the funding should be the same. Force true competition on a level funding field to finally drive academic improvement for all of our children.

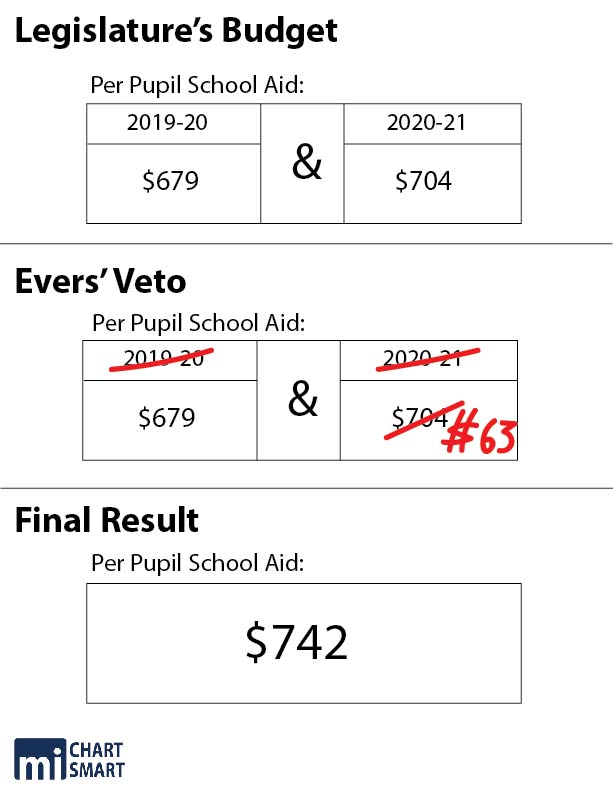

That being said, we must acknowledge that Gov. Evers and his use of the veto pen makes any discussion about adding policy to a budget document a risky proposition. The Governor’s veto pen is strongest in a budget document. The Governor’s veto options are limited if language is passed through “normal” legislation. As he proved in his first budget, Gov. Evers has no qualms about using the veto pen to grow the size and scope of government, something we are fundamentally opposed to and work against every single day. The Governor literally vetoed into existence a higher spending amount, something most taxpayers would agree is wrong and should be illegal.

Adding language that the Governor can use to turn a positive (a ban on CRT in our schools) into a negative (CRT is required in our schools), by way of the veto pen, is worrisome for us.

Taking the risk of adding extensive policy language to the budget document is not worth it, and so the omission of extensive policy language by the Legislature is the final reason why this budget is a very good budget that is deserving of Wisconsin conservatives’ full-throated support.

Editor’s Note: When Governor Evers makes public his vetoes of the Legislature’s changes to the 2021-2023 state budget, MacIver will publish the updated information to this analysis and a detailed assessment of the final document.