When even McDonald’s is becoming unaffordable, America’s inflation problem has become a full-blown crisis.

May 23, 2024

Perspective by Dan O’Donnell

Want to fully understand the devastating impact on inflation on the American family? Look no further than a fast food menu. Prices on basic items like McDonald’s cheeseburgers and Chick-fil-A nuggets have risen as much as 200% in less than five years with dire consequences for the lower- and middle-class families who make up much of the fast food customer base.

The Labor Department reports that over the past decade, prices at “limited service restaurants” (i.e. fast food joints) have risen by 47%, but research into specific sandwiches and sides at some of the nation’s largest chains reveals even bigger price hikes. In late 2019, a beefy five-layer burrito at Taco Bell cost just $1.69. Today, it’s $3.99. A nachos bell grande in 2019 was $3.29 in 2019, but upwards of $6.19 today.

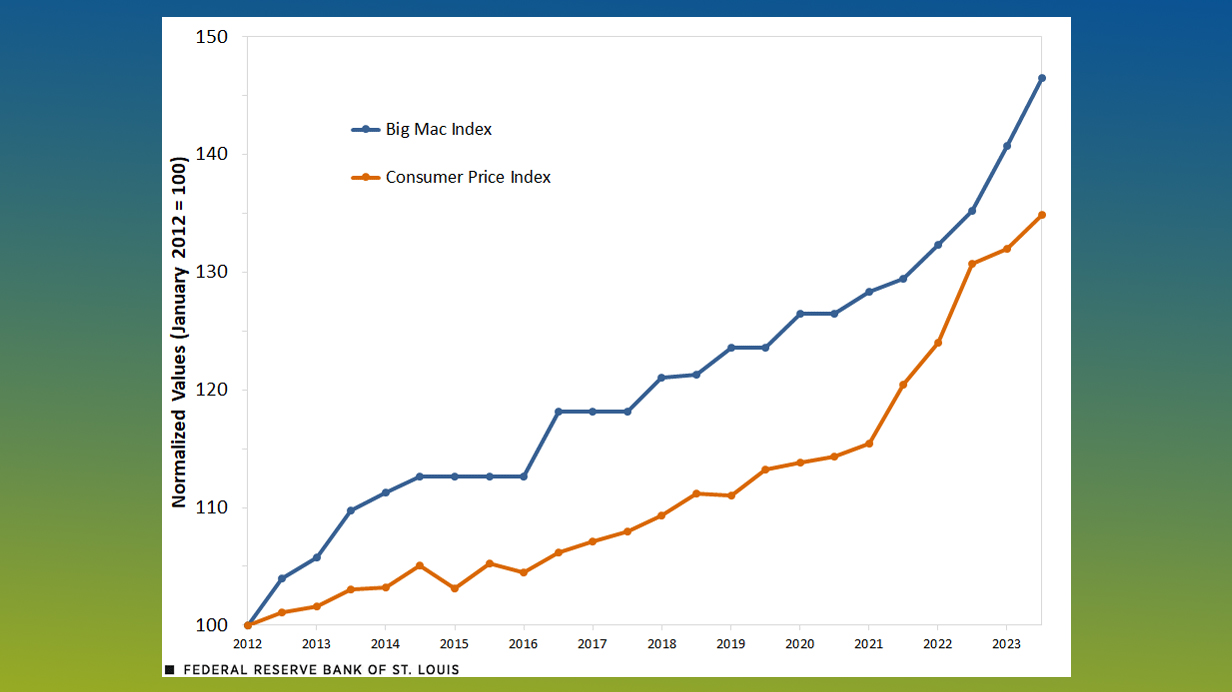

Prices, of course, vary by location and even across different restaurants in the same location, but the so-called Big Mac Index provides a solid benchmark for comparison. Originally published by The Economist in 1986 as a lighthearted illustration of purchasing power across countries, the Big Mac Index is now often substituted for the traditional “basket of goods” standard for determining just how much one can buy for a certain amount of money.

It is also incredibly instructive in gauging the impact of inflation on the average family. In 2020, the average price of a Big Mac in the United States was $4.89 but has risen to an average of $5.69 today. While that may not seem like much, the price of the fries and soft drink that accompany it have risen much higher, pushing the price of the now-ironically named “Extra Value Meal” to more than $15 in some locations and more than $10 in most.

This is not, as the White House has repeatedly insisted, the result of price gouging, but rather the shockingly high cost of wages and food production for restaurants like McDonald’s and Taco Bell. Since their business model is entirely predicated on providing quick, convenient meals at low prices, they can ill afford to price their menu items out of the reach of their bargain-conscious customer base.

Fast food patrons are generally lower-income earners—many with young children—who rely on a quick, affordable meal before soccer practice or a band concert. When prices at these restaurants spike from $35-$40 for a family meal to $65-$70 in just a few years, those families either have to sacrifice a night out or extend themselves just a little further to afford it.

This would be bad enough if inflation under President Biden were limited to fast food or even restaurant prices more generally, but food-at-home prices have increased by 21% in just three years (after rising by 18% over the preceding decade). Home energy costs have soared by more than 30%. Rents are up 21%.

All told, the average American family is paying $1,069 more per month for the same goods and services it was just three years ago. That’s $246.69 every week or $35.24 every single day, and it represents the most insidious form of taxation in existence because of how regressive it is.

A wealthy family might be easily able to absorb this additional burden, but a poorer one will struggle and be forced to dip into savings just to make ends meet. Personal savings, which typically average 6.2% of an individual or family’s income, have now dipped to 3.8% and record numbers of Americans have fully depleted their nest eggs just trying to stay financially afloat.

Because of this, 44% of Americans can no longer afford a sudden $1,000 expense, while 28% have absolutely nothing saved for retirement. An additional 30% don’t think they’ll ever be able to retire. Really, though, how could they even be thinking that far in advance when affording dinner for their kids has become such an ordeal?

When even fast food is slipping out of reach, it’s clear that America’s inflation problem is now a full-blown crisis.