Evers refuses to use billions of unused federal relief monies he controls to fund his election-year tax shift

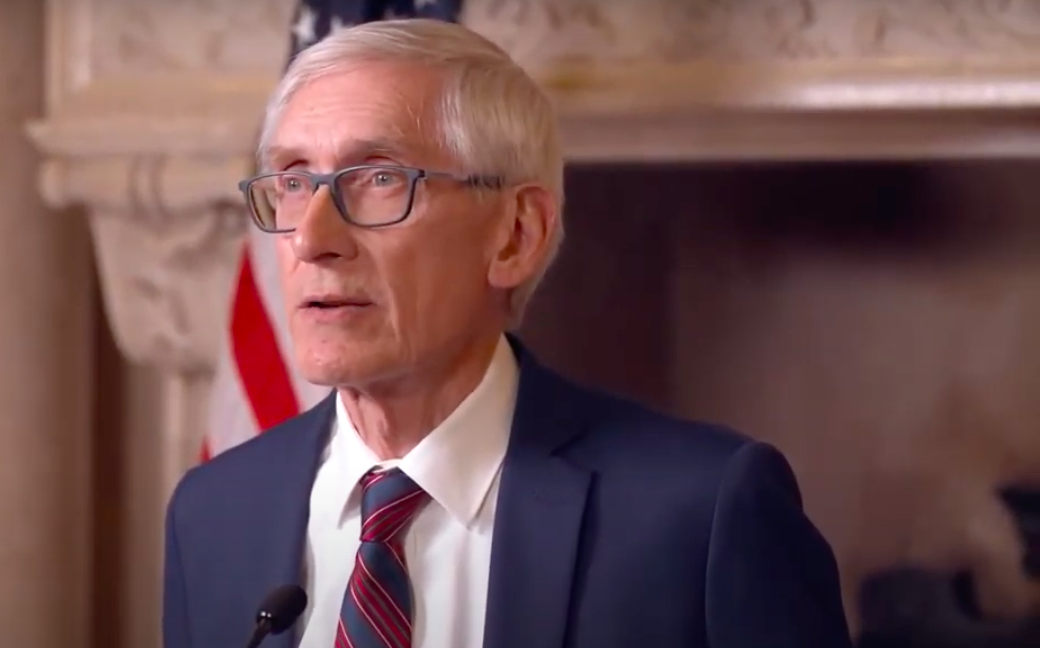

It’s no accident that on the anniversary of unchecked rioting that resulted in death and destruction that could have been prevented by a governor, any governor, who wasn’t putting violent criminals ahead of victims by pushing Scold-and-Release crime policy, Tony Evers is posing as a tax cutter.

In a clear election season gimmick, Tony Evers – the governor who proposed billions and billions of dollars in tax hikes during his 3+ years in office – is again trying desperately to stake out a position as the tax-cutting candidate in the race.

The Real Evers Tax Proposal Record:

- Twice proposing over a billion dollars in tax hikes

- Tax hikes on farmers, food processors, and manufacturers

- A 30% hike in the gas tax – and is far too often the case with Evers, he lied about what other states were doing, to justify his proposal

- Opening the floodgates for unfettered local property and sales tax increases

In addition to his tax increase proposals – blocked by the Republican legislature – Evers has been playing politics with his veto pen, hoping to conceal his real tax-to-the-max policy agenda.

Within days of taking office, Evers, who campaigned on a promised middle-class tax cut, vetoed just such a bill put on his desk by the legislature.

His excuse? That he would only do a tax swap, not a tax cut, so he could increase spending. If the middle class were to get Evers promised “tax cut,” they’d have to pay more out of their other pocket.

Now, in a tight race he sees slipping away, Evers is proposing spending one-time state surplus dollars – something he decried in the past – on a “tax cut” proposal that’s a retread of failed past proposals.

The Evers Election Year Hail Mary Tax Plan would pick winners and losers; while some would see tax decreases, his use of one-time money guarantees that other taxpayers would permanently pick up the tab.

Evers wants to use up the potential budget surplus comes while he sits on over $2.3 billion in unspent federal funds over which he has complete control. If he were serious about his new tax shift plan, he could use those funds. But he isn’t serious.

The truth is Evers has vetoed multiple middle-class tax cut proposals while proposing billions of tax increases, and actions speak louder than words.