Faced with uncertainty and rising prices, consumers are buying more and more on credit.

Mar. 6, 2024

By Michael Lucas

Biden’s administration, via the Consumer Financial Protection Bureau, recently imposed a price control on credit card late fees. The regulation institutes an $8 maximum late fee on card issuers and providers who administer more than 1 million credit card accounts. Typical late fees ranged from $25-30 for those who missed their first payment, but this new regulatory price control would reduce the limit by more than 73%.

No one likes paying late fees, but to institute a price control to reduce them is to ignore the important role that fees play. When banks and other credit card providers issue credit to debtors, the imposition of a late fee for failure to make payments on debt is an obvious incentive that benefits the creditors and the debtors. Those who miss a payment on their debt take a credit hit. If by reducing the cost of late payments the Biden regulatory agencies think they’re helping debtors, they have totally neglected the fact that they’ve created a moral hazard, incentivizing more late payments. How will this affect their ability to borrow in the future?

While the folks in D.C. probably think they’re doing debtors a valuable service, banks and financial institutions who issue credit are not the principal lenders—depositors at these banks are the lenders. When consumers take on credit card debt they are borrowing from the other depositors at their bank. The bank is merely an intermediate manager and facilitator of the loan. By reducing the cost of being late on credit card payments, banks will need to find other ways to mitigate this risk by reducing the availability of credit via lower credit card limits, higher minimum bank balances, higher transfer fees between checking and savings accounts, or some other means of risk management.

This new price control makes it clear that Biden’s administration is ultimately unwilling to address the real source of the issue, and instead would like to label banks and financial institutions as the culprits of the current economic hardship facing Americans. But as far as the facts are concerned, rampant inflation over the last three years has caused prices to skyrocket. Given that real wages have not increased nearly as much as the general price level, Americans are finding ways to cover their expenses in an increasingly unstable economic environment. Faced with uncertainty and rising prices, consumers are buying more and more on credit.

With average savings already being quite low, consumers much prefer to purchase everyday items on credit rather than dip into their savings. A 2022 survey by The Motley Fool Ascent put median savings at $4,500. In 2023, median savings balances had fallen to just $1,200. Is it any wonder, then, why credit card debt has soared? Americans don’t have the means to pay their bills and so have resorted to borrowing. And now, in their infinite wisdom, Biden’s administration is going to further encourage borrowing instead of addressing the root cause of the current economic hardship.

This situation is so dire that current credit card debt is at an all-time high, with the New York Fed reporting that 4Q2023 credit card debt was more than $1.1 trillion. Furthermore, the annualized delinquency rate on credit card debt was a staggering 8.5% compared to the 3.1% delinquency rate of all outstanding debt.

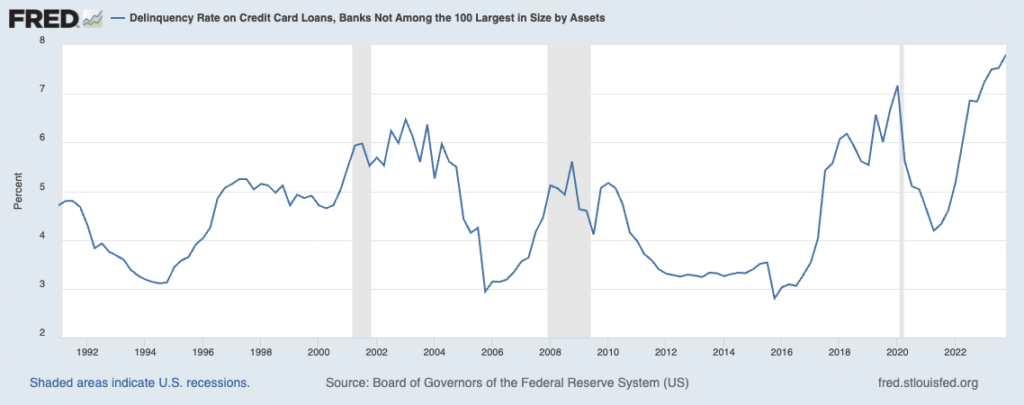

Commercial banks that are not among the top 100 largest banks have seen delinquency rates increase dramatically over the last two years, further supporting the fact that in an inflation-rich economy, reductions in real wages incentivize consumers to borrow on credit.

If the regulators in D.C. and the Biden Administration had any understanding of economics and the role of prices, instead of supposedly “sticking it to the 1%,” they would stick it to the Fed and reign in the disastrous guineapig experiments they run on the American people every single day.

Instituting a price control on late fees is nothing more than political grandstanding—a nice looking band-aid on a non-existent wound when we are hemorrhaging blood from our jugular. As if FDR’s reign was not a painful enough lesson, the administration is going to do more of what doesn’t work. Prices coordinate activity among billions of people throughout the world and across time. Prices inform us of the opportunity cost of a decision, the risk associated with a course of action and the desires of consumers. Prices are the data of economic reality by which we orient ourselves in an otherwise confusing world.

Of course, since we understand economics, we would never even begin to think about micromanaging the economy; deciding on the “right” price or the “true” price. But politics is a different beast. The first lesson of economics is scarcity. But the first lesson of politics is to disregard the first lesson of economics.