Six Things to Know About the Milwaukee Bailout and Shared Revenue Bill

Racing Through the Legislature

- Conservatives across the state have promised to grow local government by a half billion dollars, and their local officials plan to hold them to that promise.

- It paves the way for a tax increase of a quarter-billion dollars for the Milwaukee Bailout.

- Pressure is mounting to allow Milwaukee officials to bypass taxpayers to enact sales tax increases directly.

- The Milwaukee Bailout doesn’t require all new tax revenues raised be devoted to their underfunded pension systems.

- The quarter billion Milwaukee Bailout may not be enough to stave off insolvency.

- It looks like it’s about to get much worse.

Mainstream media are reporting that legislative leaders have gone to Governor Evers asking how they can amend their Shared Revenue/Milwaukee Bailout “deal” to get his blessing.

Not sure why it is necessary for Republicans to further negotiate on their legislation grab bag when they told the western world to great fanfare that they had a deal that needed to be rushed through the legislative process because it was so great, but we will set that aside for the moment.

There are still many fundamental questions that are unanswered and basic information that is missing before taxpayers, and fiscal conservatives for that matter can be comfortable that the original deal is good for the state and a good public policy solution.

Now we hear that the original deal is being changed behind closed doors for Governor Evers, which raises even more questions. Whatever the deal was, it’s only going to get worse for taxpayers.

What provisions from the original deal will be discarded to secure Evers’ support?

How much new money, and how many new programs will be added to secure Evers’ support?

Have Republicans capitulated on taxpayer approval of the Milwaukee sales tax increases?

So while legislative leaders desperately scramble for ways to earn Evers’ approval, we will continue to seek answers to the basic questions taxpayers have asked.

UPDATED 5/17/23 – The Assembly has released a memo detailing amendments to the shared revenue/Milwaukee bailout bill that come after negotiations with Governor Evers.

Predictably, attempting to appease the Governor increases the shared revenue price tag by about $35 million.

Since the governor has not committed to sign the bill, Republicans apparently were negotiating with themselves – again. Expect the price tag to continue to grow as Legislative Leaders attempt to secure the bill-signing support of Governor Evers that somehow has eluded them to date.

The amended formula assures no local government gets an increase of less than 15%, up from 10%, except Milwaukee, which gets 10%.

An added $18 million goes to counties that received less than a 500% increase.

The amendment keeps the loophole allowing Milwaukee to use revenues from the increased sales tax for purposes other than shoring up their pension systems.

The amendment adds another broad spending category to the list of acceptable “costs” that the new shared revenue program can be used to pay for – court costs. The list now includes law enforcement, fire protection, emergency medical services, emergency response communications, public works, transportation, and court costs.

The amendment would allow local public health officers to shut down businesses for more than twice as long as the original bill – from 14 days to 30 days without a vote of the local governing board. Seriously??!!

Isn’t it amazing how quickly Republicans forget the whole Covid shutdown, the government-forced isolation, and the autocratic overreach by public health officials? Remember how we were promised by public health that we just needed to isolate for two weeks to stop the spread? Remember how wrong public health was on just about every strategy or prescription they tried to force on us? Remember the supposed righteous indignation by conservatives and Republicans over Fauci, Palm et al? Guess that was just for show.

Now, Republicans are going to reward public health officials here in Wisconsin for their performance by giving them a full thirty days of absolute power over our lives, our businesses and our freedom? We would love to know who specifically requested this change.

It also allows the local government to extend such an order for twice as long. Under the amendment a business can be shut down for a total of 60 days; under the original bill, it was limited to 28.

It appears that the amendment tries to head off potential union collective bargaining shenanigans in Milwaukee by specifying that public safety employees may not bargain for changes to Mke pension system benefits or payments.

The amendment removes the quota-type number of citations as a measure of public safety maintenance of effort but requires every community to keep or increase their level of expenditures or staffing, regardless of local need.

The amendment now only requires a 2/3 vote by Milwaukee government on new program spending or new positions if the sales tax increases are imposed.

There are many other changes in this amendment including new language on TIFs that we are still researching and analyzing. We will update you as more information becomes available. Now back to our original analysis.

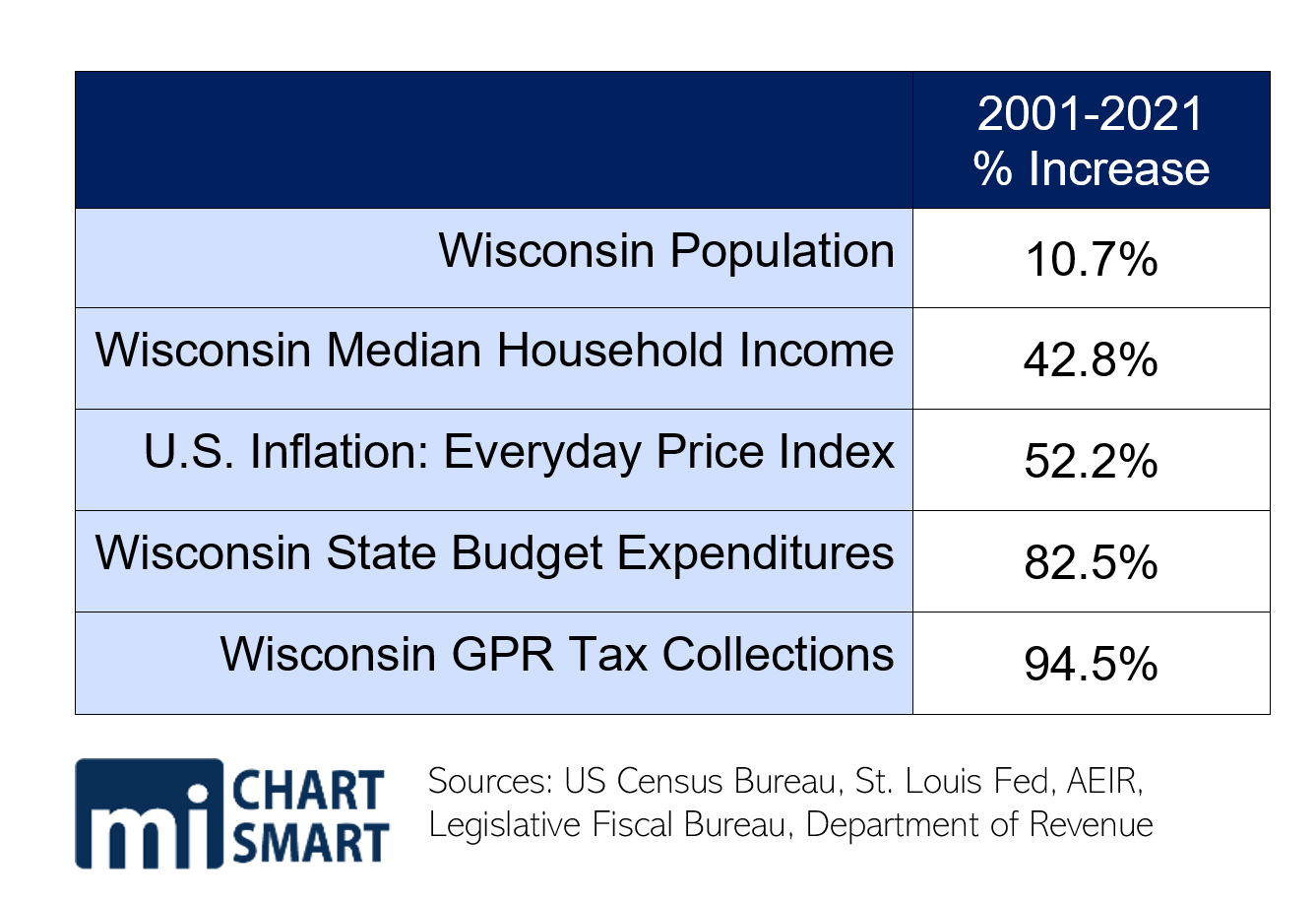

Conservatives used to say that a big surplus is bad for taxpayers.

They had two reasons. First, a surplus means the government already took more from taxpayers than it needed to fund government. And second, a surplus is an irresistible temptation to indulge in more spending and create bigger government.

When we pay for groceries and hand over $100 for $90 of food, we expect our change. But when we hand over $7 billion more than the state needed to run already-bloated government, we watch policymakers debate how to spend it on programs to ‘benefit us’ as though we couldn’t put our money to better use in our family budgets.

The historic $7 billion state surplus, which was adjusted down by 1% Monday, is part of a perfect storm of conditions that is seeing Republicans in the legislature propose big spending and taxing increases.

With $7 billion ‘free’ money just laying around and nearly 7 billion ideas on how to spend it, and the difference between conservatives and liberals has come down to what they want to spend it on.

With an opportunity to make meaningful tax reform, deliver across the board cuts to taxpayers who pay among the highest income taxes in the nation, in a state with among the biggest tax code disparities, the biggest goal conservatives seem to have is how to spend a half billion more on bigger local government, and how to allow Milwaukee to tax their way out of budgetary problems of their own making.

Milwaukee Bailout and Shared Revenue Bill

We’ve already covered the many questions taxpayers deserve an answer to about the bill. But to recap, the major portions of the bill:

- Increase shared revenue to local units of government by a minimum of 10%.

- Send 20% of all future state sales tax revenue to local units of government to spend.

- Sends money to locals who find ways to save money.

- Rescues Milwaukee from budget and pension problems by allowing increases in the sales tax in the city and county (while also increasing their shared revenue payments from the state.)

The bill is in answer to pressure from local governments who say they have been unable to provide basic services because the state shared revenue payment has been frozen for nearly 2 decades and their local levy has been frozen (allowing for growth) for even longer. Locals say they can’t keep up with inflation, and the big surplus allows the legislature to send more money to help local government grow, and perhaps lessen complaints from local officials.

Milwaukee shares these concerns and adds to them their self-made pension crisis, which they say puts them in danger of bankruptcy which will be A Very Bad Thing for us all. Listen to our Newsmakers Podcast where we fact check these predictions.

Is The Problem Real?

Local governments say there is not enough state aid flowing into communities. They say that the shared revenue formula was frozen decades ago, and that, combined with levy limits, has not allowed them to keep up with inflation, and has forced cuts in necessary services to taxpayers.

Shared revenue has been frozen. But has local spending has been cut? Not at all.

As we’ve reported, local revenues have increased, and local government spending has increased. And while the local levy limits do put a ceiling on tax increases, it’s important to remember the reason they were put in place was to stop year after year of huge property tax increases. Levy limits are working as intended. Moreover, the increase in local spending during this time of ‘deprivation’ is above the growth in household income and well above the rate of inflation. It is ironic that government, specifically President Biden’s economic policy, created the inflation crisis that now government is complaining about and the reason why government needs more money from taxpayers.

One comparison that makes the local government spending increases look small is a comparison to state spending increases during the same period. Some of that increase came from picking up the tab for items that were on the property tax rolls (personal property tax, technical colleges, etc.) but although the legislature has been in Republican hands for most of the past 2 decades – meaning they OK spending – spending is increasing, and the pace has picked up in the last 8 years.

This explosion in state spending may be part of the reason state lawmakers are sympathetic to locals who haven’t been able to keep pace with the spending by their Madison colleagues.

Are Locals Better Stewards of Tax Dollars?

Locals have increased spending at a slower rate than the state, but as we discussed above, only because of levy limits. There are certainly more recent examples than the property tax hell of the 70s and 80s which resulted in levy limits that call into question the ‘locals always know best’ argument.

Many people have asked for details about the spending of the billions of APRA dollars that flowed into the state but gotten few answers. The Evers Administration has made Wisconsin among the least transparent of states in terms of how state pandemic aid was spent. And forget any statewide accounting of how local governments spent their funds. For most towns and villages, it takes going through the minutes of every meeting where spending was acted upon for over 2 years to get an idea of how they used the money. Many don’t even bother to post their budgets on their websites.

But we know some things some locals spent ARPA money on:

- Building the existing LGBTQ+ children’s collection at the library

- Solar panels on the roof of the village hall

- Paying bonuses to staff who worked (and were paid) during the pandemic

- A new skate park

- Hiring a social worker to “forge deep and dependable relationships”

- Hiring more Diversity, Equity and Inclusion staff

- Artificial turf athletic fields

- New staff who will work to find more state and federal tax dollars to fund new programs started with pandemic aid, when the pandemic aid runs out.

Given the few limits placed on spending of federal pandemic aid, these expenditures don’t create an image of local units of government barely able to make payroll.

The legislature is taking a similar approach with the new shared revenue funds. There are few limitations on how locals will spend the money. And because the other revenues available to locals will be freed up by the influx of cash the limits are all but meaningless.

If The Problem Were Real, Would This Solve The Problem?

If one accepts there is a problem in every municipality acute enough that every unit of government needs more state funding, then a plan that provides a minimum of a 10% boost in state aid – and in some cases more than a 700% increase would seem to be massive enough to solve the problem for years to come.

Not according to the local government officials who testified. Their virtually universal message was that this massive windfall is a much-appreciated drop in the bucket, but not nearly enough.

Further, tying future aid to the sales tax means that in difficult economic periods, the aid may well decrease, as it has a couple of times in the past 15 years. The officials who addressed that concern – and few did – said they’d figure it out. Presumably for many of them that means coming back to the state with one hand out and the other holding a tear-drenched hanky.

It’s a plan where there are only winners, but even the biggest winners say is no more than a stop-gap. It’s hard to call it a solution.

Does The Formula Bake In Different Imbalances?

The formula used to provide increases provides a bigger bump to smaller communities, but then freezes that change into the formula. It’s an incredibly difficult undertaking to change a massive statewide formula (although willingness to assure there are no losers makes it easier) and layering changes into a flawed base may be easier but not better. But it’s worth a look at a couple of examples of how the changes impact similar communities.

Village Comparison

The suburban Village of River Hills will get a 275% increase in their shared revenue. This follows about $105 per person in ARPA funds, which they largely spent to put solar panels on the village hall, and used a bit left over to give bonuses to staff.

Meanwhile the rural Village of Bangor in La Crosse County, with nearly the identical population, will get only a 48% increase to their shared revenue. Bangor apparently does not feel it necessary to post their budget on their website so it’s anyone’s guess how they spent their ARPA funds.

Both villages will get roughly equal increases in shared revenue per capita under the plan – just over $36 per person in each village. But for Bangor, that increase is about 11% of the amount of their total levy, while in River Hills it’s not even 2%. River Hills levys over $3 million and Bangor levys less than 1/6 that amount, under a half-million.

Township Comparison

In townships we can see a similar effect. The town of Trimbelle in Pierce County and the town of Arena in Iowa County have similar populations of around 1,600. They each get roughly $35 increase per capita under the bill in their shared revenue payments. But while Arena’s levy is under $250,000, Trimbelle’s is more than double that at about $550,000.

Does a village of 1500 on one side of the state need 6 times the amount of tax levy to provide services as a village of 1500 on the other side of the state? Does a town in the northern part of the state need nearly double the levy of one in the south? Is the new formula baking in disparities that reward bigger spenders? Does the bill simply add more money to a system that does not look at frugality or need?

The Milwaukee Bailout

While Milwaukee will get its share of increased shared revenue (a combined $28 million additional shared revenue payments), the bigger prize for them is the bailout of their budget, and pension systems. With the huge surplus and the Republican National Convention heading to town, Milwaukee finally has the ear of the legislature.

Local leaders seem to have been successful making the case to legislative leaders that the success of next year’s Republican National Convention may be imperiled by Milwaukee’s pension woes. They seem to have suggested that cutting government services, like police, would be bad for the convention, and that a bailout will fix any potential unpleasantness. The idea that the proposed bailout will turn things around in a city – one that continues to see increases in homicides while rates in other large cities are declining – in just a year’s time is laughable. But it seems to have had impact.

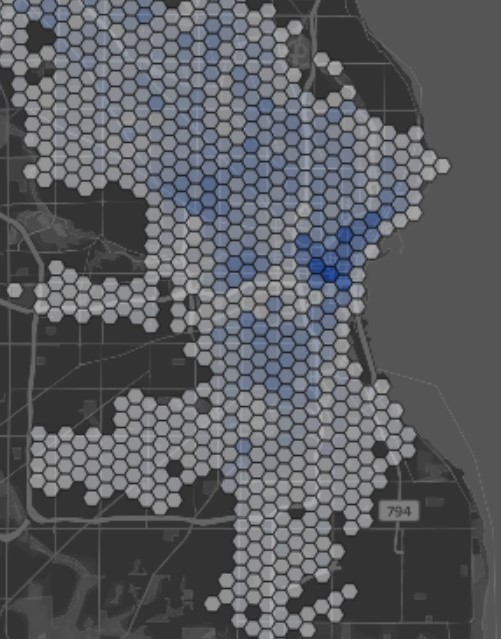

The convention will be located smack in the middle of the city’s worst crime hotspot and like any event in the city – like walking to your car – these days, safety is a major concern.

But capitulating to not-quite-said-out-loud proposition that the city has to have a bailout or there will trouble for the RNC in 2024 seems like a bad public policy precedent.

The image below is the City of Milwaukee Police Department’s Incident Map for the past year – the region that’s shown in darker blue near the lakefront is where the national committee will convene in July of next year.

Milwaukee Pension Problems

Bailing out Milwaukee’s pension programs are a central component of the plan.

The City and County of Milwaukee have their own pension systems while the rest of the local government employees in the state participate in the Wisconsin Retirement System (WRS). For decades Milwaukee hasn’t managed their pension systems responsibly.

The combined unfunded pension liabilities of Milwaukee and Milwaukee County are roughly $2 billion.

The problems are legion in both systems – they set their assumed rates of return unreasonably high making the fund appear healthier than it was, they increased benefits without regard to future pressures, they went years without making contributions. The systems are both underfunded and the ratio of working contributing members to benefit recipients is dropping.

When the city finally put in place a plan to periodically review future contribution needs, they planned an adjustment only every 5 years. In 2018 the contribution was set at $71 million per year. Now, in 2023 the adjustment is expected to nearly double.

Act 10 helped Milwaukee put off thinking about the pending pension problems by requiring employees to contribute to their pensions. But police and fire were not treated the same as other employees; only those hired after 2011 pay toward their pensions, so many officers are not contributing. And we see how that is impacting Milwaukee. To fund the current pension benefits for their police and firefighters, the contributions to the pension fund need to be in excess of a quarter of their salaries. Even with a 7% contribution from the employees, the city must contribute close to 20% of the salary for police and fire employees to their pensions.

The Bailout Plan Isn’t New

The city has been pushing elements of this bailout plan for years. The Milwaukee-specific portion of the bill mirror closely Tom Barrett’s pension task force recommendations: bring new employees into the state retirement system, have a dedicated stream of shared revenue for public safety employees, let the city implement a sales tax to help shore up the fund.

This bill would require new employees to be enrolled in the state retirement system, a move meaning both the city and county will be contributing to two different pension systems. Moving new Milwaukee local government employees to the state retirement system is a action not without precedent. The state has had to take over in other areas where Milwaukee has shown itself unable to provide responsible government, such as child welfare.

The bill would also require Milwaukee (both city and county) to go to referendum to ask to raise (and in the case of the city, impose) the sales tax to fund pension obligations and public safety expenditures. The county could raise the sales tax by 0.375% and the city could institute a new 2% city sales tax.

In testimony, press conferences and news stories, Milwaukee officials and the business community have voiced their opposition to the referendum requirement. Trust local officials, they say. If we ask, the voters will say no and we’ll be stuck, they say.

We know what’s best for Milwaukee, Milwaukee leaders say.

Does Milwaukee Know What’s Best?

Over the years, the rest of the state has rubbernecked at the disaster of Milwaukee government – city and county. Wasteful spending, corruption, deliberate policy choices that have led to the fiscal (and criminal) problems they have today. But that wasn’t us, they say. That was other, bad leaders, and we’re different.

Has Milwaukee Turned Over A New Leaf?

Milwaukee government (and they are not alone in this) has been intractable in terms of election administration concerns. The city is being sued over allegedly using government resources to help Democrat-organizations with get-out-the-vote in 2022.

Recently we saw the county decide to spend ARPA funds to pay down private health care debts. And to pay for health insurance for people who don’t qualify for Medicaid, in a locally funded quasi-Medicaid-expansion. We’ve seen the city choose to spend pandemic aid for physical ‘traffic calming’ alterations to help slow down reckless drivers.

Milwaukee government has unfortunately not become a hotbed of fiscal restraint or even basic responsibility. Their pension problems are the result of a history of bad choices, including years with no contributions at all.

And now they want a bailout.

Year After Year With No Contributions

The City of Milwaukee made no pension contributions between 2004 and 2009, and in both 2011 and 2012 they contributed only $800,000. In 8 of the 10 years from 2009 to 2018, it appears money was taken from the pension reserve fund, used for who knows what.

The city has $1.3 billion in unfunded pension liabilities, roughly $45,000 per pension member – members include those working, those retired and those who have deferred retirement.

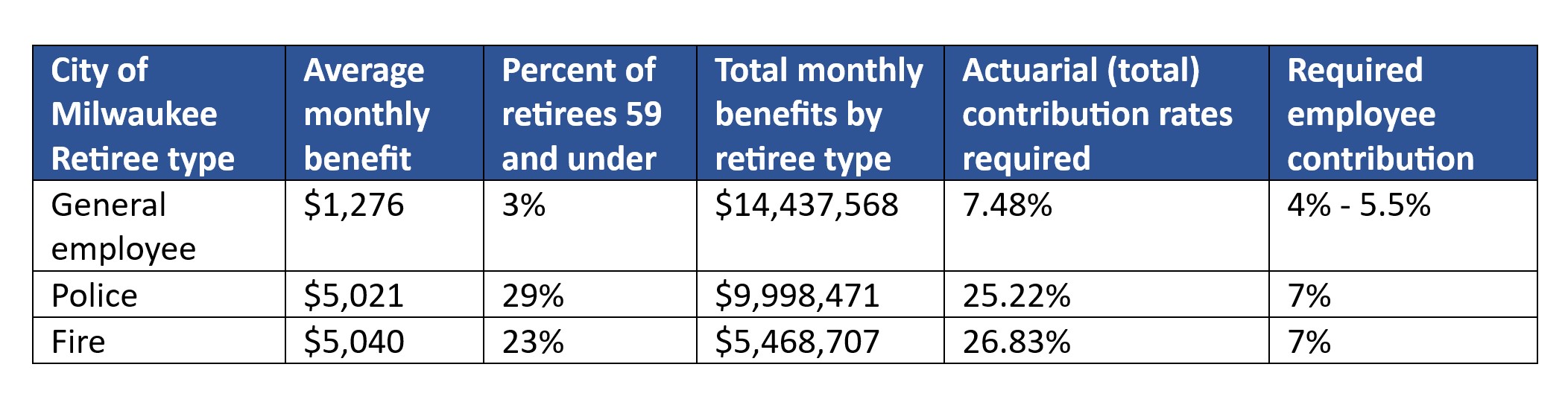

According to a 2021 actuarial valuation report on the city’s pension system, the average payment to retirees is over $30,000 per year. Digging into these figures shows how much the problem will grow in the coming years and makes plain how little thought was given to planning for future needs.

Many of the employees receiving the highest benefits – police and fire retiree benefits average over $60,000 annually – are young and will have many years in the system. In 2021, $10 million per month was being paid out to police retirees alone, over $3 million to retired cops not yet 60 years old. Police and fire are 27% of total city retirees but account for more than half of the monthly retiree payments.

Milwaukee County has similar fiscal challenges with their pension system. However, with fewer protective service employees in their system, the average monthly retirement benefit in 2021 was a much lower $1,981. The average age of retirees is 72, and only about 7% of their retirees are under the age of 60.

But the county has unfunded liabilities of $569 million. They failed to make the full required contributions between 2012 and 2016, although they did contribute. And where the city’s pension system is about 83% funded, the county’s is only 75% funded.

Unquantified Impacts, Unintended Consequences

The unintended consequences of legislation can easily have the most impact in the long term. The timeline has made it difficult to determine if many of the potential impacts of the Milwaukee bailout have been considered or if there are plans to address them.

New and existing officers and firemen would be in separate pension plans. No public discussion of how to handle – or even acknowledgement of – the problems that will result from differences in contributions and benefits between union members in the same workforce but in different pension plans.

The sales tax would be set to sunset in 30 years. Since a number of retirees are in their 50s and some even younger, the Milwaukee pension system could be actively paying benefits to retirees well past the 30 year mark. Is the plan for the city to pick up the full tab at that time? There does not seem to be a requirement that the city work to fully fund all future benefits as soon as possible, with benchmarks of expected progress.

The biggest question is whether – or how – the sales tax revenues will be able to support the increasing demands of the local pensions while the local workforces whose contributions help fund retiree payouts will shrink every year while the benefits paid increase every year.

A Look at the City of Milwaukee

In 2021, just shy of $30 million a month is paid out to roughly 11,000 retirees in the city’s system. While the number of retirees is growing, the number of active members (those working and paying in) is declining. The last year where there were more workers paying in than retirees receiving benefits was 2010, and the ratio was down to .77 in 2021, and .73 in 2022. Fewer workers paying in to support more retirees puts pressure on the contributions needed.

The city’s actuary projects that the expected benefit payments will increase by 85%, based on current members, from 2022 to 2041.

So as new employees go into the WRS under provisions of the bill, the ratio of workers paying in to retirees receiving benefits from the city plan will plummet, forcing city contribution rates up. Ending the pension system this way means every year the city will face two strong upward pressures on their contributions, the increasing number of retirees and the decreasing number of working employees helping fund benefits.

A model showing an idea of the timeline, the amounts contributions will need to increase to meet the future need, and whether new sales tax revenues will be close to sufficient to sustain them should be a required component for this decision.

With an unfunded liability of over $1.3 billion, and new sales tax revenues not required to be dedicated entirely to the pension problem, it’s reasonable to wonder just how far $194 million in annual sales tax revenues will really go under reasonable assumptions of revenue growth and rate of return.

A model that shows the new revenue will be sufficient would be a selling point; none has been released. If this deal was a true attempt to solve Milwaukee’s pension problem, wouldn’t an outline of how long it will take for this solution to fix the problem be the first analysis created?

But a quick look at some topline figures raises the question about when the sales tax will end. The current monthly outlay to retirees is about $30 million; the estimated city revenues resulting from a 2% city sales tax just under $194 million per year. The required contribution is expected to be around $130 million each year from 2023 to 2027, and the city has budgeted only $100 million. The bill specifies only that the sales tax revenue should be used to pay ‘required contributions.’ Once they have met the minimum required contribution, the bill allows the city to spend the rest of the revenue on public safety.

It’s a no-brainer that the city – given it’s history – would want to have extra spending money instead of plowing all the new revenue into the pension system. It’s less easy to understand why the legislature would want to give it to them.

But in the years the city made no contributions, no contribution was ‘required.’ And meeting their required contributions over the last 5 years has not improved their situation. In 2018 the pension was 89.9% funded, now that’s dropped to only 83.4% funded. The unfunded liability has increased slightly. Merely making required contributions and spending the rest will prolong the full funding of the pension plan and higher sales taxes being paid by residents and visitors to the city.

It’s nearly impossible to imagine a good public policy reason to structure this bailout with such a huge loophole instead of requiring every cent to be plowed into the pension system. The quicker the fund is built up, the more returns will build. The city faces years of rapidly increasing contributions, and if there is to be a bailout, allowing locals – who have proven themselves nearly criminally irresponsible on pension financing – to contribute the bare minimum and spend the rest is itself nearly criminally irresponsible.

Does the Milwaukee Bailout Solve Milwaukee’s Pension Problems?

It allows them a source of money to use (in part) for their pension liabilities and requires them to make required contributions. But it also allows them to spend the new revenues on other things guaranteeing they will keep kicking the can down the road. The growing cost pressures of a diminishing number of employees paying in to the local systems may well be dwarfed by the sales tax revenues available, setting the stage for another bailout in the future.

Referendum

The question of whether Milwaukee must go to referendum on the sales tax may be the only thing that can stop the bill. The governor has said he wants no referenda requirements (and more funding) and has promised a veto.

But that’s far from a sure bet since so many Republicans seem to want very badly to increase local spending. Badly enough to send a lot of money to local coffers with virtually no strings attached. Some of them want bigger local government badly enough to negotiate up to the governor’s position.

The progress of this bill, with just hours between introduction and hearing and bypassing committee work on amendments and going to the floor needing changes may also help push it through. It will be hard for the many legislators who have been selling a deal to give every one of their local governments at least 10% more state aid to let that promise die over whether or not Milwaukee voters get a say. Other local government officials won’t want their new funding held up by an argument over a Milwaukee referendum. After all, most municipal and county governments haven’t wanted to ask their voters for more money either.

With a leading argument for the Milwaukee Bailout being if we don’t ‘do something’ quickly state taxpayers will be on the hook, an easy excuse for bypassing local control will be that we shouldn’t take a chance on Milwaukee taxpayers when we might be left holding the bag.

A Final Note: The Maintenance of Effort Provision

The bill is a Christmas tree of provisions, from quarry regulation to limiting the ability of unelected public health officers from closing businesses indefinitely. But one that stands out as troubling is the provision requiring maintenance of effort for law enforcement.

The bill requires all local governments to certify yearly they are keeping the same level of law enforcement as the previous year. This provision includes the number of arrests and citations as potential measures of their maintenance of effort.

Requiring governments to keep a level of service, even when no longer necessary, is was anathema to conservatives. While the laudable goal is to keep communities safe by preventing local officials from defunding police departments, requiring communities that have declining population (or other reasons for diminished need) to keep a potentially artificially high level of coverage, and using the number of arrests and tickets as a measure of service, constrains many to punish the few.

If schools sought a mandate of a maintenance of effort as measured by a specific number of teachers or a specific number of lesson plans regardless of their enrollment we would strongly object, as we do here.

This may seem like a long and lengthy list of questions but that reflects how little taxpayers know about this deal and the uncertainty surrounding its viability. We hope our elected officials will take the time necessary to get taxpayers the answers we deserve before this new and ever changing deal is rushed through what should be a deliberative process.