Wednesday, a proposal to overhaul the state’s shared revenue formula was introduced and a hearing held Thursday.

Testimony came largely from local officials and lobbyists who were united in one message: Thank you, but it’s not enough.

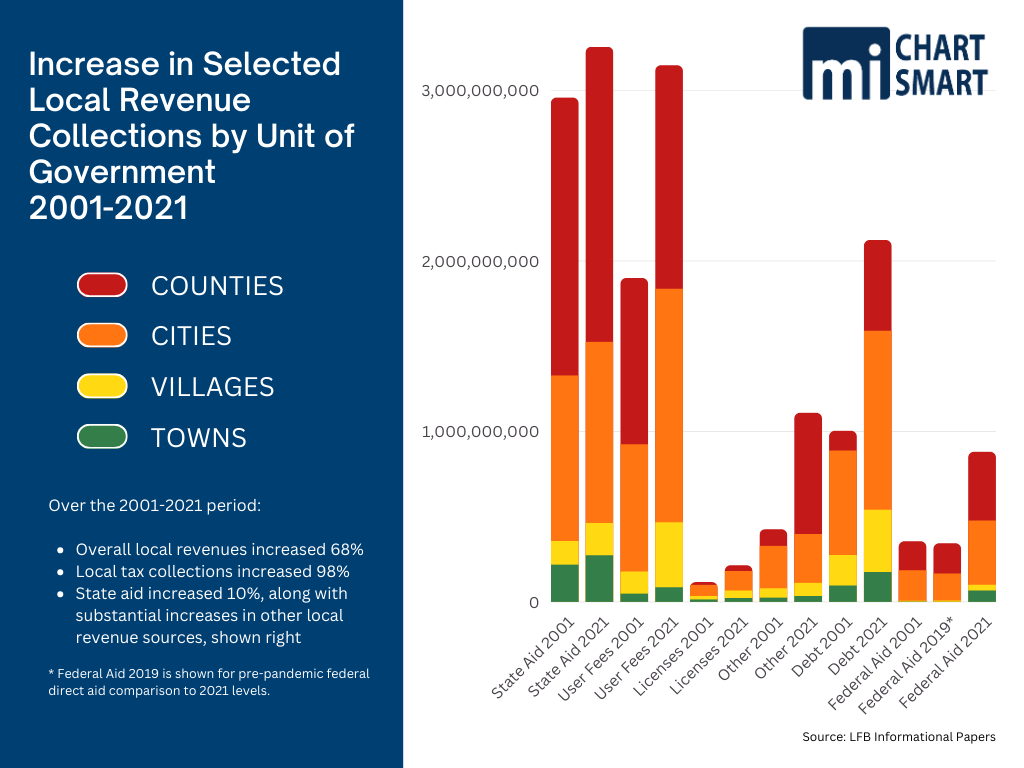

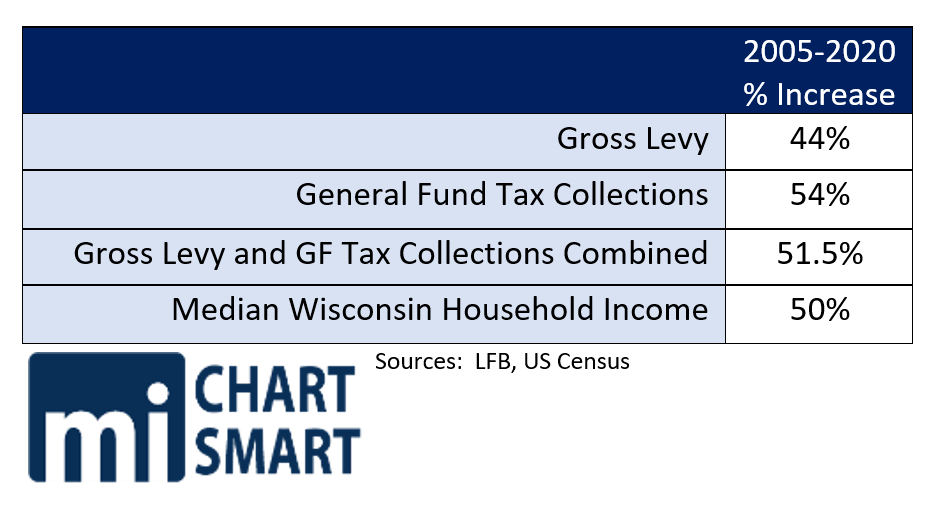

In looking at the increases in spending, revenues and levy at the local level, as well as notable examples of wasteful spending of pandemic funds, we have strongly questioned how truly desperate local governments are. Government spending is increasing at a far greater pace than household income. Big government is taking a bigger chunk of family budgets.

And we question why the state taxpayers, and anyone who visits Milwaukee, have to help bail out the city and county that have, for years, and at every turn, rejected responsible governing, and mindfully spent themselves into this situation where they now eagerly await a bailout, and stubbornly oppose limits on the local irresponsibility that put them into this situation.

This bill seeks to solve the problems local governments say they’re struggling with, but despite a huge new investment, locals are saying it’s not enough.

Thursday’s Top Takeaways

The bill is not soup yet.

The authors and committee chair repeatedly acknowledged there would be changes coming. Local government officials consistently characterized it as a starting point, one that falls far short of meeting their needs. The governor has promised a veto, also saying it falls short of his marker.

Some of the local government officials testifying characterized the increases as:

- Merely allowing them to make payroll

- Enough to fund 1/3 of a police officer

- Just holding off the crisis

The uncertainty as to what might be in the final package, and the fact that the governor seems not to have been part of the negotiations and apparently feels no pressure to support the plan as it stands, means the future of the package is in question.

The hearing also left more questions than answers – there were very few questions, and virtually none on some of the critical areas of a plan with a high price tag and lasting impacts on state and local spending.

We have reported on the increases in both revenue and spending of local governments, as well as some examples of uses of pandemic aids that call into serious question the reality of the fiscal desperation local officials claim.

Here, we are including the basics of the shared revenue and bailout portions of the bill, along with some of the questions taxpayers should have (we do!) that went unasked and unanswered during the hearing.

The Bill Basics

Statewide Changes

The bill changes the formula for distributing shared revenue, increasing the amount and tying future growth to growth in sales tax revenue by creating a new fund, from which shared revenue is paid, financed by 25% of all state sales tax revenues taken in. Last year, the state portion of sales tax collections was roughly $7 billion; 20% would be $1.4 billion. Shared revenue payments are currently $753 million.

Nearly a quarter billion additional dollars are allocated for police, fire, EMS, public works and transportation expenditures. Other funding increases include police training reimbursement, 911 grants, and EMS provider funds.

Every unit of government would get a minimum of a 10% increase in shared revenue, and according to those who have seen distributional tables, most much more.

It creates a $300 million Innovation Fund to incentivize and help finance local government cost savings.

Strings Attached

Locals face a penalty if they do not meet a maintenance of effort requirement for police/fire/EMS.

Milwaukee (city and county) must increase police staffing, with maintenance of effort requirements.

Some funds (Milwaukee city and county) are directed to courts, correctional officers.

Questions That Need To Be Discussed And Answered:

- Are local governments truly destitute and in desperate need of a massive increase of taxpayer funding? See charts above.

- Why should state taxpayers bail out the lavish and reckless pension plans of the city of Milwaukee and Milwaukee County?

- How much has the City of Milwaukee and Milwaukee County paid towards their pension plans for the last twenty years? Is this a case where the irresponsible local politicians, rather than fully paying for the pension they promised their government employees, just kicked the can down the road to create this bailout crisis?

- Since all the locals that testified said it wasn’t enough, how long before the state is back at the table with another influx?

- During negotiations, how much did the locals say it would take to actually solve the problems?

- Was there any consideration of placing limits on local governments preventing them from allowing outside funding and administration of elections?

- Some of these communities have gone to referendum to ask for more money and been denied. Towns under 3,000 population, and there are more than a thousand of them, can raise taxes by a vote at an annual meeting. Does the state want to be in the business of second-guessing the residents, and simply taking tax dollars out of a different pocket?

- Given how consistently locals testified this is not enough of an increase, what happens when sales tax revenues fall, as has happened twice in the last 15 years by more than 3 and 4 percent?

- How meaningful are the ‘limits’ on what the shared revenue dollars can be used for? Only a few categories were not included, and with additional state funds, it frees up local revenue to boost spending in those other categories.

- What kinds of limits will there be on allowing locals to outsource to non-profit entities? If Green Bay wanted to outsource their IT to, say, a group like CTCL (the non-profit that funneled Zuckerbucks into communities to buy access to election administration) would that be permissible or wise?

- Maintenance of effort requirements for public safety are clearly aimed at making sure locals do not defund their public safety employees. But government requirements that don’t recognize local needs cause unnecessary spending – what is the option for a community that may have a decreased need for services?

- What will the funds currently used to pay for law enforcement training be repurposed for? Does training mean instructing officers how to check their white privilege and make sure criminals feel valued while they cause more mayhem on our streets?

- Was there any discussion about Act 10 provisions applying to all public employees?

- Increased numbers of police in Milwaukee is clearly needed, but unless the justice system – courts, DA’s office, etc – change the way they do their jobs (using the changes on bail requirements, pursuing charges, ending excessive plea bargaining and the scold-and-release policies that put criminals back on the street), it’s not going move the needle. Was there thought to requirements other than more police officers?

- What is the plan for how agencies will be able to hire more officers, and does it involve more than just increased pay?

- What kinds of reporting will be required on police and fire staffing levels, and what is in place to prevent phony claims? In his reelection, and at the hearing, Mayor Genrich in Green Bay claimed to have added police officers, when in fact he cut their numbers.

- Was there consideration of building a new shared revenue formula rather than adding layers on top of the current formula? A number of communities expressed that the new elements don’t appropriately recognize needs, and this will perpetuate inequities that disadvantage different communities. How was this set of factors arrived at?

- Was there any consideration of putting specific limits on the transportation spending – we’ve seen expenditures like “traffic calming” projects, roundabouts, safe streets initiatives – would some guidelines have been appropriate? Governor Evers just took $46,579,500 out of a roughly $1 billion federal transportation grant to spend on climate change projects, not roads or bridges, so the diversion of funds from basic transportation needs is a serious concern.

The Milwaukee Bailout

Locals, legislators and lobbyists joined in ringing alarm bells about Milwaukee nearing insolvency and going bankrupt. That fear – the only specific downside mentioned was a potential hit to the state bond rating in the event of bankruptcy – is the genesis of the bailout plan. The legislation puts in place a few strings, leaving others on the table.

City and County of Milwaukee Bailout

Allows Milwaukee, both city and county, to levy additional sales taxes with approval at referendum from the voters. The city would be able to charge up to a 2% sales tax and the county could increase their existing rate by 0.375 to .875. If both passed at the max, that would be an additional 2.375% sales tax for purchases in the city. In 2021, the County collected about $90 million in sales tax revenue from the existing half-cent tax.

The revenues from these sales taxes may be used for paying down pension liabilities and public safety. The taxes would sunset when the pension liability is paid. There are audit and report requirements, and penalties if the funds are not used as required.

Strings Attached:

In order to increase the sales tax, both units of government must add new employees to the state retirement system, limit their spending on cultural items to 5% of the total budget and require two-thirds vote of the governing body to increase spending or positions.

Additional Strings for the City of Milwaukee

They may not use hiring practices that use social constructs like race and gender in hiring and promotion decisions.

They cannot use any of the new tax dollars for the trolley

Requires a number of changes to the governance of their police and fire commission.

Questions That Need To Discussed And Answered:

One of the talking points for the sales tax increases has been that it will go to pay off the pension liabilities that are driving them to insolvency.

But the bill allows the sales tax revenue to be used for new public safety spending as well – not just to clear the pension liabilities.

- Doesn’t allowing the funds to be used for other purposes just delay ending the pension problem?

- What is the reason that all the funds raised are not exclusively dedicated to the pension shortfall?

- How does the bill assure the tax truly sunsets as promised?

- Milwaukee’s elected officials have willfully exacerbated their pension problems with poor, reckless and unnecessary spending – how will this plan stop that?

- Milwaukee County has recently voted in both a plan to spend more than a million dollars to cancel private medical debt, and another million plus to fund health insurance for people who do not qualify for Medicaid. It argues that they feel little pressure to solve their problems and are just looking for the state to allow them to increase taxes.

- What is to stop Milwaukee from implementing a guaranteed income program that would shift the burden of the additional sales taxes away from Milwaukee residents and on to visitors and businesses?

Sticking Points

The major sticking point is that the governor has promised a veto. And negotiating up to meet his requirements will make this already-costly plan even more so.

Milwaukee’s sticking points are a bit different than the balance of the state’s largely because there are many more provisions in the bill that impact Milwaukee (city and county) as part of the bailout.

Milwaukee Concerns:

They do not want to have to get voter approval for the sales tax hikes and prefer the legislature puts faith in the local elected officials.

They don’t like the limitations placed on them, particularly (but not only) the super-majority vote to increase spending or positions.

Balance of the State:

It’s not enough additional funding.

The innovation fund dollars are not useful since they already do all they can.

Other Provisions

There are numerous other provisions in the bill, we have not covered here including quarry regulation, Stewardship project approval, and ambulance staffing, and among them, a couple we like.

We have long supported consistent, comparable reporting of local government finances. The bill includes a requirement for DOR to publish a report, made available online, that would provide comparable tax collection, license revenues and use of public funds. This is a start, but falls short of the comprehensive information on staffing, benefits, and other information that would allow real comparisons between units of government and identification of best practices. A static report is one step, but an interactive dashboard would be preferable.

The bill also contains limits on public health officers from closing businesses more than 2 weeks without a vote of local government to extend no more than 14 days.

Despite the public statewide announcement of a bipartisan and historic shared revenue deal, it is clear from the first hearing this week and Governor Evers’ veto promise, that this is still a work in progress. Hopefully, the politicians involved will remember that we taxpayers too have questions and concerns about this government spending package that need attention. Our concerns deserve to be addressed first, before they try to make this package “better” (translation: more expensive) for the very irresponsible units of government that forced this crisis on the state.