69% of all districts ask their employees to pay 12% or more of monthly premium as required by Act 10

Taxpayers spend more than $20,000 a year on the average school district family health plan

Use of taxpayer-friendly High Deductible Health Plan (HDHP) continues to grow, 38% offer HDHP now

August 13, 2020

By Ola Lisowski

The average public school district employee contributes 11 percent to their monthly premiums, leaving taxpayers to pick up the rest, according to a new report.

Nine years after Act 10 allowed school districts more flexibility in choosing health insurance policies, many districts have changed plans to require bigger contributions from their employees. Still, taxpayers are on the hook for tens of thousands of dollars in insurance costs for each employee.

Some districts don’t require their employees to pay anything toward monthly premiums, according to the expansive new report from the Department of Administration (DOA).

Out of 421 public school districts, taxpayers in 26 districts (6.2%) pay the entirety of employee monthly health insurance premiums for single plans. For family plans, 24 districts (5.7%) pay all of the monthly premiums.

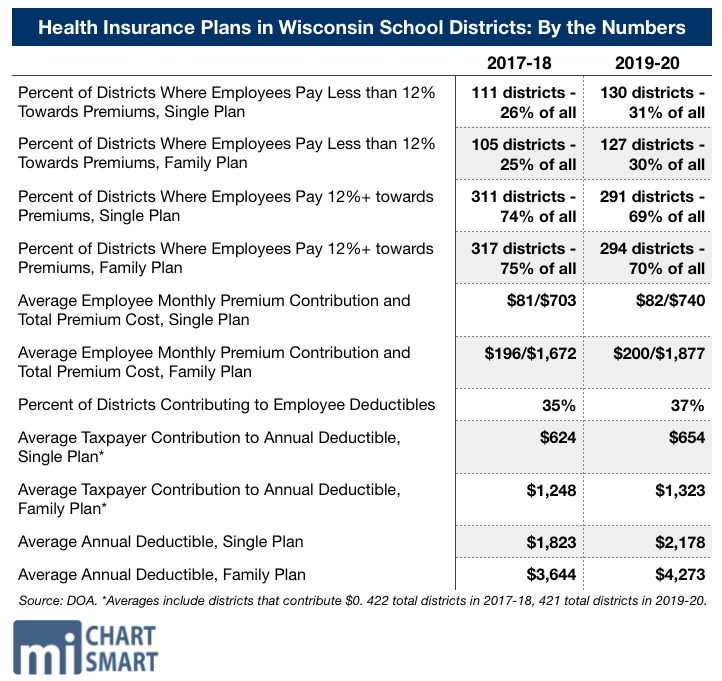

The average monthly premium for a single plan is $740.25, and the average monthly employee contribution is $81.84. School districts pick up the remaining $658.41 monthly, which means taxpayers spend $7,901 on the average school employee health insurance single plan every year. The total value of single plan premiums is $8,883 annually.

Family plan premiums cost an average of $1,877.32 per month. While employees contribute an average of $199.75, taxpayers pay the remaining $1,677.57 each month. Annually, the family plan premiums cost taxpayers $20,131 per school district employee. Family plan premiums are worth $22,528 annually.

Under 2017 Wisconsin Act 59 (the 2017-19 biennial budget), DOA must publish information on school district health insurance plans, including data on premium contributions, costs, deductibles, providers, and even co-pays. All figures in the latest dataset come from the 2019-20 school year.

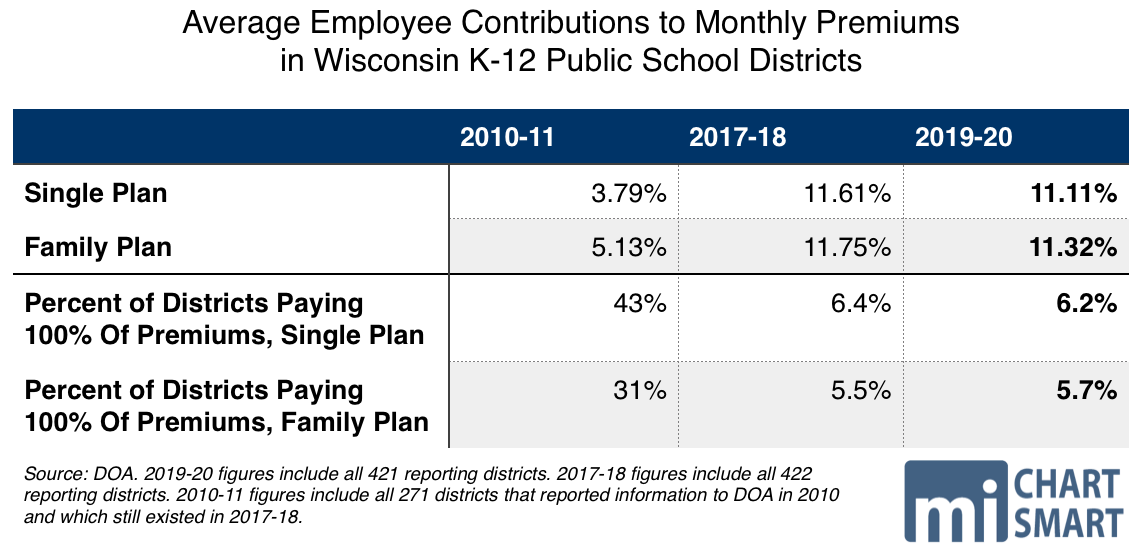

On average, employees on single plans pay 11.1% of their monthly premiums, while those on family plans pay 11.3% of the premiums. In the 2010-11 school year, employees paid just 3.8% of the premiums toward single plans and 5.1% toward family plans.

At almost one-third of all districts, employees pay less than 12 percent toward their monthly premiums. That marks an increase from 2018, when 25% of all districts didn’t require employees to contribute more than 12% towards their premium.

In 70% of districts, employees pay 12% or more toward monthly health insurance premiums on family plans. In 2018, employees at 75% of districts had to pay 12% or more toward family plan premiums.

Those contributions are a far cry from 2010-11, before Act 10 required that certain public sector employees contribute at least 12 percent toward health insurance costs. In that year, 43% of districts paid all monthly premium costs for single plans, and 31% paid all premium costs for family plans.

Health insurance “costs” are most commonly defined as insurance premiums, but contributions toward health savings accounts—common with high deductible health plans—are also permitted.

That could be why some districts still don’t require employees to pay at least 12% of their premiums. Determining whether school districts are following the law is more complicated than just looking at premium contributions, though those figures are a good place to start.

Introduced in 2011, Gov. Scott Walker’s landmark legislation aimed to lighten the load on taxpayers. Following Act 10, districts found savings by opening up bidding to new insurers for the first time in years. Others increased required employee contributions toward benefit plans.

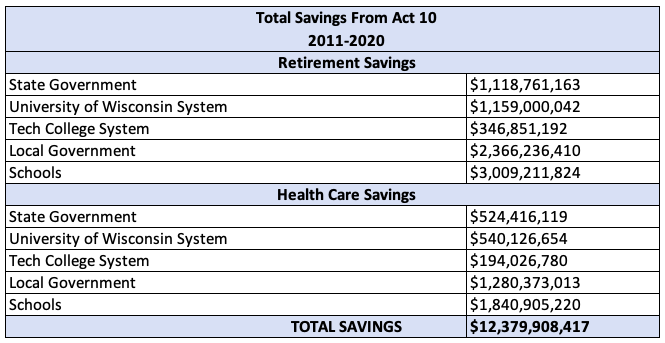

Estimates show that taxpayers have saved billions of dollars on benefits plans alone. According to the MacIver Institute’s latest analysis, taxpayers have saved over $12 billion total since Act 10 was implemented.

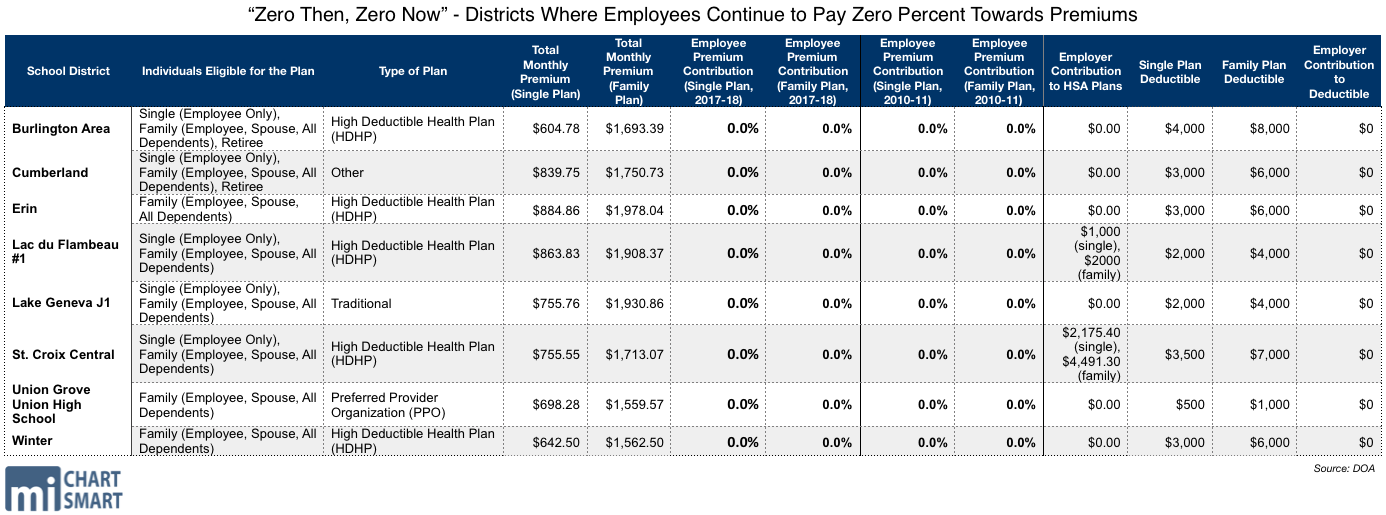

Some school districts have continued their generosity at taxpayer expense despite the changes in requirements. The data show that eight districts continue to have employees pay nothing toward monthly premiums, as they did in 2010.

Two years ago, the last time we examined this data release, 10 districts made this particular list. What changed? First, Lake Geneva-Genoa Union High School report data differently now and aren’t the same entity they were in back in 2010. Much more interestingly, New Berlin began requiring employees to contribute to premiums after we reported the supposedly taxpayer-friendly district had no such requirements.

Today, New Berlin employees on single and family plans pay 10 percent of their monthly premiums. That amounts to $52.60 a month for single plans and $189.50 for family plans. Employees also pay the entirety of their deductibles–$2,750 for single plans and $5,500 for family plans. However, district taxpayers contribute to employee HSAs. Those cost $850 for single plans, and $1,700 for family plans.

The districts that still don’t require employee premium contributions have made changes to their plans, too. Some of the changes are notably taxpayer-friendly, but others are not. The school districts of Erin and Lake Geneva J1 no longer cover health plans for retirees. Cumberland no longer chips in for employee deductibles and switched its plan type to “other” where it had used a PPO before. St. Croix Central significantly increased employer contributions to HSAs, while Union Grove eliminated their traditional plan and lowered deductibles.

Still, districts are generous in other aspects of health care plans. 37% of all districts contribute to employee annual deductibles, a slight increase from 2018, when 35% of districts contributed toward deductibles. In 2020, the average employer contribution to deductibles was $654 for single plans, and $1,323 for family plans.

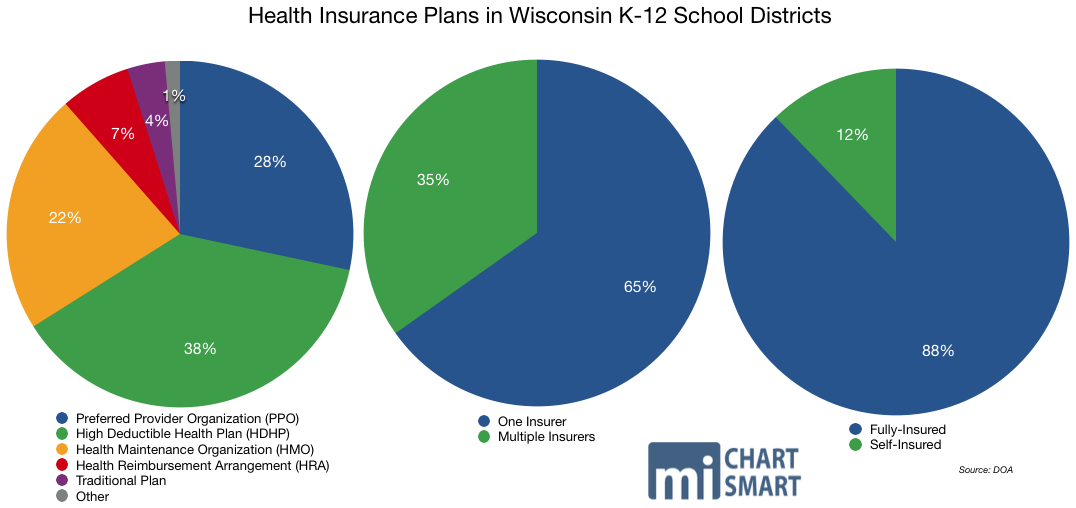

Compared to two years ago, many more school districts have moved toward high deductible health plan (HDHP) models, with 38% of districts opting for the taxpayer-friendly plans today. Under HDHPs, employers pay for some or all of the monthly premiums, while employees contribute to health savings accounts (HSAs) to cover costs. HSA contributions are tax-deductible up to $3,550 for individuals, or $7,100 for families.

Accounts are not tied to particular employers but simply the employees themselves. That means that even after an employee leaves a job with a high deductible plan, they can tap into their HSA for health costs. In 2018, 23% of school districts offered high deductible plans.

The second-most common plan offered by school districts is a more-traditional preferred provider organization (PPO), which 28% of districts use. Two years ago, PPO plans were the most common, with 36% of districts using them. Health maintenance organizations (HMOs) come in at third-most common, with 22% of districts offering them, up from the 17% using HMOs in 2018.

While 14% of districts offered health reimbursement arrangements in 2018, 7% of districts use the plans today. 10% of districts used traditional plans in two years ago, and just 4% of districts offer them today.

More districts offer only one insurer compared to two years ago. In 2018, 61% of school districts used one insurer. Today, 65% of districts offer one insurer for health plans.

While 74% of plans were fully-insured in 2017, 88% of plans are fully-insured today. No districts reported jointly self-funding, although 14% of districts were jointly self-funded in 2018.

The DOA report also shows that school districts continue to change their plan providers. Since the first database was published two years ago, numerous school districts have changed providers, most often moving to smaller and more localized plans.