November 17, 2014

by James Wigderson

Special Guest Perspective for the MacIver Institute

The ball is in the legislature’s court. Last week State Rep Robin Vos released a memo from the Legislative Fiscal Bureau saying the income tax revenue generated from the Milwaukee Bucks players, personnel and visiting teams could fund $150 million in bonding over twenty years. The revenue generated in 2012 was $10.7 million.

The $150 million would be added to the $200 million pledged by the current owners of the Milwaukee Bucks and investors, and the $100 million pledged by former owner Herb Kohl.

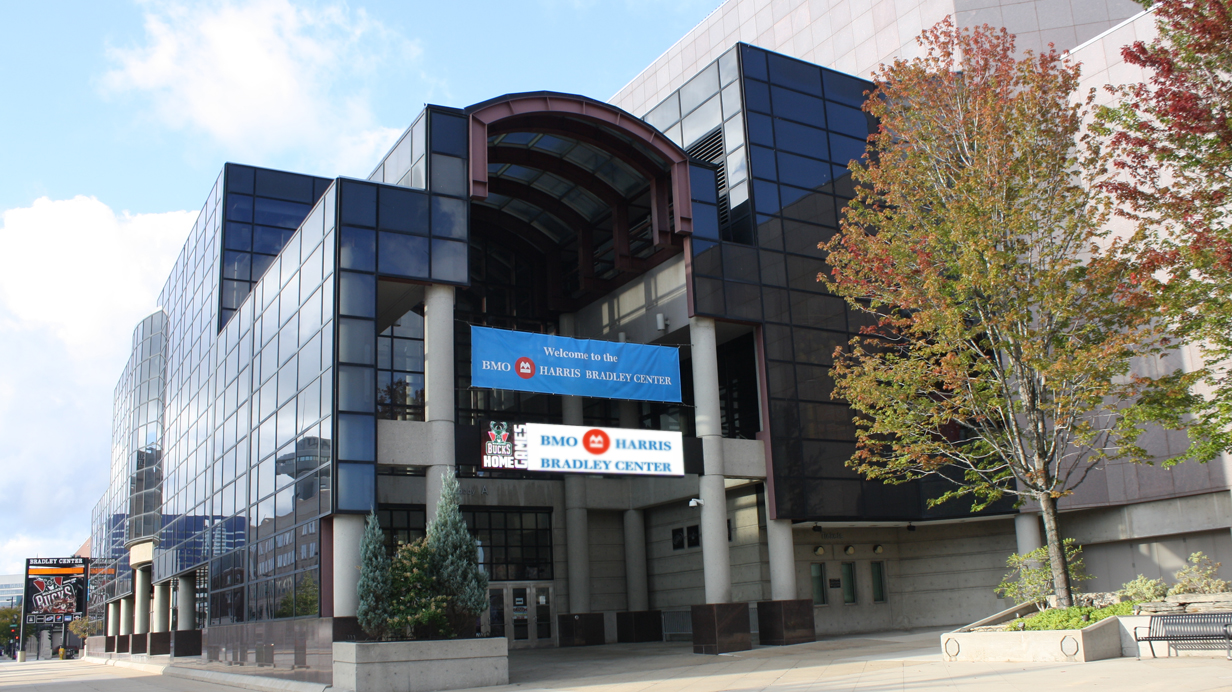

The cost of replacing the aging BMO Bradley Center, the current home of the Milwaukee Bucks, is estimated to be between $450 million and $500 million. The Bradley Center opened in 1988.

That estimate does not include the wish list of the cultural needs task force put together by the Metropolitan Milwaukee Association of Commerce. The wish list includes funding for such institutions as the Milwaukee County Museum, the Milwaukee County Zoo, and a number of private arts organizations in Milwaukee County. The cost of deferred maintenance projects for Milwaukee County’s cultural attractions is $105 million or $7.9 million annually over the 20 years. The cost of capital improvements for Milwaukee County’s cultural attractions is $140 million or $11 million annually.

To pay for that wish list, the task force and arts groups hoped to tie funding of the Milwaukee Bucks’ new arena to “cultural needs” funding. To pay for all these “cultural needs” as well as a new arena, the task force is considering everything from an additional regional sales tax (similar to the tax to fund Miller Park) to additional taxes on beer and alcohol.

Should the state legislature decide to divert the $10.7 million in income tax revenue from NBA players and personnel, there may be enough to fund a new arena but not anything else on the task force’s wish list.

The state legislature would also have to figure out how to make up the $10.7 million in lost revenue to the state’s general fund. This is at a time when the state department of transportation is requesting additional $751 million in new revenue over the next two years to make up for a $680 million shortfall to cover road infrastructure costs. There will also be demands on the budget for additional educational spending and additional health care spending.

The $10.7 million in tax revenue from NBA players and personnel is not free money. It will have to be made up in the budget somehow, whether it is in reduced future income tax cuts or taking money from other spending priorities. As studies have shown, the economic impact of any new sports arena is very limited (if not a detriment) and therefore will not generate the new revenue to make up for the loss to the state budget.

Approving the diversion of the $10.7 million in tax revenue is also setting an uncomfortable precedent. Prior to the LFB memo’s release, Vos had publicly opposed the creation of the TIF district that would have included the diversion of state tax revenue as well. Vos had correctly pointed out that other communities also have spending desires, including for new arena-like facilities, and they could demand similar TIF districts for their own projects. The same principle would apply in diverting player and personnel tax revenue to fund the new arena.

However, that $10.7 million in tax revenue may be lost anyway if the Milwaukee Bucks move to a new city. Under the terms of the purchase agreement approved by the NBA, if the team does not have a new arena by October 1, 2017, the NBA will purchase the team and move the franchise to another city.

Given that scenario, a diversion of the tax revenue from NBA player and personnel salaries may be an easier sell than any of the alternatives proposed so far. It also has the advantage of limiting the tax impact at the surface level to those who would benefit from a new arena, even as it would still have an impact on taxpayers statewide on a secondary level – making up for the lost revenue.

Since most elected officials outside of Milwaukee County have said that public funding from their constituents is a non-starter, it will be interesting to see if the diversion of tax revenue can get enough support to overcome resistance to public funding.