A Historic Surplus Funds Historic Spending, Expanding Government…Historically

But is it a pyrrhic victory?

The legislature is on track to bring the Shared Revenue & Milwaukee Bailout bill – with an even higher price tag – to the floor in the coming days.

The bill raises shared revenue payments to fund increased local spending by a whopping 36.5% in the current agreement and allows the taxpayer bailout of Milwaukee’s pension systems to move forward without giving the taxpayers – even the ones in Milwaukee – a say.

Undercutting decades of messaging casting referenda as the ultimate in local control, some Republican legislators now claim Milwaukee ‘already voted for’ the sales tax increases by electing the people who spent the pensions into crisis. Meanwhile lobbyists are saying if Milwaukee taxpayers don’t like the tax hike, they can vote their elected officials out of office. Afterwards.

Of course, the taxpayers from across the state who will pay more for goods and services bought in or from Milwaukee get no say either. Erstwhile conservatives pretend the sales tax will only impact Milwaukee; the (liberal) flaw in that reasoning is that Milwaukee can’t both be the economic engine of the state, too big and too important to fail, and so removed from the rest of the state their tax rates don’t matter.

While taxpayers and the few remaining fiscal conservatives who have been watching the cost grow and the taxpayer protections shrink over the past several weeks might be holding out hope for a little frugality, it’s not in the cards.

Republicans had to agree to spike local government spending by increasing state aid nearly 37% in order to get the governor to agree to…a historic increase spending on schools, a fraction of which will go to choice schools. It was definitely a win-win for…someone.

Big spenders? Lobbyists? Democrats? Certainly not taxpayers.

Democrats and Republicans alike are declaring victory over the bill – both sides using terms like ‘historic’ and ‘transformational’ – in describing the massive fiscal implications of the bill:

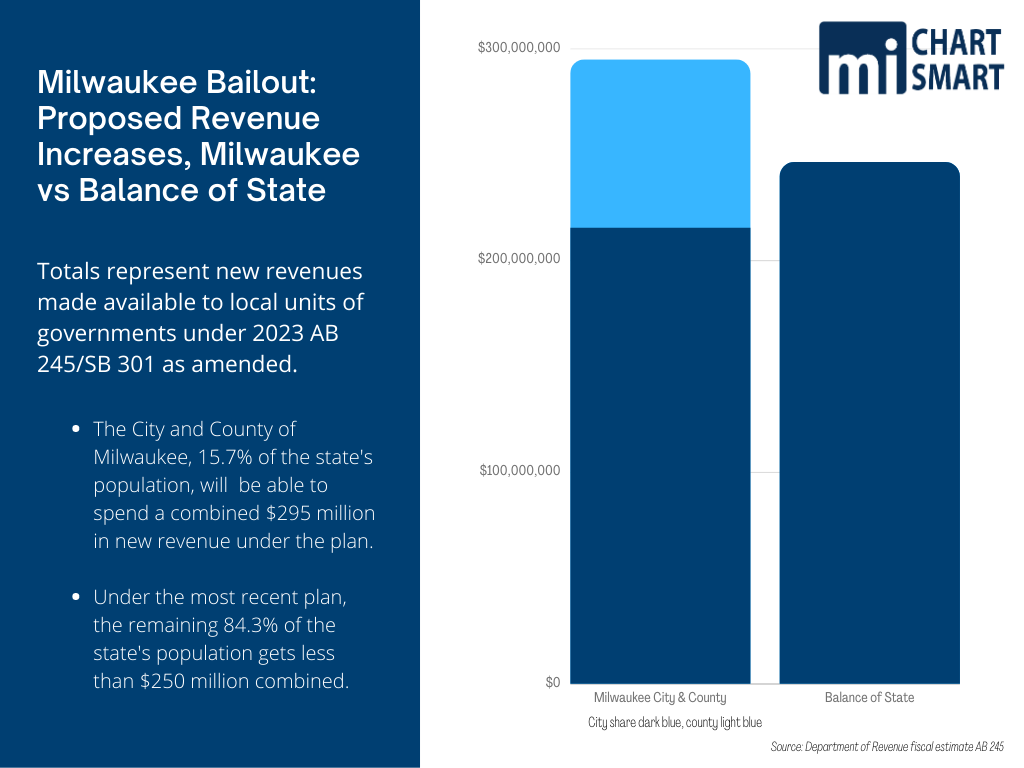

- $297 million new revenue annually for Milwaukee.

- $232 million new revenue for local governments in the rest of the state.

- $300 million new cash for ‘innovation’ grants to locals to incentivize spending less.

- $1 billion new education funding.

And some wins:

- Increasing the per-pupil funding levels for choice students.

- Preventing the city of Milwaukee from using tax dollars to fund a position dedicated mainly to Diversity Equity and Inclusion. (They can use other funds to do so.)

- Banning Milwaukee from using tax dollars for the trolly. (see above)

- Preventing local governments from holding advisory referenda.

- Shifting the remaining personal property tax to the general fund.

Oddly, since the governor was glowing about the bill, Republican legislators who have concerns about the historic, transformational growth of government in the bill are being strong-armed to vote yes anyway. The historic big deal brokered by savvy Republicans didn’t, apparently, include the governor bringing Democrat votes to the table.

Republicans are being pushed to vote for huge spending increases, while Democrats are sitting out the Milwaukee Bailout. Even though blue Milwaukee gets more new money to spend under the bill than the entire rest of the state combined.

The agreement to boost funding for the choice program is a win; DPI is failing at their critical mission to educate Wisconsin’s children. The increase will allow more kids to escape failing public schools, but the cost of this win was incredibly steep. Among the many conservative left on the table:

Education Reform and Parents’ Rights

Parental Bill of Rights. Evers vetoed a bill last session giving parents rights regarding what and how their children are taught in schools, including reviewing curriculum and controlling their child’s health care. Since Republicans agreed to Evers’ in-school mental health expansion, protections for parents who are already being walled out of their child’s healthcare needs by their public schools should be part of the deal. Think placing more social workers in schools to improve mental health can’t backfire on kids and parents? California is considering legislation to allow social workers to take children into care if parents are “abusive” by refusing to affirm their child’s trans-identity.

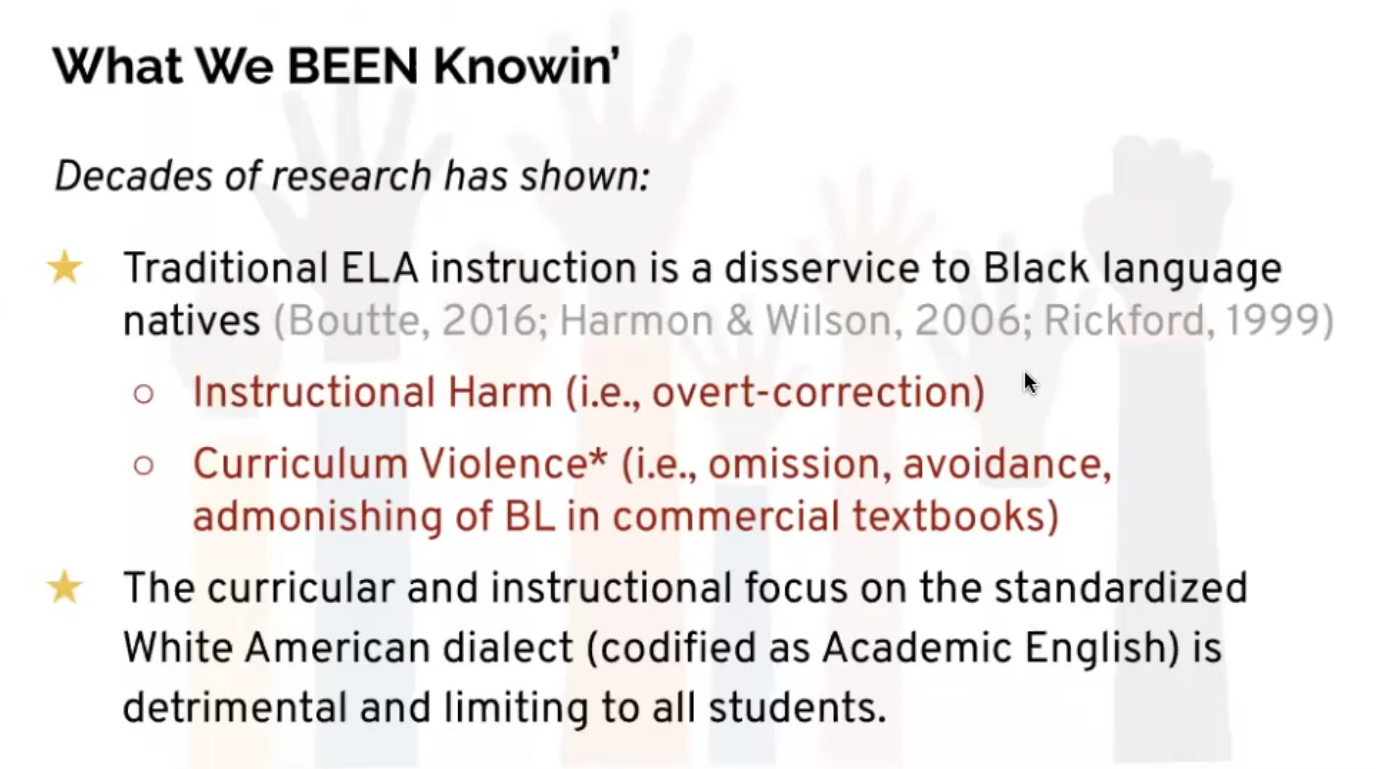

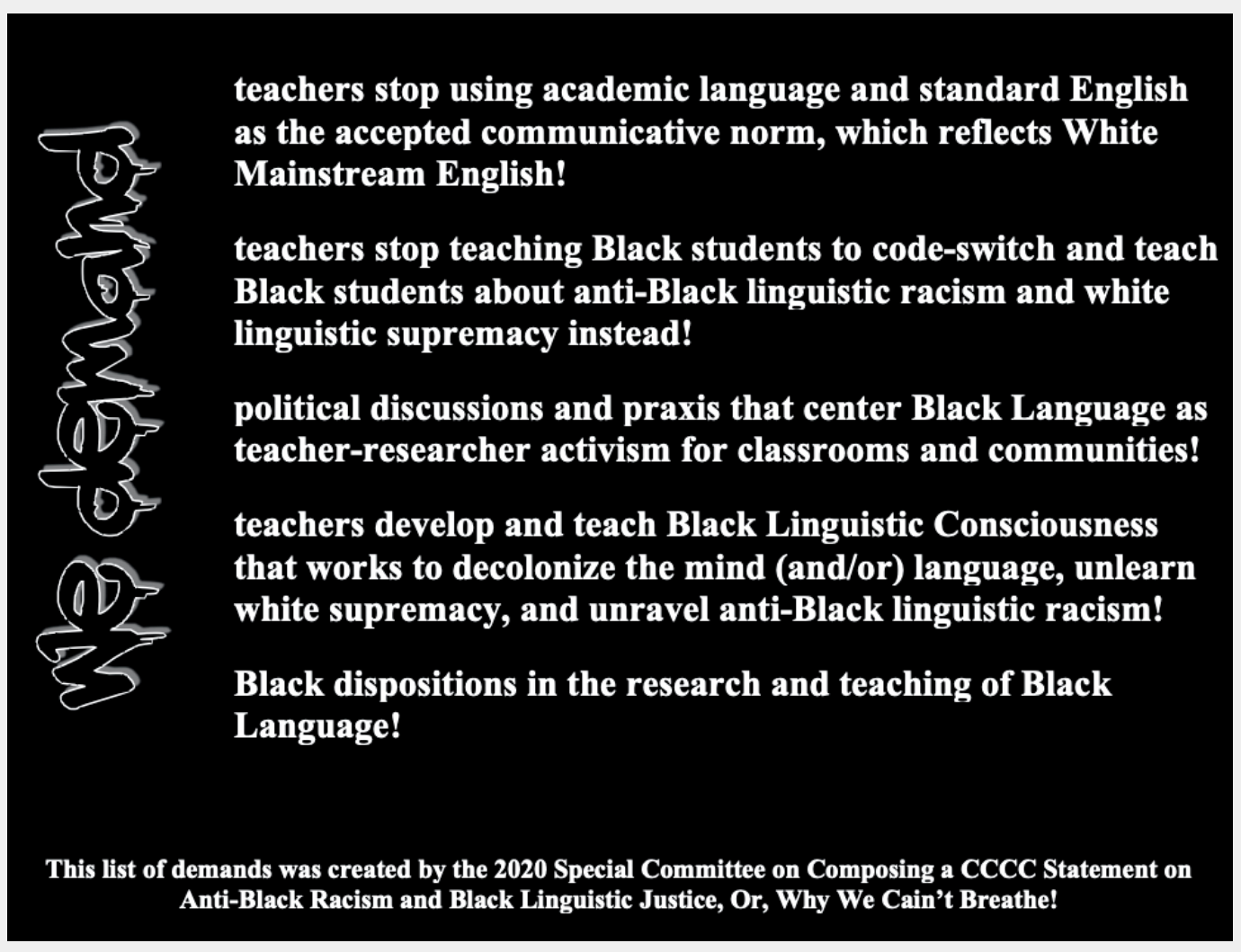

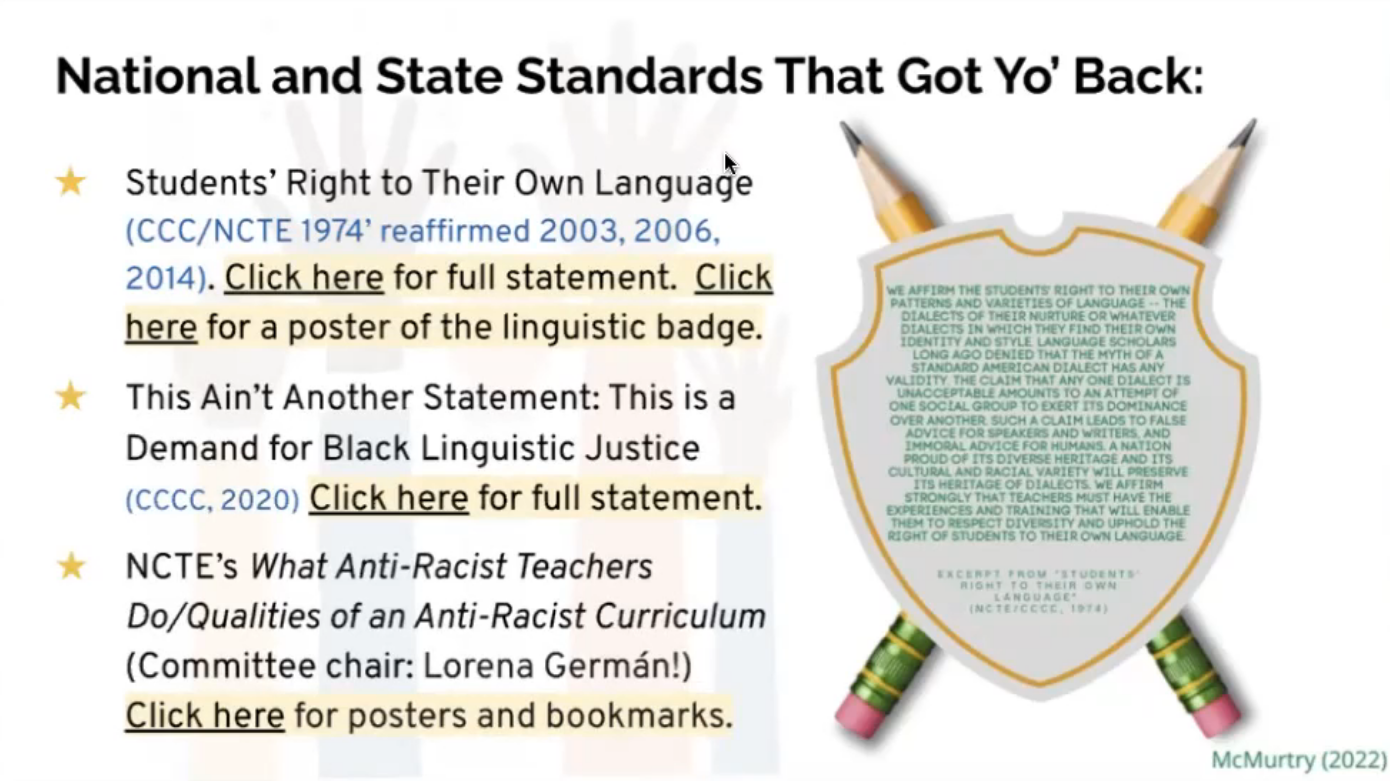

Basic Literacy and Education. Evers vetoed requiring a credit in civics for high school graduation. In the new reading standards, the word ‘culture’ was inserted more than 60 times, and ‘identity,’ ‘representation’ and ‘diversity’ added roughly a dozen times each; meanwhile the Preamble to the Constitution, the Bill of Rights, The Federalist, Lincoln’s Second Inaugural Address and Shakespeare were removed. Children are now taught that standard English is just one dialect of many which has a ‘history’ implicated in ‘power relationships.’ The agreed-on pot of $50 million to all-of-a-sudden start teaching literacy (shouldn’t that be the fundamental, bedrock goal of the first dollar of any education spending?) might have potential effectiveness blocked, given our standards were created viewing standard English as a verbalization of colonialism and white supremacy.

Maybe they could have bargained for a credit in civics, or a ban on pornography in school libraries, or even a tiny ban on teaching children some kinds of racism are good racism. Real, meaningful school report cards that reflect honestly which schools are failing kids?

Special Education. The agreement puts another $97 million into special education. The federal government had fallen short of promised funding levels for years, but one pot they do send to DPI for disabled students is being passed through to a group that spends the money nearly exclusively on indoctrinating public school teachers and administrators to use the principles of CRT in their classrooms.

Federal Individuals with Disabilities Education Act (IDEA) funding, meant to endure children with disabilities have a free, appropriate public education that provides services to meet their unique needs, goes through DPI and is awarded to the Educational Equity Network (aka The Network) which focuses on racism and inequity rather than disabled students. The bill could have attempted to ensure that the special education funds we do receive from the federal government are not diverted from disabled children and spent on training teachers to be race warriors.

Local Responsibility and Transparency

Limiting Local Public Health Officer Authority. The original bill limited their sole authority to close down businesses to 14 days, which inexplicably more than doubled to 30 days. No business should be closed down on the orders of one person for an entire month without local elected officials weighing in.

Banning Zuckerbucks. While Evers vetoed a statewide ban, this bill could have left it up to local governments tying their shared revenue increases to passing and maintaining a local resolution prohibiting outside dollars influencing election activities.

Banning Guaranteed Income Programs. Madison has one up and running, Milwaukee has the framework in place (from legislation sponsored by the Mayor) and is just waiting to find more money, and Wausau is working on one. Guaranteed Income Programs provide cash welfare payments – no strings – to low-income residents under the belief that being given a cash handout will incentivize work. Republicans might have considered banning local governments from starting up cash welfare with the new funds flowing into their coffers. No one should be surprised when Milwaukee gets their program going now that Republicans made sure they are flush with cash.

Enhancing Election Integrity. Since locals will be getting a lot more state cash courtesy of Republicans, it might have been a good time to require locals to keep their voter rolls updated, check photo IDs of all voters every election, limit ballot drop-off sites, allow election observers clear views, and requiring them to maintain any video record of their canvas.

Requiring Local Government Transparency. The bill asks for DOR to provide information already on their website while not requiring specific transparencies from local governments. DOR could have been required to host a Local Government Open Book, modeled after Governor Walker’s award-winning transparency website making local expenditures across the state searchable by purpose, vendor, and amount.

In return for as much as 800% more state aid for some local governments, legislators could have required local budgets to be produced using the same format and required to be posted online. Information on local spending of federal pandemic aid is spotty at best, it’s difficult to imagine that locals would be anything but eager to share details of those expenditures if required to access all their new state aid. And local governments could also be posting all candidate election documents online instead of forcing people to make, pay for, and wait for open records requests. It’s difficult to believe that starving communities across the state, struggling to meet payroll, and dependent on the kindness of strangers would not want to shine a light on their abject poverty if for no other reason than to justify the largesse they’re receiving.

Public Safety Requires More Than More Cops. There’s no doubt that crime is a growing concern, and while the bill nods to this – through maintenance of effort language requiring all communities to maintain (freeze) their police spending, and language directing the funds away from cultural, educational and administrative purposes. Milwaukee is required to meet benchmarks on public safety staffing levels.

What is not addressed is the other elements in the justice system that account for the increases in crime we’ve experienced, particularly in Milwaukee. Low-or no-bail releases, soft sentences that put perpetrators back on the streets too quickly, slow moving courts that end up having to release those charged because their right to a speedy trial had been violated, the increasing unwillingness of witnesses to testify against criminals they know will be back in their neighborhood soon, the state Department of Corrections ignoring violations of community supervision, and an increase in juvenile offenses that offenders know nets them a slap on the wrist all factor heavily into community safety. More police and fire staffing is obviously needed In Milwaukee, but without a justice system forced – because they’ve proven they will not do it willingly – to end their Scold and Release policies, the police will be fighting a losing battle. The bill could have contained transparency provisions to let the public look at the plea bargaining and sentencing that happens in each court and by each DA and ADA, but it does not. Neither does it attempt to push judges to hand down tougher sentences or prevent DAs from plea bargaining away so many felony charges.

Truth in Taxation

Sales Tax to Fund Pensions, Period. Supporters claim the sales tax will sunset; that’s somewhere between an outright lie and a red herring. A built-in loophole allows a portion of the new sales tax revenues to be skimmed off and used for expanding and supporting other ongoing expenditures including law enforcement. The city and county are receiving nearly $30 million in increased shared revenue funds, AND they’re being relieved of the vast majority of their responsibility to contribute to their pension systems, freeing up those funds. The city will be able to make massive investments in public safety using those funds. Delaying the full funding of their pension by allowing unions to bake in ongoing dependence on revenues everyone is pretending will disappear down the road encourages the exact irresponsibility that got Milwaukee into the crisis that requires this bailout.

Strings on the Bailout. Prohibiting Milwaukee from using tax dollars to hire Diversity Equity and Inclusion staff. The state DPI has shown how to end-run such a ban – in response to open records requests, DPI indicates that equity is an agency priority and that all employees are dedicated to diversity, equity, and inclusion.

The bill does nothing to stop Mayor Johnson from spending resources on climate-change-environmental-justice-crime-deterrence-greenhouse-gas-reduction initiatives. Johnson said last week that climate change and crime are linked, and he plans to build a protected bike lane system in Milwaukee to reduce greenhouse gasses and focus on green jobs to reduce crime. He also highlighted the importance of federal funds to accomplish these goals – funds that can be used for the trolly, environmental justice and any of the many new plans to spend money Milwaukee will come up with now that they’ve got hundreds of millions of new tax dollars to play with. Plans that, like guaranteed income, weren’t prohibited in the bill.

Give the Surplus Back. The bill includes the “elimination” of the final portion of the personal property tax, a general positive although it is a tax shift to the general fund, and it was in Evers’ proposed budget, so hardly a negotiation point. This tax shift is the only recognition we see in this bill of the tax burden in the state. A tax burden so high that in this budget cycle, that there is a surplus that amounts to almost $1,200 for every man, woman and child in Wisconsin.

The $6.78 billion surplus could have been the basis for a substantial income tax cut, with progress being made toward either a low flat tax, or the eventual elimination of the income tax. With the past two budgets increasing spending by $7 billion and $6 billion respectively, state government has been blowing up. Holding the line on new spending and sending the surplus back to the people who earned the money to begin with, the same people who are struggling with government-caused inflation was a possibility that was abandoned before it was discussed.

Alas, No Historic Tax Cut

Governing Magazine reports that 2023 is another banner year for tax cuts across the nation. North Dakota cut the number of brackets from 5 to 2 and cut rates, though they didn’t get the flat tax some wanted. The North Dakota tax cut package was a half-billion dollars – in a state with a budget only about one-twelfth the size of Wisconsin’s. Montana cut taxes $750 million, Kentucky dropped over $300 million, Tennessee cut $400 million, Idaho $355 million. Texas, with a $33 billion surplus, is working on a $16 billion tax cut. Iowa cut taxes another $100 million in May, on top of their in-process flat tax transition. Georgia is using their $6.2 billion surplus to send out $1 billion in retroactive tax credits. A ‘historic’ $6 billion tax cut package was signed into law in Nebraska in May.

While they’re cutting, Wisconsin is jacking up spending and falling behind.

Senate Majority leader LeMahieu said there was not support in his caucus for the flat tax bill he authored. There is apparently support in that same caucus to increase taxes, sans voter input, to bail out Milwaukee and to increase state aid to locals by 36.5%, expanding government substantially.

The Assembly declared a flat tax phase-in unlikely for the session before it even had a hearing. The silence on plans for a tax cut from either house has been deafening since. Despite the historic surplus, following on the historic levels of pandemic aid that flowed into state and local governments over the past few years, meaningful, conservative – even historic – tax reform has not been on the table for this legislature. Spending has.

Based on the current spending by JFC, shared revenue promises, the historic education increase deal, Medicaid cost-to-continue, and the slew of pork that always makes its way into the final motion, a ballpark guess is that there could be a bit over $1 billion left of the $6.8 billion surplus to use for any spending the legislature wants to do for the remaining 10 months of session and a tax cut.

The first year of the 3-year LeMahieu flat tax phase-in, which delivered tax cuts in every bracket, would have cost twice what will likely be available.

Republicans seem to be building their budget based on spending milestones set by the governor, creating a set of talking points about their historic spending accomplishments. The governor’s net income tax cuts for tax year 2023 were around $300 million, his income tax cuts alone were $665 million; if they follow pattern, the legislature may try to beat the $665 million (if they’ve left themselves enough money) otherwise they’ll call anything over $300 million a win and say they cut more than Evers. Maybe they’ll push the cut to the second year to save money and give back less.

The legislature can still cut taxes, and hopefully they will. If they do, it won’t be historic tax reform returning a historic surplus to taxpayers as many conservatives expected. Instead, legislators delivered to taxpayers historically bigger government, another budget with little discussion about wasteful spending, and even fewer budget cuts.

Any income tax cut is a win. But any tax cut in this budget – assuming one is forthcoming – will be for conservatives a pyrrhic victory coupled as it is with so much spending and rampant growth of government.