Dan O’Donnell on Governor Evers’ disastrous (and immortal) budget vetoes.

July 6, 2023

Perspective by Dan O’Donnell

Think about what the world was like 402 years ago. The King James Version of the Bible was just a decade old while the Pilgrims had not yet celebrated the first Thanksgiving. Now think about what the world might be like 402 years from now. Will mankind have permanent settlements on Mars? Or will artificial intelligence have enslaved all of humanity?

The distant future may largely be unknowable (would the Pilgrims have even been able to imagine artificial intelligence?), but one thing about it is certain: 402 years from now, Wisconsinites will still be paying an additional $325 per K-12 student.

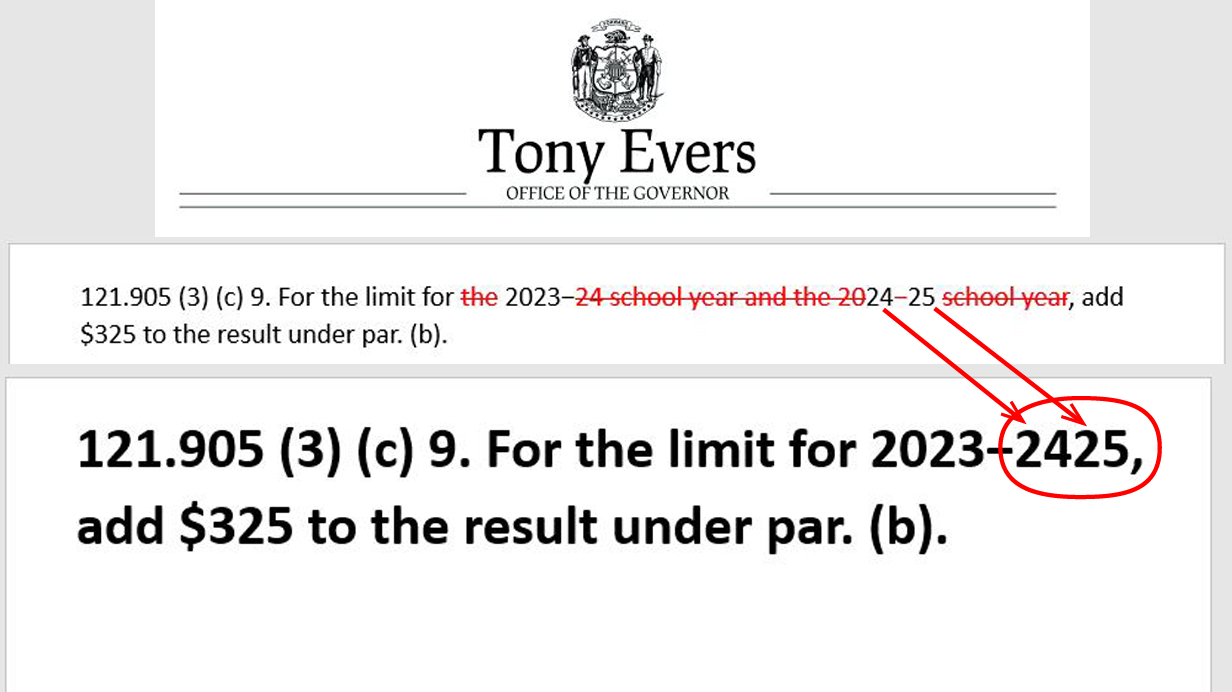

On Wednesday, Governor Evers used his line-item veto power to extend school spending for a further four centuries. In one of the more egregious examples of what has become known as the “Frankenstein Veto,” Evers struck the number 20 and the hyphen from “2024-2025” to get to “2425,” the year Wisconsin will finally be free from King James’, errrr, King Anthony’s proclamation.

In one of the more egregious examples of what has become known as the “Frankenstein Veto,” Evers struck the number 20 and the hyphen from “2024-2025” to get to “2425”

Last year, Wisconsin had 846,693 public school students. With Evers’ $325 per-student increase next year, total state spending on K-12 schools will be raised by more than $275 million ($2715,175,225 to be precise). In 2025, spending would increase by another $275 million. By the mid-2400, taxpayers will be on the hook for more than $110 billion per year just in K-12 funding. By way of comparison, the total budget spends approximately $99 billion over the next two years.

That, however, is a problem for another century or three. The more immediate concern with Evers’ vetoes is that their decimation of the Republican Legislature’s historic $6.5 billion tax cut. The governor’s plan will drop that number by 97% to just $175 million and will only apply to those in the lowest two tax brackets.

Republicans moved Wisconsin closer to a flat income tax by lowering the tax levy for all brackets, but Evers decided that only those married filers who make $36,840 or less will see any benefit whatsoever. More than three-quarters of the state’s taxpayers will not be affected.

In his veto message Wednesday, Evers crowed about keeping a campaign promise of a middle-class tax cut while eliminating tax breaks for the wealthy, but he certainly has an interesting definition of both “wealthy” and “middle class.” A family earning $60,000 annually—the very definition of middle class—would have seen a 10% income tax reduction under Republicans’ plan. (The percentage changes depending on income level with a maximum of about 16%). Instead, their children—and their children’s children’s children’s children’s children’s children’s children—will be stuck with the bill for his immortal school tax.

Making matters even worse, nearly all of Wisconsin’s small businesses pay income taxes at the individual rate; slightly more than half at the highest rate. Under Republicans’ budget, they would have seen a 15% reduction. For the modest business that turned a profit of $400,000, this would have meant thousands of dollars in savings. In other words, that business could have hired a new employee and provided a middle-class income to a family that now will not only fail to see a tax break but also suffer as small businesses (the largest private sector employers in the state) can’t as easily expand their operations and hire new workers.

Evers’ budget is thus ironically shortsighted even though it extends spending increases for more than four centuries. Who exactly is going to pay for them? With small businesses less likely to grow and would-be entrepreneurs less incentivized to strike out on their own, Wisconsin’s economy is more at risk of stagnating, especially as neighboring states have far more competitive rates (even Illinois, believe it or not). If Wisconsin does not have an economic reason to entice commerce, then by definition capital—which will become ever more mobile because of emerging technology like artificial intelligence—will flow elsewhere.

The Governor wouldn’t have been able to gut the tax cut without scrapping the entire budget if the Legislature stopped nibbling around the edges of a flat tax and instead implemented one. They didn’t and instead made a Milwaukee bailout the primary focus of the budget process.

So too will people, who are leaving high-tax states like New York and California for Texas and Florida, two states with no personal income tax that also saw by far the most inward migration of any over the past decade. Countless Wisconsinites have been among them, and count on that trend to only exacerbate over the next, oh, 402 years or so.

Evers may have created this mess, but Republicans themselves aided and abetted him. The Governor wouldn’t have been able to gut the tax cut without scrapping the entire budget if the Legislature stopped nibbling around the edges of a flat tax and instead implemented one. They didn’t and instead made a Milwaukee bailout the primary focus of the budget process.

Now they’re crying foul, claiming both Milwaukee and Evers double-crossed them. What did they think was going to happen? Milwaukee has been a tax-and-spend nightmare for more than a century and Evers has put Wisconsin on a similar path for the next four.

Evers won re-election last year in part by taking credit for Republicans’ last tax cut, but now that he is safely in his second term, he has abandoned all pretense of fiscal sanity. That Republicans didn’t see this coming is the most shortsighted thing of all.

And now they’ll have 402 years to live with their mistake.