Troubling Trend – State Government Spending Increase Is Outpacing Tax Revenue Coming In

By MacIver Staff

The nonpartisan Legislative Fiscal Bureau published a new analysis of the recently passed 2023-2025 state budget that outlines a disturbing trend – the politicians in Madison are spending more of your money than state government is estimated to take in.

Now, this spending structural deficit is mitigated by the enormous “surplus” of taxpayer money that state government is sitting on. At the start of the budget debate, the surplus – which is really the amount government overcharged taxpayers to fund government services and bureaucrats – was almost $7 billion dollars.

After the massive and historic state government spending increase of $10 billion passed in the budget and the Governor’s veto of most of the Republican-proposed $3.5 billion income tax cut, state government is currently sitting on a $4 billion surplus.

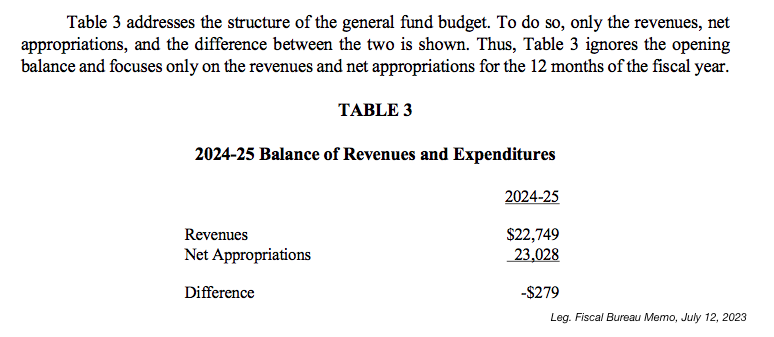

According to the memo, the surplus is helping to hide the fact that in 2023-2024, the state will take in about $22.08 billion in taxes and other revenue but will spend $24.6 billion. In 2024-2025, state government will take in $22.749 billion in taxes and other revenue and spend $23.029 billion, for a spending deficit of $279 million.

The ending balance surplus grew dramatically when Gov. Evers vetoed out most of the Legislative Republicans’ $3.5 billion income tax cut.

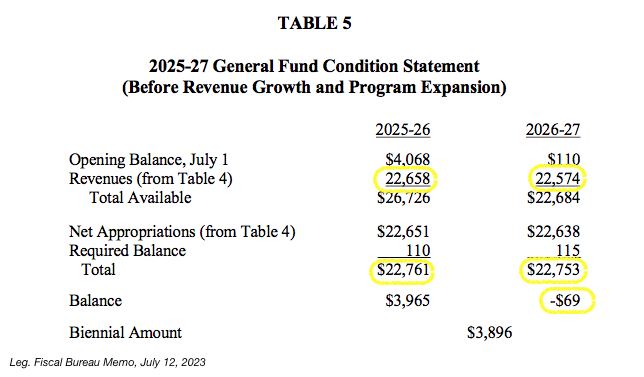

The spending structural deficit looks even worse for the next budget. According to the LFB, in 2025-26 state government will take in $22.658 billion in taxes and other revenue and is scheduled to spend, under commitments made in the current budget, $22.761 billion. In 2026-2027, state government will take in an estimated $22.574 billion in taxes and other revenues and is scheduled to spend $22.753 billion. If you set aside opening balances and potential surpluses, the spending structural deficit of the next budget sits at $282 million before any new spending increases are passed, any new programs are adopted or economic conditions are factored in.

Even with a $4 billion surplus, the rate of spending in this budget puts the state in a structural deficit at the end of the next biennium, estimated at $69 million.

The memo does point out that in eight of the previous ten biennia (two-year budget cycles), spending outstripped revenues. The current spending structural deficit is smaller than the average size of the eight recent spending structural deficits, which is normally around a $1.43 billion deficit.