The Milwaukee Bailout and Shared Revenue Bill:

Did the Legislature lay an egg?

Just 2 years ago, Governor Evers proposed allowing counties and municipalities over 30,000 to increase (or newly levy, in the case of municipalities) the sales tax 0.5% with voter approval at referendum.

The 2021 plan was labeled “dead on arrival” by GOP legislative leaders with some definitive language:

“There is no chance this is going to happen. I think the problem we are looking at, especially in Milwaukee, is systematic problems where they have made bad decisions over decades they now do not have the courage to solve. Now they want to go to taxpayers for an easy, quick fix. That is not going to happen.”

The debate came down to this virtual 101 on how the parties (used to) view tax increases and taxpayer input:

Republicans asked whether communities now looking for a local sales tax had gone to referendum for specific spending, or whether they only a perpetual revenue source to allow new spending taxpayers may not support.

Democrat leaders said some communities don’t bother go to referendum for levy increases where they have to specify the amount and the specific purpose for the additional taxes, even for “vital” services, because the voters might say no.

Republicans countered that if voters rejected a levy increase, it meant they did not believe there was a real need.

Democrats said no, it meant the voters weren’t smart.

What A Difference Two Years Makes

Republicans are now fighting for a sales tax increase for Milwaukee County and the creation of a new 2% sales tax for the City of Milwaukee, quadrupling the amount the city would have gotten in the Evers proposal the GOP rejected last budget.

Senate Republicans have gone even farther, fighting against a referendum requirement for those taxes to go into effect.

With Republicans united in seeking massive tax increases, Democrats are exploiting the divisions among the majority by rejecting the referendum requirement they supported in 2021.

What’s most perplexing to observers is not the Democrat head fake, but the Republican flip-flop.

It’s not like the past two years have shown a sea change in Milwaukee’s level of responsibility.

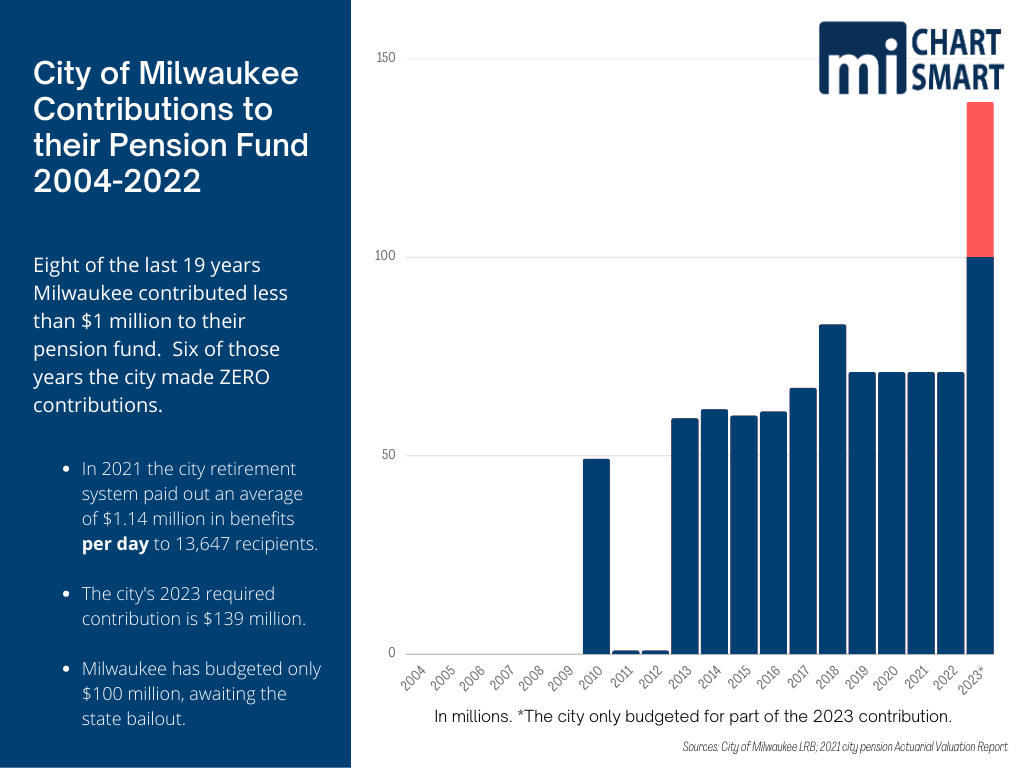

The city has only budgeted $100 million toward their $139 million required pension contribution for 2023. This follows 8 of the last 19 years where the city contributed less than $1 million to the pension fund; 6 of those years they made zero contributions.

In his 2023 budget, Mayor Cavalier Johnson makes the absurd claim that 14 years ago pension payments were “just not needed.”

Milwaukee obviously needed to make contributions; they just as obviously didn’t want to make them. So, with a near billion-dollar unfunded liability, they set unrealistically high projected rates of return whistling past the graveyard, believing they were too big a deal to fail, and the state would bail them out when their bubble burst.

The city and county have taken hundreds of millions in federal pandemic aid and used it for things like a de facto county Medicaid Expansion and paying off the private medical debt of some residents. The city brags in its 2023 budget that their Office of Equity and Inclusion are spending time and money to budget based on “racial equity.”

The city is being sued over potential use of government resources and personnel to assist Democrat organizations to turn out targeted voters in 2022.

Some say the relationship between the city, county and state GOP leaders has improved, but you wouldn’t know that based on the arrows slung by the new Mayor in his budget document.

There has been some concern over policing levels for the Republican’s national convention in 2024, but the federal government is poised to award $75 million to the city for security, and this fall they received $15 million in federal dollars to hire 50 new officers.

The city’s streak of breaking its own homicide records is bucking the national trend, but with a justice system that puts offenders back on the streets as quickly as possible, police alone won’t be able to move the needle. Yet this bill does absolutely nothing to change that dynamic.

The bill caused at least one senator to ask:

Have Republicans Lost Their Minds?

They have completely flip-flopped.

Instead of looking at the $7 billion tax dollars left over after running already bloated state government and figuring out a tax cut plan, Republicans in the legislature are trying to outdo one another growing government.

The Assembly wants to spend more, the Senate wants less taxpayer input, and they both want to raise taxes. And that’s just the Republicans.

There’s a lot of money at stake, not just now, but in continued growth in government spending. Meaningful tax cuts are on the back burner perhaps for the session, and taxpayers still have more questions than answers.

- Why are Republicans pushing higher spending and higher taxes?

- Is this a Milwaukee bailout?

- Does the bailout solve Milwaukee’s pension problems?

- What about the skim?

- Is Milwaukee hamstrung?

- Will rewarding bad behavior encourage good behavior?

- Is a bailout the best answer?

- Starving officials wouldn’t buy a communications platform to learn about backyard chickens would they?

- What’s so wrong with asking taxpayers before taking their money anyway?

- Is this bill good for Wisconsin?

Why Are Republicans Talking About Bigger Government and Higher Taxes?

This bill was born in a perfect storm:

- A $7 billion surplus of tax dollars.

- A legislature that hasn’t controlled its own spending excess and feels pressure/guilt to spread the wealth to grow other layers of government instead of returning it to taxpayers struggling under generationally high inflation.

- A governor so committed to spending he introduced bill to take the state from a $7 billion surplus to a $4 billion structural deficit, who the Republican legislature fears will get the upper hand in messaging if they don’t compete.

- Local officials who have been moaning about fiscal controls since they forced them into existence by taxing and spending those limits into existence.

- The looming self-imposed fiscal cliff many local governments created by using one-time federal pandemic aid for ongoing and unnecessary purposes, and a state legislature that doesn’t want to be blamed for the end of any local program.

- Monied special interests who have read the room and know the bill is the path to getting something on their wish list.

- Republicans who have fallen prey to the magical thinking that if we toss some bucks at Milwaukee now, their leaders will get the city shipshape in time for next year’s national convention and people won’t come as ‘delegates’ and leave as ‘crime victims’. (And a mayor who knows how to capitalize on this)

Is the Milwaukee Bailout Really a Bailout?

Anything requiring special act of the legislature granting unique permission for a municipality to charge taxpayers higher taxes specifically for the purpose of filling a fiscal hole they created through years of mismanagement and irresponsibility, is the very essence of a government bailout.

Hiking the sales tax doesn’t force only Milwaukee taxpayers to foot the bill for Milwaukee problems. Sales taxes in large cities draw heavily from non-residents who work, play, and do business in the city. The entire state will be helping to foot the bill for Milwaukee’s problems.

And increased local sales taxes impact the state tax rankings we’ve worked for years to improve.

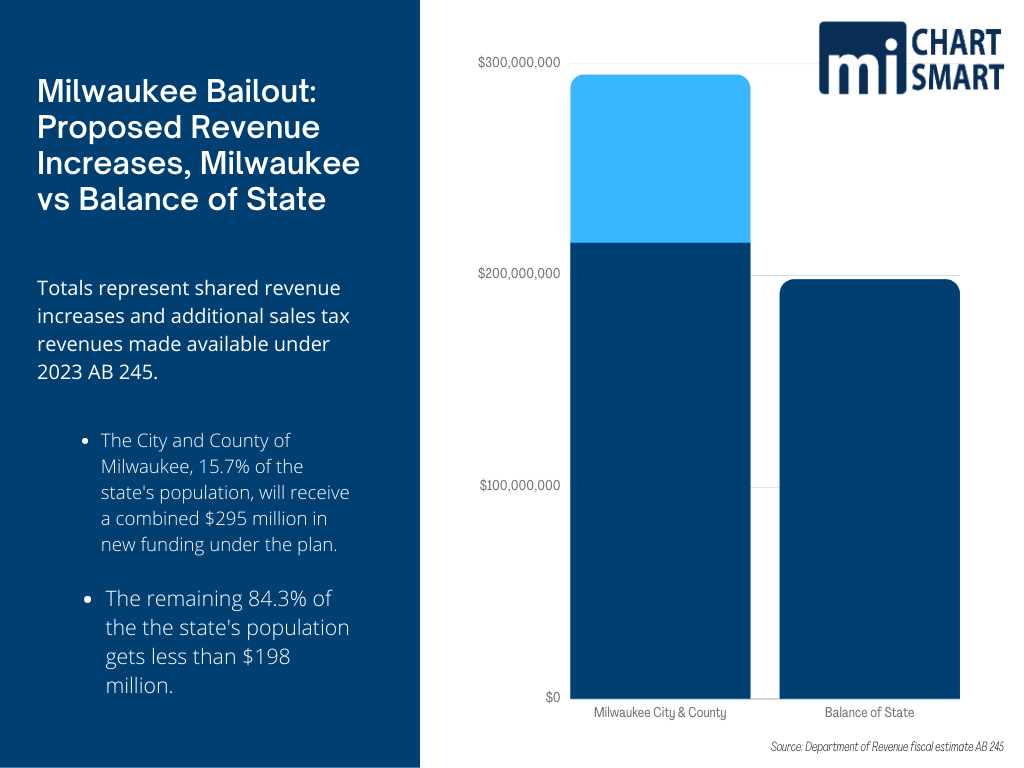

If there is any question as to whether Milwaukee is getting special treatment or special access to tax dollars compared to other communities, this graph provides a clear answer.

Milwaukee County in light blue, the city in dark blue.

Under the bill as introduced, between the new sales tax funds and the increased state aid, Milwaukee will be getting $295 million in new funding; the entire rest of the state will get less than $198 million combined. The city alone gets more than the rest of the state combined.

When a county that accounts for less than 16% of the state’s population gets 50% more than everyone else in the state combined: that’s a bailout.

Does the Bailout Solve Milwaukee’s Pension Problems?

While this legislation would commit taxpayers to 3 decades of footing the bill for yet another case of Milwaukee fiscal negligence, there are serious questions about whether it will fully bail them out.

In the last 4 years the city’s credit rating has dropped from AA+ to AA- to A-.

Tuesday, Fitch again downgraded Milwaukee’s credit rating to BBB-, based on their “large and growing structural budgetary imbalance” and the rating agency’s belief that the proposed legislation “may not be sufficient to minimize the budgetary imbalances in the near-term.”

The Skim Nobody is Talking About

The Fitch analysis does not even take into account that the temporary, 30-year sales tax being sold as a fix for the floundering city and county pension systems has a massive loophole.

The bill allows the derelict leadership of Milwaukee to divert unspecified amounts of the bailout tax revenue to be spent for other purposes, which will mute the impact and delay a potential solution to the pension problems.

Consider: the city will be required to contribute $139 million per year to their pension fund yearly from 2023-2028, nearly doubling the $71 million required contribution from 2018-2023. According to the state Department of Revenue, the city can expect about $193.6 million in new sales tax revenues if they implement a 2% sales tax. That means more than a quarter of the new sales tax revenues, almost $55 million, could will be diverted to the mayor and city council to be used for other purposes.

The city is unable to meet their current obligations – they have budgeted for only about 70% of their required 2023 pension contribution – yet the bill allows them to skim and spend. Any growth in sales tax revenues over the next 5 years while their “required” contribution is $139 million will simply jack up the size of the new city slush fund.

The new skim spending will be ongoing expenditures funded by a sales tax that is being billed as temporary.

It’s a far larger problem than false advertising; every penny of skim lengthens the timeline for the pension fixes.

Did Anyone Do the Math?

There remain questions about whether, even if every penny went to solve their pension woes, 30 years of a new sales tax along with moving new employees into the state system would be enough to sustain the pension fund for the current retirees and current employees who will retire into it.

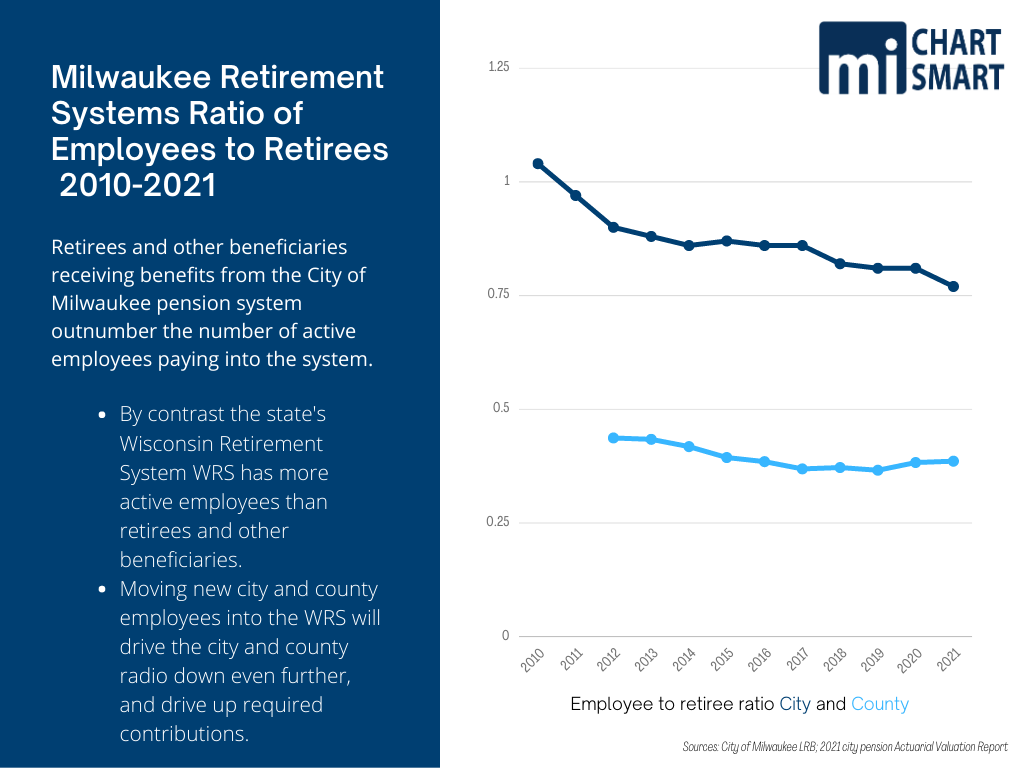

The bill would move new employees to the stable Wisconsin Retirement System, keeping their pensions out of reach of the mismanaging hands of elected city officials.

Removing future employees (and their future contributions) from the Milwaukee retirement systems means the city and county will have to substantially increase their contributions into the legacy systems to simply keep pace with future needs in their system, not to mention becoming fully funded.

The city’s ratio of active employees to retirees and other beneficiaries has been dropping and is now down to about .77 workers contributing into the system for every beneficiary receiving benefits. In the county the ratio is even lower, roughly .39 workers for every beneficiary. Moving new employees to WRS will make those ratios plummet.

In 2022, the city’s retirement system paid out about $1.25 million in benefits per day, to beneficiaries. The largest portion of that goes to police and fire retirees, 27% of which are not yet 60 years old

Police in Milwaukee can retire with full benefits at age 50 with 25 years of service. Currently they pay 7% of their salary into the system, while the city contributes 18.7%; similarly firemen contribute 7% and the city kicks in 21.3%. While the public safety unions are all in favor of the bill, the question of disparity of benefits and contributions between coworkers in different pension systems has not been addressed. And will no doubt require even more money.

In 30 years, when the sales tax is slated to end, a not-negligible proportion – perhaps 10-15% – of current beneficiaries now in their 40s and 50s will likely still be alive and receiving benefits. And all current city employees will retire into that system, some no doubt currently in their 20s who will be more than a decade from retirement when those 30 years have elapsed.

If there is a plan for how the city will cover the benefits continuing past the time the sales tax revenues will be available? If lawmakers know how much revenue will be required to secure the pensions of current employees and retirees, and how long it will take to get there – figuring in the built-in skim- that information has not been made public.

If – and it’s a big if – this legislation guarantees the pensions of even the youngest of current employees will be fully funded using only a portion of the new sales tax revenue, one question begs to be asked and answered:

Why isn’t the legislature proposing the shortest time period possible for the new tax by requiring all the revenues go toward fully funding the pension and nothing else?

Instead, locals will spend the sales tax skim on ongoing expenses, making minimum required contributions to the pension system, and when the 30-year sunset comes, there will be another predictable, deliberately created “fiscal cliff.” The plan seems designed to ensure Milwaukee will be back for another bailout down the road.

It’s no surprise that Milwaukee leaders would embrace a solution that doesn’t solve anything. It’s their brand.

But legislators should come clean about their intentions.

If legislative leaders want to give the city and county more additional revenue sources permanently, tying only a portion of the funds to cleaning up their pension messes, they should have the courage to make that case to taxpayers.

As it is, it looks like the legislature is using the bill as a trojan horse for permanent tax increases and a permanent new revenue source for Milwaukee.

Is Milwaukee Hamstrung?

To listen the left, local governments, the mainstream media, and the former mainstream media reporter who has become the legislature’s chief policy advisor, the very idea that elected officials should have to get permission from voters to take more of their money is not only onerous but somehow unconscionable.

They’ve normalized dealing voters out and deliberately conflate levy limits and flat shared revenue with flat spending. Milwaukee’s Mayor Cavalier Johnson, another up-and-coming tax-and-spend advisor to the legislature, said Milwaukee is “hamstrung” by not having the revenue they “need.” He blamed the legislature for keeping their shared revenue at levels from “the last century.”

Milwaukee increased spending 57.6% between 2001-2021. During that time, the median household income in Wisconsin increased 42.8%. Milwaukee’s spending is far outpacing the median household income of taxpayers who foot the bill.

The taxpayers are hamstrung, not city leaders.

Will Rewarding Bad Behavior Encourage Good Behavior?

As we noted above, Milwaukee gets 50% more than the rest of the state combined out of this deal. All because they mismanaged and spent their way to “crisis.”

Mayor Johnson took several swipes at the state in his budget, including whining that while the state “amasses surpluses in the billions of dollars” Milwaukee is constrained by frozen state aid, levy limits, and no hotel, sales, or income taxes that their peer cities have.

It’s true that Milwaukee doesn’t have as many revenue options as many other cities but while Johnson snipes about paltry state aid stuck in the “last century,” he forgets to mention amount of state aid they receive is far greater than most peer cities. The revenue mix of the city is more limited than other cities, but each pot is much larger.

There are good arguments to have a broader revenue mix, but Milwaukee has made it crystal clear they’re not looking for a new revenue mix, where they swap some decreases in state aid and/or property taxes for more revenue sources like a city sales tax. On the contrary, they just want more money.

If the legislature wanted to adjust the revenue mix for the city, they could do that in this bill. They could reduce property taxes and/or state aid and allow the city to implement new local revenue options to give a broader mix of funding. They’re not doing that either.

Instead, legislators are doubling down, locking the state into ever-increasing amounts of state aid and giving Milwaukee a temporary sales tax. Which will never be temporary, won’t solve their self-imposed pension problems, and will have them back on the state’s doorstep in short order.

The city set unrealistic rates of return for their pension system, making it appear fully funded when it was not. Yet Mayor Johnson – slamming the legislators he is lobbying for a massive bailout – doubled down on the lie that just 9 years ago ‘no contributions were needed.’ The city refuses to acknowledge past bad behavior much less improve it.

Is A Bailout the Best Answer?

Milwaukee has a long, strong history of failure to execute fundamental government responsibilities by dint of incompetence, corruption, mismanagement, and disinterest in the well-being of the community.

- The state has had to take over the management of some vital government services that Milwaukee was unable to provide safely or effectively.

In 1998 the state had to take over the management of Milwaukee Child Welfare because of what was described as gross mismanagement that failed to protect the safety and well-being of Milwaukee children in their care. The child welfare system is functional.

In 2010, the state had to take over the management of the enrollment and eligibility for the Medicaid and Food Share programs in Milwaukee because they were failing to effectively manage the programs intended to help vulnerable and low-income families. Medicaid enrollment is functional.

- A four-year investigation into mismanagement of the city Health Department’s handling of lead testing for children ended last year with no charges filed, in part because of the city’s “unreliable recordkeeping.”

- Milwaukee public schools fail to properly educate the majority of children, and local leaders have rejected every solution that isn’t pumping more money into a failing system.

In Milwaukee the solution to every problem is cash, and since this legislation was born in Milwaukee – it is rooted in former mayor Tom Barrett’s pension task force – it’s little surprise that money is the centerpiece. The city gets a 10% increase in shared revenue and nearly $200 million more in sales tax revenue; the county gets a 15% increase in shared revenue and almost $73 million more sales tax dollars, even more under the Assembly version.

But Milwaukee officials are already complaining. And legislators – most of whom are too far down the bailout road to turn back – haven’t required much in terms of guiderails or strings to prevent predictable Milwaukee mismanagement.

Would Starving Local Officials Buy a Communications Platform to Learn About Backyard Chickens?

Part of the reason so many legislators have hitched their wagon to the Milwaukee Bailout is that they have their own constituency to appease and perhaps a guilty big-spending conscience to assuage.

Local governments have been complaining about levy limits since they were imposed – because of year after year of unfettered nearly 8% increases – and shared revenue since well before it was frozen.

Pandemic funds pushed billions into local government coffers, directly from the federal government, and through the Evers Administration. For all the wailing and gnashing of teeth about how desperate local governments are, some of their ARPA spending argues that maybe they’re not in such bad shape after all.

We’ve already talked about spending ARPA dollars for skate parks, solar panels on government buildings, children’s LGBTQ library materials, synthetic turf for sport fields, and staff to figure out how to get more government money to replace pandemic aids when they run out. And to add more Diversity, Equity and Inclusion staff and pay “bonuses” to staff for working during the pandemic.

Taxpayers managing their own inflation-impacted budgets may be forgiven for struggling to process the whining from elected officials about a lack of funds while they spend tax dollars on things that seem a lot more like wants than needs.

- Green Bay Mayor Eric Genrich, testified on the bill saying he “leaned into public safety” and increased spending in the police budget, even though he actually cut police staffing. Genrich said the $1.5 million additional funds they would receive was a start, but they need more money if they are to hold the line on property taxes.

- Genrich is currently advertising for a “Workplace Culture Specialist” who will review city policies and develop, implement and monitor a workforce culture, diversity and equity plan. This Green Bay ‘Diversity Police’ position is located in the city’s HR department, with a salary comparable to what Green Bay pays a new patrol officer.

- Eau Claire County spent over $2,000 a day of ARPA money to run heating and cooling centers, while also asking for a levy increase. They will get an additional $714,000 in state aid.

- Dane County spent $1 million of ARPA funds to support their local art community. They’re slated to get $4 million more a year in state aid.

- Madison spent $1 million ARPA to help illegal aliens and others access taxpayer-funded services; the bill would give them another $2.9 million in state aid.

- Appleton has a full-time Diversity, Equity and Inclusion officer; they’ll be getting another $1.4 million in shared revenue every year.

- The city of Waupaca will use ARPA to give grants to low-income people for siding, roofing, garage doors and windows. They will be getting $184,000 in additional shared revenue yearly.

- Waupaca County is using ARPA dollars for a micro-transit system and to hire regional events coordinators to plan large events. They’ll be getting an extra $800,000 every year under the bill.

- The Village of Howard, which found the funds to develop a luxury apartment complex they own and rent, and increased their levy 10% in 2023, went to referendum for public safety services in April. Taxpayers voted it down. But the state is coming to the rescue with a 93% increase in state aid under the bill earmarking nearly $500,000 for the struggling village’s coffers.

- The Village of Ellsworth, perhaps hoping to follow suit, is using ARPA funds to purchase a dilapidated old building they will demolish (using other state funds) to build housing. The bill gives them a 116% increase in state aid.

- Marshfield spent ARPA funding on ATV signage and for an online platform which collects comments, similar to a Facebook post, which they’ve used in the past 7 months only to ask about backyard chickens. This spring, voters said no to a referendum to provide $1.3 million for public safety. The bill would send the city an extra $812,000 in state aid a year.

- Racine, where the mayor testified $3.7 million in new state aid yearly is a drop in the bucket that will allow him to ‘make payroll,’ used ARPA funds to create a new Equity Officer position.

ARPA funds hard at work for desperate communities starved of funds.

Those are some that could be tracked down. Many local governments don’t post their budgets online, and few specify where they spent all their pandemic dollars.

Maybe all the taxpayers in these communities would find these kinds of expenditures necessary. Perhaps emotions on chickens in Marshfield run so incredibly hot that it justifies spending tax dollars on a new “platform” that acts like a free Facebook post.

What’s So Wrong With Asking Taxpayers Before Taking Their Money Anyway?

But a hint might be that this spring only 10 of 25 municipal referenda passed – 40%. Some of those rejected were voted down in communities with overwhelming support for the liberal Supreme Court candidate. It’s clear that taxpayers of all partisan stripes will vote to increase their taxes for causes they consider worthy and will say no when they’re unconvinced there is a need – or that their local officials are spending money wisely.

A lobbyist for the League of Municipalities said that if elected officials raise taxes or spending the taxpayers don’t like, they can throw them out at the next election. Which is closing the barn door after the horse is out.

But the question of whether asking taxpayers before picking their pockets is a good or bad is a now a central point of contention between Republican lawmakers.

In the olden days two years ago, Republicans believed referenda were one valuable means of local control. They are one way families have a direct say over how much money they have to spend on their own needs and wants.

The fact that this option is still so rarely used – while local units of governments ceaselessly lobby for more money without having to be bothered to make their case – and that they don’t all automatically fail proves two things: local officials want to spend more, they just don’t want to justify it.

Towns Raise Their Levies All The Time, Right?

One of the talking points supporters use most often to promote the state shared revenue cash dump is that towns have been particularly disadvantaged by the shared revenue system and lack the funds to provide basic services.

Wisconsin is known for having many units and layers of government. Towns, villages and cities comprise 1850 units of government, and more than two-thirds of those are towns and more than 90% of those towns have a population under 3,000.

Where other units of government can raise their levy above their rate of growth by going to referendum at a regularly scheduled election, the 1144 towns with populations under 3,000 are singled out for broader statutory authority when it comes to raising their tax levy.

These towns can notice a town meeting and raise the levy by a simple vote of the residents present. Given how few people notice public notices, and how few of those folks attend public meetings, and how easy it is for officials to pack the room with friends, family, and stakeholders who will support the tax-and-spend plans, it’s not a high bar.

One would assume that if town governments are especially destitute, this easy process for increasing the tax levy would be frequently used.

It’s not.

Over the past 11 years, DOR records show only about 1 in 5 towns used this no-fuss, no-muss way to raise their levy – a small fraction considering the claims of destitution and deprivation. The amounts have ranged from $10,000 to $3.4 million with a strong majority under $500,000 and just a handful over $1 million.

The town of Phelps asked to increase their levy at a town meeting last year, and while residents questioned a 200% increase in festive lighting expenses, the board said a $255,000 levy increase would keep them going for years to come and the increase passed. Now the state will be sending them an additional $50,000 per year that is above and beyond what they need. But they’ll spend it.

Voters in the Town of Minocqua rejected a 2023 referendum to increase the levy roughly $400,000. Though the taxpayers felt new funding was not needed, the state will be sending them an extra $140,000 a year under the bill.

Three towns and one village rejected pandemic aid. Local officials in two of these said they didn’t really need the money and weren’t particularly impacted by COVID. They apparently didn’t get the starvation memo.

Where Is the Give and Take?

The bill contains some minimal strings but in a bill with such a hefty price tag, there are few guiderails.

Strings for All

- The additional state aid can’t be spent on culture and education or general government.

- It requires every municipality to maintain and certify they have not reduced the level of public safety employees.

Strings for Milwaukee

- Milwaukee has to undergo audits of the use of the sales tax revenues every 5 years and the pension systems annually.

- Their legacy pension systems are required to match the Wisconsin Retirement System projected rate of return.

- The legislation sets specific staff numbers for police and fire, which the city and county must maintain.

- Requires MPS to have at least 25 School Resource Officers in schools. (MPS has 36 high schools and roughly 150 schools total.)

- Requires a 2/3 vote of the city and county governing body for new spending or new positions.

- Prohibits tax dollars being spent on the streetcar.

There are many good government guiderails that could be included in the bill to give taxpayers a better window into how their tax dollars are spent. Why not require, as a condition of receiving these huge increases in state aid, local governments to:

- Provide a detailed, full accounting, posted online, of the expenditure of all each dollar of pandemic aid.

- Post their budget proposals, committee actions and final budget online with votes, in a searchable format.

- Use a budget format, developed by DOR, that will allow for easy comparisons across municipalities.

- Post all election documents (nomination papers, declaration of candidacy, finance reports) online.

- A resolution in effect banning contracting with, taking funds from, or embedding of staff from any non-profit or other outside organization to participate in election administration matters – to prevent a recurrence of the CTCL involvement in critical areas of the state.

- Keep voter rolls updated.

- Eliminate diversity and equity offices and positions to end the government-funded woke social engineering.

These are just a few of the low-hanging fruit. Some would minimally tie the hands of locals, but others would simply require a level of transparency that’s been lacking, and which would allow taxpayers, and legislators, to be better informed about local government activities. And might reveal some best practices that could save money.

Is This Bill Good For Wisconsin?

It’s being sold as a fix for Milwaukee’s pension problems, but there’s no analysis to prove it will, a major bond house suggests it won’t, and funds are able to be skimmed by locals to use for other, ongoing expenses.

It’s pouring an unprecedented amount of spending into local governments, many of whom spent pandemic aid on wants, not needs. Taxpayers in some of those jurisdictions have said no to increased spending. The bill layers new money into an old system, more concerned with creating no losers than creating the right balance.

While the legislature seems to be in a competition to provide more money with fewer guiderails, the biggest beneficiaries of the bill are thumbing their noses at the body who they want to bail them out of their self-made crisis, complaining about the few guiderails and looking for ways to continue their ingrained mismanagement.

It increases taxes and spending and grows government.

A bill that doesn’t do what it intends, spends more than it needs, increases taxes, and pressures legislators to rush is unlikely to have long-term positive results. The tougher question may be whether they have the courage to admit it.