The non-partisan Wisconsin Legislative Council confirmed something about tax increment financing (TIF) that the MacIver Institute has been warning taxpayers about for years: tax increment financing directly results in higher property tax bills for all taxpayers in that community. This contradicts what local and state government officials have claimed for years, that TIF is a win-win for taxpayers.

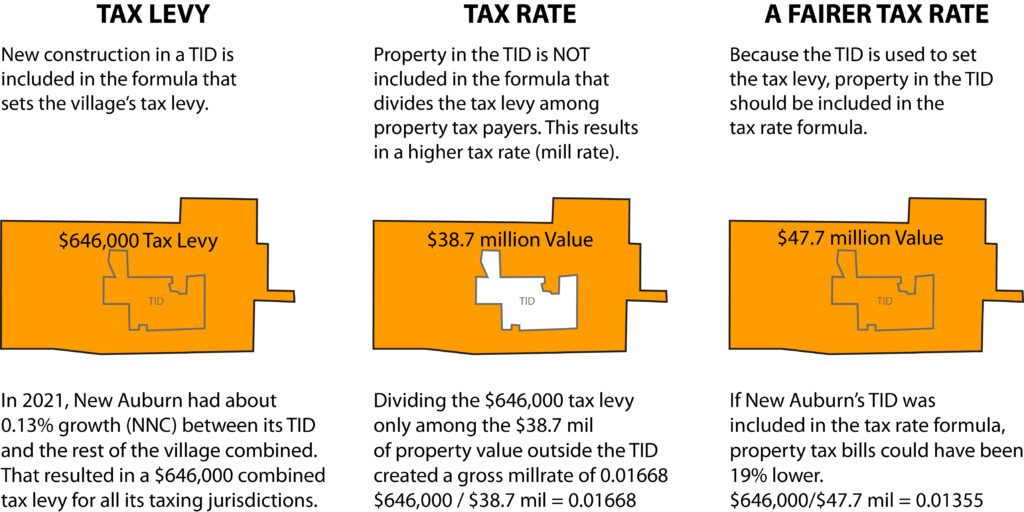

Legislative Council released the memo that explains everything on Nov. 29, 2022, which the MacIver Institute obtained through a records request. It explains that anytime there’s construction within a TIF district (TID), the mill rate goes up for the entire community. Essentially, local governments use the net new construction (NNC) that occurs within TIF districts to justify higher tax levies, but then exclude that new property value in the TIDs when calculating the new mill rate.

As the Legislative Council’s memo explains, “When a TID exists, and all NNC occurs within the TID, the mill rate will increase from the prior year, because the mill rate’s numerator increases while the denominator stays the same.”

This memo is important, because few Wisconsin taxpayers fully understand this dynamic. That’s something local leaders bank on when they pitch new TIF districts to their residents, basically claiming it’s free money. The typical sales pitch is they borrow money today, invest it into the TIF district, which leads to new development, which generates more taxes to pay back the loans. They leave out the part about how it also raises everyone’s taxes if the plan works out.

“This memo confirms what I have known but local officials, developers and consultants have usually denied,” Sen. Duey Stroebel told the MacIver News Service. “Using TIF gives your municipality the ability to raise your taxes. Every proposed project should be reviewed on its own merits. There are reasonable and beneficial uses of TIF, but we need to be honest with all Wisconsinites. When weighing the cost-benefit decision, a bump in property taxes is a real cost of using TIF.”

Legislative Council’s memo exposes TIF’s dirty little secret, but it helps if you know something about how Wisconsin property taxes work. Fortunately, the MacIver Institute has spent a lot of time over the years helping to educate Wisconsin residents about this very subject.

Wisconsin Property Taxes Crash Course

Local property tax levies are tied to a community’s equalized value, which the Wisconsin Department of Revenue (DOR) defines as “the estimated value of all taxable real and personal property in each taxation district, by class of property, as of January 1, and certified by DOR on August 15 of each year.”

The local property tax levy (numerator) is divided by the community’s equalized value (denominator) to determine a mill rate. The mill rate is the amount of taxes property owners pay for every $1000 of assessed value they own. It is multiplied by your home’s assessed value to determine your property tax bill.

Annual property tax levy increases are tied to net new construction (NNC). That measures the amount of new building construction and land improvements in a community in relation to its equalized value from the previous year. It is reflected as a percentage. As an example, if a community’s equalized value is $1 billion, and there $1 million in new construction the next year, DOR sets its NNC at 0.1%. The community is then allowed to increase its tax levy by 0.1%.

Simply put, the tax levy does not increase because home values are going up. If there is no NNC, higher home values simply mean a lower mill rate. If your home’s values is going up and the mill rate is going down, your property tax bill should remain somewhat stable.

As the Legislative Council memo explains, “When a TID does not exist, an increased levy limit will not increase the mill rate from one year to the next, because the numerator and denominator of the mill rate increase proportionally.”

When the levy does increase because of NNC, the owner of the new construction is now paying property taxes, which should offset the increased levy. Therefore, everyone’s individual property tax bills should remain basically unchanged, as explained in the Legislative Council memo.

Legislative Council’s Examples

Using those basic concepts, legislative council provided seven hypothetical examples to help lawmakers understand the relationship between NNC, equalized value, mill rates, and TIF. All of the examples begin with a municipality that has $10,000,000 equalized value and a $100,000 levy. When NNC occurs, it is $500,000. When there’s no TIF district, the initial mill rate is 1%. When TIDs exist, their base value is $100,000.

-

- No TID, No NNC. The mill rate remains 1%. (A $200,000 home’s property tax bill is $2,000).

- No TID with NNC. The mill rate remains 1%. (A $200,000 home’s property tax bill is $2,000).

- New TID. The mill rate remains 1%. (A $200,000 home’s property tax bill is $2,000).

- 50% NNC in TID. The mill rate increases from 1.0152284% to 1.039604%. (A $200,000 home’s property tax bill is $2,079).

- 100% NNC outside the TID. The mill rate decreases from 1.0416667% to 1.039604%. (A $200,000 home’s property tax bill is $2,079).

- 100% NNC in TID. The mill rate increases from 1.0152284% to 1.06598985%. (A $200,000 home’s property tax bill is $2,132).

- 50% NNC in TID for 5 years straight. The mill rate increases from 1.0152284% to 1.126126%. (A $200,000 home’s property tax bill is $2,252).

How To Analyze the Impact of TIF On Your Property Taxes

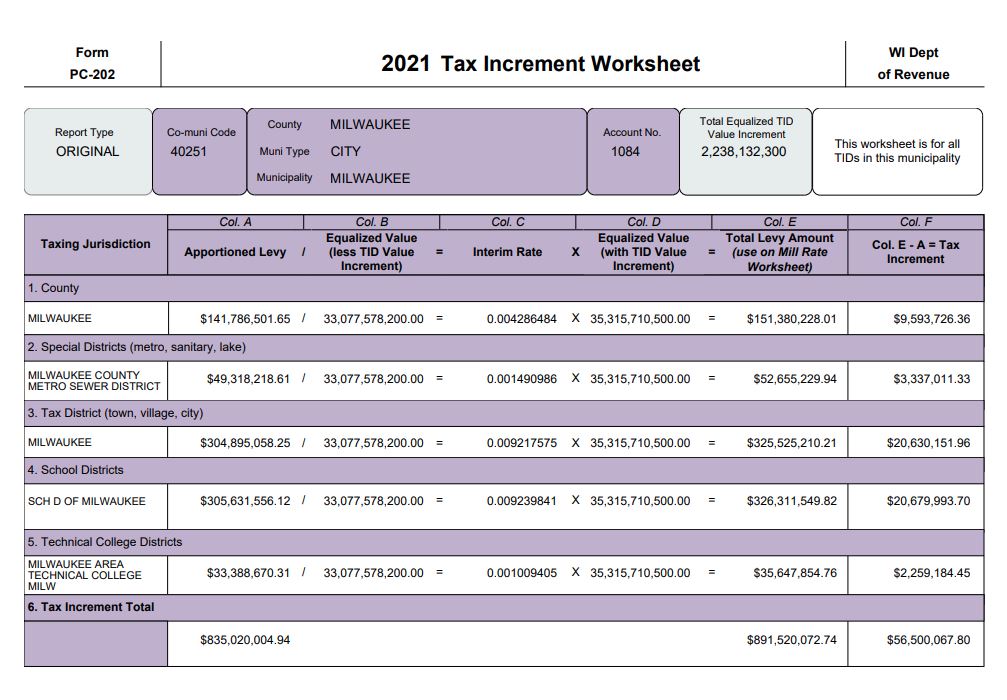

Hypothetical scenarios are great for helping people understand complicated concepts, but most people really want to know how it affects them personally. Fortunately, it’s easy to calculate how TIF is impacting your property tax bill. DOR keeps all the numbers you need in one location. Every municipality that has at least one TIF district is required to complete and submit an annual Tax Increment Worksheet. All those worksheets are collated in a single PDF file on this webpage. They’re organized by county, so you should have no trouble finding the one for your community.

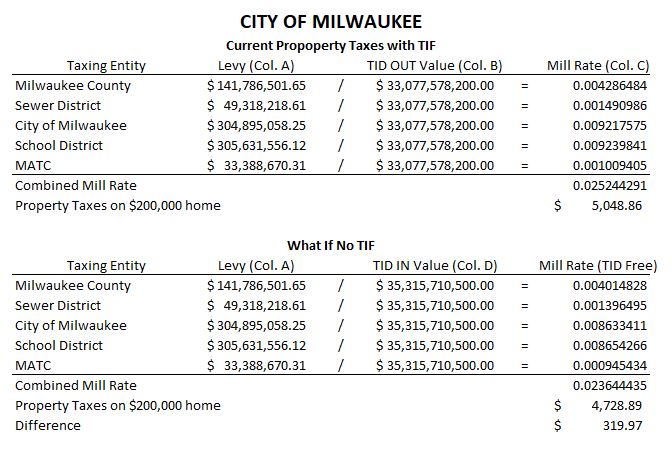

The purpose of the worksheet is to calculate the mill rate and tax increment for each taxing entity in the municipality. Because TIF is involved, the denominator is equalized value without the TIF district (also called TID OUT). To see what the rates would be without the TIF district throwing off the formula, we’re going to recalculate them using the equalized value with TIF district (TID IN) as the denominator. To demonstrate, we’ll use the City of Milwaukee’s worksheet.

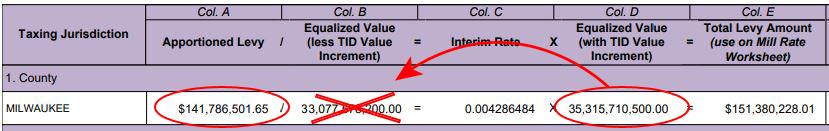

First, start with row “1. County.” Column A shows the apportioned levy is $141,786,501.65. The worksheet divides the levy by column B, “equalized value (less TID Value Increment).” We want to instead divide the levy by column D, “equalized value (with TID Value Increment).” That will provide the mill rate without the TIF slight-of-hand.

In Milwaukee, the county mill rate on the worksheet is 0.004286484. The formula is Col. A / Col. B = mill rate.

If we pretend there are no TIF districts, the formula would be Col. A / Col. D = mill rate. By doing that, we get a mill rate of 0.004014828.

Repeat those steps for each row. Then, add up all the individual mill rates to get the total mill rate for Milwaukee without TIF. Multiply that rate by the home value, and you end up with the TIF-free property tax bill.

In our example, we used a $200,000 home. With TIF influencing the property tax formula, the home’s property tax bill is $5,048.86. Without TIF, the home’s property tax bill would be $4,728.89.

Understand that the mill rates calculated on the Tax Increment Worksheet are “gross tax rates,” and are not the “net tax rate” you see on your property tax bill. Gross rates do not factor in the first dollar tax credit or the lottery tax credit. They also do not include debt levies, which are added into the mill rate later on. However, our exercise with the worksheet is still a good gage of how much TIF is impacting property tax bills.

What did your TIF-free mill rate do to your property tax bill? Let us know on our Facebook page!

Read MacIver’s Full Report on TIF here: