Finance Committee Axes Evers’ Far Left Agenda From State Budget

With Massive Federal Covid Aid And Strong State Economy, Government In Wisconsin Awash In Money

Budget Deliberations Begin This Week

High Stakes For Evers And His Re-election Budget

Will Rabid Base Allow Him to Compromise Or Force Him to Hold Out For Liberal Wish List? Will Evers Negotiate Or Veto Whole Budget?

The Joint Finance Committee (JFC), the Legislature’s budget writing committee, will kick off deliberations this Thursday, May 6th, on Governor Evers’ proposed 2021-2023 state budget. JFC also released a list of almost 300 policy items that they intend to remove from the Governor’s budget when they meet for the first time this week.

This is significant because, after Thursday’s vote, if Governor Evers wants to put back in any of his removed policy initiatives, he will need to find 9 affirmative votes out of 16 committee members. That seems unlikely with Republicans in control of the Joint Finance Committee by a 12 to 4 margin.

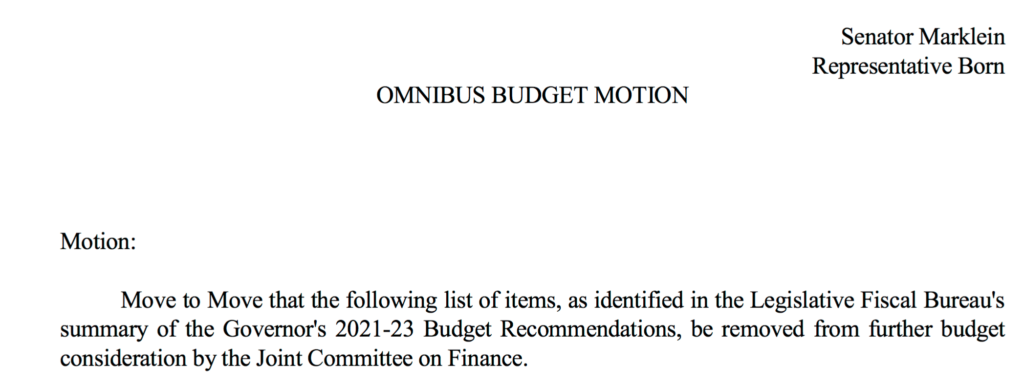

If his policy initiatives are not added back in by the Finance Committee, Gov. Evers can work with his supporters in the Legislature to introduce each of the ideas as a separate piece of legislation. Preliminary review of JFC’s policy list indicates that the vast majority of Evers’ far left policy initiatives have been removed from the state budget. Controversial items to be removed from the 2021-2023 state budget include (click here to see the memo from the nonpartisan Legislative Fiscal Bureau):

Evers’ $1 billion income tax increases

The legalization of marijuana

Allow most local units of government to increase property taxes a minimum of 2% the next two years

Early release from prison

Closure of Lincoln Hills juvenile correctional facility

Change that would treat all 17 year olds as children no matter the seriousness of their crime

The expungement of certain criminal records

Reduction of mandatory minimum sentences

Automatic voter registration

Allow unlimited early in-person absentee voting instead of just 2 weeks ahead of an election

Change voting residency requirement from 4 weeks to just 10 days

Increase taxes on private K-12 school tuition

Full expansion of Medicaid

Creation of a government-run public health insurance option at the state level and actuarial study of public option

Background check for all gun purchases

Redistricting changes

Raise the Wisconsin minimum age for the purchase of cigarettes, tobacco products and vaping products from 18 to 21

Legalize eminent domain to seize private property to build bike and pedestrian paths

Requirement that bike and pedestrian lanes be added to new highway projects

Diversity and equity initiatives, including equity officers created at almost all agencies

4-K kindergarten

Cap choice school enrollment

Changes that restrict the special needs choice school scholarship program

Mandate climate change indoctrination in K12 education

The Office of Environmental Justice

Increase residential and commercial energy taxes to increase funding for the Focus on Energy program

Institute a social cost of carbon consideration that will penalize fossil fuels and drive up costs

Allow dental therapists in Wisconsin

New tax increase on business, based on the income generated by a property not the real value of property

Allow counties or municipalities to hold a referendum to increase once again their local sales tax

Allow undocumented immigrants to get drivers licenses

Allow undocumented immigrants to pay in-state tuition rate at UW-System and technical school system

Allow student IDs to count as voter ID

Increase the state minimum wage

Restore prevailing wage which will require artificially high wages on state building projects

Collective bargaining changes that undermine Act 10

PFAS Standards

Repeal Right to Work

Restore project labor agreements that would force businesses to contract with a union

Repeal required drug testing to receive UI payments

Repeal the one-week waiting period for UI payments that combat taxpayer fraud

Repeal work search requirements for UI payments

All told, almost 300 policy initiatives were removed from the budget.

Also on Thursday, the Committee will consider two motions on standard budget adjustments and sum sufficient program re-estimates. When accepted at the first meeting, the standard budget adjustments will yield savings of $21.8 million in General Purpose Revenue (GPR). General Purpose Revenue is revenue raised from the taxes that we control here in Wisconsin, i.e., our state’s individual income tax rates, our corporate tax rate or our statewide sales tax, and because state government is in complete control of how GPR is raised and spent, it is treasured at the State Capitol. The almost $22 million in savings is good news for taxpayers.

The savings from the sum sufficient re-estimate are even bigger. The nonpartisan Legislative Fiscal Bureau (LFB) estimates that $464 million in gpr will be added to the general fund if the Finance Committee adopts this motion. Of the $464 million, $386 million of the gpr savings came from the Foxconn contract negotiated under former Governor Scott Walker. Walker structured the original agreement with Foxconn in a way that state aid was largely dependent on the number of jobs created in Wisconsin. Foxconn has not met the hiring goals from the original agreement, so $386 million in job creation aid will stay in the general fund. Gov. Evers recently announced a new deal with Foxconn that will give to the company $80 million in state aid if 1,454 qualified workers are hired and the company invests $672 million in Wisconsin by 2026. The original Walker agreement would have given Foxconn up to $2.85 billion in state aid if certain hiring requirements were met. It is estimated that Foxconn has already received just over a billion dollars in taxpayer support from local governments and in infrastructure improvements.

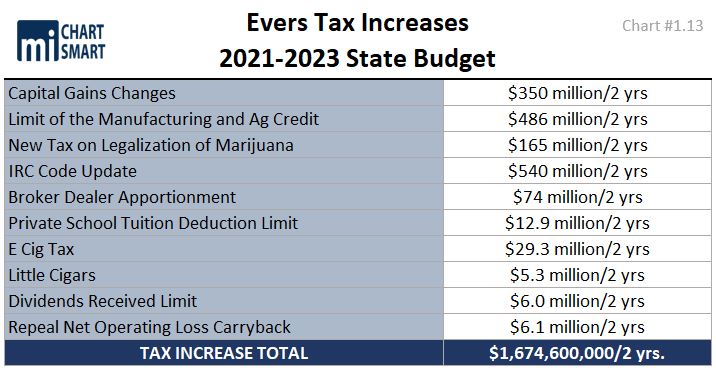

The unanticipated savings from the standard budget adjustments memo and the sum sufficient programs re-estimate will be added to what is already a very strong fiscal starting position for the state of Wisconsin. The federal government has sent a tsunami of COVID-19 and economic stimulus aid to government in Wisconsin and directly to Wisconsinites. The estimated $25 billion in federal aid, coupled with a stronger-than-anticipated economic rebound from the government-imposed lockdown, has put state government, and local governments as well, in a very strong fiscal position as budget deliberations begin. If you add in the federal aid sent directly to individuals, the federal government has sent back to Wisconsin a staggering $38 billion since the start of COVID-19. For comparison purposes, Wisconsin’s entire state budget spends $42 billion a year.

While the federal government is taking on massive amounts of debt, recklessly printing money, increasing taxes dramatically and mortgaging the futures of our children and grandchildren to provide this aid, it will, in the short term, allow Wisconsin to pass a state budget without the need for higher taxes or increased debt.

Despite all this federal aid, Gov. Evers has yet to renounce the $1 billion dollar plus in income tax increases included in his budget proposal or ask the Legislature to take the tax increases off the table. He is not alone. Mayor Barrett continues to advocate for higher taxes, specifically a higher sales tax in Milwaukee, as well.

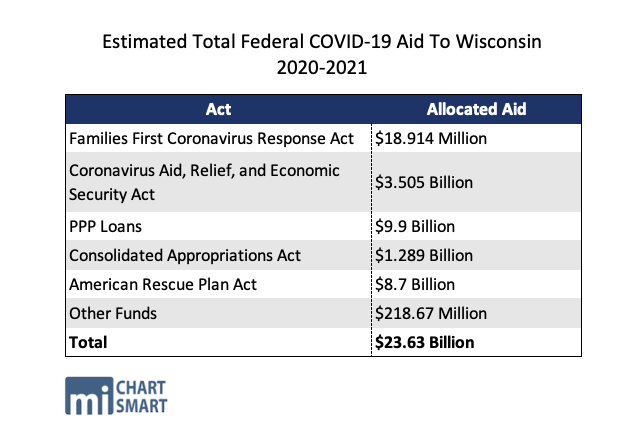

The LFB recently put out an estimate of how high your property tax bill will go under Gov. Evers’ budget. For the median-valued home in Wisconsin, property taxes will increase $142 over the next two years. See the full memo here –

The real drama that has yet to unfold is if Gov. Evers will engage in real negotiations with the Legislature this time to reach a bipartisan budget. Last budget, the Governor took a hands off approach, letting the Republican-controlled Legislature complete its work on the budget without any input from him or serious discussions about potential areas of compromise.

This is an especially important budget for Gov. Evers. This is the budget that he will run for re-election on. Does he want to work with the Republicans in the Legislature on a compromise or negotiated agreement so that the public feuding is kept to a minimum and the budget is signed into law on time? Or does the Governor, again because it is his re-election budget, need to fight tooth and nail for all of his legislative priorities so that his base is happy and supportive of his re-election?

If Gov. Evers does need to keep his base happy, does that mean the passage of the 2021-2023 will be significantly delayed or worse? If partisan fighting does break out and it delays the budget, will critically important independent voters blame Gov. Evers, the Republicans or both? Would it impact their vote in the November, 2022 election?

The stakes could not be higher for Gov. Evers or for the future of our state.

Stay tuned. All this “fun” gets started on Thursday.