JFC plans to strip out 130+ policy items from @GovEvers #wibudget and start from the base budget, meaning that any new Evers provisions must be added in with a majority vote. #wipolitics #wiright Click To Tweet

JFC plans to strip out 130+ policy items from @GovEvers #wibudget and start from the base budget, meaning that any new Evers provisions must be added in with a majority vote. #wipolitics #wiright Click To Tweet

May 8, 2019

By Ola Lisowski

This week, the Joint Finance Committee (JFC) is back to the State Capitol to kick off the first executive session on the 2019-21 biennial budget.

Since Gov. Tony Evers introduced his budget back in late February, the budget-writing committee held agency briefings and then toured the state to hear from the public. Now, it’s finally time to begin voting. Let’s take this opportunity to refresh your memory on the contents of the budget.

Every budget cycle, the Legislative Fiscal Bureau (LFB) produces a list of purely non-fiscal policy items, and it’s up to the budget chairs whether or not they want to pull them out. LFB’s list contained 70 items for consideration. Those items will be tossed. This is standard procedure – the very same budget chairs, Sen. Alberta Darling (R-River Hills) and Rep. John Nygren (R-Marinette) also tossed dozens of non-fiscal provisions from the last budget, when Gov. Scott Walker, a Republican, was in the East Wing.

This time, the chairs went further than LFB by doubling the list of pulled items to more than 130 provisions. Among those are some of the most controversial items in the entire document, including acceptance of federal Medicaid dollars and tax increases on manufacturers and retirees.

At Thursday’s executive session, the first thing the committee will do will be to formally vote to pull those items, which include more than $1 billion in tax increases. Expect a long debate on that before they move to other budget matters, including:

- Educational Communications Board

- Medical College of Wisconsin

- Historical Society

- Governor

- Lieutenant Governor

- Program Supplements

- Ethics Commission

- Investment Board

- Employment Relations Commission

- Administration — Division of Gaming

- Health Services — Care and Treatment Services

- Shared Revenue and Tax Relief — Direct Aid Payments

- Shared Revenue and Tax Relief — Forestry Mill Rate

- Transportation — State Patrol

- Revenue — Department-wide

As the budget committee begins to make its way through the behemoth spending document, let’s review the issues that you, the taxpayer, need to know about. Even without some of the more controversial provisions that will be stripped from the document, Evers’ proposal would still spend billions more than current spending levels.

The Basics

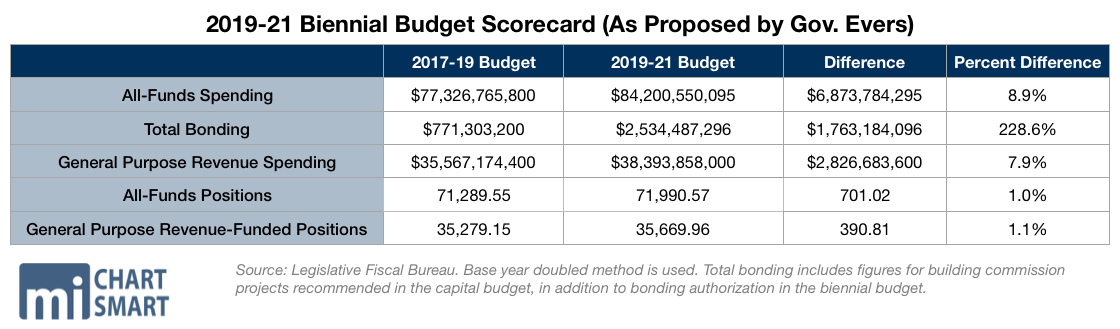

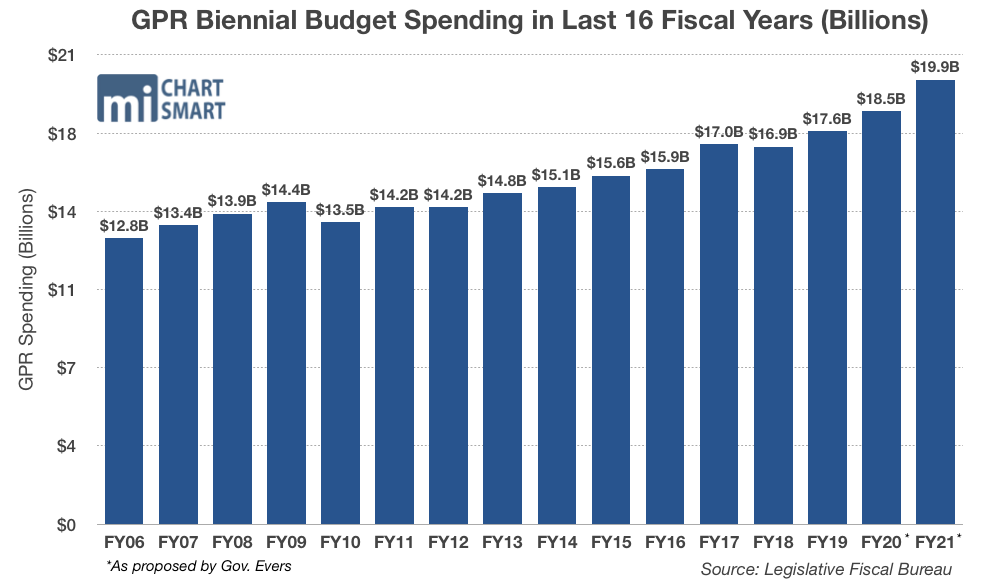

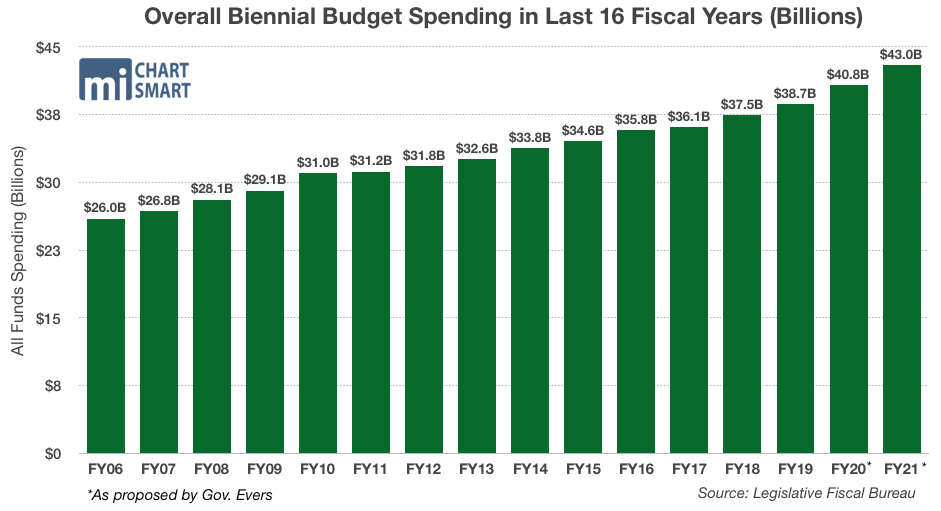

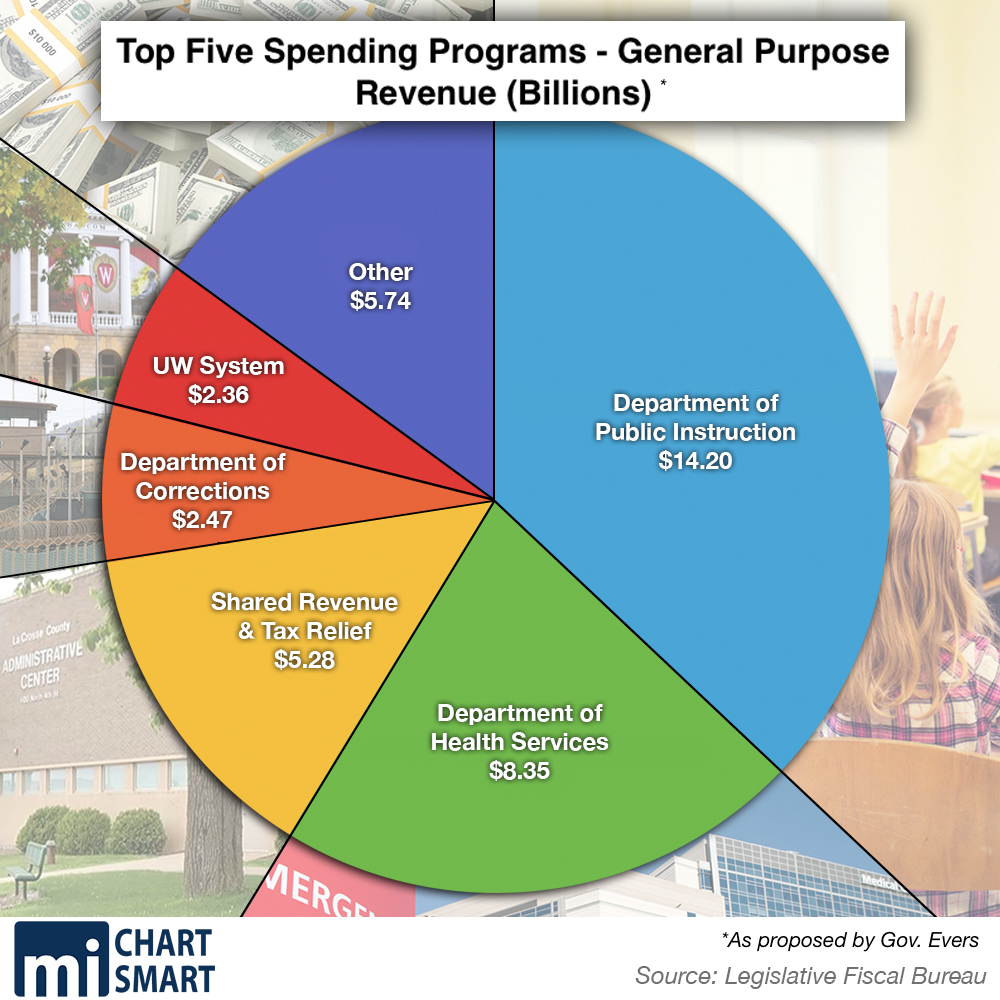

Evers’ budget proposal would increase spending by 7.6 percent or $2.7 billion over current spending levels, to $38.3 billion in general purpose revenue (GPR). Considering all funds, the document would spend $84.2 billion over two years, $7 billion in actual dollars more than Walker’s last budget. Using base year doubled math, the funding increase is $6.87 billion.

The proposal would increase total all funds positions to nearly 71,991 in the second year, a 701-position increase of government jobs from all funding sources. GPR positions would increase to 35,670 by the second year in the biennium, a position increase of 391 from current levels.

It also makes income taxes more progressive by targeting more income tax relief on lower tax brackets, while increasing income taxes for higher earners.

Taxes in the general fund would increase by a total of $1.64 billion over the biennium. General tax cuts, including a new middle-class tax credit and expansion of other already-existing credits, total $951.4 million. That means in all, the net tax increase to Wisconsin taxpayers would be $688.7 million over the next two years. However, those are just taxes at the state level. This budget would increase local taxes and fees in a variety of other ways, such as removal of property tax controls, which will push this total much higher.

The most curious omission in Evers’ budget is an apparent lack of reference to Walker’s signature 2011 reform, Act 10, which was repeatedly slammed by Evers on the campaign trail and in years past. Nowhere does the budget seek to roll back taxpayer protections created by the law, including increased contribution levels for public sector employee benefits or annual union recertification votes.

Tax Increases, Tax Cuts

Evers’ budget proposal introduces myriad tax hikes to at least partly pay for massive spending increases. First on the docket is a tax increase introduced by his office several weeks ago — a partial rollback of the Manufacturing and Agriculture Tax Credit (MAC). That change would limit the job credit for manufacturers to the first $300,000 of qualified income. The move would raise $516.7 million in tax revenue over the biennium by raising taxes on those manufacturers.

According to one recent analysis by the Tax Foundation, nearly 70 percent of Wisconsin manufacturing firms pay the individual income tax rate instead of the corporate tax rate. Since those companies are organized as pass-through businesses, all of their business income is taxed as individual income.

In other words, a manufacturer who earns $300,000 or more may appear to be part of Wisconsin’s upper-echelon of earners — but all of that business-owner’s equipment and inventory is included in the figure. As Darling said on the Senate floor, “You know a farmer is dealing with a budget that might be 1, 3, 5 or 6 million dollars. They’re not taking that money home. Those are just the expenses they have to deal with.”

If a retiree cashes in a stock they’ve held for years, those earnings would have been taxed at the highest rate available under an Evers budget proposal. That move, pulled out by JFC, would have punished taxpayers who are successful or preparing for retirement, to the tune of $505.1 million more in taxes.

Another change would increase the long-term capital gains tax. Under current law, long-term capital investment gains are taxed at a 5.355 percent rate. The budget proposal removes part of an existing exclusion, so that those gains are taxed at the top individual income tax rate of 7.65 percent for certain earners. Individuals earning less than $100,000 and married-joint filers earning less than $150,000 would keep paying the capital gains tax at the 5.355 percent rate, while earners above them would move to 7.65 percent.

If a retiree cashes in a stock they’ve held for years, those earnings will again be taxed, this time at the highest rate available. That move punishes taxpayers who are successful or preparing for retirement, to the tune of $505.1 million more in taxes.

This is where JFC’s move to strip certain policy items from the budget comes in: both the tax hikes on manufacturers and on certain capital gains will be pulled out of the budget. The budget committee will also toss the proposed repeal of the private school tuition deduction, and proposed restructuring of both the earned income tax credit and homestead tax credits.

Tax items that remain in the budget include a proposed 10 percent tax cut on the middle class, taxes on e-cigarettes and vaping products, and taxes on brown cigars. The budget chairs will also keep the creation of first-time home buyer savings accounts, and a new medical care insurance deduction for self-employed persons. The state will also begin collecting sales taxes on online purchases, and that money will go toward lowering the bottom-most individual income tax rate.

Late in his campaign, Evers announced plans for a 10 percent tax cut on the middle class. The administration is proposing a tax credit called the Family and Individual Reinvestment (FAIR) credit. Individuals earning below $80,000 and married-joint filers earning below $125,000 will receive a tax credit of 10 percent of their net tax liability or $100, whichever is greater. The credit phases out at $100,000 for single earners and $150,000 for married-joint filers. That provision remains in the budget today.

In addition to all the ways Evers’ budget would raise taxes at the state level, his plan proposes allowing local governments to increase property taxes in several different ways. When combined into individual tax bills, property owners could be in for a real shock next year. Many of those provisions have been pulled out by JFC.

First, Evers would have eliminated the school levy tax credit and the first dollar tax credit. Those credits would provide about $2 billion in property tax relief over the next two years without the change. School districts would also be able to hold referendums whenever they want, doing away with several important controls on property taxes at the state level. Both of those changes are nixed by the budget chairs.

Next, Evers would adjust revenue caps for municipalities, counties, and tech school districts. Currently, they can only increase their levy by their percentage of net new construction from the previous year. The budget proposal would set a minimum increase of 2 percent. Most communities currently have less than 1 percent growth each year, and the state average for 2018 was 1.62 percent. As a result of this change, 85 percent of Wisconsin communities would see the municipal, county and tech college portions of their property tax bills grow at a faster rate year after year than they do now.

The plan would also increase property taxes on big businesses, by allowing municipalities to base property taxes on the basis of that business’ total income rather than the value of a given property. Individuals who own homes aren’t charged property taxes based on their income — they’re charged based on the value of their home or land. This shift would fundamentally change how property taxation is calculated in Wisconsin. Both this change and the revenue cap adjustments for municipalities, counties, and tech school districts are tossed out by the budget committee.

Finally, local governments would be allowed to raise fees without having to lower their tax levies in exchange. This means local governments could start charging residents for things like garbage pickup and recycling without having to lower property taxes. In other words, if you’re not paying for things like garbage pickup right now, chances are you will be. In a surprising move, this change was left in by JFC.

One final note on taxes: apart from the minor shift on income taxes described above, Evers’ budget does not raise the general sales, corporate, or individual income tax rates. For all the tax increases tucked into other parts of the budget, the governor stayed away from a Doyle-style ramping up of individual income tax rates. Consider us pleasantly surprised on this front.

Health Care

Perhaps the most important item that the budget committee tossed out with non-fiscal policy items was the acceptance of federal Medicaid dollars. Expect that to be a big part of the discussion during the first executive session.

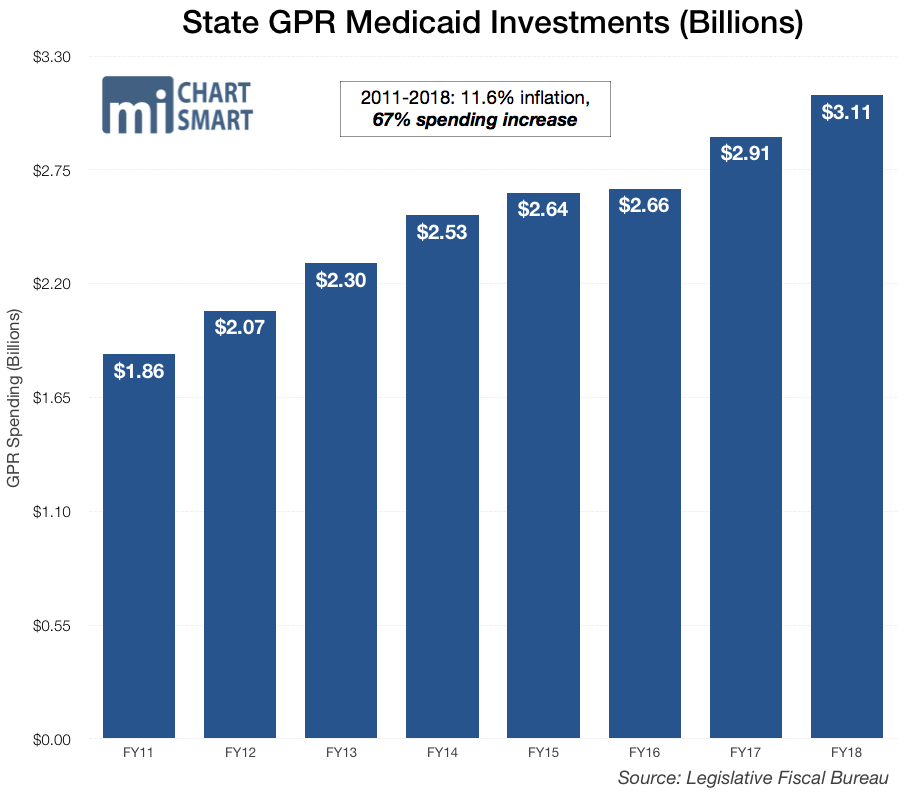

Evers’ budget would have accepted the federal Medicaid expansion under Obamacare while significantly increasing spending on a wide range of programs. The Medicaid expansion has been a costly proposition for states that accepted it. Medicaid spending in Ohio, for example, skyrocketed 35 percent in four years – from $18.9 billion to $25.7 billion between fiscal year 2013 and 2017. And in Minnesota, premiums increased 50-67 percent, forcing the state to implement a reinsurance program costing taxpayers at least $800 million so far. The federal dollars that follow a Medicaid expansion are anything but “free money,” as advocates persistently claim.

Premiums headed into 2017 were expected to increase by a staggering 50-67 percent, as opposed to Wisconsin’s 16 percent hike. As a result, Minnesota was forced to come up with $300 million to bail out 123,000 struggling Minnesotans who did not qualify for federal Obamacare subsidies.

The bloodletting of Minnesota taxpayers didn’t stop there. The following year, the Minnesota legislature spent an additional $542 million to establish a reinsurance program to hold down costs.

Despite these and many other stark cautionary tales, Evers proposed expanding Medicaid eligibility to everyone earning between 100 – 138 percent of the federal poverty level. In 2019, that income level is $34,638 for a family of four, making 82,000 more people eligible for the program. However, about half of the 82,000 people who would become eligible for Medicaid already have employer-provided coverage. The rest, those who earn between $13,000 and $17,000, qualify for plans on the Obamacare exchanges with premium costs as low as 18 cents a month. The annual deductible for those people is just $50.

That means many people who join the program would be moving backward, from self-sufficiency to dependence on government health care.

When tens of thousands of impoverished Wisconsinites can get health insurance for just 18 cents per month, it’s a clear sign that the state doesn’t need to go further or put future budgets at risk.

The budget asserts that expanding Medicaid will save $325 million in GPR across the biennium because of the federal government’s enhanced 90 percent match versus traditional Medicaid, a tenuous stream of dollars from a federal government already drowning in $22 trillion in debt. As with traditional Medicaid and its notoriously low reimbursement rates, the federal government is likely to back off that enhanced match in the future and leave state taxpayers holding the very expensive bag. Nonetheless, Evers’ budget proposal accepts and then immediately spends the $325 million—plus a lot more—on increased payments to health care providers and other new spending.

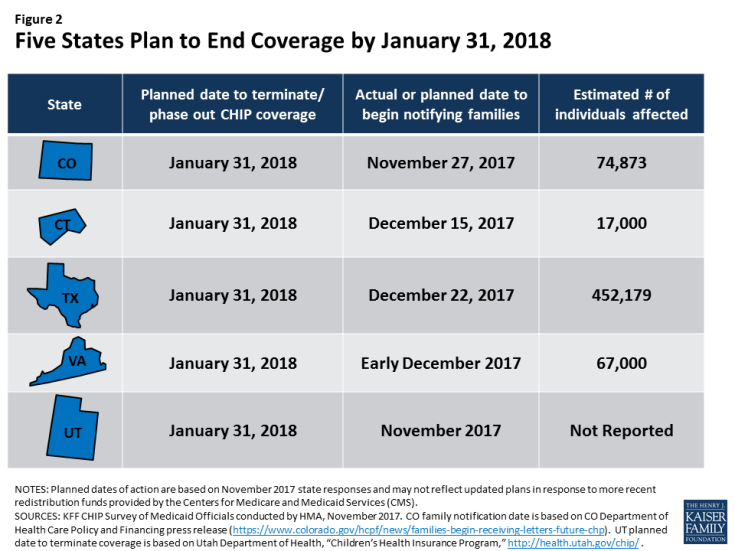

Accepting money from the federal government is a serious risk, as dozens of states learned with CHIP dollars. If Wisconsin does the same with Medicaid dollars, we risk much more than we can gain.

The federal government has a history of reneging on fiscal promises for states – just look at Children’s Health Insurance Program (CHIP) reimbursement rates.

In that instance, states built their budgets on promised federal dollars. Federal funding for CHIP expired in late 2017, and states were left picking up the slack by putting in more state dollars or cutting coverage. When the federal government backed out of paying what it promised, more than 452,000 Texans were affected when the state had to begin phasing out the program.

Accepting money from the federal government is a serious risk, as dozens of states learned with CHIP dollars. If Wisconsin does the same with Medicaid dollars, we risk much more than we can gain.

The budget spends $365 million more on reimbursement payments to hospitals serving Medicaid patients through five different, more traditional reimbursement avenues. That includes $142 million more in payments to hospitals handling a larger number of Medicaid patients than most; $100 million more for payments to acute care and critical access hospitals; $20 million more for payments to pediatric hospitals; and $1.2 million more for rural hospitals. All of those changes stay in the budget.

The budget builds off Gov. Walker’s reinsurance program, aimed at holding down premiums on the individual health insurance market in the era of Obamacare’s skyrocketing premiums. The continuation of this Walker-era program is a not-so-subtle admission that Obamacare has failed spectacularly to “bend the cost curve down,” and that failure is costing Wisconsin taxpayers dearly. The budget buttresses the program with $200 million in all funds spending for the Office of the Commissioner of Insurance in the second year of the budget. While the Walker administration, when he rolled out the plan, said it would cost taxpayers $34 million out of state coffers, Evers’ plan hikes the OCI budget by more than $72 million in the second year of the budget in state spending, or GPR — and by more than $200 million in all funds in the budget’s second year — to “fully fund” the program. That change also stayed.

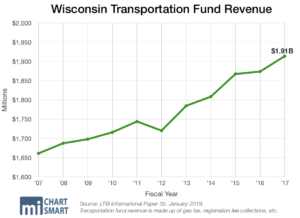

Transportation

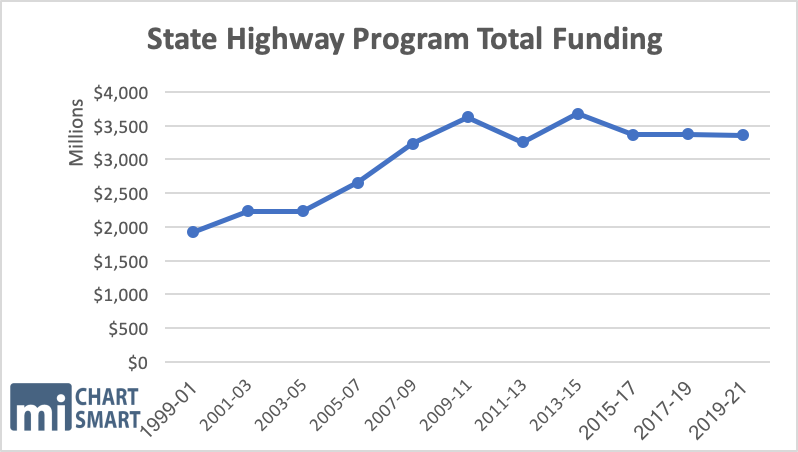

The Department of Transportation (DOT) gets a $627 million boost in the governor’s budget, bringing the total up to $6.63 billion from last budget’s $6 billion.

Of any agency budget, DOT’s was kept the most intact by the finance committee. Both the gas tax increase and indexing are left in the budget. However, the change to the minimum markup law was pulled out.

The plan calls for increasing the gas tax immediately by 8 cents, bringing it up to 40.9 cents, and producing an additional $264 million for the state. It would go up another one cent as a result of indexing starting in April 2020. Many lawmakers like indexing because it’s an automatic tax; it rigs transportation tax revenue to automatically increase without forcing legislators to actually cast a vote on the hike. In essence, it’s taxation without representation. Wisconsin would be the fifth state in the country to tie its gas tax to the consumer price index.

Evers also wants to increase vehicle registration fees by $10 for a total of $85 annually, create a new hybrid vehicle fee of $75 per car, and hike heavy truck fees by 27 percent. He claims these increases will be offset by eliminating the minimum markup on fuel. The minimum markup law is a Depression-era relic that sets a price floor on numerous products, including prescription drugs and gasoline. The minimum markup on products other than gas is maintained in Evers’ proposal.

Of any agency budget, DOT’s was kept the most intact by the finance committee. Both the gas tax increase and indexing are left in the budget. However, the change to the minimum markup law was pulled out.

The budget proposal would cut funding to major highway projects by $5.5 million, and to the highway “mega projects” category by $203.7 million. Most of Evers’ attention in the state highway program goes to the state highway rehabilitation program, which he increases by $225.7 million over the 2017-19 budget.

His main priority with road funding is on increasing road aids to local governments. Most local transportation aid comes in the form of general transportation aids (GTA) and is disbursed according to the calendar year as opposed to the fiscal year, which runs July to June. This year, the state will distribute $348,639,300 to municipal governments and $111,093,800 to county governments. Evers wants to boost that by 10 percent. That comes out to $383,503,200 for municipalities and $122,203,200 for counties next year. He also wants to increase the mileage aid to $2,628 per mile.

The transportation budget includes $338 million in additional bonding authority for transportation over the current budget.

Evers’ budget would do away with the “Fed-Swap” law, which requires DOT to consolidate federal funding into as few major highway projects as possible. The axed reform saves money by limiting the number of projects subject to the more stringent and costly federal requirements, including prevailing wage. The budget committee’s changes to the bill include pulling out Evers’ change to Fed-Swap.

Big Labor

Evers’ first budget handsomely rewards his Big Labor allies, and is a full-on assault on worker freedom. JFC took massive swipes at this particular section of the budget. Big Labor was perhaps the biggest loser in all of JFC’s changes, with Evers’ proposals for right-to-work, prevailing wage, and project labor agreements all stripped out. Many of these provisions are part of welfare reform, which we’ll cover in more detail later in this piece.

What Evers planned to do is bring back forced union dues, reinstate artificial wage floors that cost taxpayers big, and force the return of union exclusivity contracts.

Before JFC’s changes, the budget restored the prevailing wage law for state and local public works projects. Evers asserts bringing back the Great Depression-era relic “ensures that workers are not underpaid relative to other workers performing similar in the area.”

His budget plan permits the project labor agreements for public works projects that the former governor signed out of existence in 2017.

PLAs stipulate that only union firms can bid on a project, and many units of government required them — shutting out non-union shops.

The Republican-led reform law prohibits a government from requiring a PLA as a condition to bid on a taxpayer-funded project — a big win for the free market and the taxpayers who benefit from increased competition. Democrats have argued the law is yet another attack on unions and that it limits local control.

The governor’s budget plan also gets rid of a reform law aimed that ends the patchwork of employment laws statewide. Evers’ provision would repeal preemption of costly local government ordinances on family and medical leave, wage claims, employee benefits, hours of work and overtime, and solicitation of prospective employees’ salary histories. The preemption reforms require such employment regulations to be governed by uniform statewide policy, not created through the whims of local governments, at business and taxpayer expense.

JFC’s changes pulled out Evers’ proposals regarding the prevailing wage, right to work, and PLAs.

K-12 Education

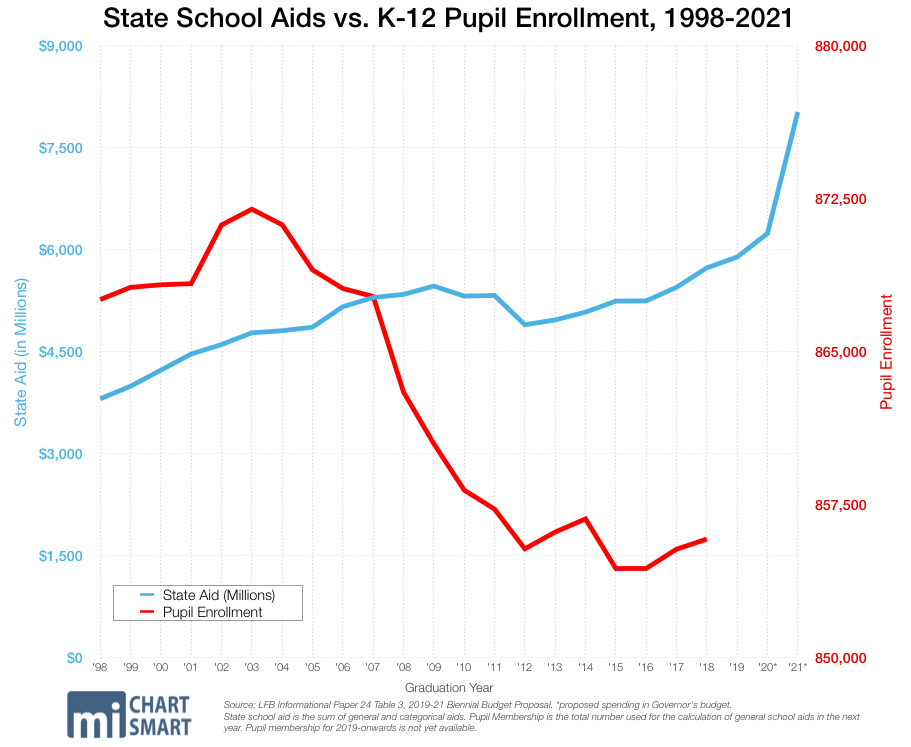

Property tax levels are largely driven by spending in schools — another issue area where this proposal would spend vastly more.

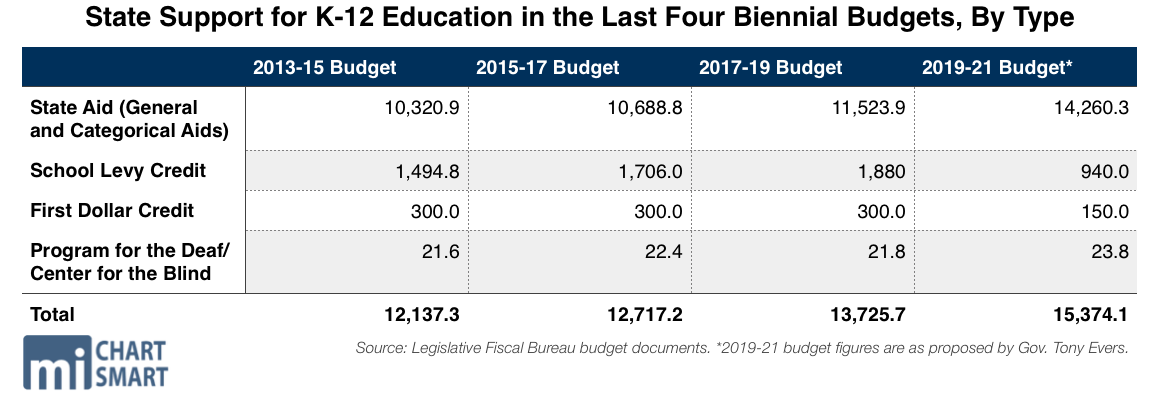

Evers’ budget proposal for K-12 education largely mirrors the budget request submitted last fall by the Department of Public Instruction (DPI), when he was the head of that agency. The total changes would increase DPI spending by nearly $1.6 billion over the biennium, more than the DPI budget request. It’s also more than twice the dollar amount of the last budget’s increase to K-12 education. That bill upped spending by more than $630 million in the biennium, the highest dollar amount in history at the time.

The majority of K-12 dollars flow through equalization aid, also known as general aid, which exists to even out funding disparities in local property taxes. Property-poor districts such as Milwaukee Public Schools (MPS) receive disproportionately high amounts of equalization aid. Forms of aid like the school levy tax credit and the first dollar credit are considered categorical aid, and are distributed equally across school districts.

Under Evers’ plan, the school finance formula would significantly change, and billions more dollars would flow through equalization aid. The school levy tax credit and first dollar credit would be eliminated in the first year, with that funding instead moving to general aid. That move alone is likely to increase property taxes, since money that is now used to offset local property taxes will instead flow directly to schools. The plan includes a hold harmless provision so that no district will receive less in state funding than current law.

Limits on school district referenda implemented in recent years would be done away with. School districts would no longer be limited in the number of referenda they may hold in a calendar year, another measure certain to increase property taxes across the state.

JFC changes delete Evers’ proposal to eliminate those property tax credits as well as his proposals on school district referenda. The hold harmless provision is maintained, as is the additional funding weight for economically disadvantaged students.

JFC changes delete Evers’ proposal to eliminate those property tax credits as well as his proposals on school district referenda. The hold harmless provision is maintained, as is the additional funding weight for economically disadvantaged students.

Other changes to K-12 funding include an increase in the revenue limit adjustment by $200 in the first year and $204 in the second year, with future increases indexed to inflation. The plan also increases the low revenue adjustment from $9,100 under current law to $9,700 in 2020 and $10,000 in 2021. That’ll allow school districts across the state to levy millions more in local property taxes. Assembly Republicans have pushed to increase the low revenue adjustment in recent years, including during the previous budget debate. The Assembly Republican plan in 2017-19 would have increased the low revenue adjustment by much less than Evers’ plan, and would have allowed local property taxes to increase by up to $92.7 million statewide. Evers’ plan, of course, goes much further than that, signaling even bigger property tax increases down the road. Those changes, as well as a more than half a billion dollar investment in special needs reimbursements, are kept in the budget.

The budget would also spend more than $600 million on students with special needs, while limiting many of those students’ options. The majority of the hike would go toward increasing the state reimbursement level for special education costs by $606 million over the biennium. The high-cost special education program would be made sum sufficient, and special education transition readiness grants would increase from $1,000 per pupil to $1,500 per pupil, increasing spending by more than $7 million on those grants.

While students with special needs who attend public schools are rewarded in the proposal, students in the Special Needs Scholarship Program (SNSP) would be shut out of their educational options. That program, established in the 2015-17 budget, allows students with special needs to attend private schools with scholarships from the state. No new students could join the program after the 2019-20 school year.

All of the provisions that limit educational choice, including the changes to SNSP, independent charter schools, and choice enrollment, are eliminated by JFC. Other additional regulations, such as different accreditation rules and licensure requirements, are also tossed.

Evers had proposed massive rollbacks to educational choice include freezing enrollment in the popular private school choice programs in Milwaukee, Racine, and statewide. Total seats available would freeze after the next school year. Students could join the programs when others graduate or otherwise leave. An estimated 38,187 students across the state participate in the three programs, with nearly three-quarters in Milwaukee.

The number of independent charter schools would freeze under the proposal, with a ban on authorizations of new schools by entities other than public school districts until 2023. Under current law, any chancellors of the UW System, the City of Milwaukee’s common council, tribal authorities, any technical college district board, the Waukesha County Executive, and the UW-System Office of Educational Opportunity can authorize independent charter schools.

Choice and charter programs have been remarkably successful in Wisconsin, showing strong proficiency rates despite higher levels of student poverty. Of the 17 MPS schools receiving five stars on the most recent state report cards, 10 are in the private choice program, four others are charter schools, and just three are traditional public schools. On the other end of the scale, 50 MPS schools received one star in 2018, or “failing to meet expectations” designations. Ten of those schools are in the private choice program, while three are charters and 37 are traditional public schools.

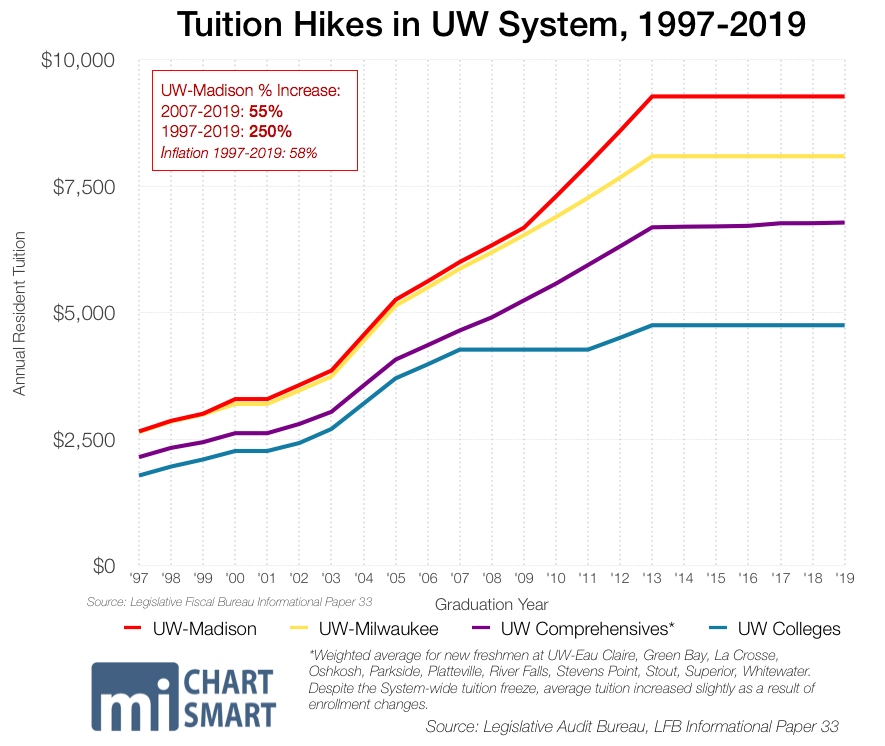

University of Wisconsin System

Evers’ budget proposal for the UW System would continue the popular tuition freeze for in-state undergraduate students. The UW System would see a boost in funding to the tune of $175 million over the biennium.

Almost all of Evers’ proposed UW budget is kept by the budget committee, including the tuition freeze, employee raises, and changes to performance-based funding for UW institutions.

Spending increases at the UW System include $10 million for fellowships and loan forgiveness for certain nursing candidates who commit to teaching in the system for three years after graduating. Student support services for the UW Colleges would see $5 million, and 20 more employees would be hired for UW-Extension county-based representatives. Need-based grants for Wisconsin students attending the UW System, tech colleges, private universities or tribal colleges would be funded by $17.3 million in GPR.

The proposal sets up a study committee to examine creating a state-run student loan refinancing authority. The committee is charged with making recommendations by late 2020, for inclusion in the 2021-23 state budget. JFC pulled that proposal, calling it a non-fiscal policy item.

The committee also pulled out one provision that would give undocumented students in-state tuition. Students who are citizens of other countries but who graduated from a Wisconsin high school, lived in Wisconsin for three continuous years before high school, or have applied for a permanent resident visa would qualify for in-state tuition under the original Evers plan.

All told, Evers’ budget spends $5.9 million more than the UW System requested in last fall’s agency budget request, and creates 219.84 new full time positions.

The Wisconsin Technical College System would also receive a funding increase of 7 percent in each year, totaling $18 million over the biennium.

The budget proposal eliminates the Early College Credit Program, which allows high school students to take university classes under a cost-sharing agreement. Students can earn high school credit, college credit, or sometimes both. Instead, the budget requires that the UW System implement a program to provide tuition-free classes for high school students. The budget gives similar treatment to a program that lets high school students take classes at tech colleges, instead requiring the tech colleges to provide them for free. JFC chose to leave in that provision.

Welfare Reform

Other than the Medicaid-related changes, welfare reform is the issue area where the finance committee pulled out the most policy items. Every single Evers proposal for unemployment insurance and equal rights was stripped out by JFC.

The budget would have rolled back some of Walker’s reforms to the state welfare systems. Able-bodied adults with dependents aged six to 18 would no longer need to satisfy work requirements in order to receive FoodShare. Drug testing for most public assistance programs is eliminated. Evers’ budget includes $5.3 million to help welfare recipients in the Wisconsin Works (W-2) program “access affordable Internet.” Those changes are now gone.

It’s another big-government initiative, that looks a lot like the city of Madison’s failed broadband-for-all pilot program for low-income neighborhoods. Evers’ $5.3 million seems all the more excessive given that free Internet access is as close as the local library, neighborhood school, or any number of retailers and restaurants.

Childless able-bodied adults would still be required to satisfy job requirements in order to get FoodShare. That became compulsory in April 2015.

A different budget provision also stripped by JFC would create a statewide broadband goal for all businesses and homes.

Minimum wage for state employees would increase to $15 per hour in 2021. For everyone else, the state minimum wage would increase to $8.25 in 2020, followed by 75-cent increases annually until 2023. Once the minimum hourly wage reaches $10.50 in 2023, it would become indexed to inflation. The governor’s budget proposal also creates a task force to study how to get the state to a $15 per hour minimum wage. Those changes are also axed by JFC.

Wisconsin would make a statutory goal for all electricity produced in the state to be completely carbon-free by 2050. That’s pulled right out of the Green New Deal, which argues that the entire world should become carbon-free by 2050.

Most state employees would see a wage increase of 2 percent in each year of the biennium, totaling $82.1 million in GPR. Another $12.1 million would be provided for targeted increases to certain state employees.

Wisconsin would make a statutory goal for all electricity produced in the state to be completely carbon-free by 2050. That’s pulled right out of the Green New Deal, which argues that the entire world should become carbon-free by 2050. As temperatures dipped below freezing in much of the state this weekend, a similar move enacted today would mean death by frost. Thirty years changes a lot, but it seems likely that Wisconsin will still be a cold northern state by 2050. That particular idea was pulled by the finance committee.

Other Evers proposals would repeal the changes in law the Legislature passed during December’s Extraordinary Session, including the ability of the Attorney General settle cases without the approval of the Legislature. The Legislature would no longer be able to intervene in lawsuits as a matter of right. Both of those changes are now stripped out.

All the Rest

As with any budget, there are always a few items that go mostly unnoticed. They may not be the biggest whoppers, but they do leave us scratching our heads. JFC pulled out all of the following items.

One provision would have created a government-run “private” retirement system. It would be similar to a pension that anyone in the state could join, creating yet another duplicitous new government program. This is one area where the wealth of private options that work for millions of people should make it clear that the state does not need to step in – but big government advocates seemingly just can’t help themselves.

Evers also proposed creating a first-time homebuyer savings account, similar to a health savings account, that would allow first-time buyers to set aside money tax-free.

Several government reforms were stripped, including automatic voter registration run by DOT, and a new model for redistricting and drawing legislative maps. Evers’ team calls that the “Fair Maps Plan,” claiming that the current maps give Republicans a political advantage.

Numerous energy-related provisions were taken out by the budget chairs, including spending money from Volkswagen settlement funds on the creation of charging stations for electric vehicles. That’d be similar to the government paying gas station owners to build new gas pumps. Instead, Evers would have the government take over another responsibility.

Other expensive energy initiatives include an unlimited electricity tax. Currently, the state’s Public Service Commission requires utility companies to spend 1.2 percent of annual revenues to fund energy efficiency and renewable energy programs. By law, the PSC can’t require utilities to spend any more than that. Evers’ budget would eliminate that 1.2 percent cap, opening the door for massive utilities increases. JFC stripped that item out as policy.

One energy-related provision that’s still in the budget is $2 million in one-time funding to the Washington Island Electric Cooperative. That money would replace a cable that brings electricity to Washington Island. Providing replacement cables is a direct function of what co-ops are supposed to do, but in this case, they might just get away with fleecing taxpayers statewide for local infrastructure improvements.

—

Ultimately, the JFC chairs made the budget a much, much more conservative spending document. The vast majority of deeply concerning items will no longer be in the budget, with the greatest exception being indexing of the gas tax.

Joint Finance is also starting from the base budget, meaning that any new Evers provisions must be added in with a majority vote. Tomorrow, get ready for a long re-hash on the budget in its entirety before the committee dives into votes. Luckily, you’ve now got a re-set on the document as a whole – and that’s exactly why we’re here. As always, follow @NewsMacIver and @MacIverWisc for live updates.

Bill Osmulski, M.D. Kittle, and Chris Rochester contributed.