Prediction is very difficult, especially if it’s about the future.

Feb. 5, 2024

By Michael Lucas

Many economists predicted a deep recession in 2020… and they turned out to be correct—but in the wrong way. Instead of an economic crash resulting from years of intensely activist monetary policy they got Draconian lockdown measures that stopped the economy dead in its tracks. But while the actual cause of the recession was quite different from what was foretold, the fundamentals of the analysis were spot on. Now, at the beginning of the new year, an economic slowdown seems inevitable.

The main reason economists were warning of recession leading up to 2020 rests on a leading indicator of recession: the inverted yield curve. This metric is universally recognized as the single-best predictor of recession. Why? Because an inversion of the yield curve has preceded every recession going back to 1959.

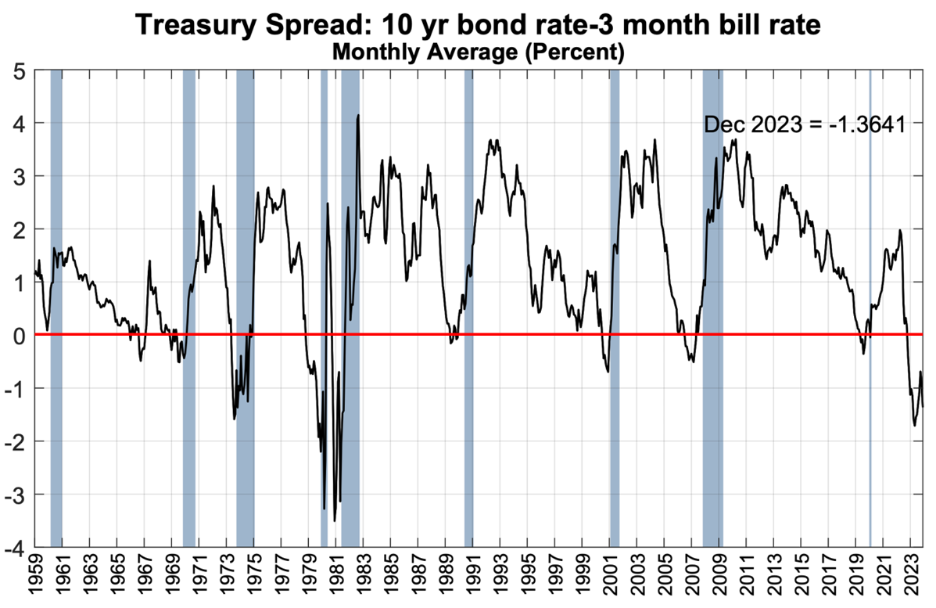

There are many different yield curves floating about out there in financial journals and corporate media outlets but the only one of real importance is this one:

What this curve shows is the difference in yield between the 10-year treasury bond and the 3-month treasury bill. In other words, when the yield on the 10-year bond is less than the 3-month bill, the curve goes below zero (the red line). When this curve dips below zero it is said to have inverted. As you can probably tell, each recession (indicated by the blue bars) has been preceded by an inversion of this curve.

However, this metric is not the be all and end all of recession forecasting. In 1960, for example, the yield curve comes close to inverting but fails to predict the recession. Yet again in 1967, the yield curve inverts, but no recession follows. All in all, however, the curve has predicted eight of the last nine recessions and has produced only one false negative. When considering the historical relevance of this curve, therefore, the recent yield curve figures are not exactly reassuring.

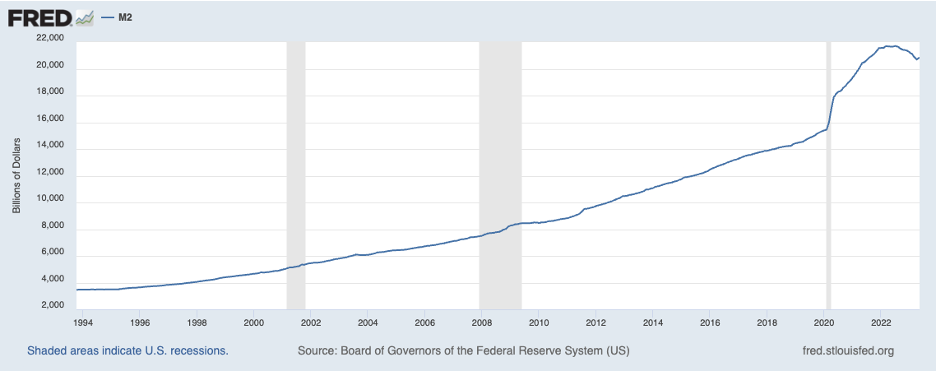

Since November of 2022 this curve has not only been inverted but has been well below zero. The most recent data point—December 2023—has the spread between these treasuries at -1.36% and we can expect this situation to persist for some time, at least until we come nearer to the general election. Typically, in election years, the FED “loosens” its monetary policy at the behest of the incumbent president who would like to be able to tout low market interest rates, low unemployment and increasing GDP figures while on the campaign trail. But engaging in loose monetary policy of this sort only pushes back the recession to a later date. And given that there were nearly $7 trillion created in 2020 and 2021, the Feds have bought themselves some time. However, because of the extent to which the FED increased the money supply, many economists believe that the crash will occur before the general election.

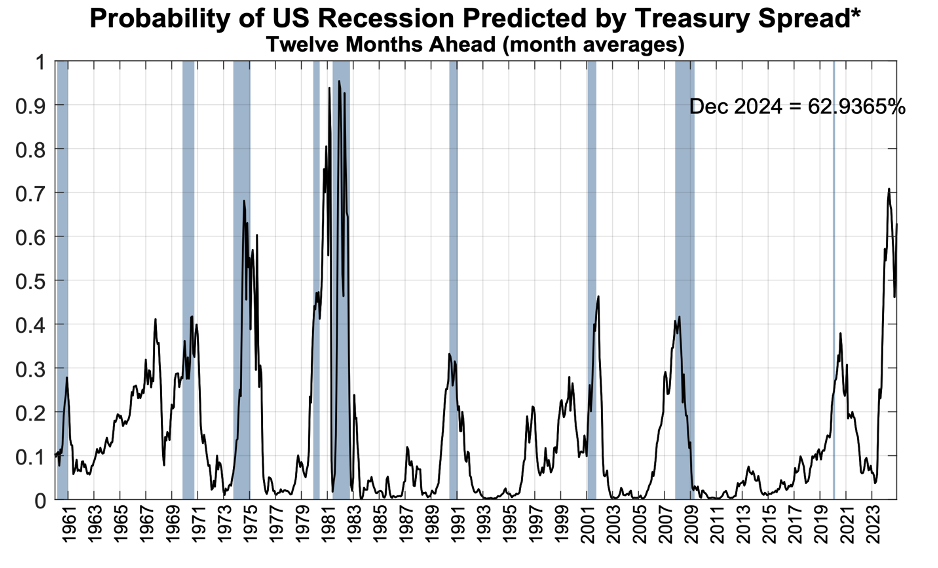

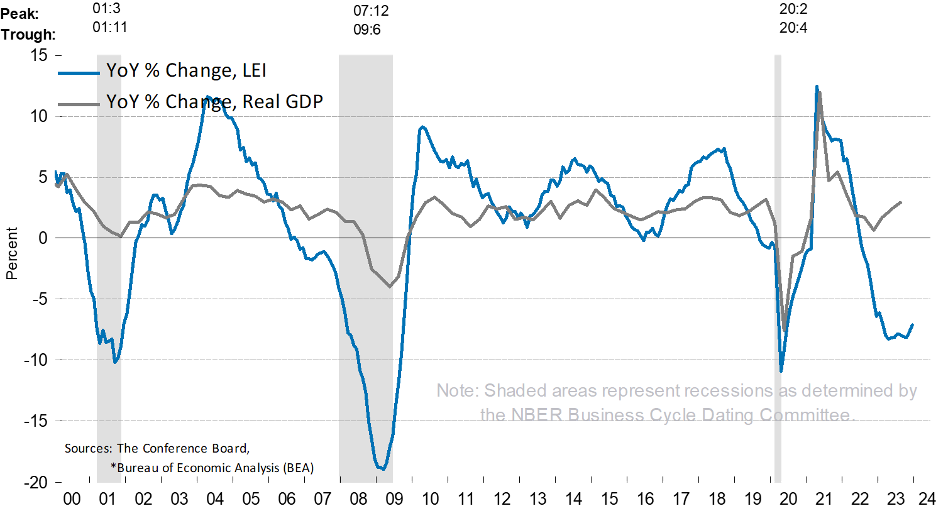

The graph above posted by the New York FED puts the probability of recession at 70.84% in May and 62.94% in December. Other indicators express similarly pessimistic views for this year. The Leading Economic Indicator published by The Conference Board has been signaling recession for many months as well. As with the inverted yield curve, when the blue LEI curve dips below zero recession follows shortly after.

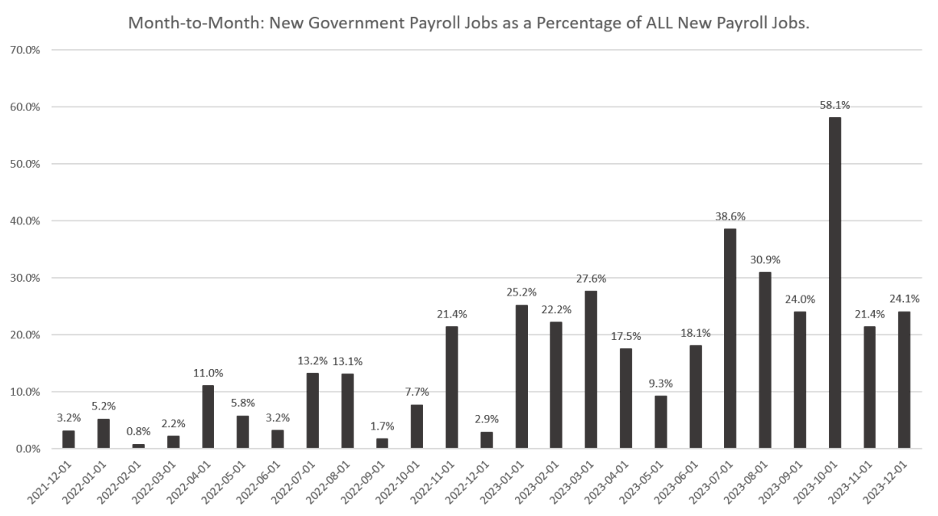

Current labor market data tell an equally dismal story. The Bureau of Labor Statistics’ latest job report touted impressive job growth but real job growth in the private sector is sluggish at best and nonexistent at worst.

Since December 2021 the percentage of new jobs that are government jobs has steadily increased. In October of last year 58% of all new jobs created were government payroll jobs, and in December, 24% were government jobs. This trend indicates that opportunities in the private sector are becoming less available and less attractive to members of the labor force who feel that better job security and compensation can be found in the public sector. A friend of mine in the consulting industry recently told me, “Yeah, I’m trying to go Govie. You just can’t beat those pension plans and the vacation hours.” Anecdotes like this reflect real choices being made by people in the job market. Why pursue a career in a vulnerable industry and worry about your financial security every day when you can get a job with fewer hours and better benefits?

But even the job growth that is happening in the private sector is nothing to write home about. The number of private sector employees holding multiple jobs is at an all-time high, meaning employers do not feel comfortable employing full-time employees upon whom they would have to confer benefits. As such, a huge portion of new private sector jobs are part-time positions, not full-time. In December of last year, the total number of part-time jobs increased by 762,000 while the total number of full-time jobs fell by 1.6 million—a net loss of 838,000 jobs.

As of December, the total number of people in the labor force with multiple jobs was 8.69 million, well above the previous 1996 high of 8.49 million. The labor force participation rate fell slightly in December as well—from 62.8% to 62.5%. Furthermore, current labor force participation is still below pre-2020 rates when 63.3% of eligible people were members of the labor force.

Many people might wonder why the recession hasn’t started yet. After all, if all this expansionary monetary policy is so damning, why hasn’t the economy locked-up? It’s important to understand two things: first, recessions are identified ex post facto, never in real-time; second, there is a lag to the FED’s monetary policy. When the FED manipulates interest rates the effects do not instantly materialize in the economy. This is frustrating for economists and laypeople alike who want to know exactly when and where we can expect a downturn.

If we suppose that the greater the increase in the money supply, the further back the recession is pushed, then the increase in M2 from $15.4 trillion in February of 2020 to $21.6 trillion in May 2022 indicates that that new money is still affecting the economy by stimulating malinvestment and over-consumption in the economy. Essentially, we got as much money supply growth in two years as we got in the last nine years. That this newly created money is still making its way through the economy is somewhat obvious when we recognize that even the Evers administration here in Wisconsin is still spending the ARPA money it received from the FED. So long as that money is still circulating and being used to stimulate consumption, we will not be able to see the full affect it has had on the private economy.

Fortunately, in the FED’s attempt to get a handle on rising consumer prices, they have ceased expanding the money supply. This means, at least, that they are not adding more fuel to the fire and further exacerbating an already serious problem. Whatever the talking heads might say, there is nothing the FED can do to avoid the ensuing recession. And interestingly, no matter how many PhDs they have at their employ or how many press conferences they give, they never can seem to get it right, can they? As Milton Friedman said, “In a good year—when things are good, when the economy is booming—you will read that the Federal Reserve, by its wise policy, has produced this fine situation. However, let things get bad, and all of a sudden the tone of the annual report is different. Then you discover that despite the best efforts of the Federal Reserve, outside forces combine to produce difficulties.”