We’re likely a couple of weeks away from knowing the ultimate winners and losers of the 2023-25 state budget as we await floor action this week and the governor’s vetoes shortly after, but today we take a look at the Joint Finance Committee (JFC) product.

The committee voted out its final version of the budget last Thursday on a partisan 12-4 vote in a process marked by delays and next to no discussion by majority committee members about the state’s 2-year spending plan. This continues a recent trend of the formerly almost omnipotent committee shying away from stopping the dramatic growth in government or even questioning the perpetual spending increases.

As the committee and leadership have become more hesitant to grill the Evers Administration agencies about spending and to make a case for conservative priorities, or publicly defend their expenditure choices, or debate their liberal opponents, or to even provide details about the budget they’re building, the messaging advantage has shifted even further in favor of the left and the government spending has continued to balloon.

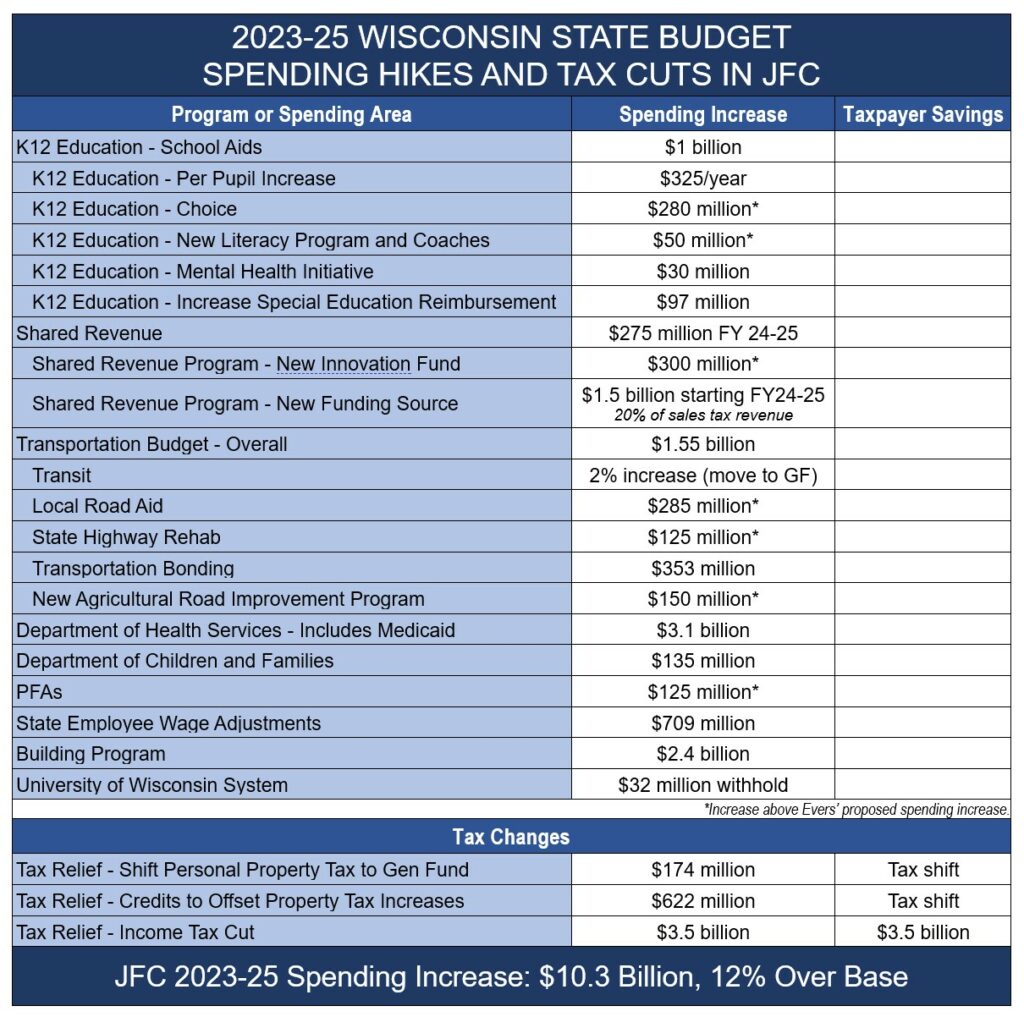

Here is a first look at the major provisions of the budget passed out of Finance.

A Historic Tax Cut – If It Is Not Vetoed

The Republican budget plan contains an estimated $4.4 billion in tax relief, including:

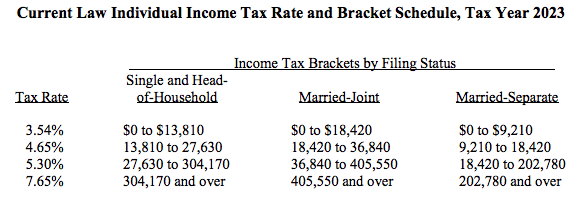

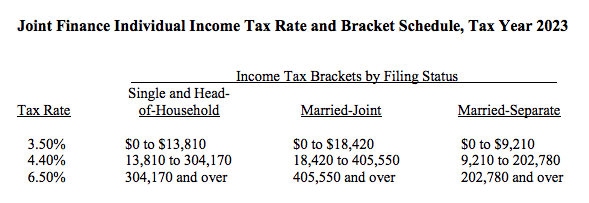

- a $3.5 billion income tax cut, collapsing brackets and cutting the rates in every bracket

- $622 million in property tax relief

- $174 million to end the personal property tax and shift the burden to the general fund

The overall tax relief in the budget is welcome, and the income tax reduction is substantial and a needed step toward a flat tax. The package will provide, on average, $573 per year in tax relief. But the question is will the income tax cut survive Governor Evers’ veto pen?

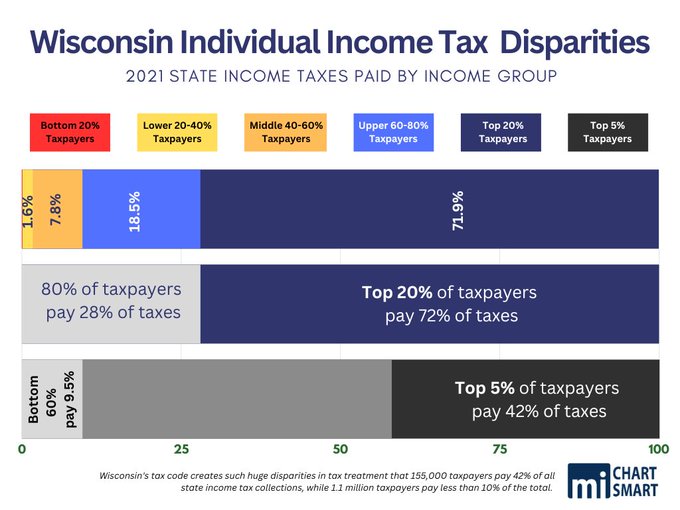

The Republican’s move to reduce each tax bracket, not just the bottom rate, is important and noteworthy. Too often, Republicans cave to the liberal argument that cutting the taxes of the successful is immoral. Or worse, Republicans won’t even try to provide needed tax relief for everyone. Instead, too often, Republicans will go along with the Democrat’s favorite political ploy, a small tax credit for those deemed politically worthy, the select few. Here, Wisconsin Republicans offered up a serious and broad tax cut for all taxpayers.

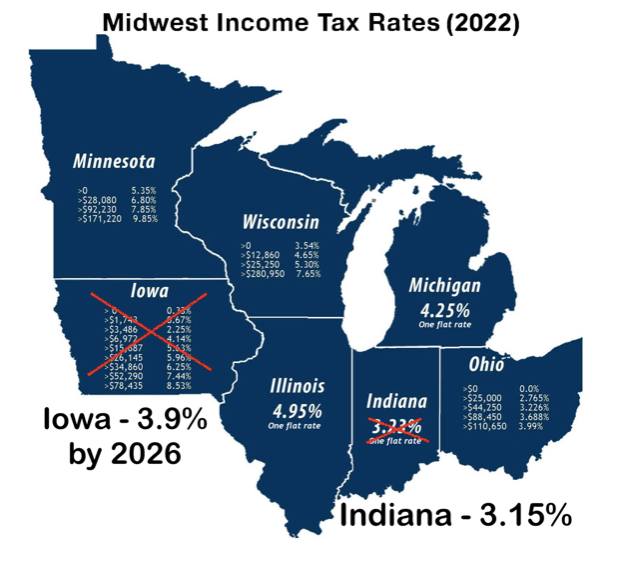

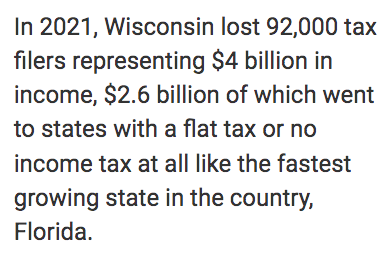

MacIver has been talking about the need to move to a 3% flat income tax rate for years in order for the state to stay competitive with our midwestern neighbors, to slow the incessant growth in the size and scope of government, and, most important, allow taxpayers to keep more of their hard-earned money so they can spend it as they see fit.

Seven states have no income tax at all while 15 have implemented, or are in the process of implementing, a flat tax. Governing Magazine reports that in 2023 North Dakota cut the number of brackets from 5 to 2 and cut rates, though they didn’t get the flat tax some wanted. The North Dakota tax cut package was a half-billion dollars – in a state with a budget only about one-twelfth the size of Wisconsin’s. Montana cut taxes $750 million, Kentucky dropped over $300 million, Tennessee cut $400 million, Idaho $355 million. Texas, with a $33 billion surplus, is working on a $16 billion tax cut. Iowa cut taxes another $100 million in May, on top of their in-process flat tax transition. Georgia is using their $6.2 billion surplus to send out $1 billion in retroactive tax credits. A ‘historic’ $6 billion tax cut package was signed into law in Nebraska in May. Clearly, Wisconsin needs to dramatically cut taxes to keep up with the competition.

The most serious problem with this much-needed and historic income tax cut is that it is unlikely to become law. According to Legislative Republicans, the income tax cut was NOT part of the budget negotiations they held with Governor Evers. Republicans and Evers did reach agreements on K12 funding, School Choice, the Milwaukee pension bailout, Shared Revenue, and literacy improvement, but not the tax cut.

Without a budget agreement where Republicans give Governor Evers one of his top budget priorities – say a $1 billion dollar increase in spendable K12 school aid – in exchange for his approval (his assurance not to veto) of this tax cut, there is no certainty that the tax cut will survive.

Unfortunately, only moments after the income tax cut was announced – well before it was voted on in committee – the governor’s office weighed in saying he believes tax relief should be directed at the middle class and not across the board.

Democrats across the state have taken to the media to lambaste the tax cuts, some spreading wildly inaccurate information. For example, Senator Pfaff on WIZM radio Tuesday claimed that Governor Evers’ proposed income tax cuts would have provided a married couple with income of $150,000 a year a whopping $15,000 tax cut. The idea that the liberal Evers would propose a $15,000 income tax cut is laughable but it goes to show you the lengths that Democrats will go in their attempt to submarine a fair tax cut for all taxpayers.

Evers has recently been more indirect about whether he will veto the income tax cut, or veto the entire budget.

The only sure way this tax cut becomes law is if Republicans made it their top priority in negotiations with the Governor at the start. That did not happen.

Republicans quickly point out that Evers signed the last large tax cut the Legislature passed, but that was when the Governor was getting ready to run for reelection. Evers needed to sign that tax cut to make it appear to voters that he was a moderate Democrat, not the far-left progressive he is. Governor Evers has always believed in higher taxes to fund massive government growth and higher spending. We don’t believe he will now switch his governing philosophy to care about fundamental and substantial tax cuts for all Wisconsinites, including the “millionaires and billionaires who don’t need the extra help,” as he put it in the past.

Maybe we are wrong. Maybe the Republicans are correct. We hope we are wrong.

But if Governor Evers vetoes the entire tax cut or even if he vetoes out the parts of the tax cut that help small businesses and successful individuals, this historic tax cut becomes a historic missed opportunity and a failure to negotiate for what our state needs most – transformative and long-lasting tax reform. Remember, this budget process started with a $7 billion surplus and here now at the end of the process we are not sure if some of that surplus is going to make it back to where it all should go – you, the taxpayer.

If Evers were to veto the tax cut and some of these other victories we discuss later in this piece are overturned, that would guarantee this as the biggest Democrat budget victory in decades – record-high spending at the state and local level, little to no tax relief, a billion+ in additional K12 funding with no reforms, and an ever-growing source of tax revenue for the liberal Democrats in Milwaukee.

While the property tax relief and personal property tax shift are important policy decisions, they are not, in fact, tax cuts. Both shift the burden to a different set of taxpayers. The personal property tax was a particularly onerous and archaic tax, and for those who previously paid it, the ‘elimination’ is true relief – from a financial and time standpoint. But it’s important not to forget that the local governments who took in the personal property tax dollars are made whole by the general fund. The tax wasn’t eliminated so much as spread out across a larger group of taxpayers.

Given how much more local governments are receiving this budget in new shared revenue funding, why can’t we just eliminate the personal property tax instead of the state paying the locals to quit assessing the tax?

Another Historic Spending Increase On Top Of The Two Recent Massive Spending Increases

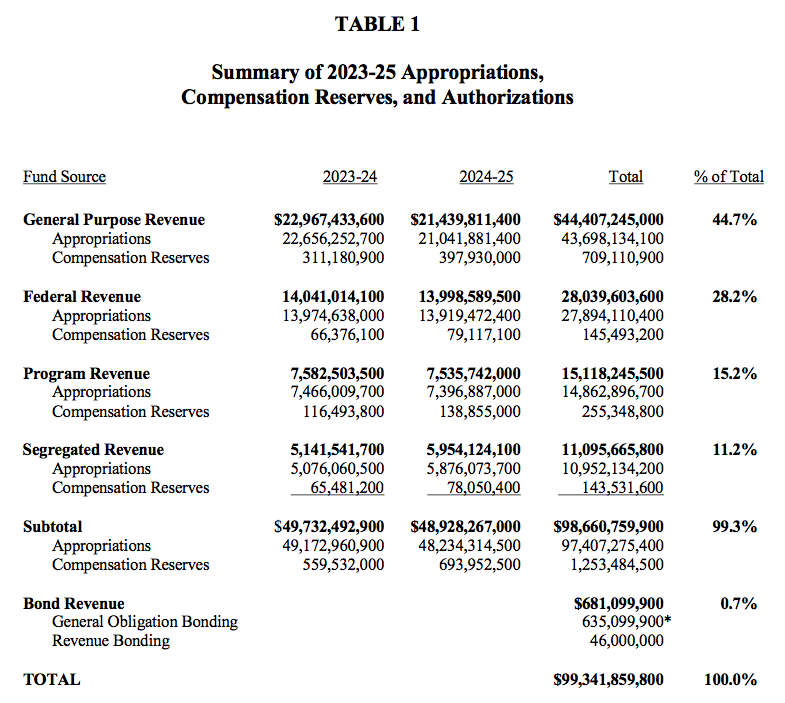

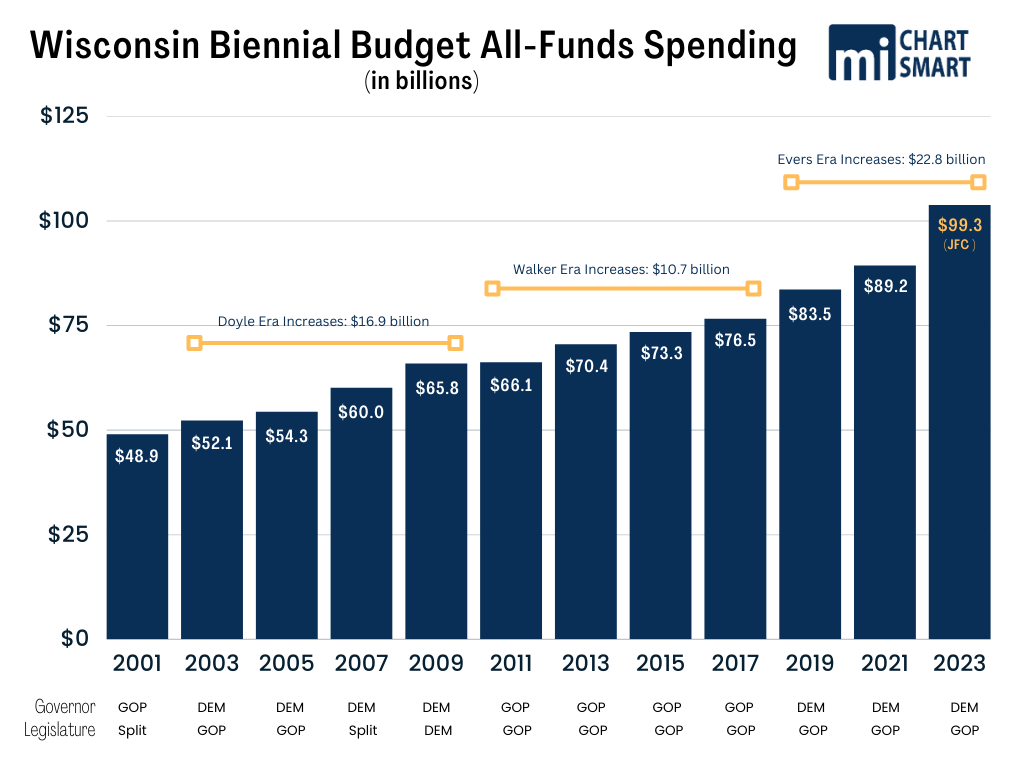

The committee spent about $10.1 billion more than the previous budget, an 11.7% increase. The 2021-2023 budget spent $89.2 billion all funds. The 2023-2025 budget, as passed by the Republicans on the JFC, spends $99,341,859,800 all funds (See table 1 below). It’s a historic level of spending, and the increase is more than the previous two budgets.

The spending expands state government, and the additional funds for local governments, which get a 36.5% increase in state aid, permanently grows local government as well. The more government grows, the more bureaucrats there are looking to justify their existence, grow their control over every facet of our lives, and build out their fiefdoms.

This budget appears to be on track to increase spending in just this budget what it took Walker approximately 4 budgets to do. In Evers’ three budgets, since spending seems to be on track to about $100 billion, spending will have increased almost $23 billion, from $76.5 in 2017. $23 billion. Uff da.

Remember, state expenditures have already increased by 83% since 2001, a 22% greater increase than the rate of inflation. That 83% increase does not take in to account the new historic spending increase of almost 12%. Wisconsin’s median household income, a measure of a taxpayer’s ability to pay taxes, increased just 54% over the same time frame.

State government spending has skyrocketed under Governor Evers and Legislative Republicans. And now we are going to add on the largest state government spending increase in history on top of all of this existing government spending.

If the Republican budget passes both houses this week and is signed by the Governor as is, state government spending will increase by $10 billion while the income tax cut will save only $3.5 billion. Let that sink in for a second.

If you are a Republican or at least a fiscal conservative, shouldn’t the size of the tax cut be greater than the increase in government spending, especially given the recent large spending increases this budget is built on? And if you factor in the $58 billion dollars the federal government has sent back to Wisconsin since the start of Covid, why would you agree to another “historic” state government spending increase, let alone trumpet this historic government spending increase as a good thing?

If you are a Republican, why would you agree to spend more taxpayer money on an existing program or a new initiative than what Governor Evers proposed? Especially when you already gave him and his bureaucracy over $12 billion in additional spending in his first two budgets? Republicans control the purse strings in Madison. Legislative Republicans outspent the liberal spending Evers on PFAFs, the new literacy solution, the new shared revenue push to expand government at the local level, a new program for rural roads, or a new program to bribe local governments to be efficient or to downsize.

Historic Education Funding Increase With No Reform Or Accountability

Historic School Choice Expansion If It Survives Legal Challenge

This budget achieves what school choice advocates and parents – increasingly fleeing underperforming public schools – have long sought: equal funding, or at least more equal funding, for students regardless of where they attend school. School Choice advocates believe that this higher reimbursement level could lead to a 20-30% enrollment increase in the program. That would be a big win.

Unfortunately, union bosses are talking about legal challenges with the hope of upending the entire school choice program and forcing over 50,000 kids back into public schools.

Leaders worked with the governor on this plan, and in exchange for nearly meeting his per pupil increase, increasing special education funding by $97 million, increasing mental health funding in schools by $30 million, and increased funding for literacy (at $50 million, $30 million more than the governor proposed), Republicans got the choice expansion in return. Isn’t teaching our children to read one of the basic duties, a core responsibility, we expect our schools to carry out and yet, we need a new $50 million program so that schools will

However, most of the Republicans seem so pleased with all of this increased K12 spending without any reforms or accountability that it is hard to tell if any negotiating actually took place. Their bargaining netted them in return…no parents’ bill of rights, no bans on CRT, no bans on grooming, gender indoctrination or pornagraphic books, not even a ban on drag queen shows in schools.

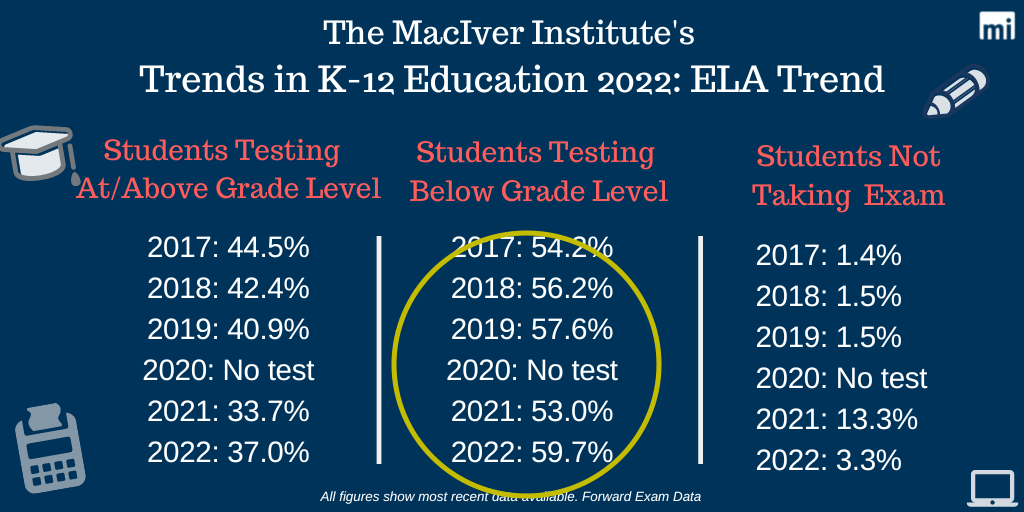

This newest funding increase does not recognize the large spending increases given to schools in recent budgets or the massive amount of federal ARPA funds that were sent to our schools to stem learning loss. This new huge spending increase perpetuates the liberal talking point that more taxpayer money will fix everything in K12 education, a dangerous lie that will keep most of our kids locked in the downward spiral we currently find ourselves in.

Our schools have plenty of money and have received reliable and significant funding increases in recent years. Academic achievement has steadily declined as funding has steadily increased. There is a deeper and more basic problem going on in our schools. This is the most important crisis that we face today but no one is talking about it and no one debated it or even brought it up during the budget deliberations.

Without reforms, this only throws more money at the schools that will continue to teach our kids to hate our country, that 2+2 does not equal 4 and that perfection or being forced to turn in your homework is a trait of white supremacy. Without reforms mandating more academic instructional time in the school day, or that teachers focus only on reading, writing, math and science, another billion dollars sent to our schools will have little impact on the academic performance of our children.

Years and years of school spending increases have resulted in lower scores, but we are to believe that this spending increase will change everything?

More choice students will improve overall academic achievement outcomes but there are far more students in public schools who will continue to fail and still be indoctrinated every single day.

We have been drawing attention to the literacy problem in our state for years. This is potentially the most important and critical provision for the future of our state in any of these packages. So we want to believe in this one. We worry that legislators who want to cozy up to the education establishment will water this down so nobody at DPI has their feelings hurt or blame is properly placed for our current education disaster. Legislators dropped the provision holding back young children who struggle to read because the education establishment is more worried about the social stigma attached with holding a child back a year so he or she can master the building block of reading than the social stigma of having a high school graduate who struggles to read try to make in the world without this fundamental skill. That is not a good sign. That is not in the best interest of our children. That is not in the best interest of the future of our state.

If Superintendent Underly and the ultra-liberal education establishment is left to their own devices, they will undermine the entire operation and our kids will continue to drown in failure. We hope the legislature will stay engaged and finally demand that DPI do better teaching our kids to read.

With the $590 million levy credit to buy down property tax increases that would otherwise result from the plan, the budget puts roughly $2 billion more into K12 – again, a hefty increase, but well short of the $2.6 sought by the governor.

We agree with the Legislature’s attempt to go after the amount of money the UW System spend on the divisive DEI indoctrination but we have to ask why did the Legislature stop there? As we have exposed time and time again, DPI and our K12 schools are spending a significant amount of time and resources on the racist anti-racist doctrine.

Isn’t it more important to stop the brainwashing of our young children than what is going on at the UW? Both efforts are important but stopping DEI/CRT in our K12 schools must be our top priority. Maybe one of the reasons 60% of our children are failing in math and English language arts on the Forward Exam is that educators are spending too much time teaching CRT in our classrooms?

Case in point. The budget agreement puts another $97 million into special education. The federal government has fallen short of promised funding levels for years, but one pot they do send to DPI for disabled students is being passed through to a group that spends the money nearly exclusively on indoctrinating public school teachers and administrators to use the principles of CRT in their classrooms. Federal Individuals with Disabilities Education Act (IDEA) funding, meant to ensure children with disabilities have a free, appropriate public education that provides services to meet their unique needs, goes through DPI and is awarded to the Educational Equity Network (aka The Network) which focuses on racism and inequity rather than disabled students. See below. The bill could have attempted to ensure that the special education funds we do receive from the federal government are not diverted from disabled children and spent on training teachers to be race warriors.

As we type, the Evers Administration continues to push DEI and CRT every single day throughout all of state government. There is so much more we can do here than cut UW by $32 million, which is a rounding error in their multi-billion dollar budget, or delete 188 positions out of their over 72,000 total positions. So much more that we should be doing.

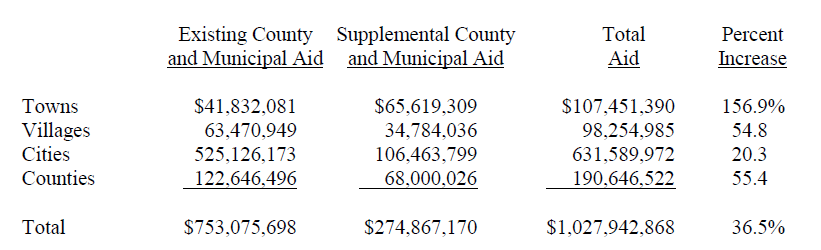

Historic Shared Revenue And Local Government Spending Increase

Last week, the shared revenue bill and one of the negotiated parts of the budget became law, which provides an historic increase in state aid to local governments. By diverting a portion of state sales tax collections into shared revenue, local aid will increase by a quarter of a billion dollars or 36.5%. Madison and Milwaukee are guaranteed to get at least a 10% increase in state aid, while everyone else will get at least a 20% boost. However, according to the distribution tables provided by the Legislative Fiscal Bureau last week, only a fraction of communities will receive the minimum increase. Madison, for example, is getting a 58% increase.

The Town of Cedar Rapids in Rusk County will get the highest percentage increase at 5,753%. The 36 resident community will go from $532 in annual state aid to $31,138. (That’s in addition to the $45,876 in general transportation aids it receives to maintain its 18.83 miles of roads.)

The City of Milwaukee will get the highest dollar amount increase at $21.7 million. The next five cities with the biggest increases are: Racine, Beloit, Green Bay, Madison, and Kenosha.

All of this additional funding for the current shared revenue program and the dedication of a growing revenue source going forward passed despite data that shows local government expenditures are up 69% since 2001, compared to an increase in inflation of 51% and the median household income in Wisconsin increasing only 54%. Despite what the special interests say, local governments in Wisconsin were not starving or on the verge of insolvency.

Here, too, litigation could dramatically change this ‘historic’ deal. The ink wasn’t even dry on the Governor’s signature and the Milwaukee City Council signaled that it would sue to overturn parts of this deal that supposedly violate the city’s home rule. So the requirements that Milwaukee spend a certain amount of money on minimal policing levels and public safety, the limit on cultural spending to 5% of the total budget, the requirement that two-thirds of the council must approve increase spending or positions, the requirement that tax dollars cannot be used for the trolley and all the others might fall by the wayside.

With new State Supreme Court Justice Janet Protasiewicz taking her seat soon and the control of the court flipping to a liberal majority that only cares about wielding political power for the progressive cause, there is a good chance that many if not all of the reforms Republicans attached to the shared revenue and the Milwaukee pension bailout deal will be overturned. All that taxpayers will be left with is growing government at the local level and higher taxes for any of us who visit Summerfest or do business in Milwaukee.

We must point out again that just forcing Milwaukee to hire a couple dozen more police officers is not really going to change anything in Milwaukee. Low-or no-bail releases, soft sentences that put perpetrators back on the streets too quickly, slow moving courts that end up having to release those charged because their right to a speedy trial had been violated, the increasing unwillingness of witnesses to testify against criminals they know will be back in their neighborhood soon, the state Department of Corrections ignoring violations of community supervision, and an increase in juvenile offenses that offenders know nets them a slap on the wrist all factor heavily into community safety, all of these scold and release policies will continue to undermine and negate the work of Milwaukee’s Police Department, even when they hire more police officers.

Most incredulously, this 36.5% increase is still not enough. Despite hundreds of millions in new state aid and a higher sales tax in Milwaukee County to pay for more government, Wauwatosa plans to add a new ‘utility’ tax, charged to residents and businesses, to cover road maintenance. The Milwaukee City Council has instructed their department heads to look for new and additional sources of revenue. It is never enough for government. Alderman Bob Bauman wants to move the park system to Metropolitan Milwaukee Sewerage District (MMSD) because MMSD is not subject to property tax limits and dramatically jump up spending on parks. The government’s persistent and relentless pursuit of taking more of your money never ends.