Taxpayers are shaken and stirred at the nearly $15 billion spending hike in Governor Evers’ 2023-25 budget proposal – but what about the bonding?

We’ve covered Evers’ proposed capital budget, but we haven’t looked at the bonding contained in the proposed state budget.

Government Bonding

Government bonding is simply borrowing money to finance (usually) long-term projects in much the same way individuals borrow to purchase a home or car. Government bonds can be broken down into two broad categories – General Obligation (GO) bonds and Revenue Obligation bonds. GO bonds are backed by the state’s credit and taxing authority, and the debt is repaid by tax collections. Revenue bonds are project-specific borrowing backed by revenues from an income-producing project, or by specific revenues set aside for the project.

It makes sense to bond for things that come with a high price tag that will be used for a number of years and can be paid for by taxpayers over a number of years. But bonding has been misused to finance spending that taxpayers can’t afford.

Bonding in the State Budget

The budget process splits up the initial bonding proposals initially into two segments. First, the governor proposes a state budget, which contains some level of GO and revenue bonding. Then, generally following month the governor proposes his Capital Budget, which is based on a plan developed by the Building Commission, which the governor chairs. During the legislative process, these plans are combined.

Wisconsin’s Joint Finance Committee is among the most powerful in the country; while some legislatures have little authority to change a gubernatorial budget, here, JFC has a license to kill – programs, spending increases, projects and bonding. JFC often does kill projects and bonding proposed by the governor as they work through the budget process, but the committee also adds their own projects and bonding.

Prior Budget Bonding Levels

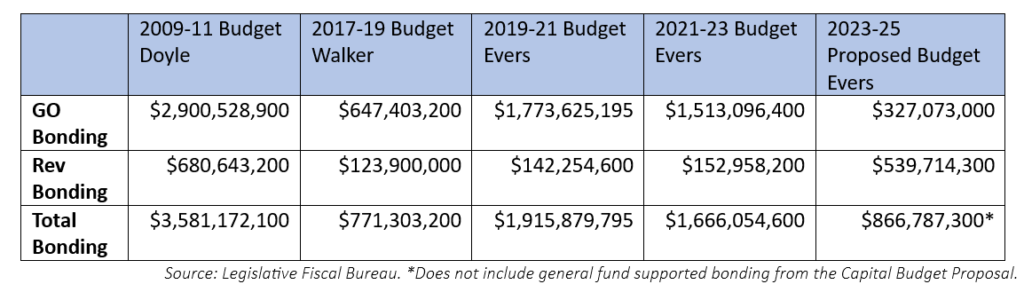

As you can see in the table above, Governor Walker was a comparative Dr. No on bonding in his 2017-19 final budget, holding the level of borrowing to about 1% of total spending. By contrast Governor Doyle’s 2009-11 final budget used the living daylights out of bonds – taking the level of borrowing above 5% of the total biennial spending plan. Doyle’s budgets contained high levels of borrowing, 2 of them borrowed over $3.5 billion each.

2023-25 Budget Bonding

This biennial budget contains roughly $867 million in bonding. The 2023-25 Capital Budget calls for about $538 in new bonding, which brings total bonding to $1.4 billion.

This proposed level of borrowing is lower than in many previous years. Evers’ proposed Capital Budget bonding is substantially lower than requested by the Building Commission because he substituted roughly $1.1 billion cash for proposed general fund supported borrowing. The combination of a $7.6 billion surplus, unspent federal ARPA pandemic funds and the $1.5 billion tax increases he’s proposed allows Evers that unusual flexibility.

We’re pleased to see some one-time funds being used for one-time purposes. In the context of a budget where the motto seems to be ‘the world is not enough’ that increases spending $15 billion, raises taxes $1.5 billion, and creates large structural deficits in the future, using one-time cash in place of borrowing is a small concession to fiscal responsibility, but one we appreciate, if the project warrants.

The state currently has $11.4 billion total in outstanding principal owed on debt, $6.8 billion of which is GO debt. In 2021-23, we paid $876 billion in debt service (principal and interest) which is about 2.65% of our total GPR expenditures – a far cry from the nearly 5% level we saw after the Doyle years of high borrowing – but as the state budgets skyrocket year after year, substantial sums.

Whether they grow through spending or borrowing, ballooning state budgets, like diamonds, are forever. And most borrowing with a 20-year term is committing future taxpayers who have not yet been born to helping repay the debt. As taxpayers cry May Day over the proposed budget, we hope the legislature will be mindful of our moneypennies as they set the state’s bonding level.