$22 Billion in Tax Savings

As thoughts turn to how much of our earnings we hand over to the government on this tax day, it’s worth taking note of a memo recently released by the nonpartisan Legislative Fiscal Bureau outlining savings to Wisconsin taxpayers attributable to tax law changes between 2011 and 2021.

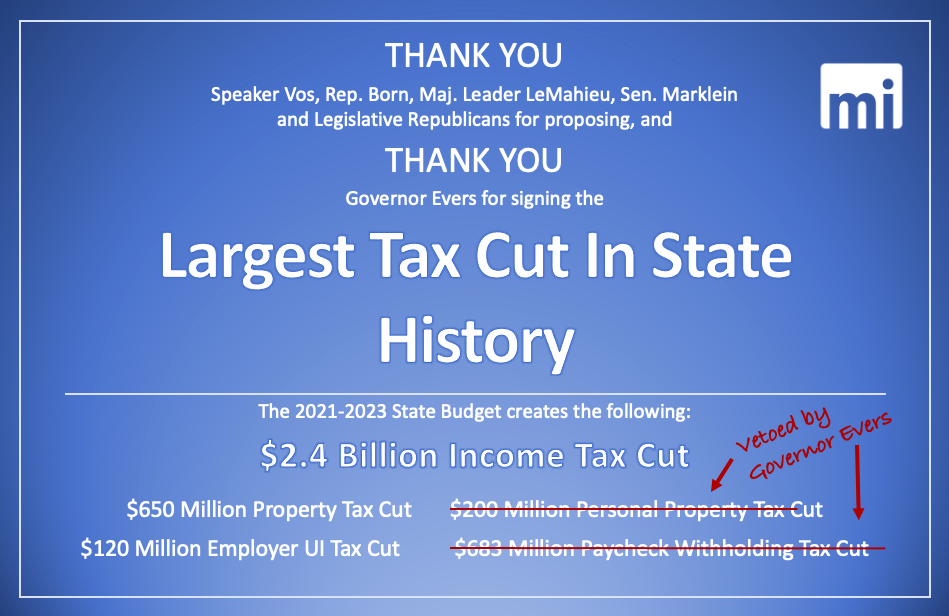

Their result? Thanks largely to legislative Republicans, taxpayers kept $22 billion in their pockets that would otherwise have been turned over to the government. Income taxes were cut $13 billion, property taxes $8.6 billion and other general fund taxes by $184 million.

These savings to taxpayers ran the gamut:

- Across-the-board income tax rate reductions cut income tax rates for all earners.

- Healthcare-related tax reductions included deductions for Health Savings Accounts as well as insurance for independent children and the self-employed.

- Education related tax reductions included private school tuition deduction, EdVest and ABLE account changes, deductions targeted for teacher’s expenses.

- Tax credits for agriculture and manufacturing.

- Family-friendly tax reductions including deductions for childcare expenses and increasing the standard deduction for married filers.

- Property tax relief for homeowners across the state.

This $22 billion in tax savings amounts to an average of over $3,700 per person in the state. Whether families invested their savings for their children’s education, spent it spurring the economy, used it to help start a business, or simply to help make ends meet a little more easily, money is always better left in the hands of taxpayers than handed over to the government.

The Fiscal Bureau analysis included only changes that resulted in lower tax collections. Not included were savings from the legislature’s rejection of the Evers gas tax hike. Another recent memo shows that if the legislature had gone along with Governor Evers on this single tax hike – one of many Evers has pushed –as of April 1, Wisconsin drivers would be paying the 4th highest gas tax in the nation, up from 15th highest, on top of the sky-high prices we’re already paying at the pump.

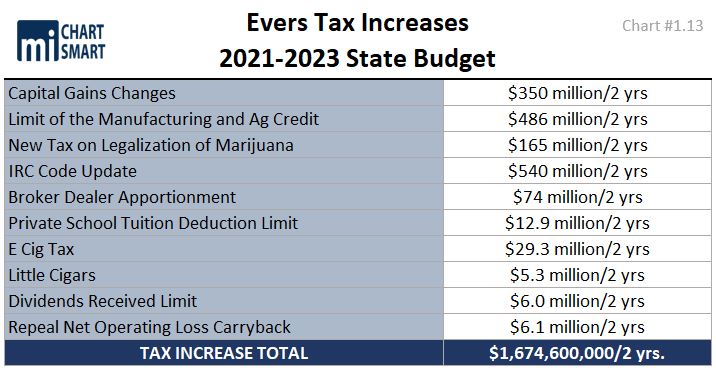

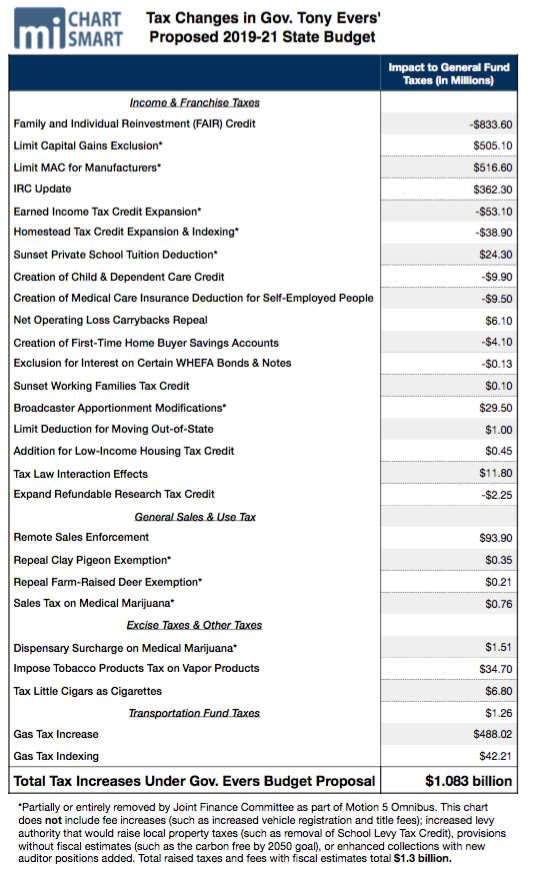

Tax increases proposed by Evers in the 2021-23 budget alone amounted to over $1.6 billion.

The $22 billion in tax savings have not resulted in massive program cuts, as the left always claims. On the contrary, spending in the 2021-23 budget is $23 billion higher than in the 2011-13 budget, a 35% increase over the decade. Even in inflation-adjusted dollars the 2021-23 budget is $9 billion higher. The impact of these tax cuts is undeniable, but there’s clearly much work to be done to slow the growth of state government.

We recently spoke with Senator Roger Roth about his plan to use our surplus to buy down income taxes with a goal of putting Wisconsin on a path to eliminating the income tax altogether.

We at MacIver have long advocated a fair flat tax of 3%, which would give Wisconsin the lowest tax rate in the Midwest, attracting new families and businesses while keeping our retirees and college graduates. This would be a logical next step to build on the substantial tax relief we can thank our legislative majorities for delivering.