Assembly and Senate pass budget on a bipartisan vote, sending bill to Gov. Evers. Assembly votes yes 64-34, with every Republican and 4 Democrats in favor. Senate votes yes 23-9, with every Republican and 3 Democrats in favor.

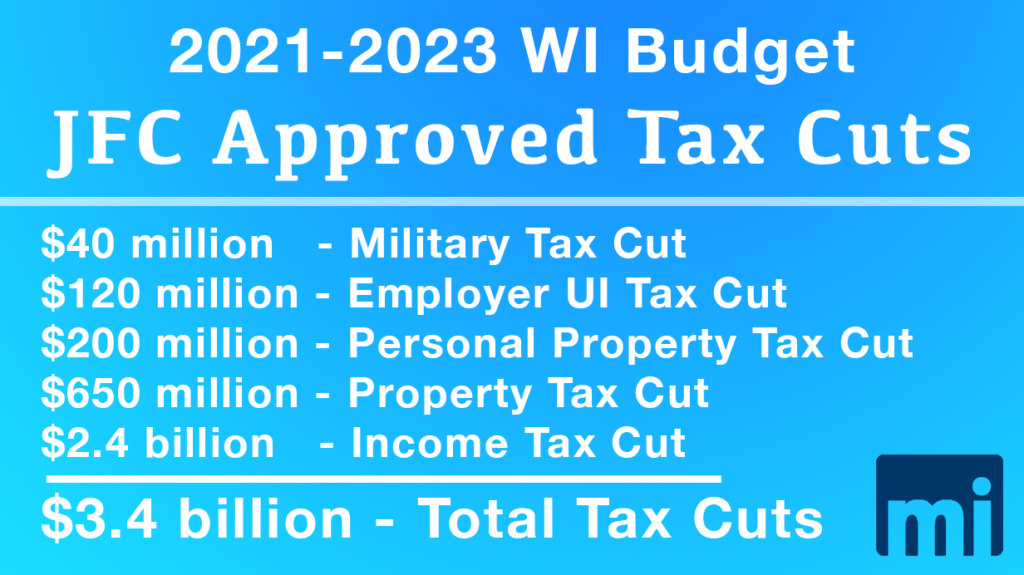

Republicans propose over $3 billion in tax relief – a $2.4 billion income tax cut, the largest in state history, $650 million for property tax relief, over $300 million in business tax cuts and more

Will Gov. Evers, set to run for re-election next year, cave to pressure from far-left base and veto the tax cut? Would Evers veto the entire budget as he has threatened?

With Republicans in the Legislature set to pass their version of the 2021-2023 state budget this week, you will be hearing a lot of rhetoric and talking points about what this budget does or does not do. While we wait for the final product to pass both houses before MacIver produces our comprehensive analysis, let’s take a look at the fundamentals of the budget passed by the Republican Finance Committee and the budget proposed by Democrat Governor Tony Evers back in March.

With every budget analysis, we start with the fiscal basics:

- Taxes

- Spending

- Government bonding or borrowing

- Number of bureaucrats

TAXES: THE LARGEST TAX CUT IN STATE HISTORY

The question of taxes provides perhaps the starkest difference between Governor Evers’ budget and the budget adopted by Legislative Republicans.

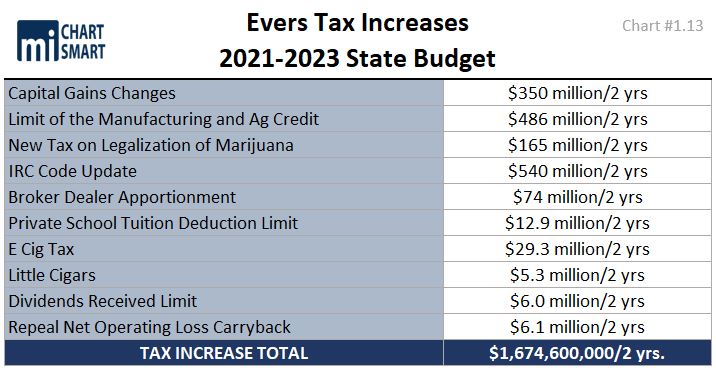

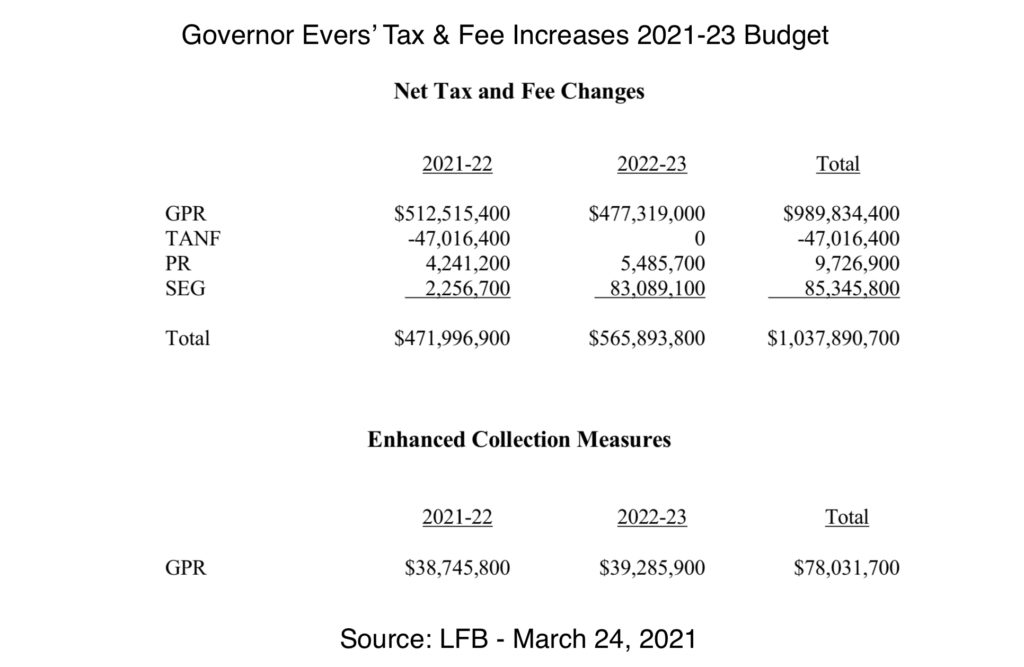

Gov. Evers proposed over a billion dollars in income tax increases and a significant increase in property taxes – at least a 2% increase for most local units of government for the next two years. The Governor proposed this massive tax increase despite receiving a massive spending increase of almost $8 billion dollars in the last budget and the state running a surplus recently.

The Governor proposed increasing taxes on businesses, parents with children attending a private school, the successful and the majority of the public who have investments in the stock market. See the entire list below. For someone who is counting on the sale of their original home or a long-held stock to fund his or her retirement, the Governor’s tax increase would have been a cruel financial blow just as the golden age of retirement loomed near.

The Legislature, instead of following Governor Evers’ lead to dramatically increase taxes, decided instead, to cut taxes. In fact, the Legislature has proposed the largest tax cut in state history. In state history. On behalf of all Wisconsin taxpayers, we say thank you.

So, starting from Gov. Evers’ $1.12 billion TAX INCREASE and moving to a $3.4 billion TAX CUT proposed by the Legislative Republicans shows you the fundamentally different approach to government Democrat Tony Evers has compared to Republicans in the Legislature.

Now, Gov. Evers’ defenders will say that the unexpected $4.4 billion in state revenue was not known when the Governor put together his tax and spend plan earlier this year. The implication being that, at the time, he had no choice but to propose tax increases and that he would never increase taxes with an extra $4 billion lying around. The problem with that defense of Evers is that the Governor has not rescinded or asked the Legislature to ignore his original tax increase proposal. Even though, with all the Federal Covid aid flooding into the state and the unexpected revenue from our economic recovery, there is absolutely no need for new or increased taxes (We, of course, would argue that there is never a need for new or increased taxes), the official position of Gov. Evers is that a billion dollars worth of new or increased taxes is still needed. If Gov. Evers is unwilling to forgo a large tax increase when his state is flush with unexpected revenue, more than enough revenue to pay for critical and vital government services, than his push for higher taxes really isn’t about raising enough revenue to pay for those services, Gov. Evers’ push to raise taxes was about punishing success and targeting certain taxpayers. We shouldn’t be too surprised by Evers’ vindictive proposal, his far-left radical base has talked for years about the rich paying their fair share.

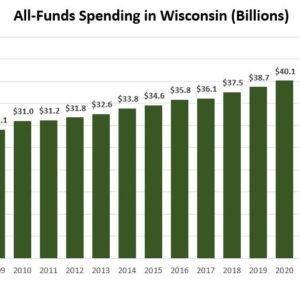

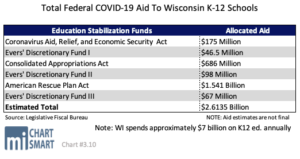

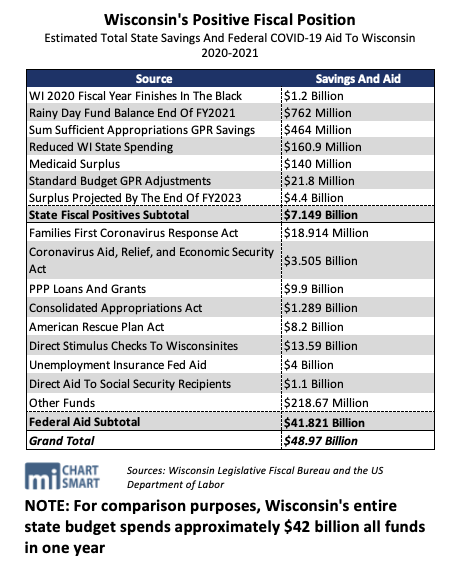

We have been drawing attention to the following table ever since it became clear that President Biden and Congress would be sending unprecedented and unfathomable amounts of federal aid to states to supposedly combat COVID-19 and stimulate the economy. As you can see, government in Wisconsin and Wisconsinites have received over $41 billion in just over a year. For comparison purposes, the entire state budget for the State of Wisconsin spends roughly $42 billion a year. We have received enough federal aid here in Wisconsin to replace an entire year’s worth of spending by state government. So, any politician or bureaucrat that tries to argue that state or local government doesn’t have enough of your tax dollars already is just plain lying.

The Legislative Republicans’ tax cut proposal will lower the third income tax bracket rate from 6.27% down to 5.3% on income between $24,250 a year and $266,930 a year, saving Wisconsin taxpayers an eye-popping $2.4 billion. Reducing the tax rate on such a large swath of income means that this tax cut will help almost every taxpayer, from the working poor to the successful. This is real, substantial and permanent tax relief that will forever change the state.

Here again, we see a stark difference between the philosophy of Gov. Evers and Republicans. Gov. Evers’ used his billion dollar tax increase on the many to turn around to hand back some smaller tax credits to the select few. Increasing taxes just so you can hand out political favors to your base is wrong. Plain wrong. Republicans’ effort to cut a tax rate, a large cut in the tax rate, for so many actual Wisconsin taxpayers is real and just tax reform.

Not only will this tax cut keep taxpayers’ money where it should be, in their wallets, this tax cut will dramatically reduce the amount of taxpayer money available to fund state government. Let that sink in for a moment.

Letting taxpayers keep more of their money and giving government less of our money is always a good thing. Always. And we cannot emphasize enough just how big this tax cut is. It is huge. Gov. Walker, the most fiscal conservative and successful public policy Governor in our state’s history, never proposed or signed into law a tax cut of this size. Not even close. Gov. Thompson, the longest-serving Republican Governor, never dared to even discuss such a dramatic and profound change to our tax code despite his reputation as an innovator.

These Republican Legislators also deserve credit for using the vast majority of the “surplus” on a substantial and meaningful tax cut, not just a small and insignificant trim of a tax. In the past, news of a surplus would too often produce lip service from Republicans trying to assure their supporters that they were a true fiscal conservative while using more of the surplus on new government spending than on a tax cut. This is taking a meat cleaver to the tax code and forever changing how much in tax a huge portion of Wisconsinites will pay to their government.

Finally, Legislative Republicans improved upon Gov. Evers’ budget when it comes to property taxes. Gone are the property tax freeze days under Gov. Walker when it was assumed property taxes would be held in check. Gov. Evers is more concerned about making sure local units of government can raise your property taxes than he is about your checkbook. As you can from the table below, Legislative Republicans have trimmed $214 on average off your property tax bill compared to current law and $207 on average compared to Gov. Evers’ proposed budget.

SPENDING: WHY LARD MORE GOVERNMENT SPENDING ON TOP OF MORE GOVERNMENT SPENDING?

To understand the government spending contained within the 2021-2023 state budget, you need to actually start by looking at the government spending passed in the 2019-2021 state budget.

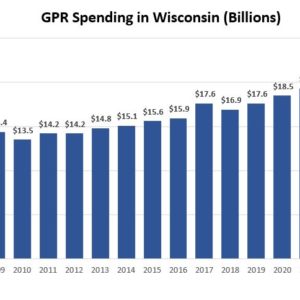

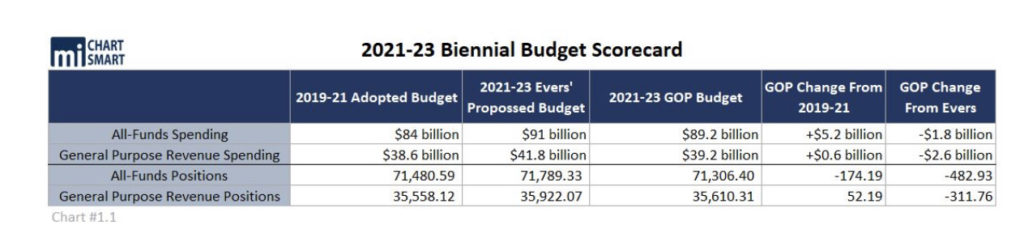

In his first budget, the 2019-2021 state budget, Governor Evers introduced the single largest increase in state government spending ever. Evers proposed increasing spending by a shocking and unimaginable $10 billion dollars. In one budget. For comparison purposes, the budgets signed into law by Gov. Walker generally averaged about a $2 billion increase every two years. Gov. Evers proposed a spending increase five times that average, all in one budget. Thankfully, the Republicans did not agree to that spending level. Unfortunately, Republicans agreed to a $8 billion increase. When you look at spending levels in the 2021-2023 budget, knowing that the last budget contained a historic increase in spending gives the current debate context.

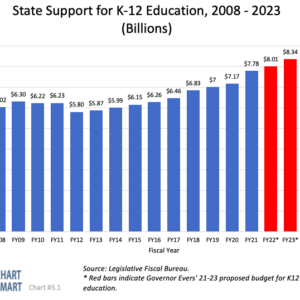

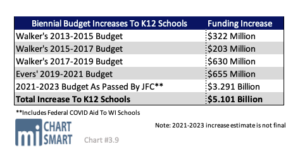

Not deterred in his zealous and continual quest to explode government spending, Gov. Evers this time around only proposed a $9 billion increase in spending. Not a record but again a staggering amount of new spending. Again, thankfully, Republicans rejected Gov. Evers’ original spending increase. And Republicans are adamant that this time, they passed a budget with very little new spending. Republicans added about $3 billion for Medicaid cost-to-continue, $650 million to K12 education that becomes property tax relief, $2.4 billion to “pay” for the income tax cut and some other various smaller spending increases. While the overall spending increase of approximately $5 billion is still too high, it does appear that Republicans did very little new or increased spending in general and certainly when compared to the 2019-2021 version of the budget.

To achieve this goal, Legislative Republicans adopted a common sense, taxpayer-friendly approach to spending in this budget: wherever possible, use the massive amount of one-time (hopefully!) federal COVID and economic stimulus aid to fund government operations. From the taxpayer’s perspective, it doesn’t matter if your federal tax dollars are funding state government or if your state tax dollars are funding state government, state government is being funded either way. Democrats and their special interest allies, of course, wanted to pile “normal” state government funding on top of the mammoth federal funding, which would have just larded more state government tax dollars stacked on the federal government dollars.

BONDING: HOW MUCH STATE SPENDING ARE WE PUTTING ON THE STATE’S CREDIT CARD?

Gov. Evers proposed general and revenue bonding (borrowing) totaling $3.617 billion. In the 2021-2023 budget, Gov. Evers proposed $2.44 billion in total bonding and the Republican Legislature approved just $1.915 billion. In this budget, the Legislature did even better. They shaved almost $2 billion off the Governor’s proposal and agreed to $1.676 billion, a 12.50% reduction compared to last budget and a 54% reduction compared to the Governor’s original proposal.

The less borrowing, the better, for taxpayers.

STATE POSITIONS: HOW MANY BUREAUCRATS DO TAXPAYERS’ NEED TO EMPLOY?

Finally, a budget analysis looks at the number of government workers on the state’s payroll. Gov. Evers once again proposed a dramatic increase in the size of the government workforce, paid for by you, the taxpayer. In the 2019-2021 budget, Evers sought to add 701 government workers. Ultimately, the Republicans signed off on adding 482 new positions, bringing our total government workforce here in Wisconsin to 71,480. My goodness, 71,000 state government workers. 71,000. In the current budget, Evers wanted to add 308 new positions. Republicans instead rejected the 308 new positions and eliminated 170 currently authorized positions, for a net reduction of over 400 government positions. While not nearly a big enough reduction, it certainly is a step in the right direction.

Even before you consider the gigantic tax cut, just about every other way you look at this budget proposed by Republicans, it is a dramatic improvement to what Governor Evers proposed. Taxes, spending, bonding and government employees all were made better by Legislative Republicans. And in many ways, like outright rejecting over 400 horrible policy ideas contained in Evers’ original proposal or adopting the largest tax cut in state history, Republicans did outstanding and exemplary work to make this budget taxpayer-friendly and something all conservatives can be proud of.