Federal Government is $28 trillion in debt and unlikely to keep funding promises

$23 billion in ARPA, CARES Act and other federal COVID-19 aid negates need for more federal Medicaid reimbursement

Wisconsin’s current system has no waiting list, unlike other states

Wisconsin’s working poor can already find inexpensive private coverage on the federal exchange

Expansion in other states has not proven to save money, improve health outcomes, or improve healthcare access

April 20, 2021

By Lexi Dittrich

In the 2021-2023 state budget, Governor Tony Evers has once again proposed accepting the Affordable Care Act (ACA) Medicaid Expansion plan being pushed by the Biden Administration. Under the Medicaid Expansion proposal, the federal government would temporarily increase their share of the cost of the behemoth state Medical Assistance (MA) plan if Wisconsin forces those who earn up to 138% of the Federal Poverty Level (FPL) off of the private health insurance exchange and onto MA. The Governor included the Medicaid Expansion plan in his 2019-2021 budget, but the Wisconsin Legislature rejected the idea then over concerns that accepting the temporary enhanced federal reimbursement rate would put Wisconsin taxpayers on the hook for a large spending increase in the future.

While the Governor and his allies have attempted to portray this idea as a no-brainer, there continues to be a multitude of reasons why this scheme is a bad idea for the working poor, the very group it purports to help, and the Wisconsin taxpayer.

The Medicaid Expansion plan would allow all Wisconsinites earning up to 138% FPL to qualify for MA coverage. A single adult at 138% FPL earns $17,774 per year. A family of four at 138% FPL earns $36,570 per year.

Wisconsin’s MA program currently provides healthcare for low-income individuals, including able-bodied childless adults who have earned income up to 100% of the Federal Poverty Level (FPL) or $12,880 per year, parents and caretakers at 100% FPL or below, and pregnant women and children earning up to 306% FPL, or $39,413 per year. MA also provides coverage to the elderly and to people who are blind or disabled.

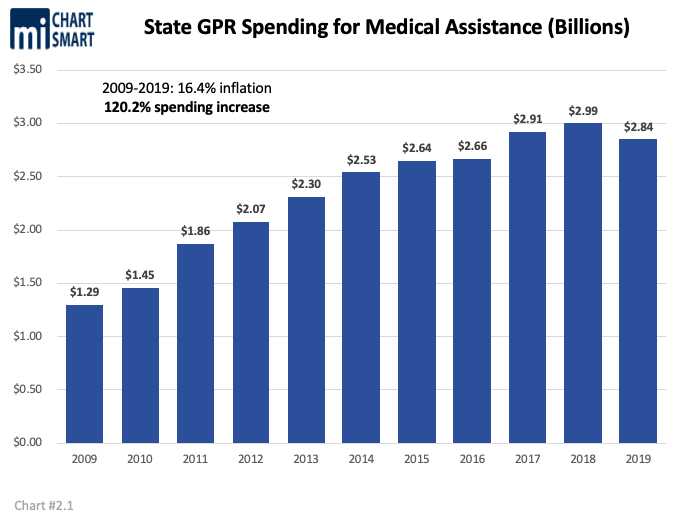

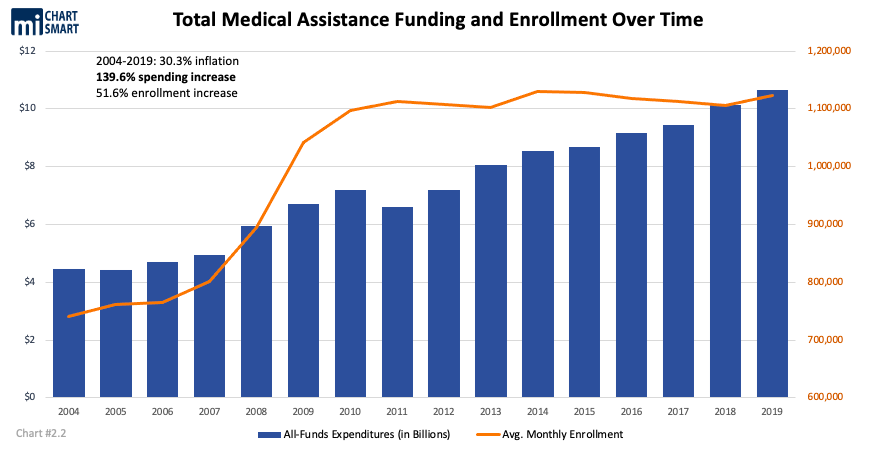

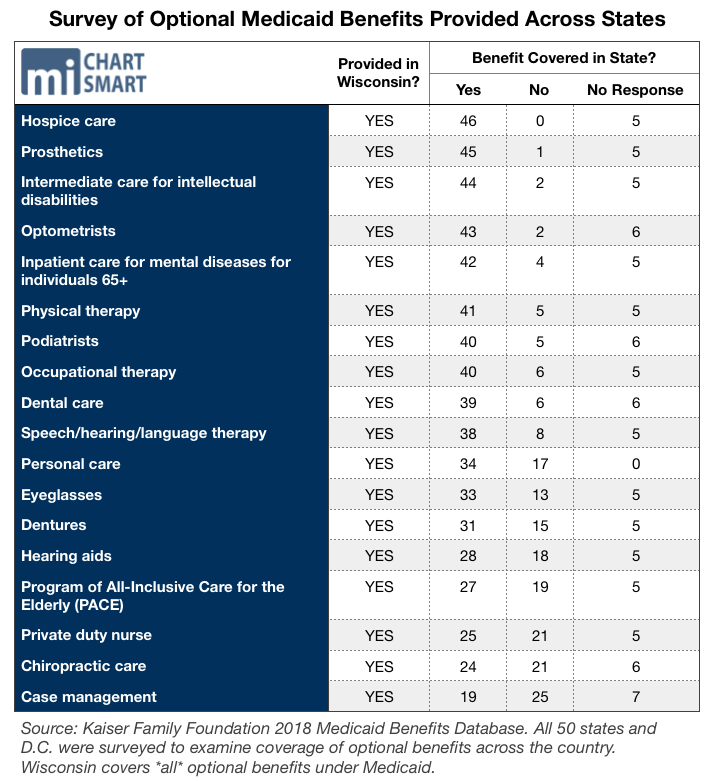

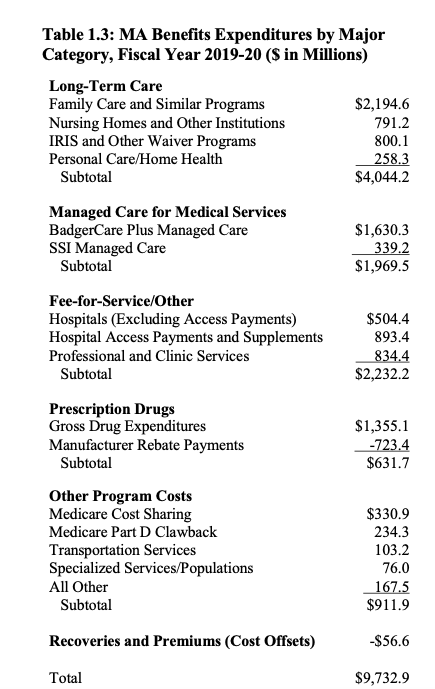

Wisconsin has invested a great deal into the MA program, making it one of the country’s most generous. From 2009 to 2019, Wisconsin invested $92.4 billion all funds (which includes federal and state spending), including $25.5 billion General Purpose Revenue (GPR) funds into MA. In 2019 (FY19) alone, the State of Wisconsin invested $10.66 billion all funds, $2.84 billion GPR on 1,123,000 MA recipients. Without expanding MA eligibility, the cost to continue services for those already enrolled in Wisconsin’s MA program will be $1.49 billion all funds in FY21 and $1.42 billion all funds in FY22. Even without the Expansion, Wisconsin’s MA program already covers all optional MA benefits and offers 28 programs for various populations in need.

Any idea that somehow Wisconsin taxpayers have not provided enough support for this program, so we have no choice but to turn to the federal government for more help, is patently false. Yet Evers’ Expansion pitch adds further spending onto the program.

Evers’ proposed Expansion plan would increase spending on MA to $13.3 billion all funds in FY21, $13.5 billion all funds in FY22.

Governor Evers is, of course, only emphasizing perceived positives of the Expansion deal. He promises that expanding the BadgerCare Medicaid program would “provide affordable health insurance coverage to tens of thousands of uninsured Wisconsinites, improving access to mental and behavioral health services while improving health outcomes and drawing down billions in federal funding for healthcare, recapturing billions in federal taxes paid by Wisconsin residents” all while saving millions.

If Evers’ spin sounds too good to be true, that’s because it is. Likely none of his Medicaid Expansion promises will come to pass

Expansion, instead, puts Wisconsin at risk for major economic uncertainty, entirely dependent on a federal government rife with national debt. MA also doesn’t result in improved health outcomes for the poor. On the contrary, as more people sign up for MA, healthcare access decreases for the poor and the cost of care increases for everyone else, including those on private insurance.

Wisconsin has no need to accept that kind of a deal, especially because the current system of insuring Wisconsinites in need already covers the Expansion population.

State lawmakers need to look past the temporary Expansion sweeteners to recognize the long-term negative consequences of Medicaid Expansion to all Wisconsinites.

Wisconsin Already Provides Coverage For The Expansion Population Through Obamacare

In Wisconsin, everyone up to 400% FPL, including the Medicaid Expansion population, has access to affordable government-supported healthcare. This is because of Obamacare and a strategic move by the Walker administration that eliminated gaps in coverage for certain income levels, making Medicaid Expansion unnecessary in Wisconsin.

The coverage gap is a problem in all non-Expansion states, except for Wisconsin. The gap occurs when certain low-income individuals earn too much money to enroll in their state’s MA program, but don’t earn enough to qualify for subsidies on the Obamacare insurance exchange. Often, the majority of people in this coverage gap are able-bodied childless adults.

Wisconsin does not suffer with this problem. In 2013, Wisconsin’s Governor Scott Walker requested a federal waiver that made all childless adults up to 100% FPL eligible for MA and shifted those between 100-200% FPL onto the Obamacare exchange. This meant that poor people in Wisconsin, who normally would be in the coverage gap, now have a guarantee of available, affordable coverage on the exchanges.

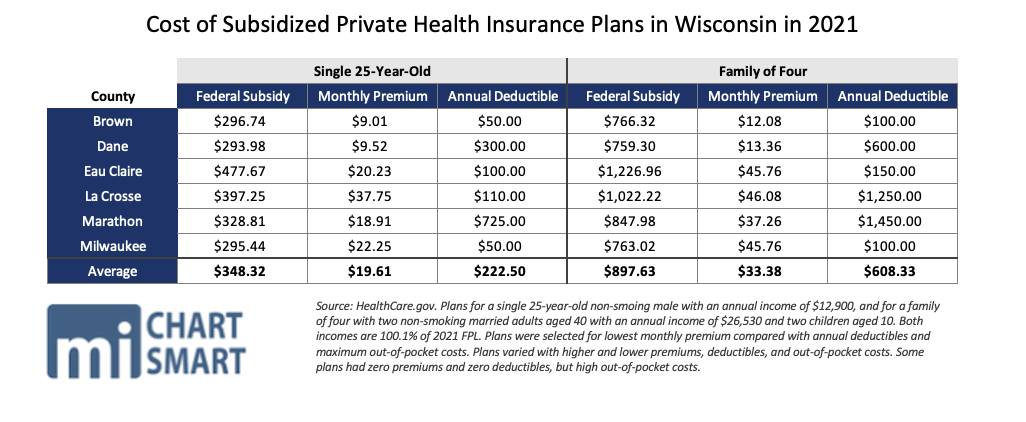

The table below proves that, in 2021, it’s still very affordable for someone above 100% FPL to buy their own plan on the private market.

Data below reflects some subsidized plans on the HealthCare.gov website for a 25 year old, single, non-smoker, with an annual income of $12,900, and for a non-smoking married couple, both 40 years old, with two children age 10, with an annual income of $26,530. Both sets of applicants have incomes at 100.1% FPL in 2021. (Note, plans for a 25 year old single person were the same for female applicants as for males).

If low-income Wisconsinites can already get private, subsidized health insurance for just $20 a month with a $50 deductible, why do we need Medicaid Expansion?

While Governor Walker’s maneuver admittedly required state reinsurance payments to keep exchange premiums low, the plan is still cheaper and more beneficial to Wisconsinites. The plan ultimately got people above the poverty line off of costly government-run healthcare and onto the less expensive private market, and it historically eliminated Wisconsin’s coverage gap.

It makes little sense to us then why Gov. Evers would take the expansion when Wisconsin’s system already effectively insures the expansion population. The perceived “benefits” from accepting the expansion are far outweighed by the benefits Wisconsin already enjoys because we refused the Expansion.

The Too-Good-To-Be-True Federal Offer Won’t Last Long

In his 2021-2023 budget proposal, Governor Evers first estimated that the Expansion would yield $634.7 million in GPR savings. After President Biden got his 2021 American Rescue Plan Act (ARPA) passed, estimated savings jumped up by an additional $1 billion, according to the nonpartisan Legislative Fiscal Bureau.

That’s a hefty chunk of change, and if it seems too good to be true, that’s because it is. For one thing, the “savings,” created by increased federal contributions, are all temporary. Once the federal boosts are taken away, Wisconsin will have to find a way (AKA, increasing state tax) to make up for the lost federal money.

Here’s how the Medicaid Expansion plan is purported to work. In Wisconsin today, able-bodied childless adults, parents, and caretakers may be on MA if their earned yearly income is 100% FPL or less. The Expansion would open MA eligibility to childless adults, parents, and caretakers who make up to 138% FPL. This 100-138% FPL group is commonly referred to as the Expansion population or Expansion enrollees. Under the regular Expansion plan, the federal government promises to cover the majority of the cost of coverage for Expansion enrollees by increasing their share of the Federal Medical Assistance Percentage (FMAP) to 90%.

MA is jointly funded by state and federal taxpayers. FMAP determines what percent of the cost of MA is paid by the federal government and what percent is paid by the resident state government.

The federal government normally pays for 59% of the cost of MA in Wisconsin. Wisconsin taxpayers directly pay for the remaining 41%. In 2019, Wisconsin taxpayers paid $4.53 billion GPR to cover the state share of the cost of MA.

The promised 90% FMAP from the feds only covers childless adults between 100-138% FPL. The 90% FMAP does not apply to other Expansion enrollees, like those who are parents or caregivers.

If low-income Wisconsinites can already get private, subsidized health insurance for just $20 a month with a $50 deductible, why do we need Medicaid Expansion?

The newly-passed ARPA attempts to sweeten the Expansion deal. The 90% FMAP for the expansion group will remain the same, but if Wisconsin takes the Expansion plan now, the federal government will increase their FMAP share for all currently eligible demographics by 5 percentage points (that 5% FMAP boost does not apply to kids on the Children’s Health Insurance Plan (CHIP) or to payments to disproportionate share hospital (DSH) payments). The boost will expire after two years.

The 5% boost goes on top of the 6.2 percentage point FMAP increase that was enacted by the Families First Coronavirus Response Act (FFCRA). The 6.2% boost expires at the end of the COVID-19 public health emergency.

As we’ll discuss below, the 90% increased federal FMAP for the Expansion population will likely be temporary, too. That’s the rub of Medicaid Expansion that Gov. Evers readily ignores when faced with immediate federal handouts. Increased federal contributions to MA in Wisconsin will not last, and when those increases and boosts do go away, future Wisconsinites will be saddled with the rapidly increasing costs of an Expansion plan that Wisconsin truly does not need.

Expansion Doesn’t Save Or “Draw Down” Money – It Creates NEW Federal Spending, And Lots Of It

MA is jointly paid for with state and federal tax dollars, but it really doesn’t matter which of the two is paying what portion of the cost. MA is an expensive program for both the federal taxpayer and the state taxpayer. But fans of the Expansion, like Evers, want you to think that the federal government owes Wisconsin some MA “savings.”

“This isn’t something that is just some part of some wish list,” Evers told Wisconsin Health News. “We pay taxes, and those taxes go to D.C., and we’re not getting our fair share back.” He said the estimated over $1 billion in ARPA-related MA savings is “a fair hunk of change.”

Evers is mistaken. First, the Foundation for Government Accountability finds that Wisconsin receives $1.06 back from the federal government for every $1 our taxpayers send to D.C. That extra 6 cents comes from our federal government’s spendthrift deficit system, which will grow worse if Wisconsin expands our government healthcare entitlement.

Furthermore, there’s no pot of Medicaid Expansion money for the federal government to return to Wisconsin. The money that Wisconsin taxpayers have sent to the feds has already been spent, and then some. Every new MA dollar spent by the federal government is another dollar borrowed from future taxpayers.

Federal borrowing of future dollars adds to our national debt. Today, that debt is over $28 trillion. Every new MA enrollee is another new invoice for more federal borrowing from future generations, who will shoulder the weight of that debt.

Without paring back the excessive level of spending at the federal level, the Congressional Budget Office projects that debt will only get worse.

“Spending, taxes, deficits, and the debt are all projected to increase to record levels,” writes Matthew Dickerson for the Daily Signal. “The median household income is about $63,000 per year. This year alone, the government is projected to collect the equivalent of the total income of 55 million median-income American families and spend the equivalent of 91 million median-income families.”

Whenever the federal government decides to reduce their unsustainable spending habits, cuts will be made, and Expansion kickers are prime for the chopping block.

If Wisconsin were to accept the Medicaid Expansion today at 90% federal FMAP, Governor Evers should be prepared for the negative consequences that will come when the federal government can’t keep their promises and the 90% FMAP is pulled back.

If the 90% FMAP is entirely removed, Wisconsin taxpayers will be forced to pay our normal 40% FMAP for Expansion enrollees. That could more than quadruple the direct cost to state taxpayers.

With the significant risks attached to the Medicaid Expansion, Wisconsin is better off continuing with our already effective system of insuring the working poor.

Make No Mistake, Wisconsin Taxpayers Will Pay For The Expansion

Medicaid Expansion will never be “free” to Wisconsin taxpayers. As we discussed above, Wisconsin taxpayers are federal taxpayers. A dramatic increase in a federal entitlement like MA should raise concern for all taxpayers because they, their children, and their children’s children will ultimately be the ones paying it off well into the future.

Gov. Evers estimates that the Expansion will lead to 91,000 new enrollees to the entitlement. Approximately 37,930 of the 91,000-some new enrollees (41.7%) would be childless adults who earn between 100-138% FPL. The remaining 52,989 (58.3%) would be newly-enrolled parents and caretakers between 100-138% FPL.

It’s critical to note here, all 91,000 expected Expansion enrollees in Wisconsin already have access to affordable healthcare coverage through the Obamacare exchange. Evers estimates that around half already have insurance coverage. With that in mind, arguments that Expansion is the only way to give this population healthcare are moot.

So what exactly is the motivation to pull those people off of the free market and onto a government entitlement? That’s hard to say when the cost of expanding MA is so high.

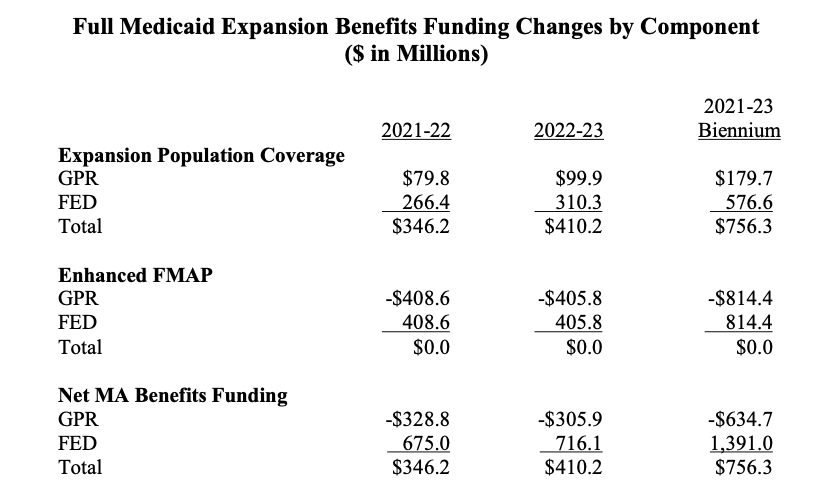

The LFB writes that two years of coverage for an estimated 91,000 new enrollees will cost $756.3 million in new all funds spending, which includes $576.6 million from the federal government. Wisconsinites would directly pay the remaining $179.7 million, which includes the 10% state FMAP for newly enrolled childless adults, and the normal 40% state FMAP for newly enrolled parents.

The 90% Expansion FMAP from the feds is also expected to apply to around 230,000 childless adults earning up to 100% FPL who are already enrolled in Wisconsin’s MA program (in a non-pandemic year, typically around 140,000-150,000 childless adults are enrolled, but enrollment increased in 2020 during the coronavirus pandemic). If the federal government applies the 90% FMAP to this group, Wisconsin would pay $814.4 million less over the biennium for the cost of insuring those childless adults, with the federal government picking up the $814.4 million cost.

When Governor Evers said that the Expansion would save the state $634.7 million, this is how it would happen, through the federal government spending a total of $1.4 billion brand new dollars per biennium on MA.

We argue that the net $634.7 million biennial savings aren’t true savings, because again, Wisconsin taxpayers are federal taxpayers. The $634.7 million that the federal government is promising to take on is still paid for by the taxpayers. The Expansion deal will ultimately funnell $1.4 billion total in new federal spending into Wisconsin. You, the Wisconsin taxpayer, are being obligated by the Evers Administration to sign that $1.4 billion check every biennium.

That bargain also signs Wisconsin up for even more future MA costs and surprise expenses, like unanticipated amounts of new MA enrollees.

“States that expanded Medicaid experienced large enrollment and spending increases—often greater than they thought possible,” write Brian Blase, Sam Adolphsen, and Grace-Marie Turner for the Galen Institute. “In expansion states, both enrollment and spending per enrollee averaged roughly 50 percent above federal government projections as enrollment surged almost immediately… Illinois expected fewer than 300,000 enrollees in 2015 and more than 600,000 people enrolled that year.”

Ohio provides another example. In 2015, Former Ohio Gov. John Kasich boasted that he brought home billions worth in federal MA money when he took the Expansion. In reality, MA spending in Ohio skyrocketed 35 percent in four years – from $18.9 billion in FY13 to $25.7 billion in FY17 – after a massive influx of unexpected enrollment. Kasich had predicted 447,000 more Ohio Expansion enrollees to MA by 2020, but by 2017, the Expansion enrollment was already 720,000. Minnesota and Oregon have seen some of the same crises after accepting the Expansion.

So when Governor Evers estimates 91,000 more Wisconsinites eligible for Expansion enrollment, expect the actual number of new enrollees, and the cost for taxpayers to cover them, to be much higher.

Again, don’t let Governor Evers make you believe that expanding Medicaid would save money. More MA enrollees inherently means more new spending, and $1.4 billion in new spending is not “saving” money, no matter which taxpayers are footing the bill.

Medicaid Patients Don’t Demonstrate Better Health Outcomes After Enrollment

Enthusiasts often praise Medicaid Expansion for improving the health outcomes of enrollees. Evidence doesn’t support that claim. Rather, evidence shows that Medicaid Expansion is correlated with increased ER visits, but not necessarily with better health outcomes.

The Galen Institute finds that “Hospitals in expansion states have reported ER visit increases are twice the rate in non-expansion states. For example, the non-expansion state of South Dakota saw just a 7 percent increase in emergency department visits from 2013-2017, while neighboring North Dakota, an expansion state, saw an increase in visits of 24 percent.”

Results of The Oregon Health Insurance Experiment corroborate with this data. In 2014, researchers reported that Portland-area Expansion enrollees visited the emergency room 40% more than uninsured people in the Expansion demographic. Despite this increase in ER visits, the Galen Institute writes that MA patients from the Oregon study “did not show improvement on the three physical-health measures assessed—blood pressure, cholesterol and blood sugar. If Medicaid would cause health improvements, it would likely occur on these basic measures of health.”

The only indicator of health that did improve in the Medicaid Expansion group, versus the uninsured, was reported improvements in depression and feeling secure. Observed rates of depression decreased by 30% among those new MA enrollees, according to the study.

Other research has shown that MA patients generally have worse outcomes after hospital treatment. A 2010 University of Virginia study on post-surgery outcomes found that MA patients were 13% more likely than uninsured patients, and 97% more likely than privately-insured patients, to die in the hospital. Those same patients were also more likely to stay longer in the hospital due to surgery complications. Observational studies have suggested these poor health outcomes might be because MA patients are assigned to less-experienced physicians and surgeons.

Without evidence that Expansion would cause better health outcomes, it’s worth questioning how useful MA would be to Wisconsin’s Expansion population, who already have insurance available to them through the Obamacare exchange.

Medicaid Expansion Lowers Access To Providers For Enrollees, Raises The Price Of Healthcare For Everybody

The cost of the Medicaid Expansion isn’t exclusive to state and federal budgets, but directly affects the cost of care for everyone. That happens, for one reason, because federal MA dollars don’t cover the full cost for healthcare providers to administer their services.

MA is notorious for insufficient federal reimbursements to healthcare providers who serve MA patients. Hospitals often hike the cost of care for everybody else in order to make up for lost revenue after treating MA patients. Some call this a “hidden tax” on healthcare.

When lawmakers expanded Medicaid in Arizona, one of their goals was to insure more people, which would decrease the number of uninsured people seeking care and, theoretically, reduce how much hospitals shifted costs onto the privately insured. A 2018 study by the Goldwater Institute found that, instead, the privately insured still paid 27% above list prices for hospital care in 2017. That’s a jump from a 14% cost shift estimated in 2007.

The Colorado Healthcare Affordability and Sustainability Enterprise (CHASE) observed similar conclusions. Study authors wrote in 2019 that the Medicaid Expansion wasn’t able to hold down increasing healthcare costs, even though MA reimbursements went up and hospital debt decreased. The study showed that between 2009 and 2017, Colorado’s hospital prices increased by 58.7%, but hospital discharges only grew by 14.2%.

When hospital prices increase, bigger bills are sent to private insurance companies. Those companies, in turn, increase premiums in order to offset the higher cost of coverage for their customers. This is reflected in the CHASE study, which suggests “rising hospital costs and margins have contributed to rising insurance premiums.”

This evidence means that people who don’t interact with Medicaid at all may see their insurance costs increase as more people enroll in the MA program.

Crummy reimbursement rates also disincentivize physicians from taking on MA patients—it’s too high of a risk to bottom lines. In 2017, the non-partisan LFB wrote that Wisconsin’s MA reimbursement rate “likely has the effect of restricting the number of medical providers who are willing to participate in the program, as well as the extent of their participation.” The LFB said this “could exacerbate provider access problems.”

Further research supports these claims. In 2019, the federal Medicaid and CHIP Payment and Access Commission (MACPAC) reported that only 70.8% of all medical providers in the United States would accept new MA patients, versus 85.3% of providers that would accept new Medicare patients and 90% of providers that would accept new privately-insured patients. Interestingly, MACPAC found that new MA patients were more likely in non-expansion states to be accepted by obstetrician/gynecologists, compared to expansion states.

The data doesn’t seem to support the claim that MA decreases healthcare costs or increases access. Quite the opposite. Wisconsin lawmakers should consider the inability of the Expansion to deliver promised outcomes when they consider adopting the policy.

It’s Never A Good Idea To Expand The Welfare Rolls

Evidence shows that expanding Medicaid could lower incentives for gainful employment among enrollees. That would make sense, since encouraging employment is explicitly not one of the federal government’s goals for the MA program.

The Centers for Medicare and Medicaid Services (CMS) this month rejected Wisconsin’s proposal that would require childless, able-bodied adults on MA to attend work, school, or community service as a condition of their enrollment. In their rejection letter CMS wrote that community engagement and work search requirements are “not likely to promote the objectives” of the MA program.

Results of the Expansion speak to that. The Josiah Bartlett Center for Public Policy noted in 2016, “The few times before the ACA that states expanded Medicaid to the population of able-bodied childless adults, they found that having public insurance discouraged work and looking for work.”

In 2014, a study by the National Bureau of Economic Research looked at unemployment data related to opening Wisconsin’s own MA program to childless adults. Their findings suggest that our MA program was a substantial disincentive to work among low-income childless adults between 2009 and 2011. Results showed unemployment rates among program enrollees were 2.4-10.6 percentage points higher than unemployment rates for poor childless adults who were uninsured.

The study authors wrote “policymakers should be prepared for a reduction in labor supply among childless adults affected by the Medicaid expansion under the Affordable Care Act.” NBER projected that 511,000 to 2.2 million less people nationwide would be employed due Medicaid Expansion and the ACA.

In 2014, the Congressional Budget Office projected that Medicaid Expansion and the ACA would reduce expected full-time-equivalent employment by 2.5 million by the year 2024.

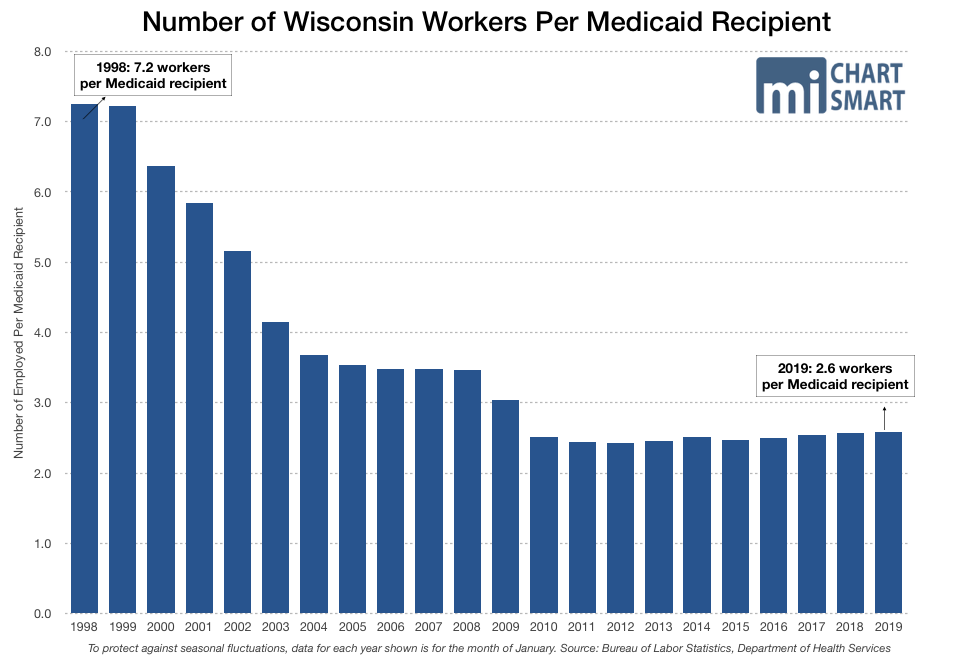

When more people choose MA coverage over gainful employment, a decreasing amount of workers are shouldering the growing cost of the MA program. In 2019, there were only 2.6 workers in Wisconsin for every one MA enrollee, a massive decrease from 6.3 workers per enrollee in 2000.

This is bad news couples with recent data showing 40% of small businesses are having trouble filling open positions post-COVID. The Foundation for Economic Freedom says this could largely be the result of “the federal government’s increase and extension of jobless benefits.”

Wisconsin needs the labor market to regain strength after the damage that government COVID-19 lockdowns caused. In light of the economic risks of expanding our MA entitlement, Expansion is ill-advised.

Moreover, we want Wisconsinites to thrive, without a long-term government crutch. If the Medicaid Expansion causes able-bodied, childless adults to lose motivation for gainful employment, then Expansion should be pulled off the table.

Wisconsin Is Working – Without The Expansion

Thanks to the 6.2% FMAP kicker from the FFCRA, Wisconsin has an MA surplus, listed at $685 million at the end of January 2021. Wisconsin is also expecting $8.7 billion in ARPA federal aid, on top of the $14.9 billion in aid and PPP loans we have already received. Wisconsin isn’t hurting for federal money.

It would be irresponsible, then, to take a temporarily sweetened Expansion deal while our budget looks good, ignoring the consequences of Medicaid Expansion that will leave the budget and every taxpayer’s pocket book hard-hit later on.

It’s also not sensible to accept the Expansion when Wisconsin already has a working market solution to insure the Expansion population. It’s especially unsensible to do so when Expansion in other states doesn’t demonstrate any of the positive changes in healthcare access, prices, or outcomes promised by people like Governor Evers.

State and national economies are uncertain right now. Medicaid Expansion would add to that volatility. Instead of accepting a deal that comes with so many economic uncertainties, Wisconsin is better off strengthening our established healthcare programs. This way, we will be better stewards to the money we are already borrowing from future generations for the MA program we run today.

We wonder why Governor Evers is still so desperate to expand Medicaid in Wisconsin when, demonstrably, Wisconsin’s system is working to get people healthcare, keep treatment costs low, and keep people gainfully employed. Expansion could upend all of that progress. The only good, fiscally responsible way to approach Medicaid Expansion is to not expand at all.