Proposed 10% spending increase for education comes on top of the $1.5 billion in the last two budgets

Public school enrollment down 3%

Budget proposal built upon “educational equity”

DPI Superintendent Stanford Taylor: “An unprecedented health crisis, economic challenges and the clarion call for racial and social justice have served to further highlight many systems of inequities. Our schools are not immune.”

December 16, 2020

By Ola Lisowski

The Department of Public Instruction (DPI) is asking taxpayers for large funding increases in the coming two-year state budget in order to address what it called “unprecedented needs” caused by the COVID-19 pandemic.

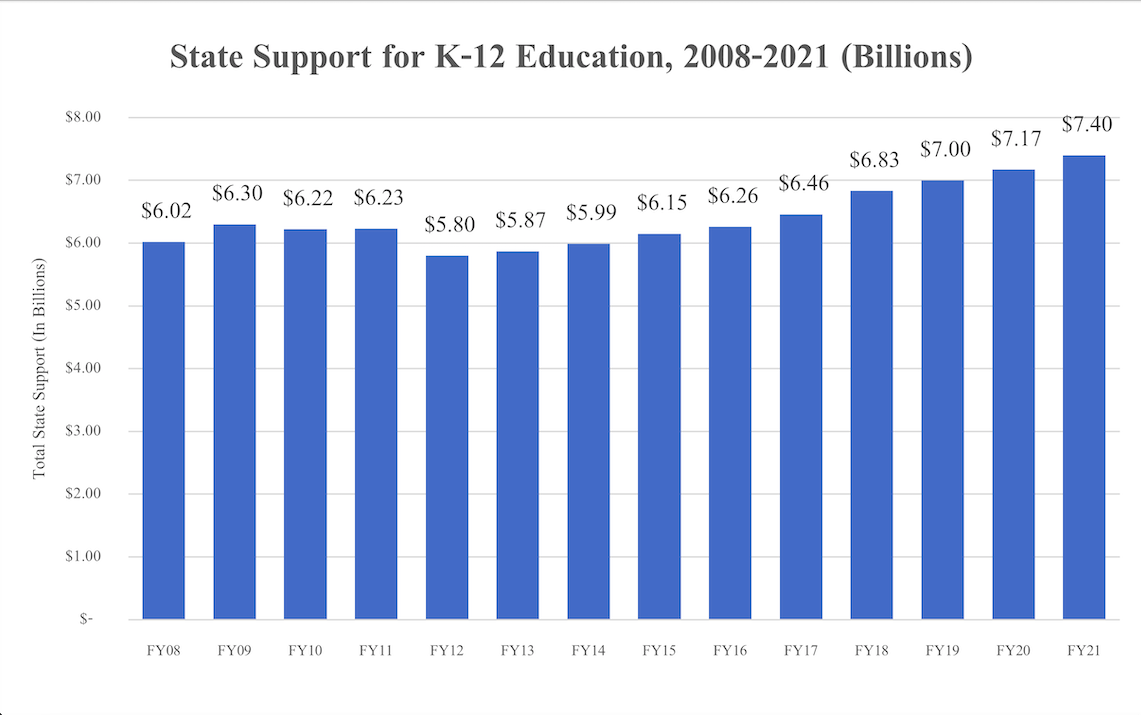

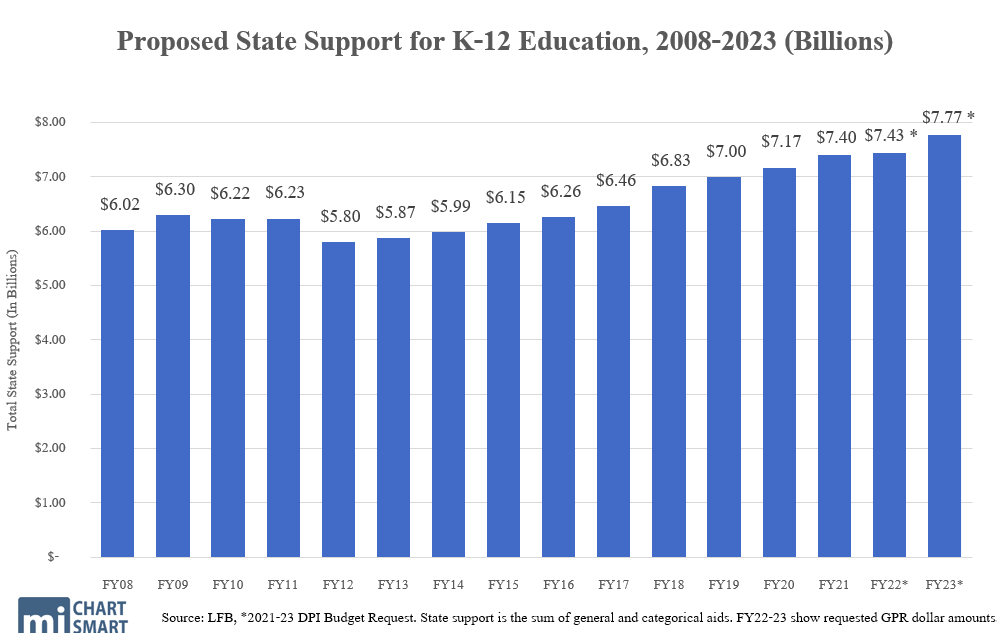

The budget request, submitted by State Superintendent Carolyn Stanford Taylor in early November, would increase spending by $1.6 billion in 2022 and 2023. The plan is a 10 percent increase over current budget funding—even as in-person instruction has been halted in many districts across the state, and thousands of families have left the public school system entirely.

The plan would rework the educating funding formula in response to the pandemic and its impact on schools. Public school enrollment fell by 25,232 students in one year—a 3 percent drop—to 818,922 students. Enrollment has steadily declined in Wisconsin over the years, but most years see a decline hovering at about 0.5 percent.

This year, total full-time enrollment (FTE) fell by 32,845, a 4 percent drop from 2019. Enrollment drops varied between age groups, with 4K and pre-kindergarten enrollment falling the most, at 15.6 percent compared to last year. The state funding formula uses student FTE as the basis for disbursing money to schools.

In response, DPI has suggested allowing districts to use the greater of 2019 or 2020 pupil count for revenue limit purposes, eliminating the impact of the enrollment drop in funding levels moving forward. Funding to schools is based on a three-year enrollment average.

It would also eliminate any impacts to revenue limits through the revenue limit exemption and the hold-harmless adjustment for one year. In addition, the budget would increase special adjustment aids through the biennium in order to ensure that no district sees equalization aids decreases of more than 10 percent in either 2022 or 2023.

In justifying these changes, the budget seems to assume that public school enrollment will rise back to normal levels after the health crisis is over.

While public school enrollment plummeted this year, enrollment at parental choice programs and independent charter schools increased, albeit at lower increases than typically seen. Independent charter schools saw total headcounts increase by 1.6 percent overall, and parental choice program enrollments increased by 5.9 percent. Enrollment figures for homeschools and private schools that don’t participate in any parental choice programs were not available.

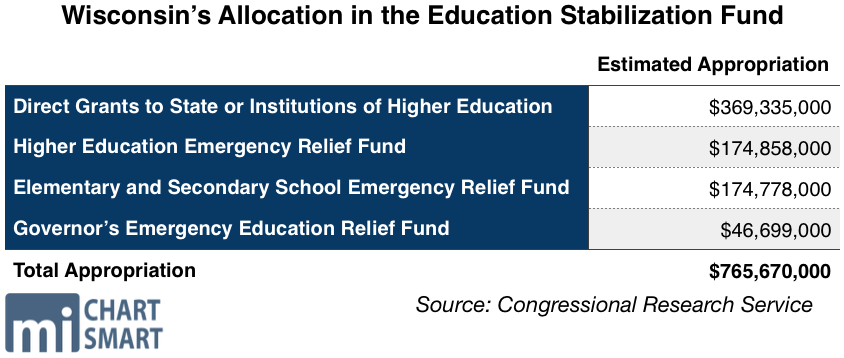

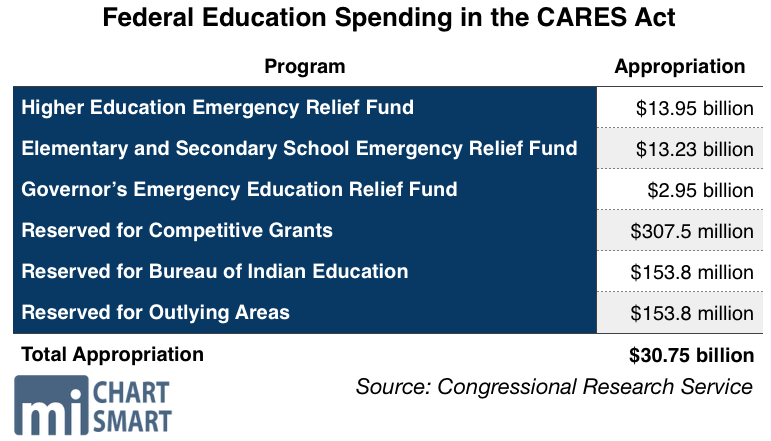

K-12 schools have received more than $220 million in CARES (Coronavirus Aid, Relief, and Economic Security) Act funding. But while the request spends much time discussing the negative impacts of the pandemic on learning, it hardly mentions the millions of federal funding that schools have already received. Only after over 100 pages of provisions does the proposal note that schools have received federal funds at all. However, it writes that such funding will only be temporary, and that continued allocations are necessary to support student learning. The document never weighs in on the need to return to safe, in-person instruction as soon as is practicable.

In releasing the budget request, Stanford Taylor said that the pandemic “magnified many existing inequities in our state and highlighted essential areas where our students and educators need further support.”

However, while some of the proposals are new ideas raised in the context of the pandemic, other provisions have long been circulated by Governor Tony Evers, who was State Superintendent for schools before becoming the governor. Ultimately, the proposal generally recycles old ideas and increases funding for existing programs.

For example, DPI’s budget would massively increase general equalization aids by $357 million in the first year of the budget, and another $487 million in the second year. That would total $844 million over the biennium, the largest single line item increase in the proposal.

General equalization aids traditionally make up the bulk of state school funding and are distributed through a complicated formula that sends more funding to districts with higher levels of poverty.

The budget would also increase the special education reimbursement rate from its current 28 percent to 40 percent by the end of the biennium. That change would cost an additional $131 million in the first year of the budget, plus another $240 million in the second year, to total $371 million more over the biennium.

Evers had put forth a similar proposal for the 2019-21 budget when he requested $600 million in new spending for special education aids. The final budget increased that fund by $97 million.

Stanford Taylor would also increase per pupil aid by $57.5 million in the first year of the budget, and $55.9 million in the second year, totaling a $113 million increase over current spending. That change would bring total aid to $750 per pupil.

Per pupil aids have slowly increased since the 2011-13 budget. The first year the program took effect, the state paid $50 per pupil, totaling $39.9 million in aid payments. The last budget, for 2019-21, increased per pupil aids from $654 per pupil to $742 in each year, totaling almost $90 million in new state spending and bringing the program to well over $600 million annually. DPI’s budget proposal requests $674 million for per pupil aids in the first year of the budget, and $673 million in the second year.

The budget would eliminate supplemental per pupil aid, which is currently funded at $2.5 million annually.

Unlike general equalization aids, per pupil aids are distributed equally across districts, based only on student enrollment. DPI’s budget request would change the calculation and send districts an extra $150 for each student in poverty. That change would cost an estimated $53 million in each year of the budget.

Other proposals would increase government spending in ways that aren’t directly reflected in state budget documents. For example, one provision would let certain school districts spend more by raising local property taxes. Districts that fall under the so-called low revenue ceiling would be able to increase to $10,150 per pupil in the first year of the biennium. After the first year, the low revenue ceiling would become tied to inflation, rising to an estimated $10,303 in the second year.

The current low revenue ceiling is $10,000 per member. Evers’ first budget increased the revenue ceiling from $9,400 in fiscal year 2019, to $9,700 in 2020, to $10,000 in 2021.

Statewide, that would allow low-spending school districts to raise local property taxes by millions of dollars. Another provision increases revenue limits for all districts by $150 per member in the first year of the budget. It would also tie revenue limits to inflation beginning in the second year of the budget, which would increase spending authority by an estimated $152.25 per pupil in that year.

Current law sets revenue limits that dictate how high school districts can set local property taxes. That system was created in the early 1990s in order to keep property taxes from skyrocketing. Some critics argue that spending levels when the system was created locked certain districts into relatively low levy rates.

Politicians on both sides of the aisle have sought to increase the low revenue adjustment. Governor Walker’s commitment to lower property taxes each year was one of the biggest obstacles for those who would increase revenue limits.

On top of the revenue limit increases, the budget would also allow school districts to vote to raise their own revenue limits through school referendum votes. Current law bans districts from putting low revenue ceilings up to a referendum vote.

DPI’s budget document claims that it would hold property taxes flat, but with increased spending and higher revenue limits tied to inflation, it’s unclear how that could be true. The nonpartisan Legislative Fiscal Bureau has not released an analysis of the proposal.

Other changes address how students are counted for funding purposes. Currently, students who attend full-day 4-year-old kindergarten (4K) are counted as 0.5 or 0.6 FTE members. The budget would count 4K students as 1.0 FTE members to send more funding to districts with 4K programs. That change in counting would also apply toward the calculation membership for revenue limit purposes—another way the budget proposal is likely to increase property taxes.

The proposal would dramatically increase spending for school mental health programs, increasing funding by $22.5 million in the first year, and $24 million in the second year. The current budget spends $6 million on mental health categorical aid in each year. The budget request would also combine the mental health categorical aid program with other funds that go to general pupil services.

The state first created the school mental health categorical aid program in the 2017-19 budget and funded it with an allocation of $3 million annually.

In addition, DPI would increase funding to school-based mental health services collaboration grants. The current budget spends $6.5 million in each year on the grant program, and DPI’s request would increase that figure to $10 million annually.

Bilingual-bicultural education aids would increase by $18.3 million in each year through new changes to the funding formula for English language learner support. DPI would create a new funding floor of $10,000 for each district that serves at least one and up to 20 English learners, plus an additional $500 for each English language learner beyond 20 students.

Sparsity aid would also increase under the plan, and DPI would create a new tier of funding for sparsity aid, an idea which legislators have repeatedly suggested in past years. That fund would increase by $6.3 million over the biennium.

Under the proposal, DPI would create a new tier of funding so that districts with student membership of 746 up to 1,000, and fewer than 10 members per square mile, would receive $100 per member. Plus, if a district loses eligibility for sparsity aid because it no longer meets sparsity requirements, it would qualify for a “stopgap” payment of 50 percent of the prior year’s aid payment. The current sparsity aid program provides $400 per member and only provides stopgap payments to districts who lose eligibility because their membership increases over 745 students.

Notably, and perhaps surprisingly, the plan would not substantively change the private school choice programs. In 2018, Evers proposed freezing enrollment in the Milwaukee, Racine, and statewide parental choice programs. He also proposed ending the Special Needs Scholarship Program and barring independent charter school authorizers from starting new charter schools through the biennium.

Stanford Taylor’s plan makes none of these proposals, but instead makes numerous small changes that school choice supporters have asked for.

It would amend the Early College Credit Program to permit students at independent charter schools to participate and earn college credit while in high school. The budget request also eliminates the charter school authorizer report, an annual requirement that critics have called unhelpful and time-consuming. Finally, the proposal would eliminate a discrepancy in per pupil payments. Current law sets a different payment amount for independent charter schools authorized by a Tribal College. The budget request would do away with the difference.

Other funding proposals in the plan include:

- $20 million, plus one full-time position, for a new out-of-school time programs grant

- $12.7 million more for high-cost special education categorical aid

- $6.5 million more for public library system aids

- $5.8 million more for driver education aid

- $5 million more for school breakfast programs

- $4.9 million more for supplemental nutrition aid

- $4.5 million more for special education transition readiness grants

- $4 million more for high-cost transportation aid

- $1 million for mental health training