February 24, 2020

By the MacIver Staff

It’s not easy to keep up during the final weeks of a legislative session in Madison. There’s always a rush to pass a bunch of bills before the clock runs out and the body adjourns so elected officials can head home to run for reelection. Bills that have been stalled in committee for months suddenly start moving at break-neck speed and there is also a flood of new, last-minute proposals the politicians hope will score last-minute political victories and earn them the adoration of the voters.

On top of this normal chaos, Governor Evers has called several special sessions this year to promote his initiatives. Evers and Legislative Republicans also have competing plans for what to do with a projected $818.2 million tax surplus that are being debated as we type.

Your ever-friendly staff at the MacIver Institute is here to wade through all the rhetoric, bluster and hyperbole to help you, the taxpayer, to stay on top of key issues as the session draws to a close.

Spend The Surplus Or Give The Surplus Back To Taxpayers?

News from the nonpartisan Legislative Fiscal Bureau in January of a $818.2 million projected tax surplus was immediately followed by proposals on how to spend it.

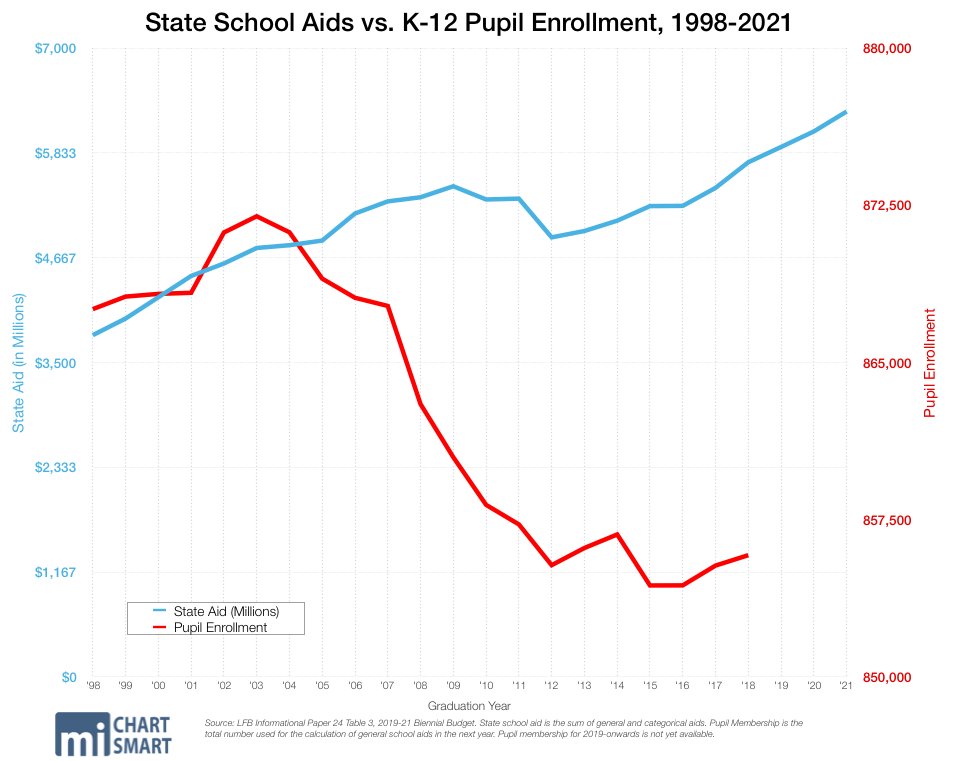

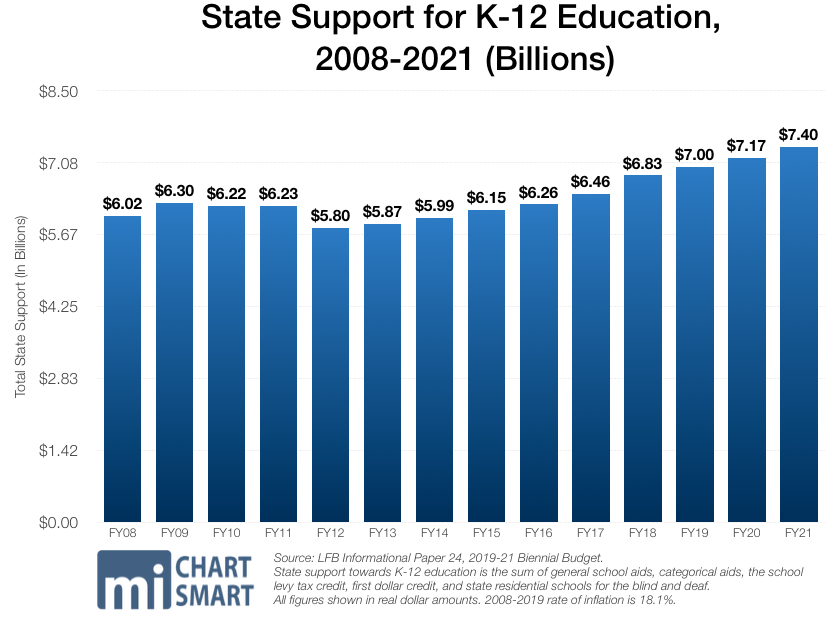

Gov. Tony Evers initially expressed caution about the one-time windfall, saying that we should be conservative in our approach and not spend this “one-time” money on continuing commitments that would be difficult to pay for in the future. Gov. Evers quickly changed his tune, however, to advocate for a plan that would pour $130 million into school equalization aid (which buys down school property taxes for property owners), $85 million for special education, $19 million for mental health programs and $10 million in sparsity aid to rural school districts.

Republicans countered with a plan to provide a $250 million income tax cut by increasing the standard deduction, resulting in a $106 average tax cut for an individual. Republicans also included a $45 million small business property tax cut and proposed using $100 million to buy down state debt.

I am disappointed to hear that both @SpeakerVos and @SenFitzgerald oppose my plan to provide $130M to help reduce property taxes while also investing $120M in our schools. Our schools and our taxpayers–especially in rural communities–need this support and they need it now.

— Governor Tony Evers (@GovEvers) February 6, 2020

Both the Repubican-controlled Senate and Republican-controlled Assembly passed the proposal last week. The Governor vetoed the package on Wednesday the 26th.

Stay tuned to the MacIver social media feed — Facebook, Twitter or Instagram — for updates on Republican leadership’s response to the veto.

Cutting taxes and reducing debt. It's what #Wisconsin Republicans do. #itsyourmoney #WIPolitics #WiRight https://t.co/0Np0EbBDTg pic.twitter.com/1FQUeOxJSb

— Speaker Robin Vos (@SpeakerVos) February 14, 2020

Special Session On Gov. Evers’ Rural Initiative

During his State of the State Address last month, Gov. Evers announced a special session on rural issues. He wanted to spend $8.5 million to provide grants and create 35 new full time government workers to support farmers.

Republicans introduced their own package of bills that focused more on property tax credits and deductions for health insurance for a total cost of about $36 million a year. Those plans passed on a voice vote in the Assembly.

The Assembly also passed two of the bills Gov. Evers proposed in his State of the State address. One will provide $5 million, up from the $1 million proposed by Evers, to promote Wisconsin dairy exports. The other will provide $600,000 in grants to dairy plants.

The Senate is expected to take up the farm bills in March, but Majority Leader Scott Fitzgerald says they will be “picking and choosing” which ones to bring to the floor.

Tougher on Crime

Representative Sanfelippo and company introduced a package of bills during a press conference at the West Allis Police Department on January 13. Their priorities focused on protecting crime victims and assigning heavier consequences for violent and repeat offenders, among others.

Five of the eight bills in this package were taken to the floor, passed in both houses and are bound for the Governor’s desk.

Of the five, one bill would increase the charge for intimidating a domestic abuse victim, and another would broaden the crimes which would send a juvenile to prison. Another would mandate strict sentencing for a felon found in possession of an illegal firearm and one would block the early release of a criminal if they were convicted of a violent crime.

AB 805 met controversy after the Department of Corrections (DOC) released a fiscal estimate showing that the bill would cost over $1 billion and require the construction of two new prisons. Considering the Evers administration is opposed to the bill and the Governor has actually stated that he wants to reduce the prison population by 50 percent, no one at the Capitol was surprised by the hefty price tag from the DOC. AB 805 would require DOC to “recommend revocation of a person’s extended supervision, parole, or probation if the person is charged with a felony or a violent misdemeanor while on extended supervision, parole, or probation.” If the person is found to be not guilty of the charges or if the charges are dismissed altogether, the accused would be returned back to extended supervision, parole or probation.

All but AB 804, which increases the charge for intimidating a domestic abuse victim, were vetoed by the Governor on February 28, 2020.

Lowering The Cost Of Healthcare In Wisconsin

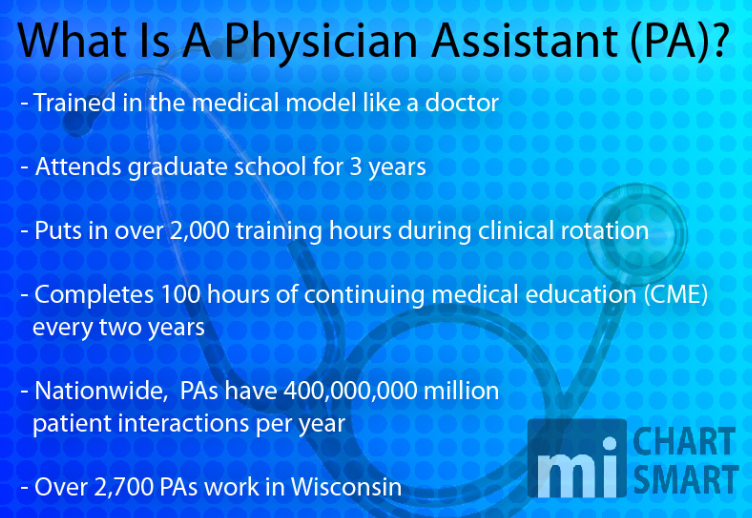

Proposals to lower the cost of healthcare in Wisconsin were another focus this session. As MacIver has covered in our reports and our MacIver Newsmakers Podcast, one bill that purports to do that would allow physician assistants (PA) greater freedom to practice in Wisconsin. The bill passed in the Assembly and is now available for scheduling in the Senate.

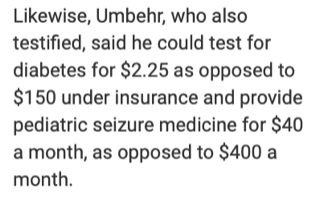

Another bill, AB 26, makes it clear that direct primary care agreements, where an individual enters into a private, low-cost agreement with a Primary Care Doctor for basic medical needs, are not insurance and should not be regulated as insurance. This bill was vetoed by the Governor on February 28th.

Another bill this session, AB 422, has passed in the Assembly and is available for scheduling in the Senate. The bill would harmonize Wisconsin’s law with federal law and prevent customers under 21 years of age from purchasing tobacco products.

Clean Water Testing and Mitigation

Two bills to test and filter PFAS, or per- and polyfluoroalkyl substances, cleared committee this session, but neither reached the Assembly or Senate floor.

An amendment, which would require a PFAS water testing study by UW Madison, was passed at the eleventh hour. The amendment also mandated that the DNR set a PFAS baseline for lab testing. The amendment was tacked on to SB 559, a bill dealing with public lake water rehab districts.

The bill was passed as amended in both houses and was referred to the committee on Labor and Regulatory Reform on February 28th. It should reach the Governor’s desk shortly. Evers has previously expressed support for other PFAS bills, so it is likely that he will sign SB 559.

DNC and the Bars

AB 869, a bill that would allow bars and wineries to remain open until 4:00 am during the Democrat National Convention this summer, has generated a lot of media buzz lately. After appearing to be all but dead, a late amendment was passed allowing this change, but only in fourteen counties that surround Milwaukee.

The bill passed in the Assembly, but it is uncertain if the Senate has the votes to pass it. Supporters of the Democrat Party convention and the Milwaukee business community are pressing to have the bill passed in time for the July gathering.

Transportation Project Reform

AB 820 would reform requirements that need to be met when the Department of Transportation (DOT) chooses to build a road project using the design-build process. The bill requires DOT to try 6 design-build contracts every 6 years.

The theory behind design-build is that construction companies can participate in the road design process and apply its practical experience to find efficiencies and cost savings that engineers might otherwise miss — saving taxpayers money and making projects more efficient.

The bill has passed the Assembly and is available for the Senate to schedule.

Ballot Integrity

Representative Brandtjen authored two Assembly bills to strengthen accountability in Wisconsin. Assembly Bill 203 would allow voters who vote early absentee in-person to immediately put their paper ballot into the standard electronic voting machine.

AB 203 passed the Assembly last week and is available for scheduling in the Senate.

AB 897 would require the Wisconsin Elections Commission to follow up if they suspect a voter has voted multiple times during a single election. The bill would also require an annual audit by municipal clerks on the voter rolls to seek out suspicious voting.

AB 897 was introduced late in the session and it is unclear if the Senate will give the bill a hearing or pass it before going home for the year.

Free Expression in the UW System

AB 444, a bill that requires the protection of free speech on all University of Wisconsin campuses, passed the Assembly this session. The bill mandates that the UW Board of Regents pass a policy that preserves the right of free speech — conservative, liberal, socialist, Democrat, Republican or even vile speech that we all disagree with — for everyone in the classroom and across the campus. UW institutions would also be required to maintain political neutrality and would require campuses to be open to any invited guest speakers.

The bill was received by the Senate, but it is unknown if they will take it up this session.

More Accountablity For Schools

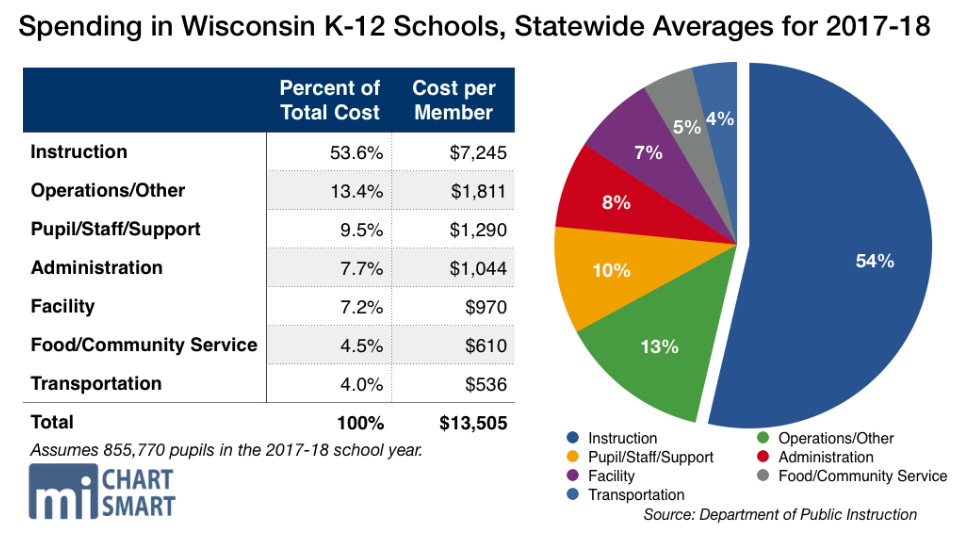

On its way to the Senate is AB 810, a bill which would create a digital school budget system with data received and compiled by DPI.

On its way to the Senate is AB 810, a bill which would create a digital school budget system with data received and compiled by DPI.

The system described by the bill would collect yearly, uniform data on how schools spent state, federal, and local funding. This is important because right now school districts can present this information any way they choose, making it difficult to compare the spending and fiscal decisions of one district to another. It would also require DPI to create an online database that would be free and easily accessible to the general public. It is unknown what the Senate plans to do with the bill.

Raising Property Taxes

MacIver spent time early this year to explain why your property taxes continue to go up in Wisconsin. Now, a bill is on its way to Governor Evers that could allow those taxes to increase further.

AB 310 would make it possible for local governments to hold referendums to increase their levy limits. Technically local governments are allowed to do this now, but they say the requirements are so restrictive, it’s practically impossible. This bill removes those barriers, paving the way for towns, villages, cities and counties to start holding referendums just like school districts do. Both the Senate and Assembly passed this bill, and the Governor signed it into law on March 4th, 2020.

Convention Of The States To Rein In Federal Spending

Assembly Joint Resolution 77 has passed the Assembly, 60-38, and has been sent to the Senate. The resolution calls for a Convention of the States in order to restrict federal spending and to create Congressional term limits.

Assembly Speaker Robin Vos announced his support for the resolution to keep the federal government from “spending us into oblivion,” but said that he opposes term limits at the federal and state levels. It is unclear if the Senate will take the resolution up before the session ends.

This morning, the Assembly will hold a public hearing on my constitutional amendment to kill the “Zombie Veto” which Governor Evers used to resuscitate dead spending in the last budget. You can follow the hearing beginning at 9am here: https://t.co/zwYcyDm22k pic.twitter.com/zXhP0giS8v

— Sen. David Craig (@SenDaveCraig) January 28, 2020

Finally, Assembly Joint Resolution 180 was brought to the Committee on Constitution and Ethics on January 28th this year. The resolution is meant to restrict the partial veto powers of the Wisconsin governor so that extra spending cannot be vetoed into a bill (or a budget, as Governor Evers demonstrated in his first state budget).

For more of the latest updates on Wisconsin public policy and government, be sure to follow MacIver on Facebook, Twitter, and Instagram and subscribe to our Youtube channel.

*Updated on March 17, 2020