Are taxpayers growing weary of perennial referendum questions?

April 8, 2019 | MacIver News Service

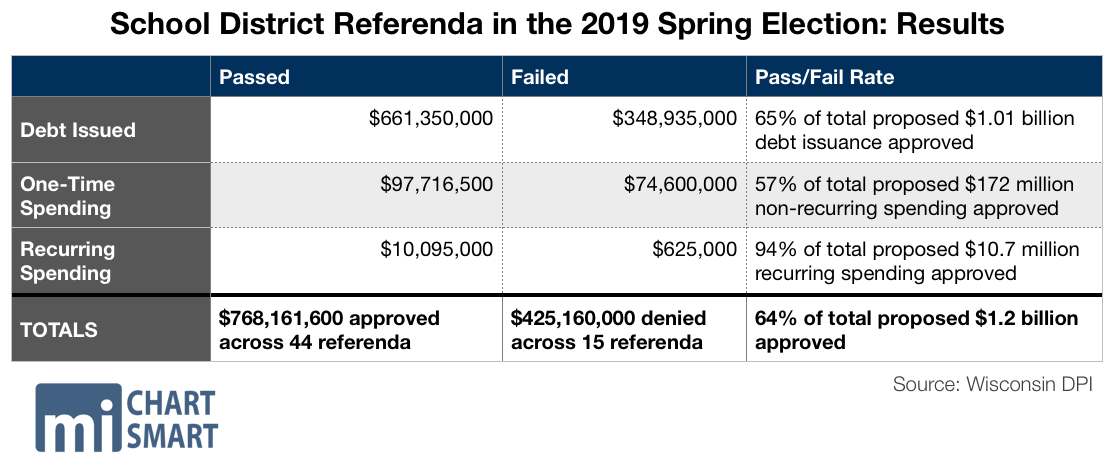

In the spring 2019 election, voters across 48 districts approved 44 referenda amounting to $768 million in tax increases. Of the proposed $1.2 billion up for a vote, voters approved 64 percent, a significant decrease in referendum passage rates.

Last November, voters approved $1.37 billion in property tax increases via referendum questions, passing 94 percent of the measures on the ballot. In the April 2018 elections, voters passed 83 percent of proposed referendum questions, approving $563 million.

With just 64 percent of referendum questions passing in the most recent election, it appears taxpayers may be growing wearing of constantly increasing property taxes.

Of the 26 districts requesting to issue debt, 16 referendum questions passed, approving $661 million in new debt. Voters approved 65 percent of the total amount in new debt that school districts proposed. Last fall, voters approved 97 percent of total new debt proposed by school districts. Out of any shift in votes, this was the most stunning decrease.

Taxpayers also approved six of the seven recurring increases on spending caps, worth $10 million, and 22 of the 26 one time non-recurring increases, costing taxpayers $97 million.

School districts have state-imposed revenue limits that protect Wisconsinites from constantly-increasing property taxes. However, districts can still ask voters for more by coming to them with referenda during regularly-scheduled primary and general elections. Even if voters do not have a referendum question on their own ballot, referenda increase the statewide property tax base, affecting taxpayers across the state.

In the past, districts could propose referenda during special elections and could repeatedly propose the same project in consecutive elections. Former Gov. Scott Walker and the Republican-led Legislature have shared a commitment to lowering property tax burdens, spurring referendum reforms to ensure more voters have a say in matters of large tax hikes.

Gov. Tony Evers’ 2019-21 biennial budget proposal would roll back some of those protections on property tax increases, allowing school districts to offer up referendum questions during any election, not just regularly-scheduled elections.

Voters in Neenah rejected the second largest referenda request, a proposed new middle school and various building upgrades that would have raised taxes by $129,580,000. The Freedom Area District was denied a request for $55,680,000 to build a new high school along with a recurring $625,000 for operating expenses. In West Bend, voters refused a new elementary school which would have cost $47,000,000. Voters also denied requests for new gymnasiums, an athletic track, and building renovations across the state.

In the Sun Prairie School District, voters approved two separate measures. They approved $164,000,000 for a new high school. In order to operate the new high school, taxpayers approved a recurring $5,000,000. All in all, Sun Prairie was the biggest spender, making up 14 percent of the statewide requests, and over a fifth of the approved tax increases.