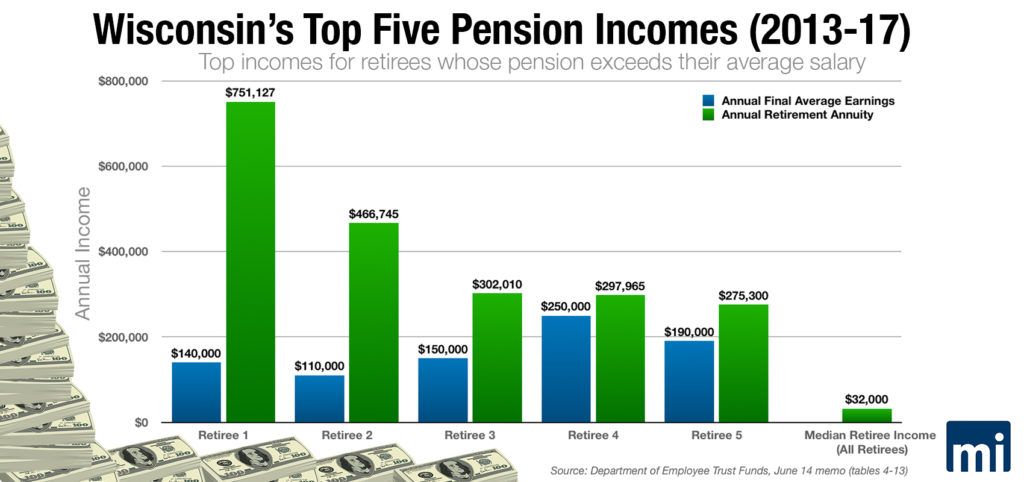

Of the 52,184 retirees’ annual annuities analyzed between 2013-17, 183 of the highest earners posted annual pension benefits higher than their average highest earnings

This is the first in a periodic series on taxpayer funded perks enjoyed by Wisconsin state government employees.

MacIver News Service | July 24, 2018

By M.D. Kittle

UPDATED on July 26 to include comments from Employee Trust Fund Secretary.

MADISON – Big government types like to paint a picture of the dedicated civil servant toiling away day after day doing the people’s business for a meager reward.

One retiree in the system collected $751,127 in annuity payments in 2017 – a five-fold increase from the $140,000 salary the former employee took home at the peak of service.

But for many government employees, there’s a comfortable retirement waiting at the end of their government service. For some, their state pension jackpot pays out the kind of retirement income that many Americans can only dream of.

A small percentage of retirees in the Wisconsin Retirement System are collecting retirement checks well over their highest annual earnings, according to a data review conducted by the state Department of Employee Trust Funds (ETF) for Wisconsin state Treasurer Matt Adamczyk.

MacIver News Service obtained and analyzed the pension documents. Of the 52,184 retirees’ annual annuities analyzed between 2013-17, 183 of the highest earners posted annual pension benefits higher than their average highest earnings.

Adamczyk requested information on the highest earnings and benefits amounts over the period. There could be many more state employees on the lower end of the income spectrum earning more in retirement than they did while on the job. These data analyzed include the most glaring numbers.

One retiree in the system collected $751,127 in annuity payments in 2017 – a five-fold increase from the $140,000 salary the former employee took home at the peak of service. The retiree was 87 at the age or retirement, and had nearly 50 years of creditable service.

Compare that pension windfall to the $32,000 median annual household income among all retirees, according to a survey released last year by Transamerica Center for Retirement Studies.

One retiree in the system collected $751,127 in annuity payments in 2017 – a five-fold increase from the $140,000 salary the former employee took home at the peak of service. #wiright #wipolitics #BureaucratBenefits Click To TweetAnother retiree in Wisconsin’s taxpayer-funded state pension system received retirement annuity payments totaling $466,745 last year, four times greater than the $110,000 the 83-year-old earned at the peak of 52 years creditable service working for the government.

One 80-year-old retiree booked $302,010 in annuity payments in 2017, twice the $150,000 salary the former employee pulled down at the highest earnings point of a 42-year state government career.

The higher-than-earnings payouts are thanks to calculations under ETF’s money purchase method, which does not use final average earnings to compute annuity payments but applies contributions to the pension fund over time and accrued interest.

“In many ways it’s like winning the lottery,” Adamczyk said of the hefty retirement payouts.

Indeed.

“I don’t think it’s fair people are making double or triple their highest salary average,” said state Treasurer Matt Adamczyk.

Indiana’s Hoosier Lottery offers a “Set For Life” game that pays winners $10,000 a month for 25 years. That’s on par with one 69-year-old state retiree who collected $121,000 in pension payments last year, $41,000 more than the employees’ highest average earnings. And that $10,000 a month in pension payments should only grow in coming years as the retirement investment fund grows.

“I don’t think it’s fair people are making double or triple their highest salary average,” Adamczyk said.

The state treasurer, who has spent much of his one and only term in office tracking wasteful government spending (Adamczyk campaigned on the elimination of the treasurer’s office), says there’s nothing wrong with public employees making a modest retirement. One of the enticements of government work is a generally generous pension. But Adamczyk said there’s no reason government employees need to earn in retirement more than they made at work – a luxury that many in the private sector will never know.

And the hefty pensions are compliments of taxpayers. For a long time, up until Gov. Scott Walker’s Act 10 required public employees to pick up half of their pension contributions, government employees received their defined benefit payments gratis. That generally amounts to 6.7 percent of the paycheck. The employer (you, the taxpayer), picks up at least that amount, depending on the employee’s status – general or protective class.

Even after Act 10, Adamczyk said, some public employers, particularly school districts, have found ways to offset the required employee pension contributions.

ETF does not identify pension recipients or the positions they held, only noting age at retirement and years of service. At 87, the retiree pulling down $750,000 in pension payments has outlived the average U.S. life expectancy of 78.7 years. But the individual could still live several more years. If the person collected the pension payout for five years, under the state retirement system’s guaranteed payouts for life option, the retiree would collect a total of $3.75 million.

The pension system offers a five-year guarantee payout and a 15-year payout, for only slightly less monthly retirement income. Other options include:

- Joint and Survivor Annuity,

75% Continued to Named Survivor - Joint and Survivor Annuity,

100% Continued to Named Survivor - Joint and Survivor Annuity, Reduced 25% on Your Death or the Death of your Named Survivor

- Joint and Survivor Annuity,

100% Continued to Named Survivor with 180 Payments Guaranteed

So a 70-year-old retiree locking in a 15-year guarantee at $175,000 a year, for instance, could collect for 10 years, pass away, and a named beneficiary, typically a spouse, could collect the hefty pension payment for another five years – guaranteed. That’s a $2.6 million-plus retirement over 15 years.

Most people are familiar with the traditional formula method of funding government pensions. It’s based on the employee’s three highest years of earnings, a formula factor based on the individual’s employment categories, years of creditable Wisconsin Retirement System service and any “applicable age reduction factor for early retirement,” according to ETF.

Among the 25 highest active employees, retirement account balances ranged from $2.74 million to $5.2 million, with a median account balance of $3.05 million.

“For most members, this (retirement income) is 70% of the final average earnings,” ETF notes.

Retirements are calculated using both calculations – the formula and money purchase methods. The retiree receives the higher benefit.

The contributions – now from the employee and from the employer – are invested by the State of Wisconsin Investment Board. SWIB boasts nearly $100 billion in assets and ranks as the ninth largest public pension fund in the U.S. More than 620,000 current and former state and local government employees and their families are part of the Wisconsin Retirement System.

Of course, longevity in public service pays off. The longer you work in government, the bigger the retirement check. The state system’s average retirement age is 61. The average retirement age of retirees pulling in annual pension checks higher than their final salaries is 72. The group boasted an average of 43 years of creditable service compared to the average retiree’s tenure of 21 years, according to ETF.

Among the 25 highest active employees, retirement account balances ranged from $2.74 million to $5.2 million, with a median account balance of $3.05 million, according to ETF. Median final average earnings for the employees was $180,000, with an average age of 77.

ETF Secretary Robert Conlin seems to take exception to Adamczyk’s characterization of the big pension payouts.

“While I appreciate the Treasurer’s interest in the WRS and his focus on a very small subset of WRS retirees, I can assure him that the WRS is not a lottery,” Conlin wrote in a statement issued late Wednesday, following Adamczyk’s press releases on the data. “Benefits are based on salary, career length and age. Pension amounts are limited by both state and federal law and the benefits are prefunded with employer and employee contributions.”

Many state employees won’t see Lottery-like payouts from their state pensions. ETF’s sample formula annuity calculation for a teacher retiring at 57, with final monthly earnings of $3,250 and 25 years of service shows pension payments of north of $15,000 per year. Add Social Security annual earnings of more than $16,000 and the sample teacher is close to the national median. That doesn’t take into account potential income from defined contribution offerings like 401(k) or self-investment mechanisms such as IRAs. The average pension in the Wisconsin Retirement System is about $24,700 per year, according to ETF.

But there are scores of former government workers earning more in retirement than they did on the job. Some just a few thousand dollars more, others banking two or three times more than their highest salary average.

Conlin attributes the hefty pensions in part to the fact that WRS “covers many public employees that earn professional salaries, like doctors, investment professionals, university faculty, lawyers and judges.”

“It should be no surprise that these folks sometimes receive commensurate pensions in retirement, a benefit for which contributions have been regularly paid over the employee’s working career,” Conlin said.

But, again, should public employees earn more in retirement than they did while working at their taxpayer-funded jobs, some significantly more? Tax dollars, after all, are seeding the retirement accounts. The ETF notes on its website that the system “provides a modest retirement income” to public employees. An ETF official did not respond to MacIver News Service’s follow-up questions.

Adamczyk says it’s more than time for the Legislature to look at caps on runaway pensions. While Wisconsin boasts one of the best-funded state pension systems in the nation, times and financial circumstances are always subject to change.

“If you take one of the larger number retirees, a person younger than 64 who worked for 30 years making $364,000 a year in retirement, at a minimum that person could easily live another 20 years. That person would take in $7.2 million,” the treasurer said. “That is an awful lot of money and taxpayers are the ones who are funding this basically.”