MacIver News Service | November 1, 2017

By Chris Rochester

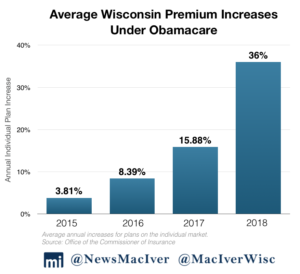

[Madison, Wis…] Wednesday marked the first day of the six-week open enrollment season for 2018 Obamacare plans, a time when many Wisconsinites shopping for health insurance will be hit with yet another year of sticker shock.Officials announced early in October that Obamacare premiums in Wisconsin would jump by an eye-popping 36 percent in 2018. That’s triple the preliminary increase revealed in August and more than double last year’s final rate increase of 16 percent.

Now that open enrollment is underway, 75,000 Wisconsinites who will lose their coverage at the end of the year are shopping for a new plan, whether they want to or not – more bad news delivered by government officials in October. That’s approximately one in three of the 215,000 Wisconsinites who buy their coverage on the individual market.

Most of the 75,000 canceled plans are the result of insurers continuing to drop out of Wisconsin’s Obamacare market. The massive losses causing them to withdraw are the result of more expensive enrollees, fewer younger and healthier enrollees, and more people deciding to pay the penalty rather than buying increasingly expensive insurance plans.

“I think we’re sitting in a market where there is some concern that we’re in a death spiral, and the individual market’s experience is deteriorating,” said deputy insurance commissioner JP Wieske in early October, adding the individual insurance market in Wisconsin has lost $400 million over the last three years. “That’s a very significant amount of money to have lost in just the individual market.”

In 2017, Anthem Blue Cross/Blue Shield joined several other major insurers in dropping out of Wisconsin’s increasingly toxic Obamacare market. They were followed by Molina Healthcare, the largest remaining insurer, which dropped out after proposing a preliminary rate hike of more than 40 percent. Health Tradition Health Plan, offered by Mayo Clinic Health System of La Crosse, also fled Obamacare this summer.

Anthem, Aetna, UnitedHealth, and Humana – four of the five largest health insurers in the country – all stopped serving Wisconsin through the Obamacare exchanges in the past two years.

On average, Wisconsin counties are losing one insurer per county from 2017 to 2018. Eleven Wisconsin counties will have just one insurer offering plans on the federally facilitated marketplace (FFM) next year: Brown, Door, Kewaunee, Manitowoc, Marinette, Menominee, Octonto, Rusk, Sheboygan, Waupaca, and Waushara, according to OCI data.

The decline of the individual insurance market is even more stark when compared with 2016. Wisconsin counties have lost an average of five insurers on the individual market per county between 2016 and 2018. Plans offered on the Obamacare market – a significant subset of insurance plans on the individual market – have declined by an average of 2.44 plans per county over that time.

#Obamacare has sent the individual market in WI into a death spiral. Watch as insurers flee the state’s exchange from 2016-18:#wiright pic.twitter.com/nVQ9piqUEH

— MacIver Institute (@MacIverWisc) November 1, 2017

The county hit hardest by the deterioration of the individual market has been Outagamie County. In 2016, 11 insurers offered plans in that county – eight on the Obamacare market. In 2018, there are just three plans to choose from, two of them through Obamacare.

The trend of individual plans in decline, whether they’re offered through the Obamacare exchanges or not, is repeated across the state as the entire individual insurance market falls victim to the dreaded “death spiral,” a consequence of Obamacare’s many fatal flaws.

Only five counties have added insurers between 2016 and 2018. Burnett, Dunn, Pierce, Polk, and St. Croix counties all gained one insurer.

The decline in competition among insurers means less incentive to hold costs down. As Wieske said, fewer and fewer insurers are being forced to take on the risk of an increasingly unstable, risk-riddled market.

The finalized 36 percent increase is a reflection of the instability that’s been growing in Wisconsin’s market for years.

Four Wisconsin health insurance plans are increasing their premiums by more than 50 percent in 2018, according to new final rate increases available on the federal HealthCare.Gov website:

-

- Dean Health Plan’s final rate increase for its Individual EPO plan is 50.47 percent.

-

- Common Ground, the nonprofit set up in the wake of Obamacare using taxpayer-backed loans, is increasing premiums for its individual EPO plan by 62.67 percent.

-

- Network Health Plan’s individual HMO plan will jump by 66.94 percent.

-

- Molina Healthcare of Wisconsin is increasing its individual health plan by a staggering 106 percent, but it will not offer the plan on the Obamacare exchange.

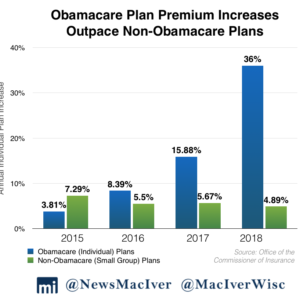

Wieske contrasted Obamacare’s individual market increases with non-Obamacare group insurance plans, which increased just 4.89 percent for 2018 – less than one-seventh the rate of Obamacare plans. Those are the plans employers typically offer and where most Wisconsinites get their coverage.

Since Obamacare took effect, its premium increases have far outpaced non-Obamacare plan increases. Those group plans have steadily increased by around 5 percent per year, while Obamacare rate hikes have consistently doubled the previous year’s increase.

The sharp contrast in premium increases between individual and group plans “indicates some concern that the individual market under this regulatory scheme of Obamacare is just not sustainable,” Wieske said.

Rate increases for 2018 will likely make the problem of attracting younger, healthier people to the individual market, and the death spiral, even worse.

On average, 21-year-olds shopping for a Silver Plan, the second-lowest-cost Obamacare plan, will see an average premium increase of 51 percent, according to data provided by the OCI. Individuals that age can expect to see a 105 percent increase in Marinette and Oconto counties and a 77.27 percent increase in Outagamie, Sheboygan, and Winnebago counties.

With finalized federal insurance data now available and open enrollment underway, check in often as MacIver continues to analyze the unfolding Obamacare disaster.