A Policy Brief by the John K. MacIver Institute for Public Policy

January 25, 2017

By Ola Lisowski

MacIver Institute Research Associate

EXECUTIVE SUMMARY

Download the executive summary in PDF format here.

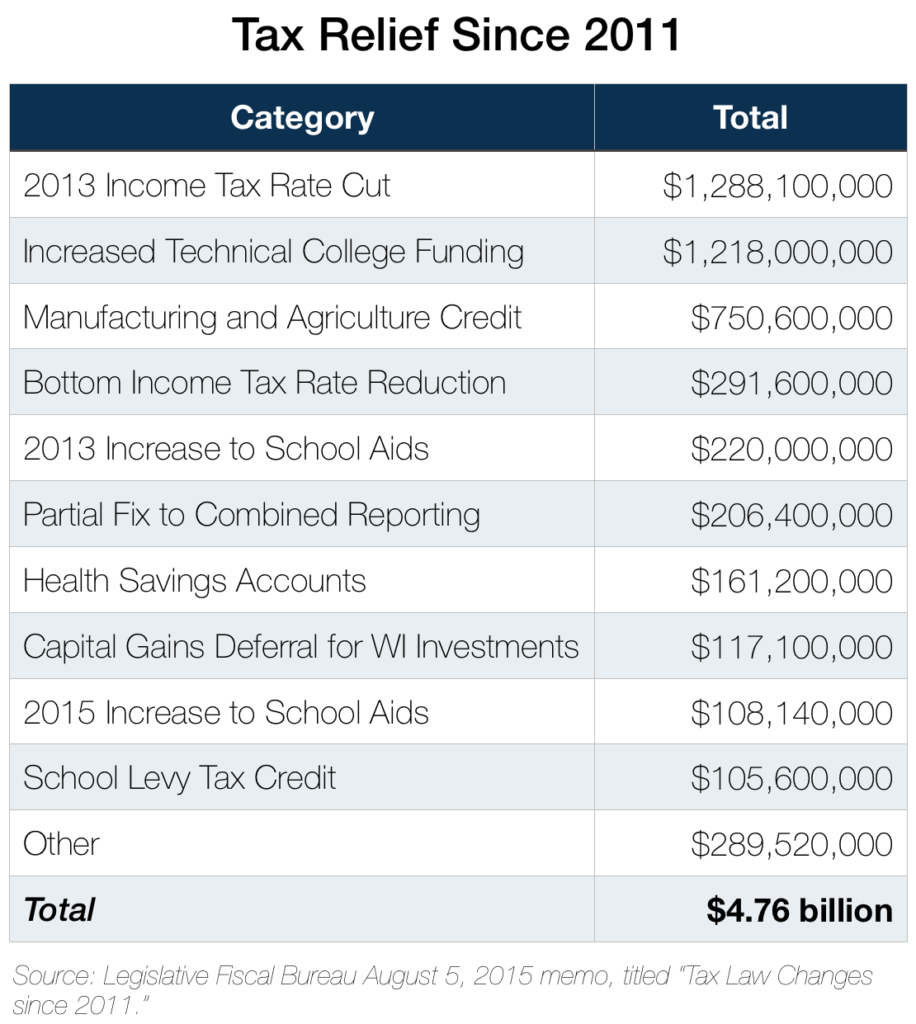

Since the beginning of his tenure, Governor Scott Walker has made tax reform a priority for Wisconsin. Walker has said he hopes to lower the tax burden every year of his term. Thus far, he has stuck to his pledge, having lowered taxes by $4.76 billion in under six years.

Both the amount of taxes and the different types of taxes that Governor Walker has cut since he took office is impressive.

It should not be simply glossed over how much progress Wisconsin has made reducing taxes in recent years. In 1994, less than 25 years ago, Wisconsin ranked 3rd nationally in overall tax burden and our taxes were 16 percent above the national average.

Today, property taxes are at the smallest percentage of personal income since 1945, 3.6 percent. The average homeowner in Wisconsin, in 2016, paid $116 less in property taxes than he or she paid in 2010. According to the Department of Revenue, the typical family in Wisconsin has seen their income taxes cut by $1,159. Wisconsin’s state and local tax burden, as reported in December 2016 Census Bureau data, fell to 10.8 percent of personal income, the 16th highest among the states. By comparison, the year prior, Wisconsin’s tax burden ranked the 15th highest at 10.9 percent of personal income.

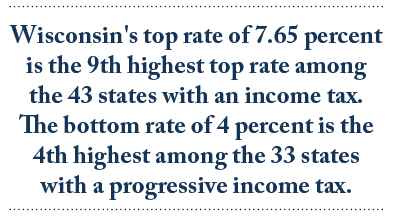

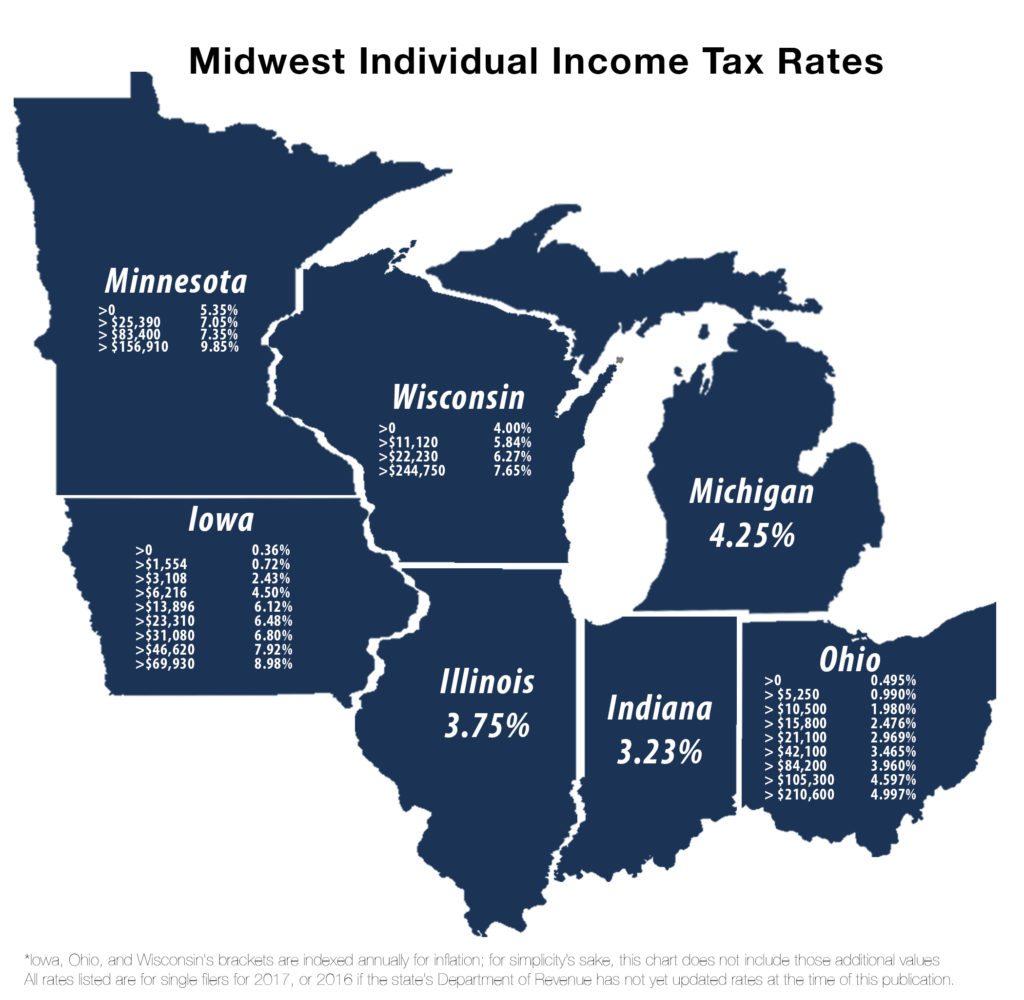

While Walker and the Republican Legislature should be lauded for all the taxes they have cut, these tax cuts have done little to improve Wisconsin’s overall tax ranking. Similar to the Census Bureau data mentioned above, the nonpartisan Tax Foundation’s most recent ranking of state and local tax burdens puts Wisconsin at the fourth highest in the nation and highest in the Midwest. In the same study, the Tax Foundation found that state and local taxes take up 11 percent of all personal income in Wisconsin every year. These tax cuts have also done little to stop or even contain the never-ending and seemingly inevitable growth of the state budget. The 2011-2013 state budget spent over $66 billion from all funding sources. The 2015-17 state budget spent nearly $74 billion.

Clearly, it is time to think about the next big and bold reform that will transform our state and make Wisconsin an economic powerhouse for generations to come. It is time for a flat tax in Wisconsin.

Wisconsin’s reputation as a high-tax state has a significant impact on the state’s ability not only to attract newcomers, but also to retain those who are already residents. Annually, Wisconsin loses an estimated $136 million in adjusted gross income to tax migration. The high tax burden drives individuals to leave for those states with lower tax burdens or no income tax at all, such as Florida and Texas. One study, which examined Internal Revenue Service data from 1992 through 2015, showed that Wisconsin lost $3.40 billion in wealth to Florida, $1.08 billion to Arizona, and $769 million to Texas during the 23-year period. In that time, almost 93,000 people migrated from Wisconsin – that’s more than the entire population of Racine, the state’s 5th largest city. The loss of so many individuals, their businesses, and their economic activity does not bode well for the economic future of the state. Lower, flatter income taxes are one way to help stem the tide of emigration from Wisconsin.

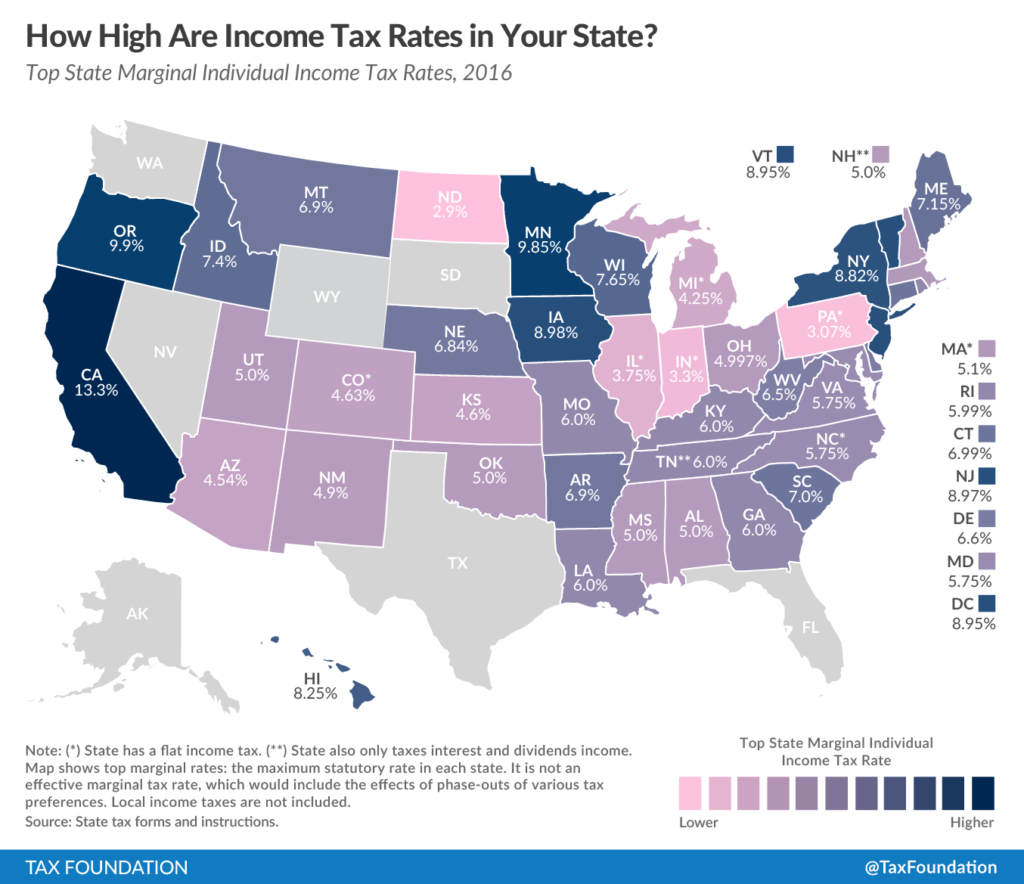

Low, flat state income tax rates are actually common throughout the country. Seven states levy no individual income tax at all. New Hampshire and Tennessee currently tax dividend and interest income, though recent reforms in Tennessee have set a glide path to total elimination of the income tax in 2022. Eight states have flat individual income tax structures, and 33 states, including Wisconsin, levy progressive tax rates based on income level.

In today’s mobile economy, every state must compete for new residents and new businesses or risk losing them to other states. While climate and the local job market are big factors in a person’s decision to move, a state’s tax burden plays an important role in keeping recent graduates, people looking for a better life, and retirees from moving to a state with a lower tax burden.

The personal income tax, not just the corporate tax, is also becoming a bigger factor in the financial health and growth of businesses. The number of pass-through entities has nearly tripled since 1980, making pass-through businesses the most common business form in the country. Pass-through entities are not subject to typical corporate taxation, but are instead taxed under the individual income tax. Profits are passed through to the shareholders or partners of these companies and become part of their income. More than half of Wisconsin’s workforce is now employed by pass-through businesses, giving the individual income tax even greater importance to the livelihoods of Wisconsinites and the success of their businesses. In Wisconsin, pass-through businesses pay a top marginal income tax rate of over 48 percent – the 8th highest rate in the country.

Taking nearly half of a company’s income is detrimental to success and economic growth. Many states are wising up to the fact that high income taxes hurt competitiveness by punishing success and hard work. Despite the rhetoric that progressive taxation results in a fairer outcome, evidence shows that progressive income taxes are actually associated with higher income inequality.

THE SOLUTION: A 3 PERCENT FLAT TAX

This report sets out to explain why Wisconsin should continue to ratchet down its relatively high individual income tax system and many different rates to one flat rate. Evidence from a variety of sources – economic, social, and fiscal health metrics, as well as academic studies – demonstrates the benefit of a lower and flatter income tax structure. After examining Wisconsin’s position within the Midwest and considering recent reforms around the country, this report will recommend that Wisconsin transform its progressive income tax to a flat 3 percent tax rate for all taxpayers over an eight year period. In subsequent papers, we will continue to build our case through a comparison with Indiana, a state similar in size and demographics to Wisconsin, and will recommend specific steps that Wisconsin can take to make a flat tax a reality.

A systematic glide path to a 3 percent income tax rate would give Wisconsin the most competitive income tax among Midwestern states while greatly improving the state’s attractiveness on a national level. Such a move would have a significant impact on the incomes of all Wisconsinites and most importantly, would allow working class people to keep more of their income. A 3 percent flat tax would be a tax cut for everyone in Wisconsin. Under the current “progressive” tax code, our lowest tax rate of 4 percent for those who make just $11,120 per year is the 4th highest tax rate among the 33 states with a progressive income tax system.

Spacing out the rate reductions over a number of years protects the state budget from sudden and steep revenue drops, giving sufficient time to make gradual adjustments so the transition to the new tax system is smooth.

If Wisconsin is serious about becoming a high-performing state in a 21st Century economy, it must continue its recent tax-cutting momentum to fundamentally change the fiscal trajectory of our state and to lighten the tax burden for its hard-working residents.

Our economic future depends on it.

—

Download the full report here.

—

Former MacIver Institute researcher Matt Crumb contributed to this report.