June 1, 2015

by James Wigderson

Special Guest Perspective for the MacIver Institute

We’re a long way from where we were when Governor Scott Walker announced his plan for state financing for a new arena for the Milwaukee Bucks. Back in January, Walker announced that he supported a diversion of the growth in income taxes paid by team personnel to finance the borrowing for a new arena. His goal, he said, was a “fiscally conservative, free market approach.”

What is currently proposed is not “fiscally conservative,” nor is it a “free market approach.” The question for state legislators, members of the Milwaukee County Board and members of the Milwaukee Common Council is whether the taxpayer investment in this project outweighs the costs of doing nothing and letting the Milwaukee Bucks go.

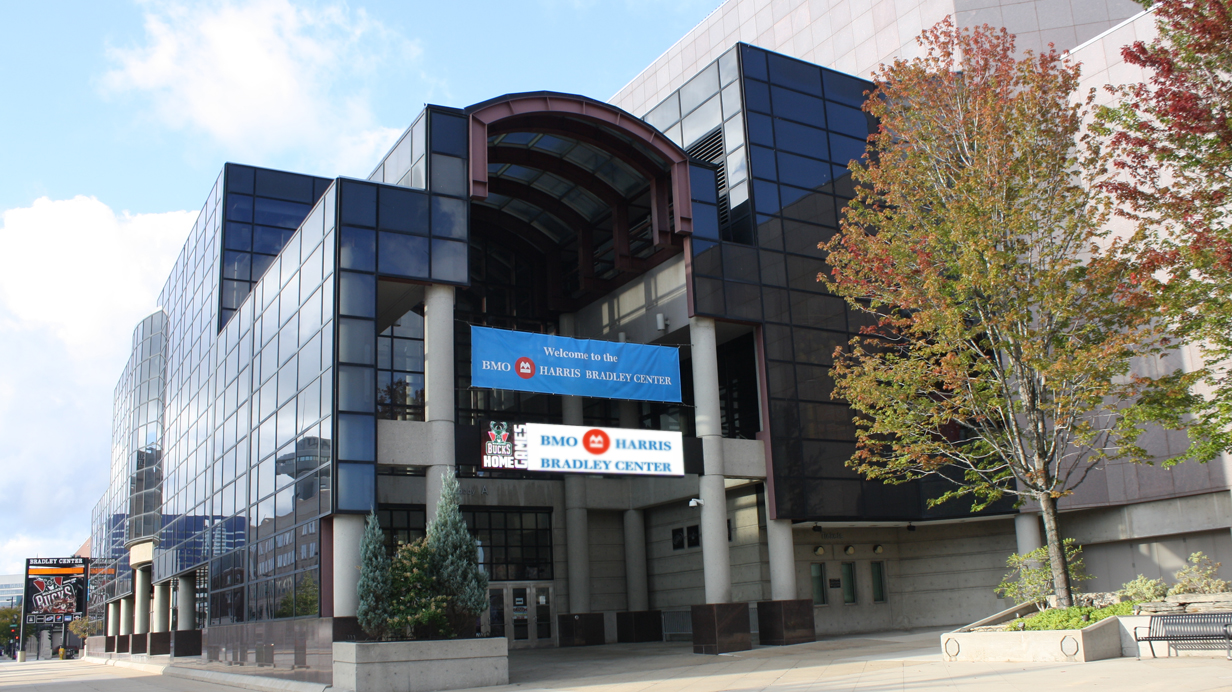

Let’s start with the dilemmas faced by state legislators and the governor. If the Milwaukee Bucks leave town, and they will leave if they don’t get a new arena, the state will be stuck with a Bradley Center with over $100 million in deferred maintenance costs. The remaining tenants, the Milwaukee Wave, the Marquette basketball programs and the Milwaukee Admirals won’t be able to sustain the Bradley Center.

In addition, the governor is correct that if the Milwaukee Bucks leave, the state will lose that income tax revenue, nearly $10 million annually. That number is expected to climb as NBA revenue from television climbs, raising NBA salaries with it.

The governor’s original plan in January was to borrow $220 million and finance it with the income taxes collected from the Milwaukee Bucks organization above the $6.52 million annually that the state currently gets in income taxes. That was to go with the $250 million from the current owners and former owner Herb Kohl.

Under the latest proposal, the state will borrow $55 million which will cost $80 million over 20 years. In addition, the state will assume the Bradley Center’s debt of $20 million, bringing the state’s contribution to $100 million.

The state will also be given $80 million ($4 million annually) in uncollectable debt owed to Milwaukee County to collect for use towards paying for the new arena. How much of that debt will actually be collectable and at what value remains to be seen. However, we’ll get the spectacle of the state shaking down poor people to collect debts owed to Milwaukee County to fund a new arena being built for a basketball team owned by billionaires.

According to the Milwaukee Journal Sentinel, of the $120 million in uncollected debts owed to Milwaukee County, $25 million is in delinquent property taxes. Let the evictions begin. The rest comes from unpaid court fees and fines, other county fees, and (my favorite) ambulance and other EMS charges.

If they wait until Christmastime to start the collecting it will truly be Dickensian. I’m sure Tiny Tim has a few ambulance charges that are unpaid. But if the state can’t collect all of the money, state taxpayers will surely be willing to forgo a few coals on the fire in the heating stove to make up the difference.

(We might wonder if it would be easier to ask multimillionaire Milwaukee County Executive Chris Abele, a Milwaukee Bucks season ticket holder, to find the money instead.)

The city will be kicking in a new $35 million parking garage which is hoped to be self-financing through parking fees. Build in Milwaukee, get a parking structure. The spirit of TV Lenny lives on. The city will also find $12 million in TIF money on whatever land is not part of the TIF districts used to finance the new streetcar system.

Finally, the Wisconsin Center District would, after paying off its current debts (approximately $180 million according to the Milwaukee Business Journal), borrow $93 million. As Steve Eggleston points out at RightWisconsin, the $93 million in borrowing will cost the district at least $135 million when the bill comes due.

Dan Bice, writing in Monday’s Journal Sentinel, says the total cost for the Wisconsin Center bonding could be as high as $200 million.

To pay for this new debt, the current food and beverage taxes, the car rental tax, and the hotel room tax would be extended, and they may go up, too. The rental car tax could increase to four percent from three percent and the hotel room tax could from 2.5 percent to three percent. So if you’re coming in to Milwaukee on business make sure you see a Milwaukee Bucks game. After all, you’ll be paying for it anyway.

It is an interesting contradiction. On the one hand, the Milwaukee Bucks are a world class attraction and Milwaukee hopes the team will continue to bring visitors to the city to spend money. On the other hand, the city will punish any visitor with taxes when they do come, limiting what the tourist will be able to spend.

What’s also interesting is that the Wisconsin Center District would now be responsible for the Convention Center, the Milwaukee Theatre, the UW-Milwaukee Panther Arena, and the Marcus PAC, in addition to building a new arena for the Milwaukee Bucks. A study by the Public Policy Forum released in December 2013 showed that the Marcus PAC could use a new parking structure (as long as the city is handing them out) with an estimated cost of $25 million. The Marcus PAC also has $11.6 million in other capital needs. Meanwhile the convention center could use $300 million to expand. They’ll wait while the Milwaukee Bucks players get deluxe accommodation locker rooms.

There is a promise that the new Bucks arena will stimulate development nearby, as much as $500 million worth. Details on that development have not been forthcoming. It’s also possible city and county taxpayers will not see any direct benefit from possible new development for some time as the Business Journal is reporting that the area may also be part of a TIF district.

The TIF district may be necessary as proponents of new sports facilities are notorious for overestimating the economic impact on the surrounding area. The reality is that, as the facilities themselves become bigger revenue generators for the teams by providing more restaurant and entertainment options within the structure, there is actually less entertainment dollars being spent nearby by game attendees. There is less need for a steak dinner after the game if you had one while watching the game.

Ironically, the current Bradley Center with its limited amenities has not been able to sustain entertainment activity close by compared to the Third Ward with no athletic stadiums nearby. Why would anyone assume a new arena, with new internal restaurants and other ways to take entertainment dollars, would result in more entertainment spending nearby?

Making the deal worse for the taxpayer is all of the borrowing. Instead of borrowing for infrastructure and long term improvements, local and state borrowing is being used to subsidize a private business that could actually pay for its own arena. The additional borrowing adds to the public debt, reducing the government’s ability to borrow for actual needs.

Supporters of the deal claim the taxpayers will come out ahead because the state will avoid losing tax revenue and the costs of deferred maintenance for the Bradley Center. But the Bradley Center maintenance costs are on the assumption state government remains in the entertainment business.

WISN’s Mark Belling has been reporting the Milwaukee Admirals are likely out at the new Bucks arena and will have to play at UW-Milwaukee Panther Arena instead. If the Bradley Center is closed without replacement, it’s a wash for them. Yes, it’s ironic since the Bradley Center was really built with them in mind.

Marquette and the Milwaukee Wave are not capable of supporting the Bradley Center or a new arena on their own. They, too, could move into the UW-Milwaukee Panther Arena, and there would be no need for the state to remain in the entertainment business.

That leaves the loss in state income tax revenue. The loss of the estimated $10 million annually is put on the scale against the cost of all that borrowing at the city, county and local levels, and the tax revenue from the hotels, restaurants and taxi cabs. It’s not even close.

It also sets a bad precedent that any business threatening to leave Wisconsin could demand that their income tax revenue be diverted instead to subsidize their own businesses. Government deciding which businesses are worthy of such treatment is not the work of the free market.

The arena deal also raises taxes, despite what Walker says. Just because the Milwaukee Center District board does not tax to the maximum now, it’s still a tax increase when they, wait for it, raise taxes. It raises taxes at the county level because if those bad debts really are collectable that’s money lost to Milwaukee County. That’s taxes at the state level, because the additional borrowing raises the cost of all state borrowing.

So we have a plan that raises taxes, borrows money for the wrong reasons, commits another government entity to future borrowing, counts on revenue that may materialize somewhere down the road, promises economic development that it won’t deliver on its own, solves a non-existent problem, spends more money going out than the government will see coming in, and relies upon the taxpayers to subsidize billionaires.

There is nothing fiscally conservative about this plan. Which Illinois legislator suggested it?