Walker’s April Withholding Tax Cut means Less Revenue to the State but More Tax Relief for Wisconsin Families

MacIver News Service | June 30, 2014

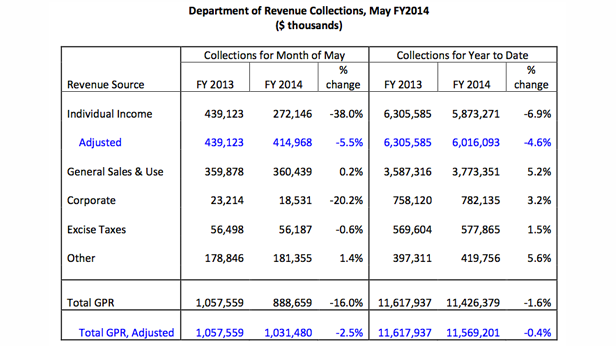

[Madison, Wisc…] General fund tax collections in Wisconsin are down 2.5 percent for May when compared to the same month last year and are down 0.4 percent fiscal year to date when compared to the same time period last year.Individual income tax collections are down 5.5 percent for the month of May from $439.1 million to $415 million. In April, Gov. Scott Walker ordered the Department of Revenue (DOR) to give Wisconsinites an immediate tax cut by lowering the state’s income tax withholding tables. So, this drop in revenue to the state, at least in part, was predicted. At the time, DOR Secretary Rick Chandler said the withholding table changes would cost the state $323 million but would allow a typical Wisconsin family to keep an extra $500 of their own money in 2014.

Total individual income tax collections for fiscal year 2014 to date are $6.02 billion, a 4.6% drop from $6.31 billion in fiscal year 2013 over the same period.

Corporate tax collections saw the largest drop of any type of state tax in May. The collections were $18.5 million in May of fiscal year 2014, a 20.2 percent reduction from $23.2 million in May of fiscal year 2013.

However, corporate tax collections are up 3.2 percent fiscal year to date.

General sales tax collections saw a 0.2 percent increase for the month of May and are up 5.2 percent for the fiscal year.