Don’t call it student loan forgiveness. In a blistering column, Dan O’Donnell destroys the new round of election bribery President Biden announced in Madison this week.

Apr. 10, 2024

Perspective by Dan O’Donnell

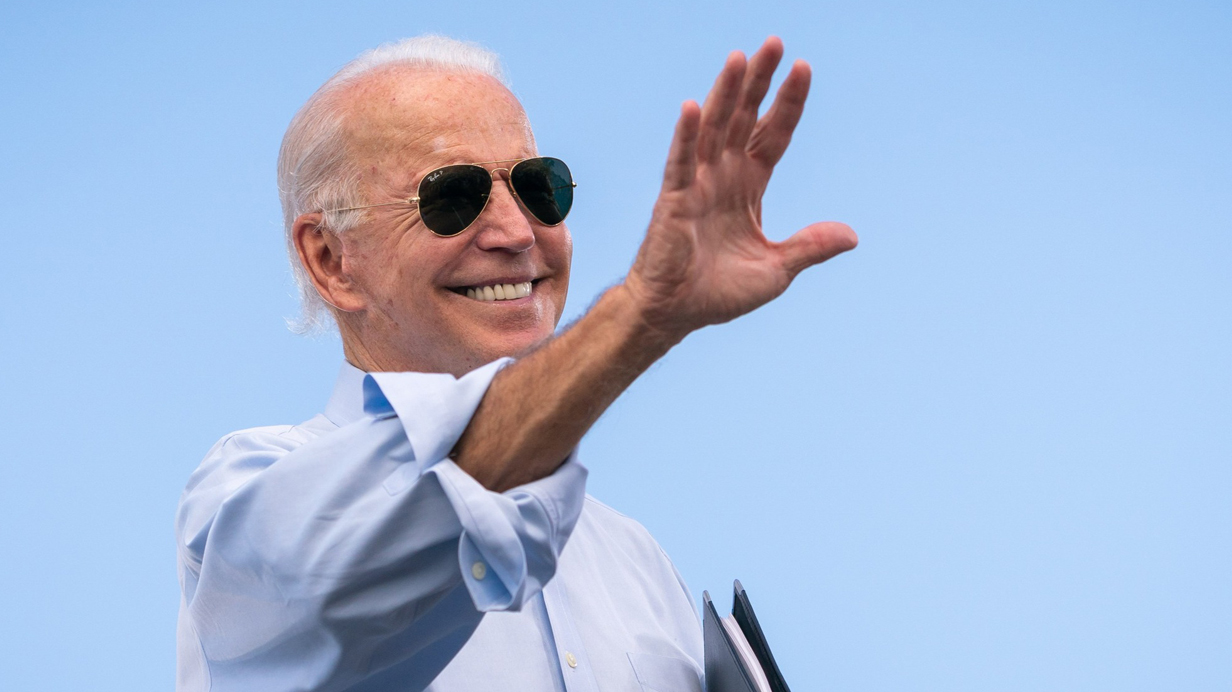

It was no coincidence that President Biden came to the critical swing state of Wisconsin this week to announce yet another round of bribes to young voters. He called it “student loan forgiveness,” of course, but a cynical political ploy by any other name would smell as noxious.

“Today, too many Americans, especially young people, are saddled with unsustainable debts in exchange for a college degree,” he said Monday, thoroughly failing to appreciate the irony that his “forgiveness” is nothing more than a transfer of that unsustainable debt to the catastrophically unsustainable national debt.

Who, then, ultimately pays for the education of Biden’s favored political class? Literally everyone else. And it’s not as though we can afford it: The national debt is now an astronomical $34 trillion, and interest alone accounting for approximately 3% of the country’s gross domestic product and later this year will surpass entire America’s defense budget.

In just the past few months, Biden has transferred more than $138 billion from student-loan borrowers to taxpayers despite a Supreme Court ruling last June that such a move is grossly unconstitutional.

In Madison, though, Biden scoffed at the idea that his debt-for-votes scheme was beholden to any judicial oversight.

“Some of my Republican friends and elected officials and special interests sued us, and the Supreme Court blocked us,” he told the crowd, which erupted in boos. “Well, that didn’t stop us. No, I mean it sincerely. We continue to find alternative paths to reduce student debt payments that are not challengeable.”

Naturally, he’s lying. A day after his speech, Missouri led seven states in again suing the Biden Administration over its blatantly unconstitutional usurpation of Congress’ power of the purse. He needn’t take his “Republican friends’” word for it that his tyrannical overreach violates clearly established federal law—even his closest political allies understand it.

“People think that the President of the United States has the power for debt forgiveness. He does not,” then-House Speaker Nancy Pelosi explained to reporters in July 2021. “He can postpone. He can delay. But he does not have that power. That has to be an act of Congress. The President can’t do it. So that’s not even a discussion. Not everybody realizes that. But the President can only postpone, delay, but not forgive.”

A scant three years later, the President has forgiven—or at least transferred to taxpayers—student loan debt in a blatant disregard of both a Supreme Court order and the separation of powers. As if such autocracy weren’t egregious enough on its own, Biden’s plan will only make higher education less affordable for future generations of students.

In 2017, a study from the Federal Reserve bank of New York revealed that tuition rose by as much as 60% as student loans and federal aid programs for tuition increased dramatically in the 1970s, primarily because there was far less incentive to provide value to the customer (i.e. the student) who was no longer paying directly out of pocket for the schools’ product (an education).

As Secretary of Education Bill Bennett famously opined in 1987, “Federal student aid policies do not cause college price inflation, but there is little doubt that they help make it possible.”

The more the government pumped into tuition assistance programs, the more tuition increased as colleges realized that the government did a whole lot less cost-benefit analysis than did the individual writing out a check. Government checks would come in with no questions asked, ever, about how the money was being spent.

Sky high salaries, a bloated bureaucracy with fewer professors in the classroom? It didn’t matter. The money kept coming, so the salaries soared higher, the bureaucracies grew even more bloated, and students were stuck paying off enormous loans that were many times higher than the cost of higher education in the pre-federal aid, pre-student loan era.

If prices spiraled that badly out of control because of federally subsidized loans, imagine how much they’ll spike when the government simply federalizes all student loan debt! If the only customer is the U.S. Government, then there will be no incentive whatsoever to keep costs down for students or, if Biden gets his way, taxpayers.

His latest attempt at election bribery isn’t just self-defeating in its purported aim to make higher education more affordable; it is also a dubious political calculation. What could be less palatable to a blue-collar voter who proudly makes his mortgage payment on time each month than the idea that he is now paying the tuition of a blue-haired gender studies major who considers herself his social better?

That matters little amid the blue-haired rebellion against Biden over his insufficiently pro-terrorist Israel policy. He needs these crazies much more than the working class who have long since abandoned the Democratic Party for saner alternatives. And so they—we, all of us—must pay for the most insane and unconstitutional wealth transfer in recent American history.