Today, MacIver examines @GovEvers' 2019-21 health care budget, another set of big-spending proposals that drastically grow government involvement in health care. #wiright #wipolitics #wibudget Click To Tweet

Today, MacIver examines @GovEvers' 2019-21 health care budget, another set of big-spending proposals that drastically grow government involvement in health care. #wiright #wipolitics #wibudget Click To Tweet

March 15, 2019

Analysis By Chris Rochester

A health care budget in an age of spiraling costs should be a litany of ideas for reducing health care costs, empowering the market, and protecting the taxpayer from open-ended commitments. But Gov. Tony Evers’ 2019-21 budget proposal instead blows the lid off government’s involvement in health care.

Evers’ budget drastically increases spending on a wide range of health initiatives, accepts the Medicaid expansion albatross, and increases government control over the health insurance sector.

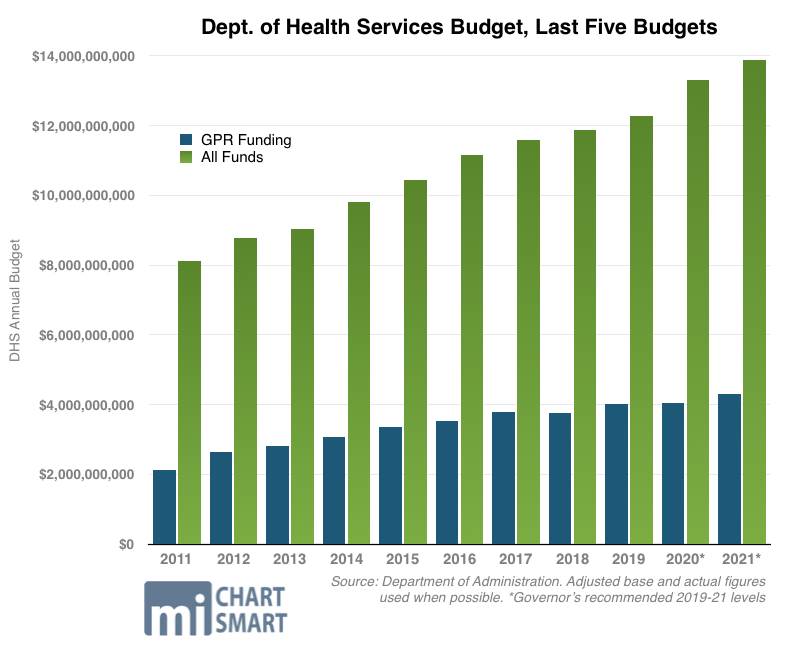

The spending plan allocates $13.3 billion all-funds spending in 2020 and $13.9 billion all-funds in 2021 to the Department of Health Services (DHS). The 2021 funding level is a $1.6 billion, or 8.5 percent increase, over the 2019 adjusted base budget in all-funds.

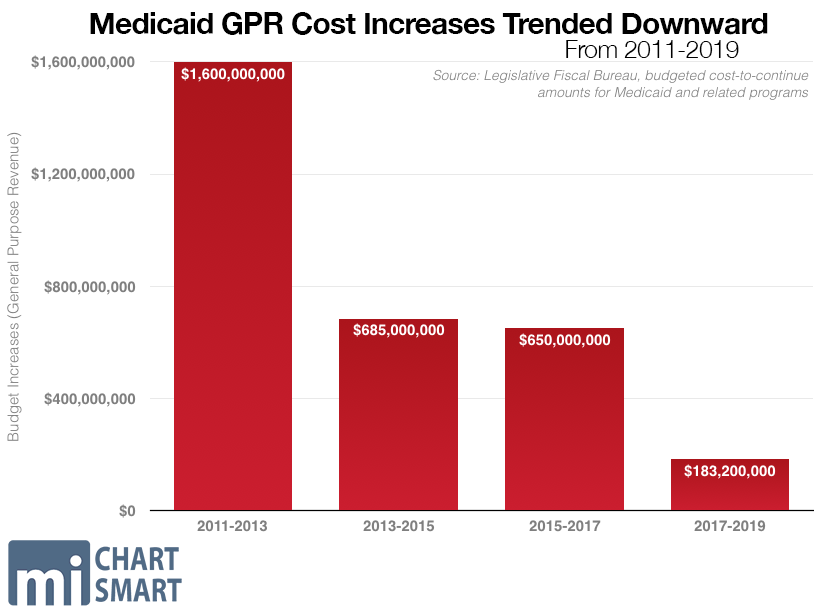

The massive increase is a sharp deviation from the trend during Gov. Scott Walker’s administration. The 2019 adjusted base spending for the second year of Walker’s final DHS budget is actually $293 million less than Walker’s recommendation, meaning spending came in lower than expected. While Walker’s budgets consistently increased spending on DHS—which administers the massive Medical Assistance program, including Medicaid—the size of the spending increases had been going down budget after budget.

From state coffers, or general purpose revenue (GPR), the Evers budget proposes spending just over $4 billion GPR on DHS in 2020, a 0.9 percent hike; but it spends $4.3 billion in 2021, a 6.3 percent increase.

In total, over two years, Evers’ budget spends $27.2 billion all-funds, and $8.4 billion in GPR, on DHS. That’s an 11.5 percent increase over the $24.4 billion all funds, and a 6.3 percent increase over the $7.9 billion GPR, allocated in the last budget. It also adds 192.04 full-time equivalent positions over two years.

Evers’ budget also increases the budget of the Office of the Commissioner of Insurance (OCI) by $200 million, mainly to fund a reinsurance program implemented during Walker’s tenure as an effort to hold down the cost of individual market insurance premiums, increases precipitated by Obamacare’s regulations.

While the new governor’s budget exclaims Wisconsin faces a “human crisis” requiring a massive public-sector intervention to provide government health insurance, the numbers don’t back that up. In fact, Wisconsin has the 9th lowest rate of uninsured in the country, with 92 percent overall having insurance. Since 2010, the percentage of uninsured has dropped by more than 4 percent despite the state rejecting the costly federal Medicaid expansion under Obamacare.

Medicaid expansion

Evers’ budget accepts the federal Medicaid expansion under Obamacare while significantly increasing spending on a wide range of programs.

The document proposes expanding Medicaid eligibility to everyone earning between 0 percent to 138 percent of the federal poverty level. In 2019, that income level is $34,638 for a family of four. The change would make 82,000 more Wisconsinites eligible for the program.

#wibudget: The federal gov, already $22 trillion in debt, is almost certain to go back on that 90% promise in the not-so-distant future. Nonetheless, @GovEvers' budget immediately spends the money, and then some. #wiright #wipolitics Click To Tweet

It’s important to note that while the number of people who become eligible for the program increases, that does not mean the newly eligible are without insurance now. With 92 percent of the population already insured—most of them through employer-based insurance—it’s likely a sizable share of those 82,000 newly eligible for government assistance already have insurance through their employers.

In short, the proposal seeks to encourage people to leave their private plans and seek increased dependence on a government program with poor health outcomes.

The budget asserts that expanding Medicaid will save $325 million in GPR across the biennium because of the federal government’s enhanced 90 percent match versus traditional Medicaid. The federal government, already $22 trillion in debt, is almost certain to go back on that 90 percent promise in the not-so-distant future. Nonetheless, Evers’ budget proposal immediately spends the money—plus a lot more—on increased reimbursement rates for health care providers and other new spending.

In all, the budget directs $580 million back to health care providers catering to Medicaid patients through the BadgerCare Plus program.

The budget spends $365 million more on reimbursement payments to hospitals serving Medicaid patients through five different, traditional reimbursement avenues. That includes $142 million more in payments to hospitals handling a larger number of Medicaid patients than most, a category of reimbursement called disproportionate share payments.

The spending plan also directs $100 million more for payments to acute care and critical access hospitals; $20 million more for payments to pediatric hospitals; and $1.2 million more for rural hospitals.

The Medicaid expansion is a cornerstone of Evers’ health care proposals. The plan spends all new federal dollars plus hundreds of millions more to greatly expand government’s role in health care.

Walker reinsurance continued

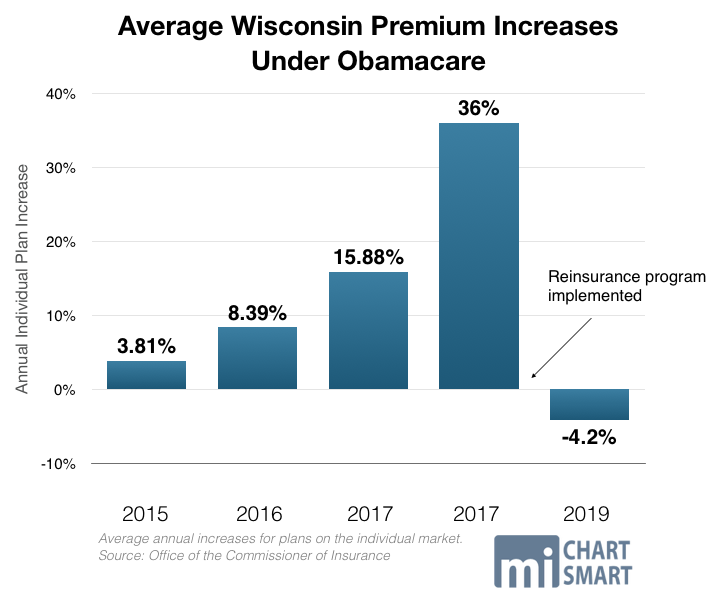

The budget maintains Walker’s reinsurance program, aimed at holding down premiums on the individual health insurance market in the era of Obamacare’s skyrocketing premiums.

The budget buttresses the program with $200 million in all-funds spending for the Office of the Commissioner of Insurance in the second year of the budget. The Walker administration, when rolling out the plan, said it would cost taxpayers $34 million GPR. Evers’ plan hikes the OCI budget by more than $72 million in the second year of the budget in GPR—and by more than $200 million in all-funds in the budget’s second year—to “fully fund” the program.

The reinsurance program was all but forced on Walker and Republican lawmakers in the wake of rapidly increasing premiums on the individual health insurance market. Headed into 2018, premiums were expected to spike by 36 percent, while 75,000 Wisconsinites were expected to lose coverage.

Only after the costly reinsurance tourniquet was applied to the state’s bleeding market did rates stabilize, with an average 4.2 percent weighted average premium decrease in 2019.

One cause of Obamacare’s price spiral was that health insurers fled the state to avoid massive losses. Anthem, Aetna, UnitedHealth, and Humana – four of the five largest health insurers in the country – as well as Molina and Health Tradition, all left Wisconsin’s market during the past few years. Molina returned only after the reinsurance program was implemented.

Notice the cluster of 7 WI counties in northeast that went from 5+ insurers in 2016 to only 1 in 2018. Sign of erosion of WI's individual market→Leads to less competition, incr. costs. #Obamacare#DeathSpiral#wiright #wipolitics pic.twitter.com/fbZp8Ddttm

— MacIver Institute (@MacIverWisc) November 15, 2017

That left only one insurer in 11 Wisconsin counties, seven clustered in the northeastern part of the state where more than 581,000 people live. That insurer was Common Ground, a nonprofit insurance company established as part of Obamacare that has received more than $107 million in taxpayer supported loans since 2012.

In 2017, with a monopoly in those seven northeastern counties, Common Ground increased its individual insurance plan premiums by an astonishing 62.67 percent.

Ironically, Obamacare co-ops like Common Ground were established with the purported goal of increasing competition and reducing costs. It’s yet another glaring example of the myriad broken promises and lies of Obamacare, its apologists, and its expensive co-ops.

Common Ground, the Obamacare experience, and the costly reinsurance program are more warnings to taxpayers about the danger of government involvement in health care.

An eye to the Minnesota failure

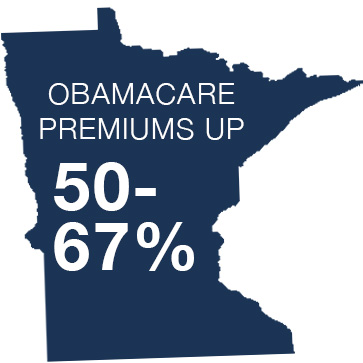

Walker’s reinsurance plan was largely modeled on a similar but much more costly plan implemented in Minnesota in a last-ditch effort to spare the Gopher State’s middle class from catastrophic premium hikes in the wake of the state’s Obamacare expansion.

Hardly a role model to emulate, Minnesota’s embrace of “free” federal Medicaid money is actually a case study in failure that has cost taxpayers there nearly a billion dollars. In 2017, after Obamacare’s implementation and Minnesota Gov. Mark Dayton’s decision to expand Medicaid, the state found itself at risk of losing all the insurers on its individual market. On the brink of collapse, state bureaucrats allowed insurers to increase premiums by a staggering 50-67 percent.

While lower-income Minnesotans didn’t feel the pinch because of federal subsidies for the poor, the state’s middle class was due to take a financial beating. That’s why state lawmakers were forced to implement the costly reinsurance program, which to date has cost state taxpayers north of $830 million — on top of the taxes they already pay to prop up Obamacare.

Health care costs have been used as a political bludgeon, with rampant distorted claims about costs. Then-candidate Tony Evers claimed that Wisconsinites pay 50 percent more for health coverage than Minnesotans, a claim rated as “Mostly False” by Politifact. Evers was only looking at a small slice of the population – those on the so-called Second Lowest Cost Silver Plan (SLCSP) on the individual market.

But the majority of people get their coverage through their employers. In Wisconsin, 3,191,800 individuals get their coverage through their workplace, or 57 percent of the population, the same proportion as in Minnesota.

And contrary to the rhetoric, costs are virtually the same. The average annual premium in 2017 in Wisconsin was $5,868 for an individual and $18,785 for a family; in Minnesota it was $5,832 and $18,507, respectively. Employee contributions to the cost of their plans were virtually identical between the two states.

By accepting the Medicaid expansion as Minnesota did prior to the near-implosion of its individual health insurance market, Evers’ plan travels a dangerous path for taxpayers.

Medicaid eligibility reforms stripped

A series of critical Medicaid reforms enacted under Walker are also repealed wholesale by Evers’ budget, despite protections enacted during December’s extraordinary session.

#wibudget: By eliminating welfare reforms for Medicaid and expanding eligibility, @GovEvers' budget completely reverses the Walker ethic of moving people from government dependence to independence. #wiright #wipolitics Click To Tweet

Work requirements and health risk assessments for childless adults seeking Medicaid are struck. Walker increased from 20 to 30 hours a week the time that able-bodied adults (ages 19 to 49) without children must be working, training for work, or looking for work to receive BadgerCare health insurance. That’s the federal maximum, as even Democrats in Congress recognize that 30 hours is not too much to ask for. Evers’ budget rolls that back.

Nominal premiums of $8 for households earning from 51-100 percent of the federal poverty level are struck; requirements that recipients be in compliance with child support orders are struck; copays for non-emergency medical services are struck; and Medicaid Health Savings Accounts are eliminated entirely.

By eliminating welfare reforms for Medicaid and expanding eligibility, Evers’ budget completely reverses the Walker ethic of moving people from government dependence to independence.

Cradle-to-grave expansion

The proposal also hikes spending on considerably less-traditional “health” spending, an array of nanny state programs shoehorned into the category of health care. It spends $45 million more for “non-medical services to reduce and prevent health disparities that result from economic and social determinants of health” such as “housing referral services, stress management, nutritional counseling, transportation coordination, etc.”

It’s a significant expansion of the left’s beloved cradle-to-grave set of government programs, paid for using tens of millions of precious taxpayer dollars meant for actual health care.

Mixed bag on dental care

The budget implements a promising new model for expanding the pool of health care professionals, important because Wisconsin lags the nation in dental care access. According to the U.S. Department of Health and Human Services, there are 138 dental health professional shortage areas in the state of Wisconsin. A MacIver Institute policy brief explores problems with dental care access and outcomes here.

Evers’ budget takes steps to address these problems, but it spends a lot of taxpayer money along the way—$43 million.

While it implements a dental therapy license in Wisconsin to increase the dental professional workforce, the proposal comes with a hefty price tag. It spends $1.5 million to subsidize educational institutions who add a dental therapy program, with the goal to “put Wisconsin on the cutting edge of this emerging career field…”

In addition to expanding spending to the tune of tens of millions of dollars for dental care under BadgerCare Plus and Medicaid, the budget also increases spending on a series of programs aimed at in-need populations and at grants for dentists who practice in rural areas or provide care to the disabled.

Everscare?

Throughout the campaign, enacting protections for people with pre-existing conditions was a political football. In one of its last actions in the December extraordinary session, the GOP-controlled Legislature passed a bill essentially replicating Obamacare’s regulations on pre-existing conditions. But Democrats argued that the bill didn’t go far enough and should essentially re-create Obamacare and all of its onerous regulations at the state level.

Evers’ budget does that.

The budget imports three key buckets of Obamacare regulations widely blamed for spiraling prices and decreased choice to Wisconsin:

- Community rating: the budget forbids health benefit plans, whether on the individual or small employer market, from setting premium rates based on any factor other than whether it’s a family or individual plan, which region of the state the plan is offered in, age, and tobacco use;

- Guaranteed issue: the budget requires every individual health plan and group health plan to accept everyone who applies for coverage regardless of sexual orientation, gender identity, or the presence of a pre-existing condition;

- Essential health benefits: the proposal requires health insurance plans known as disability insurance policies and self-insured governmental plans to offer a certain set of benefits to be determined by the OCI;

- In addition, the proposal forbids annual or lifetime benefit caps.

The budget directs the newly empowered Office of the Commissioner of Insurance to draft plans to implement all these regulations.

Drug cost initiative

The spending plan includes an effort to lower prescription drug prices, in large part through government mandates.

It proposes requiring drug companies to justify price increases, disclose proprietary information like production and marketing costs, and requires the OCI to post the information in the name of transparency.

The budget also requires pharmacy benefit managers to register with the state and “disclose price concessions they receive from drug companies” and calls for importing generic drugs from abroad to Wisconsin.

In addition, the budget includes a variety of provisions aimed at behavioral and mental health care and substance abuse treatment; it spends $69 million more for reimbursement rate increases for Medicaid recipients seeking mental and behavioral health care.

Our preliminary budget analysis, along with our deeper look into its transportation and K-12 education components revealed a budget rife with overtures to—and money for—a massive number of liberal initiatives and interests. That pattern holds true in nearly all of Evers’ health care proposals, a wish list for the big government left.

The Joint Finance Committee will begin its work parsing through the document next month. As always, MacIver will be here with in-depth analysis and coverage.