Voters approved more than 80 percent of proposed school district referenda, raising taxes and issuing debt to pay for school projects across the state

April 9, 2018

By Ola Lisowski

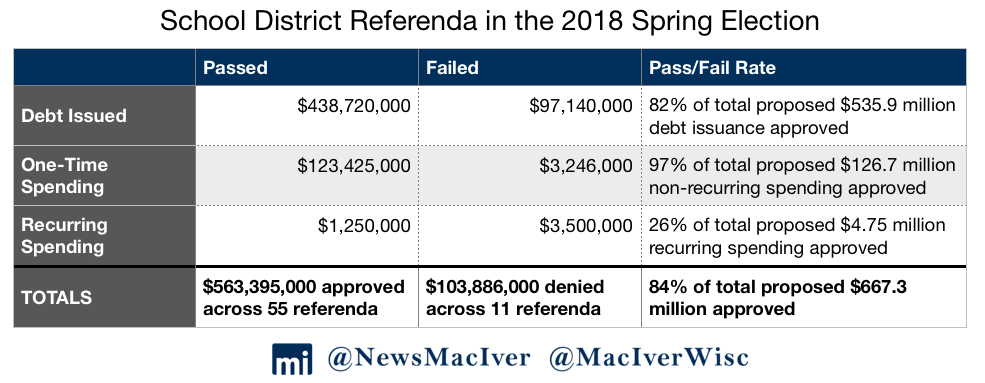

Voters across the state agreed to raise taxes by $563 million during Tuesday’s spring election. Of a proposed $667 million overall tax hike, the vast majority – 84 percent – were approved.

A data release from the Wheeler Report compiled the results of the 66 referendum votes. Fifty school districts came to voters asking for more money for various projects, including the construction of brand new schools, building repairs, operations, staff raises, and other expenses. On Tuesday, voters approved tax hikes in 43 school districts.

The majority of tax increases approved Tuesday came in the form of new debt. Twenty-two districts will issue new debt or bonds totaling $438.7 million – 82 percent of the proposed new debt put before voters.

Voters approved 55 of 66 school district referenda in the 2018 spring election, hiking taxes by over $563 million statewide.

School districts have state-imposed revenue limits that protect Wisconsinites from constantly-increasing property taxes. However, districts can still ask voters for more by coming to them with referenda during regularly-scheduled primary and general elections.

In the past, districts could propose referenda during special elections and could repeatedly propose the same project in consecutive elections. Gov. Scott Walker and the state Legislature have shared a commitment to lowering property tax burdens, spurring referendum reforms to ensure more voters have a say in matters of large tax hikes.

The largest increase in any one district is in Chippewa Falls School District, which will issue $65 million in debt to build a new elementary school, update the middle school and add a new laboratory onto the high school. The district plans to pay off the debt over 20 years.

Residents of that district will see a $1.25 property tax increase for every $1,000 of total tax assessed value on their home. The owner of a property valued at $200,000 will see a $250 per-year tax increase.

After Chippewa Falls, the next largest new debt will be issued by DC Everest Area, where voters approved $59,875,000 in debt for a school building and improvement program.

River Falls voters approved two separate asks – one bond for $45,860,000, and another for $2,100,000 – totaling just under $48 million in debt. The larger bond will fund various upgrades and renovations in school buildings, while the $2 million bond will pay for new turf, outdoor lighting, and parking. Area taxpayers will pay off those bonds for the next 19 years, through 2037.

Chippewa Fall-area taxpayers will take on a 20-year bond adding up to $65 million after approving a school district referendum for new debt. The district will build a new school and make improvements in other schools.

Sixteen school districts offered multiple referenda, splitting their “asks” into two questions. Of the 16, voters in just one district, Kiel Area, approved one while denying the other, showing that relatively few voters split their votes and tended to either approve or deny all proposed spending.

Voters in Alma, Benton, and ten other districts approved issuing debt for projects across two different referenda. In Delavan-Darien, Frederic, and Peshtigo, voters rejected both referenda proposed by each district.

A smaller proportion of the new tax hikes, $123.4 million overall, will come in the form of one-time spending, also known as non-recurring spending. Just two of 25 referenda failed in that category, with voters approving 97 percent of the total proposed $126.7 million in spending.

Howard-Suamico School District got voters’ approval to exceed the revenue limit for five years, beginning in the 2018-19 school year, to reduce class sizes, provide employee raises, and maintain facilities. That’ll cost area taxpayers $5.85 million every year for five years, adding up to more than $29 million. The district estimates that local property taxes will not increase because of old debt retiring at the same time.

Voters in La Crosse also approved a spending hike totaling more than $20 million over revenue limits. The debt is considered one-time spending, but the district is asking voters to extend a current levy limit override for another five years. Had they voted no, owners of a home worth $100,000 would have seen a $96 annual decrease in property taxes – but the referendum passed, keeping taxes at the same level. The district will use the money to maintain current operations and make various facilities upgrades.

Just six of the 66 referenda on the ballot Tuesday asked voters to approve recurring, ongoing spending increases over state-mandated limits. Four of them – in Alma, Almond-Bancroft, Benton, and Shullsburg – passed, totaling $1,250,000 in new spending overall. Those districts will begin exceeding their revenue cap, spending more than the limit beginning in the coming 2018-19 school year.

Last year, 40 of 65 school district referenda passed, totaling almost $700 million in tax increases. The MacIver Institute covered the votes here.

Stay tuned for continued coverage on school district referenda affecting taxpayers across the state.

Referenda data was provided by the Wheeler Report.