Did leadership add enough reforms to secure passage?

MacIver News Service | September 7, 2017

By M.D. Kittle

[Madison, Wis…] There are a lot of big wins for conservatives in the newly-approved JFC state budget.Plenty of pork, too.

For the 2017-19 state budget, the question is, will the recently added budget fat turn off lawmakers looking for a smaller, leaner government enough to vote no, or are there enough tax cuts and pro-taxpayer reforms to earn their vote on the final budget bill?

The GOP-controlled Joint Finance Committee late last month did away with the Forestry Mill Tax. And the committee closed its work on the budget Wednesday evening by nixing Wisconsin’s Alternative Minimum Tax (AMT). Democrats like to call it the “wealth tax,” but the AMT has been ensnaring more middle-income earners.

.@DaleKooyenga: AMT, working families tax cred clutter up tax code, waste time, and yield little results. Tax package repeals both. pic.twitter.com/xrXmdwrEVO

— MacIver Institute (@MacIverWisc) September 6, 2017

“Any time you can eliminate a tax from off the books, whether it’s AMT or the Forestry Mill Tax…you take that opportunity as an elected official,” Rep. John Nygren, finance committee co-chair, told MacIver News Service Thursday morning during an interview on the Jay Weber Show on NewsTalk 1130 WISN.

“Now when you get your property tax bill in the future there’s not going to be a state tax on the property tax bill,” the Marinette Republican added. “Eliminating that tax, for me, my colleagues, I know for the governor, we see that as a huge win as we continue to put the people of Wisconsin first rather than the government.”

While the AMT is more of an extension of Wisconsin’s income tax, it serves as a kind of income tax system unto itself. Its elimination will save $7 million per year beginning in 2019. The mill tax is the last remnant of the state property tax. Killing it will save taxpayers a combined $180 million over the biennium.

Eliminating a tax is like the solar eclipse of limited-government reform: It happens very infrequently.

The last time the Legislature struck a tax from the books was 2008, marking the beginning of the phase-out of Wisconsin’s Estate Tax.

You have to go back to the late 1990s, when the gift tax was eliminated, then back to 1974 and the death of the Oleomargarine Tax to find complete tax removal.

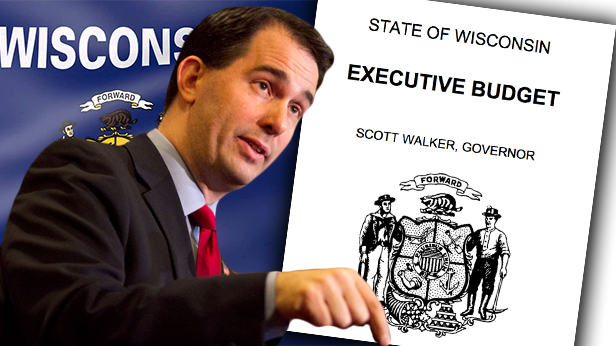

That’s basically it over the last 40 years, according to Gov. Scott Walker’s administration.

Walker and the Legislature’s Republican majority four years ago all but did away with state income tax on Wisconsin manufacturers and farmers through the manufacturing and agriculture tax credit. The tax savings total nearly $300 million, according to the Legislative Fiscal Bureau.

Liberty-minded legislators are concerned about some of the items added to the Republican-led spending plan through omnibus and wrap-up motions.

Like granting the tyrannical power of eminent domain to an unelected, quasi-public authority.

Of course budgets are about giving and taking, winning and losing. While small businesses and property taxpayers continue to see relief, the tax cuts come at the expense of income tax reductions. The governor’s budget blueprint originally called for $200 million-plus in income tax relief. Shifting priorities, JFC members say. Nygren says the trade-off was worth it.

Notable things that are not included in JFC’s motion on taxes: sales tax holiday, income tax cuts #wibudget

— MacIver Institute (@MacIverWisc) September 6, 2017

Committee co-chairs agree there was a “bigger bang for the buck” by changing personal property tax, constituents preferred it https://t.co/EhiXdzjfCH

— MacIver News Service (@NewsMacIver) September 6, 2017

“The money belongs to the taxpayers, not the state of Wisconsin, and if there’s opportunities for us to let people keep it we’re going to do that,” he said. “We’ve done that in personal property taxes, we’ve done that in property taxes…We’re going to continue to look for ways to do that while balancing the priorities of the state.”

This budget comes with some key conservative reforms, too. The JFC brought back Walker’s proposal eliminating what remained of Wisconsin’s Great Depression-era prevailing wage law. Beginning in 2018, taxpayers will no longer be on the hook for a system that artificially inflates wages on government building and highway projects. A previous study from the Wisconsin Taxpayers Alliance found that taxpayers could have saved as much as $300 million on 2015 construction projects had the reforms been in place then.

“Repeal of prevailing wage will be a huge victory for taxpayers in Wisconsin” – Sen. @LeahVukmir , co-author of bill #wiright #wibudget

— MacIver Institute (@MacIverWisc) September 6, 2017

The budget sausage making, of course, comes with an abundance of pork that isn’t sitting well with fiscal hawks.

Like the $100,000 to help pay for improvements to the Monroe Arts Center.

Like the $583,000 in annual payments over the next five years to the city of Janesville under the state’s Expenditure Restraint Program. It would seem a combined $2.9 million to the municipal government isn’t exercising much in the way of expenditure restraint.

Like the $900,000 the state will pay to cigarette manufacturers and distributors to affix the mandated tax stamp on smokes.

.@VickiMcKenna Why is a state who can’t afford income tax cuts giving $900K in cash to tobacco distributors? See item 39 #wiright pic.twitter.com/UsNh0W6h4n

— AFPWI (@AFPWI) September 6, 2017

“This is not any type of giveaway. This is actually payment for a service they are providing for the state of Wisconsin,” Nygren said of the ‘cigarette discount’ provision.

The JFC co-chair noted the so-called “999” wrap-up motions, the group of various provisions up for approval at the end of the committee’s budget work, was much less extensive this year. The controversial list of items, once numbering in the 80s or 90s, dropped to 26 this session, half of those technical or clean-up measures.

Co-Chair @rep89 says 999 wrap-up motion will be small, uncontroversial. #wibudget pic.twitter.com/YZZPJwYKXD

— MacIver Institute (@MacIverWisc) September 6, 2017

But it’s in the wrap-up where a lot of the budget fat can be found.

Like sales tax exemptions for “food consisting of more than 50 percent yogurt that is prepared by a retailer away from its retail establishment…”

Like sales tax exemptions for Tournament or League Entrance fees. The measure would provide a sales and use tax exemption for tournament or league entrance fees “advertised and set aside as prize money.”

Beekeepers get a tax break, too. They would be entitled to sales and use tax exemptions on tractors and machines used in their business – business inputs like bees and beehives, and electricity and fuel.

Farm-raised fish producers get a cut of the sales tax exemption, as well.

And it appears out-of-state, major broadcasters get a bit of a break.

It’s not the tax cuts or exemptions that are concerning to conservative lawmakers, it’s the carveouts for special interests that define the exemptions. If it’s good enough for fish farmers or frozen yogurt or Disney, why not every other business?

And so it goes with the JFC’s final transportation funding plan that includes specialized protections for quarries. The question posed by committee Democrats and others is this: What do quarries have to do with the transportation budget?

Nygren explained that restrictive local laws are making it more difficult for gravel and rock quarries to locate near road construction projects, forcing haulers to travel farther to move the key road-building components. Wisconsin’s growing sand mining industry, too, sought such protections, but members of the Republican caucuses “did not want to go that extent,” Nygren said. The idea behind the provision is to restrict local units of government from passing onerous restrictions on quarries, a benefit that regulation reformers assert should be extended to all businesses.

Reforms to the University of Wisconsin System, to municipal referenda, and federal-state transportation funding partnerships might help move the meter for some conservative lawmakers. But some of these reform measures have been watered down or don’t go far enough for passionate advocates of government accountability, transparency, and fiscal responsibility.

Another provision bars System from adopting a policy that would let only faculty, tenured prof. become System President, VP, Chancellor https://t.co/29KPXinsjR

— MacIver News Service (@NewsMacIver) September 7, 2017

Legislative leadership is in the business of counting noses. With big majorities in the Assembly and Senate, GOP leaders may not have the same sense of urgency they would have with thinner margins. But a few reluctant fiscal hawks in the Senate could present some number challenges when it comes to the final floor vote in the days ahead.

The Assembly is scheduled to take up and debate the budget bill next Wednesday. The Senate hopes to finish its work on the budget the following week.

For the latest information and insider insight, visit MacIverInstitute.com often and follow us on Twitter at @MacIverWisc.

Listen to the full interview with Rep. Nygren here: