An overview of the governor’s two-year plan for taxes and spending

February 8, 2017

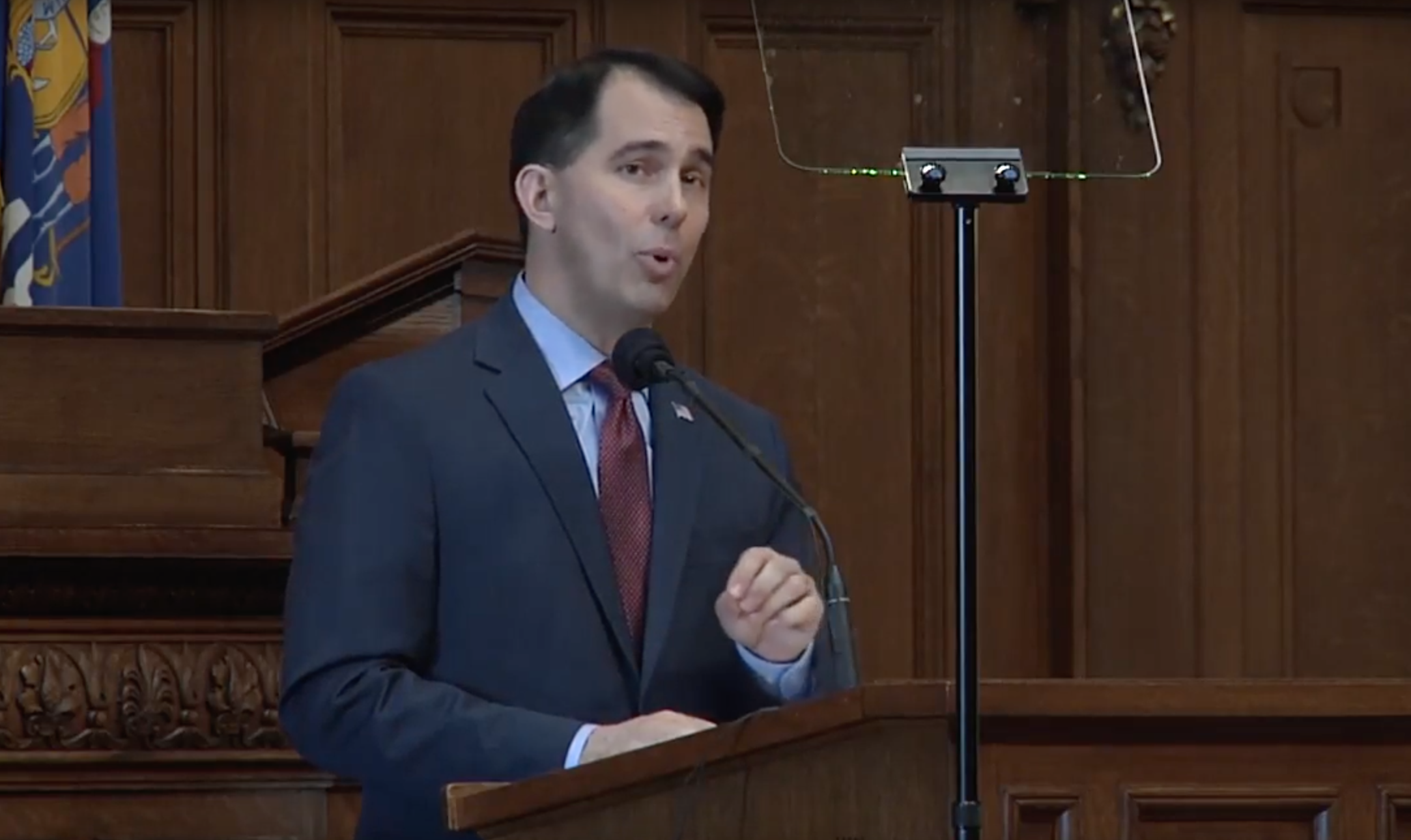

[Madison, Wisc…] After spending weeks rolling out aspects of his 2017-19 budget proposal, Governor Scott Walker delivered his budget address today in front of a joint session of the state legislature.Walker said his budget, which increases spending in a number of key areas and reduces taxes, is made possible by an improving economy and prudent fiscal management – which he calls the “Reform Dividend.”

Major themes of Walker’s budget include large investments in K-12 and higher education. The budget increases K-12 spending by $649 million, reduces tuition for in-state students at UW System campuses, and adds $105.2 million in state funding for UW.

The budget also promises to make government more accountable to taxpayers. As part of this initiative, Walker’s budget cuts taxes by nearly $600 million by reducing the lowest two tax rates, putting more of the earnings of a middle income family into a lower tax bracket, and eliminating the state’s share of the property tax. The budget also invests more money in local road maintenance and rural broadband.

In addition, Walker’s budget includes a variety of new welfare reform measures, a plan he calls “Wisconsin Works for Everyone.” The plan adds new work requirements for those receiving government assistance and includes various provisions that make it easier to transition from welfare to the workforce.

In the coming weeks, the Joint Committee on Finance (JFC) will begin to review the plan, the beginning of the long budgeting process in the legislature, but portions of the governor’s budget might encounter headwinds in the legislature.

Walker and Assembly leaders have sparred over transportation funding – Walker’s budget keeps a campaign pledge not to raise the gas tax or vehicle registration fees, but Assembly leaders are open to the increases. Assembly Speaker Robin Vos was also lukewarm to Walker’s proposed tuition cut and others have questioned the increases in spending. But before JFC starts making changes, we bring you this short synopsis of the 691-page document.

Here is what you need to know about Walker’s 2017-19 budget proposal.

The Process

Walker’s full proposal has already been referred to the JFC, which will begin deliberations after the Legislative Fiscal Bureau (LFB) prepares budget papers. That is likely to take about a month according to LFB Director Bob Lang.

According to JFC Co-Chair Rep. John Nygren, committee members are deliberating the details of how to consider the budget – whether to work entirely off the governor’s proposal or to consider certain agencies using their base funding. After JFC is finished with its work, the budget will be passed along to the full legislature.

Overview

Key Takeaways:

- Spending – The 2017-19 budget all-funds spending is $76.1 billion, of which $34.5 billion is GPR spending. That’s an increase of 2.6 percent (base year doubled) and 1.3 percent (base year doubled) over the last budget, respectively. The governor provides a sizable funding increase for K-12 education, Health Services, and tax relief.

- Taxes – The budget reduces the lowest two income tax rates and increases the amount of earnings that fall under the second-lowest bracket for a $204 million income tax cut. It also eliminates the state’s portion of the property tax, a $180.5 million tax cut. The budget does not raise the gas tax or vehicle registration fee.

- Bonding – Total new bonding in the 2017-19 budget amounts to $1.027 billion, down from $1.067 billion in the current budget. Of the 2017-19 new bonding, $500 million is for transportation.

- Positions – This budget adds 445 full-time equivalent positions, mostly in UW, the Department of Corrections, and the Department of Health Services.

- Reforms – A major new initiative is to require UW schools to provide a 3-year degree option. The governor also proposes eliminating the state prevailing wage law and incorporates wide-ranging welfare reforms.

The 2017-19 budget would spend $76.1 billion in total – $37.5 billion in 2018 and $38.6 billion in 2019, the first and second years of the biennial budget. That all-funds total includes state general purpose revenue (GPR), federal revenue, segregated revenue and program revenue.

Total GPR spending, which is spending entirely controlled by the state, would be $16.9 billion in 2018 and $17.6 billion in 2019 for total two-year GPR spending of $34.5 billion.

Compared with the 2015-17 budget, all-funds spending increases by $375 million in the first year and $1.18 billion in the second year – a total increase of $1.55 billion. Using Madison math, or the base year doubled method, that equates to a 2.6 percent increase compared to the last budget. For GPR, spending increases by $862 million. Using Madison math, or the base year doubled method, that equates to a 1.3 percent increase compared to the last budget.

As MacIver has repeatedly pointed out, GPR spending is especially important because it is the funding that the state completely controls. All GPR funds come directly from Wisconsin taxpayers – income taxes, sales taxes, and corporate taxes, among many others.

Walker has described the increased funding proposals for a variety of state agencies in this budget a “reform dividend,” made possible by cost savings and revenue increases thanks to reforms passed over the last six years.

Transportation has been the marquee matchup in the months leading up to Walker’s budget proposal. Walker has steadfastly stuck by his campaign pledge not to raise taxes or fees, and he has said he will not raise the state’s gas tax or vehicle registration fee without a corresponding decrease in taxes elsewhere. Legislative leaders disagree and say that all options should be on the table.

Walker’s transportation budget fulfills his pledge not to raise taxes or fees. Instead, his budget proposes a total of $6.1 billion for transportation. His budget invests $77 million more in local road maintenance and delays some mega-projects in southeast Wisconsin.

Walker proposes increasing spending on K-12 education by $649 million over the biennium. That includes $55.4 million more in Sparsity Aid for rural school districts, $25.4 million more in transportation aid, and $9 million in various programs in Milwaukee.

Walker’s $509.2 million increase in per-pupil funding will be tied to Act 10 compliance. That means that school districts will need to show that their employees pay roughly 12 percent towards healthcare and 6 percent towards retirement in order to receive the per-pupil funding increase. Madison Metropolitan School District, for example, is not currently in compliance with this provision. Employees would need to begin paying towards these funds in order for schools to receive the funding increase.

Overall new bonding will be $1.027 billion in 2017-19, down from $1.067 billion in the current budget. Of the new bonding, $500 million is for transportation, which is down from the previous budget’s transportation bonding level of $850 million.

The biggest funding increases in this budget versus the current budget are for the Department of Public Instruction (DPI), which will receive a $418 million increase; the Department of Health Services, which will get a $386 million increase; shared revenue – funding that is sent back to local governments – will see a $242 million increase; and the UW System, which will get a $272 million increase over the biennium.

Walker’s proposal would increase the total number of full-time equivalent positions from all fund sources from 70,411.4 FTE to 70,827.11 FTE, an increase of 415.71 full-time equivalent positions from the FY16 adjusted base. Of those positions, 35,466.49 are from GPR funding, an increase of 12.77 FTEs from the FY16 adjusted base of 35,453.72.

Walker has made tax relief one of the top priorities of his administration, and that positive trend continues in earnest with his 2017-19 budget proposal. Walker proposes cutting income taxes by $204 million total by reducing the lowest income tax bracket from 4 percent to 3.90 percent and the second-lowest bracket from 5.84 percent to 5.74 percent. The plan also expands the size of the second-lowest bracket by 25 percent. Since all taxpayers, regardless of income, pay those rates on at least a portion of their income, that’s a tax break for all Wisconsin income tax payers.

Walker also zeroes out the last remaining portion of the state property tax – the forestry tax. This tax cut will save Wisconsin property taxpayers $88.8 million in FY18 and $91.7 million in FY19 – a total of $180.5 million over the two-year budget.

These tax cuts and others Walker’s budget proposes – including a back-to-school sales tax holiday estimated to lower shoppers’ sales tax bill by $11 million per year – would save Wisconsinites nearly $600 million over the 2017-19 budget.

While Walker’s tax cut proposals are another giant step in the right direction, Wisconsin is still a long way from a truly fair, economically competitive tax system. In January, the MacIver Institute introduced its ambitious tax reform proposal – a Glide Path to a 3 Percent Flat Income Tax for Wisconsin. In order to make Wisconsin competitive in a global economy, lawmakers should strive for bold tax reform in the upcoming budget deliberations.

Transportation

Transportation funding is expected to dominate this year’s budget debate as concerns over Wisconsin’s road conditions clash with concerns over financial mismanagement at the DOT.

Governor Walker insists there will be no gas tax or fee increases for transportation, sticking with a campaign pledge made in his 2014 re-election campaign. His 2017-19 budget proposal makes good on the pledge by holding the line on the gas tax and vehicle registration fee.

He plans to bond for $500 million for transportation projects over the biennium, whereas the last budget authorized $850 million in transportation bonding. New bonding levels are $500 million over the biennium, the lowest amount since the 2001-03 budget and a dramatic 41 percent decrease from the previous budget, which borrowed $850 million for transportation projects.

Walker also wants to transfer $30 million from the petroleum inspection fund (PIF) into the transportation fund. The PIF is funded by 2 cents of the state’s 30.9 cents per gallon gas tax.

The governor says all active major projects would stay on schedule under his plan. However, the Zoo Interchange “North Leg” would remain on hold, and the state would not enumerate the East-West I-94 project. The core of the Zoo Interchange will be completed on schedule.

Walker’s plan also leaves $31 million for southeast Mega Projects for the North-South I-94 project, although work on that will not be finished on time.

In total, Walker’s budget proposes an increase of more than $522 million from the Department of Transportation’s (DOT) base funding. That includes nearly $15.9 million in increased transportation aid to counties and more than $30 million in increased aid to municipalities. DOT is also requesting an increase of $14 million for the Local Roads Improvement Program and $5 million for the Local Bridge Improvement Assistance program.

The governor’s budget also proposes nearly $30 million for highway maintenance and traffic operation needs, $33.7 million for routine maintenance performed by the counties, and one-time transfers of $19 million in FY18 and $19 million in FY19 as revenue to the segregated Transportation Fund.

In all, Walker increases aid to a variety of local transportation funds by $77 million.

Click here for a more detailed summary of Gov. Walker’s transportation budget.

UW System

Walker previewed his budget proposal for the UW System in his State of the State address in January. For the first time, he proposed a tuition cut for in-state students and promised that the cut would be fully paid for in his budget proposal. UW-Madison chancellor Rebecca Blank, in a response, praised the proposal but asked that the cut be paid for in addition to increased state aid.

Walker fleshed out his tuition cut proposal in his budget, which provides more than $100 million more in state aid to the UW System in addition to increased funding to pay for the tuition cut.

The governor’s budget proposes a 5 percent tuition cut for resident undergraduate students, saving the average student $360 per year on average. His budget offsets the reduced tuition by providing $35 million more in state aid to the UW System.

In addition, Walker grants the UW System’s request for $42.5 million in additional funding but ties it to performance measures for campuses, including improved affordability and attainability, work readiness, the success of graduates, administrative efficiency, service, and two other benchmarks to be decided by the Board of Regents. Each campus will have to produce a new “Performance Funding Report Card” that will be used to determine how the additional funding is allocated.

Walker’s budget also proposes letting students opt-out of allocable segregated fees, which are student fees allocated by a university’s student government and administration that support campus activities. This would give students some say in what they do or do not want to fund.

The governor has also emphasized that shorter times-to-degree reduce the cost of a higher education. In that spirit, his proposal would require UW campuses to outline plans for offering 3-year bachelor’s degree options – Walker cited an LFB memo stating this could reduce the net cost of a degree by $18,000-$25,000 via reduced tuition costs and increased earnings.

The governor also calls for a plan to hold faculty accountable by instituting a faculty workload policy. Campuses would be required to track and report the number of hours professors and academic staff spend teaching and establish policies for rewarding those that go beyond the standard academic load. Faculty workload reports would be made available to the public.

Walker also proposes $100,000 for Alzheimer’s research at UW-Madison and $200,000 for the Rural Physician Residency Assistance program.

However, several controversies calling into question the UW System’s stewardship of taxpayer dollars might impede any attempt to spend more on the UW. Several years ago, lawmakers discovered an undisclosed slush fund within UW System coffers totaling nearly a billion dollars.

More recently, it was discovered that the former chancellor and a top administrator at UW-Oshkosh had improperly used taxpayer money as a backstop against privately funded building projects by the UW-Oshkosh foundation. The Board of Regents has filed lawsuits against those former administrators.

UW-Madison also stirred up its own controversy when one of its course offerings, entitled “The Problem of Whiteness,” grabbed lawmakers’ attention.

In May, the UW System came across $55 million in unanticipated savings from lower-than-expected utility costs and costs of employee benefits. The majority of that money was used to pay for increased base salaries for faculty and staff – increasing the base expenses within UW campus’s budgets.

Will lawmakers overlook their well-earned skepticism about how the UW System spends the money it currently receives from taxpayers and approve a sizeable increase in funding? We’ll find out in the coming months.

Welfare Reform

In late January, the governor introduced a significant welfare reform package that beefs up work requirements for participants and makes it easier to transition from government assistance to work.

The wide-ranging plan expands work requirements for those on the state’s FoodShare program, requiring able bodied adults with school-age children to either work 80 hours per month or enroll in a job training program. It would also expand work requirements to working-age able-bodied adults on housing assistance.

The new work requirements expand on Walker’s 2015 FoodShare reform, which required able-bodied childless adults to work 80 hours per month or enroll in the FoodShare Employment Training program. Since that reform was implemented, 21,000 participants have found employment.

The plan also seeks to eliminate the “benefits cliffs” in the childcare assistance and Medicaid Purchase Plan (MAPP) programs. In both programs, a recipient loses all benefits at a certain income threshold, which means taking pay raises, promotions and more hours at work could cost the recipient all their benefits. Walker’s plan introduces a phase-out model for the benefits as a recipient’s income rises.

In addition, Walker’s plan would reform occupational licensing practices in the state, providing more scrutiny for proposed new occupational licenses and a review process for existing licenses with the intention of removing barriers to work.

It would also strengthen child support work programs in a pilot program involving five counties, help offenders re-enter the workforce with vocational training and work placement, and provide grants to help develop employer resource networks that connect job seekers with work. The plan also creates two new tax credits to incentivize work.

Portions of Walker’s welfare reform agenda will require waivers from the federal government. However, one major change since the state’s last budget is the occupant of the White House. How open will President Trump’s administration be to issuing waivers, or to make even more substantial changes to how states administer their welfare programs? We’ll find that out as 2017 moves along.

Healthcare

Governor Walker’s health services budget includes one of the largest programs the state administers – Medicaid. As always, Medicaid represents the single largest GPR increase in the entire budget.

By far the largest agency request was from the Department of Health Services, which asked for about $24.4 billion in total, a 5.1 percent increase over the agency’s base funding, which is determined by multiplying the agency’s current annual budget by two.

In a letter accompanying its budget request, DHS stated the request includes $452 million in new general purpose revenue (GPR) funding for Medicaid over the biennium. The previous three biennial budgets increased GPR spending on Medicaid by $650 million, $685 million, and $1.6 billion. While $452 million is a lot of money, the rate of increase in Medicaid spending during Walker’s tenure has slowed significantly. Medicaid’s GPR cost to continue is $279 million over the biennium – the smallest cost-to-continue in recent years.

In all, under this proposal DHS will spend $7.63 billion in GPR funds for a total of $24.4 billion in all-funds spending.

As with Walker’s welfare reform proposals, Wisconsin will be awaiting the Trump administration on how much increased flexibility the state will have in implementing healthcare reforms at the state level.

Increased Aid to Counties

Walker is also proposing a significant increase for a variety of social services programs administered by counties.

He proposes spending an additional $14,067,300 in FY17-18 and $25,205,500 in FY18-19 to eliminate a waiting list for long-term support for children with developmental or physical disabilities or severe emotional disturbances.

The governor’s budget also increases funding for children and families aids by $1.25 million in FY17-18 and by $5 million in FY18-19 for child welfare costs. It would also increase foster care and kinship care rates by 2.5 percent in each year of the biennium – additional funding for the programs under the budget proposal would be $861,300 in FY17-18 and $2,162,100 in FY18-19.

In addition, Walker proposes significant increases in nursing home provider rates amounting to $18.4 million in the budget’s first year and $33 million in its second year. He also increases funding for a variety of other programs including the Treatment Alternatives and Diversion (TAD) program, additional aid to counties to expand drug courts, and increases in a host of other forms of financial aid to counties.

K-12 Education

As expected, Walker’s budget includes massive spending increases for education. The proposal calls for $648.9 million in new state aids for K-12 education and more than $100 million more towards the UW System. Increases to per-pupil aid will be sent to school districts under the condition that they certify to the Department of Public Instruction that they met pension and healthcare savings made possible in Act 10.

In the past several months, the governor has repeatedly stated that he hopes to send more money to public schools in this budget. The new spending – nearly $649 million – is more than three times larger than the 2015-17 budget’s increase, which grew public school spending by $203 million overall.

Walker’s budget also increases funding for a variety of other education related initiatives, including an incentive fund for troubled Milwaukee schools, mental health initiatives, and workforce development initiatives geared toward schools.

Notably, Walker provides significant increases for rural schools. His proposal offers massive commitments to rural areas through Sparsity Aid, which is funding for small rural districts with fewer than 745 pupils and a population density of less than 10 pupils per square mile of district attendance. Walker’s proposal increases Sparsity Aid by $20 million, bringing the fund to $55.4 million over the biennium, or $12.3 million more than DPI requested. The 2015-17 budget allocated $35.3 million to Sparsity Aid across the biennium.

The budget also increases funding for rural schools’ transportation needs, provides funding for expanded rural broadband access, and creates a new Sparsity Aid tier for districts that are slightly too large to qualify for the aid under the current formula.

See our detailed breakdown of Walker’s education proposal here.

Prevailing Wage

The governor’s budget completely eliminates what’s left of the state’s prevailing wage law, which artificially sets wages based on the federal Davis-Bacon law. The previous budget eliminated prevailing wage for local projects as part of a compromise, leaving state projects on the hook for inflated costs.

How much could Wisconsin taxpayers save if Walker’s complete repeal is passed? One study from the Wisconsin Taxpayers Alliance showed that Wisconsinites could have saved $200-$300 million on vertical construction projects in 2014 in the absence of prevailing wage. That estimate doesn’t even consider all other public construction that goes on in the state, including billions of dollars on road construction projects.

Examples abound of cost overruns thanks to the prevailing wage law. One six-mile ATV trail in Vilas county was initially going to cost $30,000 per mile, but when the prevailing wage determination was made the price shot up to $55,000 per mile. In the Village of Grafton, an already-completed water tower maintenance project exploded in price from $597,000 to $861,000. Since the project was already completed, local taxpayers had to come up with an extra $260,000.

If prevailing wage was costing taxpayers so much extra money for local projects alone, imagine how much could be saved if legislators pass Walker’s plan to finally repeal it at the state level.

JFC to Begin Budget Debate in Coming Weeks

JFC is expected to start reviewing Walker’s budget after the LFB compiles budget papers, which should take about a month. From there, the budget writing committee will begin deliberating the proposal. Considering the disagreements between Gov. Walker and some legislative leaders, the timeline is uncertain.

One thing is for certain, though. The 2017-19 budget that Walker proposed will see at least changes before it finally passes through both houses of the legislature and lands on the governor’s desk – usually by early summer.

The MacIver Institute will provide updates throughout the budget process and should serve as your one-stop shop to get all the information you need. Follow us on Twitter, Facebook and our Budget Blog for the most up to date information and analysis.