MacIver Institute | July 20, 2015

After months of deliberation, debate and negotiations, the 2015-17 Wisconsin state budget, Senate Bill 21, has been signed into law. While the legislative process has been a concern at times, MacIver’s extensive and in-depth analysis of this budget finds that it contains many victories for taxpayers and is another step forward towards a prudent and fiscally responsible Wisconsin.

The most important victory for Wisconsin’s taxpayers in this budget came not from an affirmative vote on a proposed amendment or a new scheme to fix a perceived problem, but from Gov. Scott Walker’s and the legislature’s ability, to a certain extent, to just say no.

The pressure from special interest groups to increase taxes, increase spending and protect the political elite’s status quo was intense. Very intense. And, surprisingly, some of the most intense spending pressure came from Walker’s own administration.

Department of Transportation Secretary Mark Gottlieb submitted to Gov. Walker a budget proposal that included more than $750 million in tax increases, an immediate 16% increase in the auto gas tax, an immediate 32% increase in the diesel fuel tax and $1.36 billion in additional transportation spending. Apparently Gottlieb stopped being a fiscal conservative when he garnered the title “secretary.”

Despite the steady drumbeat to be fiscally reckless, this budget has no new taxes and it does not increase the income tax, the corporate tax or the sales tax. Think about that for a moment. This is the third straight budget signed by Walker that did not raise taxes.

Not only that, since Walker took office, income taxes have been cut by $750 million. Property taxes were cut more than $800 million since 2011. In fact, with the signing of this budget, Wisconsin will have its fifth and sixth straight year of substantial property tax relief.

When Walker said he was going to try and cut the tax burden every year he was in office, he truly meant it. What a welcome reversal to the trend of steady income and property tax increases from the past administration.

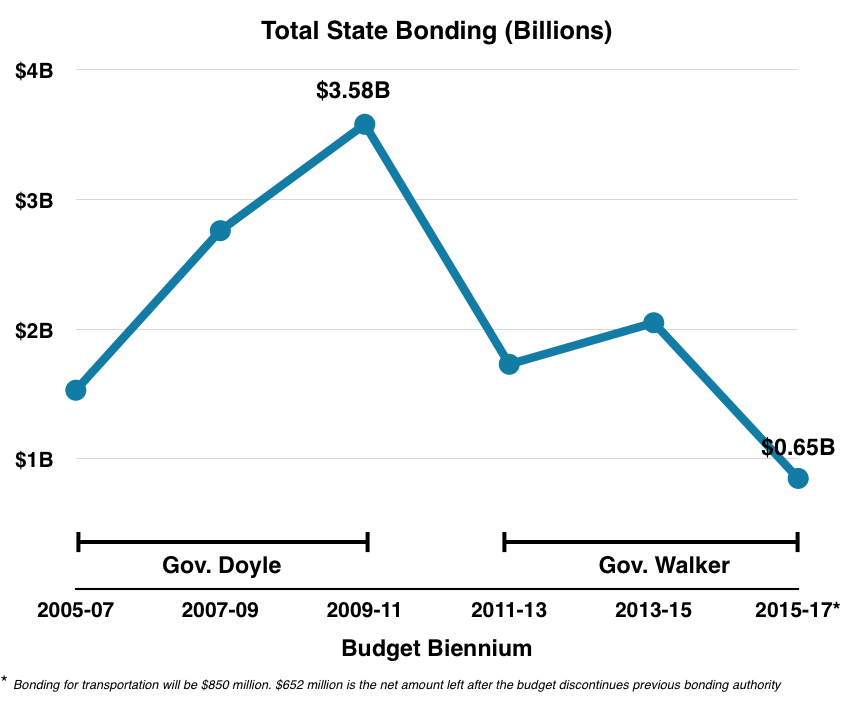

Gov. Walker also made a good faith effort to get Wisconsin’s borrowing under control, and the legislature even improved upon his plan. They brought bonding down 67 percent compared to the 2013-15 budget, a level we have not seen around here in decades.

This budget only authorizes $652 million in new bonding. The previous budget bonded about $2 billion, and that was even low compared to former Gov. Jim Doyle’s last budget, which bonded $3.6 billion. To see such a quick reduction in state borrowing is a good sign for all taxpayers.

All of this fiscal discipline is a very impressive feat considering the current political environment and the barrage of requests from special interests to spend hundreds of millions more of the taxpayer’s money. We should not casually dismiss or underestimate how important this is.

Taxpayers should thank Gov. Walker and legislators that our bottom line, our family budget, is going to be better because they had the strength to hold the line on taxes and made tough decisions to keep the state budget under control.

That is a huge victory for taxpayers and we should never forget that it was just a few years ago that a former Wisconsin governor was fighting for just the opposite, increasing taxes by over $2 billion dollars on hard-working Wisconsinites and allowing another $1.5 billion increase in local property taxes. How times have changed.

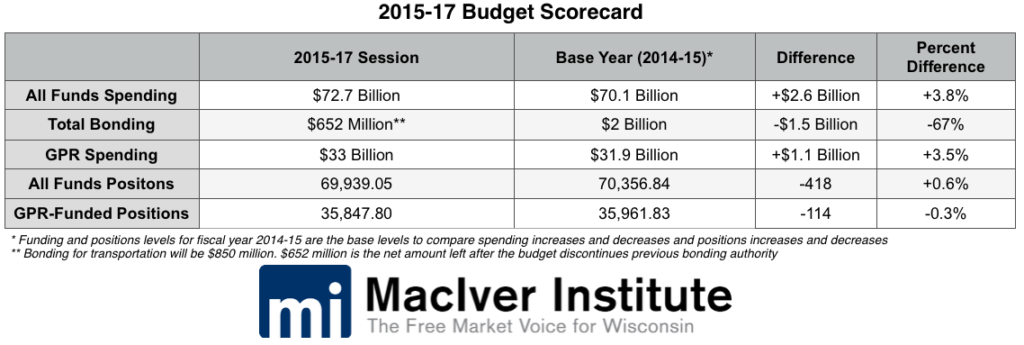

Another high point in the budget is on the number of public employees. Overall, the number of employees paid through state funding is down 114 positions. Looking at all funds, public positions are down by 418. The key to smaller government is fewer bureaucrats, and while these are small changes, at least they are going in the right direction.

This budget is not perfect, though. No budget ever is.

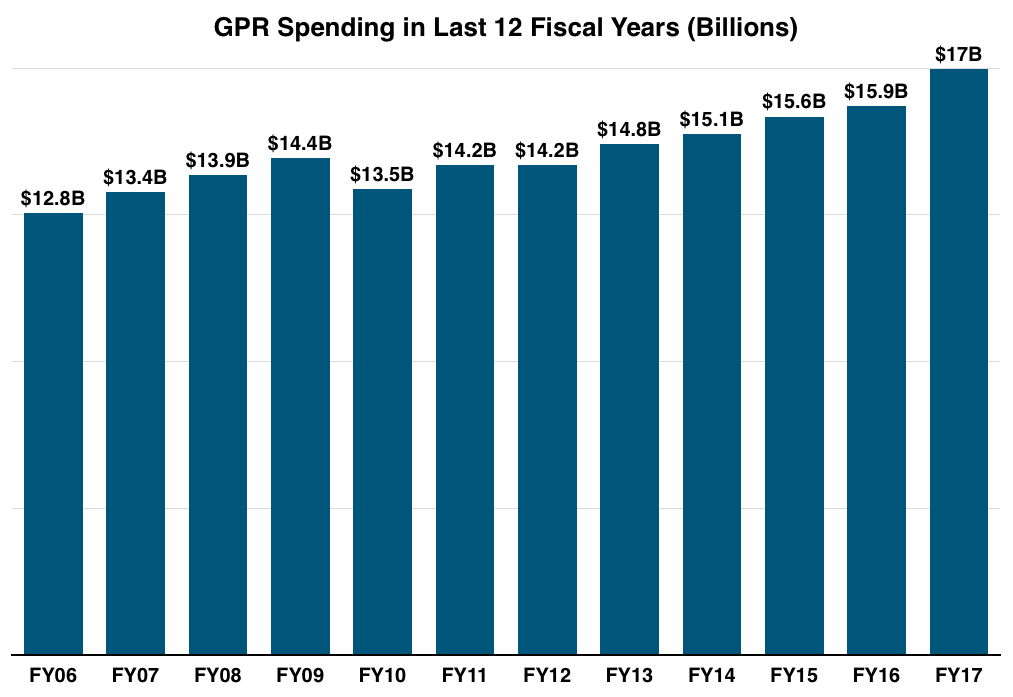

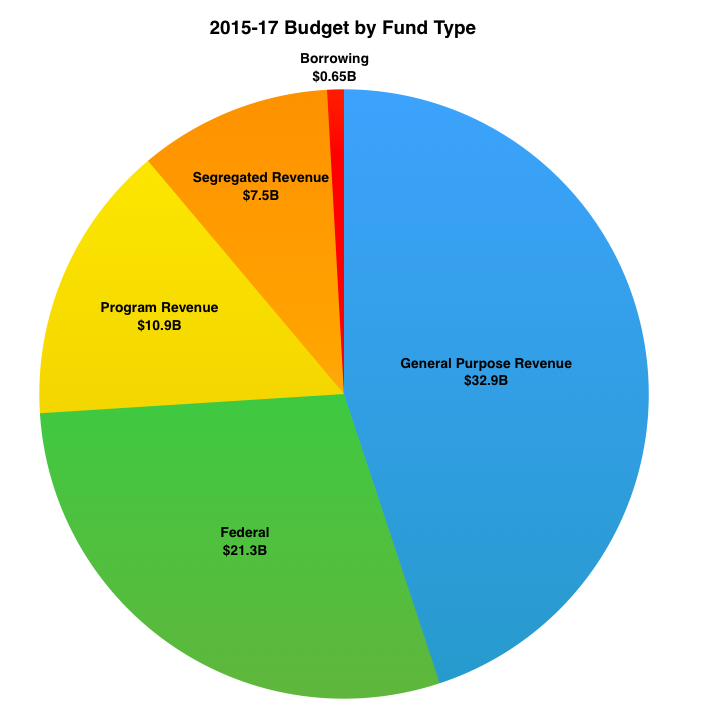

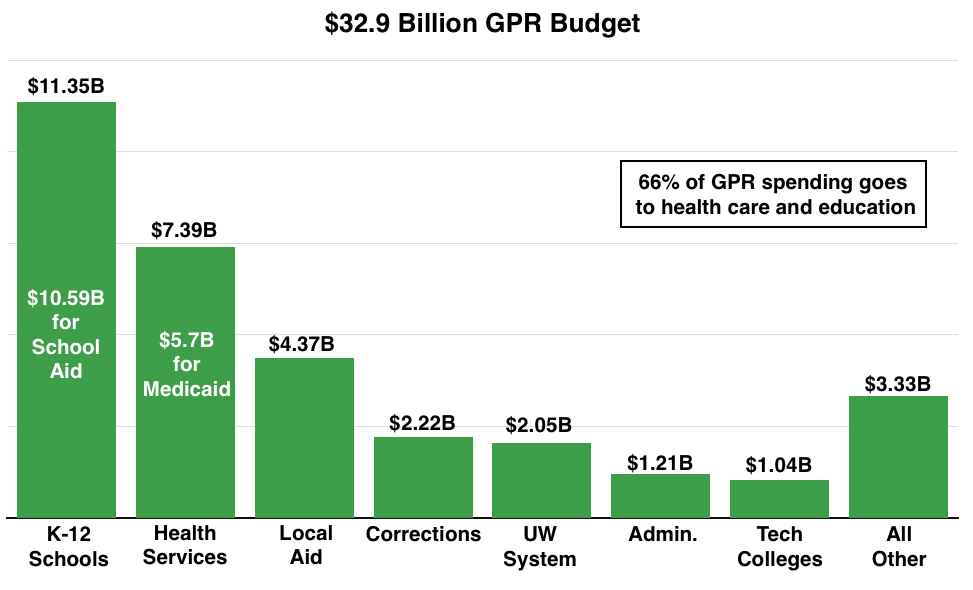

Spending once again increased. Under the 2015-17 budget, general purpose revenue (GPR) spending – made up of revenue from state taxpayers – is up about $1.1 billion when compared to the previous one. That is an increase of 3.5 percent. Overall spending – including federal, program and segregated revenues – is up $2.6 billion or 3.8 percent.

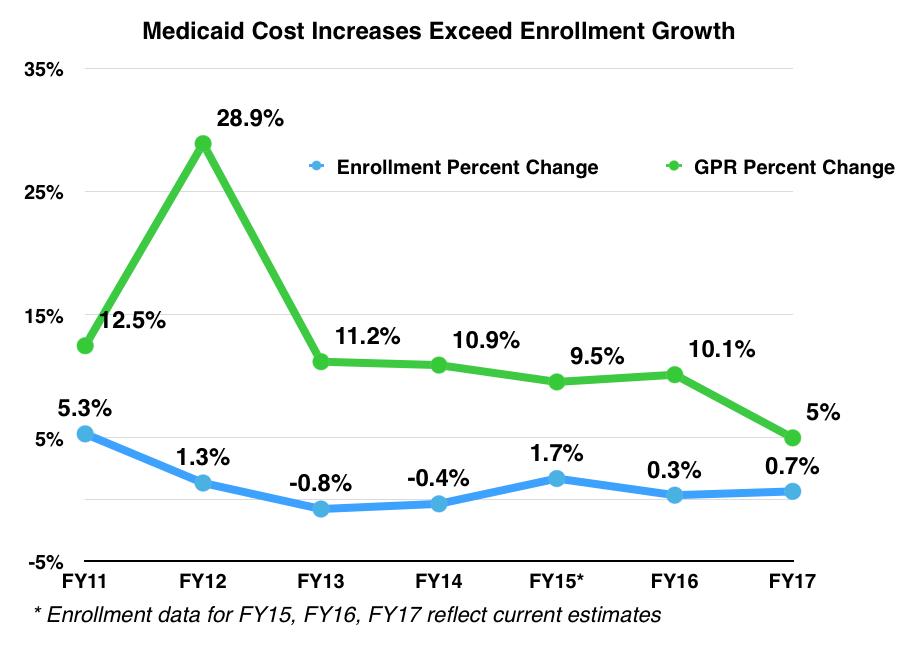

In both cases, the major driving factor of increased spending was BadgerCare. Even without taking the federal money to expand Medicaid, GPR spending increased by $648 million for the program. Looking at all funds, Medical Assistance spending is up more than $1.8 billion.

Medicaid is clearly the driving factor to increases government spending in Wisconsin.

There were other problems, too – like the last-minute attempt to change the state’s open-records law. But don’t let the well-deserved and absolute thrashing Gov. Walker and legislative leaders took over open records distract from the fact that this budget, on many fronts, moves Wisconsin forward.

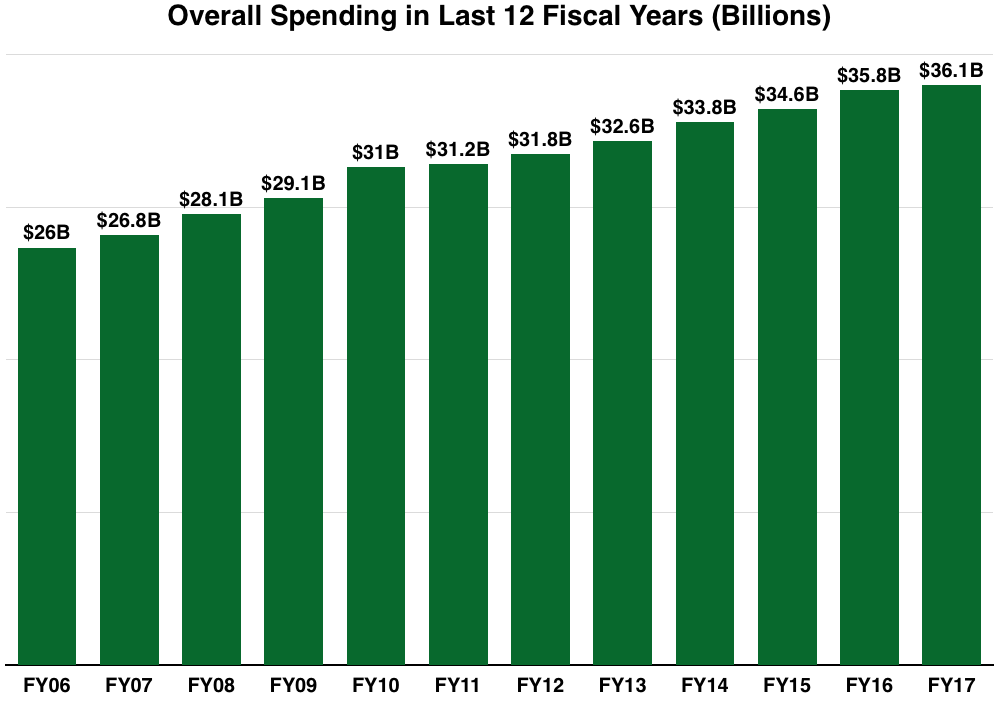

The newly signed 2015-17 budget spends $4.4 billion more overall than the 2013-15 budget did, or 6.4 percent more. In the General Purpose Revenue (GPR) category – which is state tax money that mainly comes from income taxes, sales taxes and corporate taxes – this budget spends $2.4 billion more, a 7.8 percent increase.

Madison, however, uses a different math called “base-year doubled” to track its spending. Under the base-year doubled scenario, the 2015-17 budget is an increase of $2.6 billion in all funds spending, or a 3.8 percent increase. For GPR, spending will increase by $1.1 billion, or by 3.5 percent.

Base-year doubled obviously makes spending increases look smaller than reality. Here’s a look at overall spending and GPR spending in the last 12 years.

Even though Gov. Walker and the legislature were responsible and passed a balanced budget that matches spending with revenues that will come in over the next two years, it is disappointing to see such a large increase in spending. Whether you consider year-over-year or base-year-doubled the proper accounting tool, both measures grow the size of state government by billions of dollars.

If Wisconsin’s taxpayers ever want to see substantial tax cuts again, lawmakers must identify more ways to restrain government spending and shrink the size of state government. Wisconsin already spends more per capita than every Midwest state save Minnesota and tax-happy Illinois. Are we really getting our money’s worth by redistributing $73 billion through Madison?

On the positive side, lawmakers once again looked out for the interests of property taxpayers in this budget. Gov. Walker’s $319 million property tax relief package was endorsed by the legislature and will freeze property taxes in the next few years. Under this budget a typical homeowner in Wisconsin will experience his or her fifth and sixth straight year of a property tax freeze or reduction.

The legislature also made progress toward fixing the “marriage penalty” for married joint-income tax filers by increasing their deduction amounts. Currently, single filers can claim a larger combined deduction than those filing jointly. This results in a penalty of sorts for married couples, who cannot claim as big of a deduction on their taxes. While the budget made strides in improving the penalty for taxpayers, there is still more reform needed.

Members of the Joint Committee on Finance (JFC) also aligned Wisconsin’s Alternative Minimum Tax (AMT) to the federal AMT. This move will save taxpayers $6 million in the 2015-17 biennium and is projected to give back taxpayers $55 million in the 2017-19 biennium.

While Wisconsin is still one of only a handful of states to administer an AMT, Rep. Dale Kooyenga (R-Brookfield) and Sen. Howard Marklein (R-Spring Green) are making headway to fix this tax code problem. The AMT essentially acts as a second tax code for the unfortunate few who qualify.

The budget also lowers borrowing by 67 percent compared to the last budget, appropriating $652 million that will mainly be used on transportation projects. That number is lower than the $850 million approved for transportation borrowing because previous bonding authority that had yet to be used was eliminated in this budget. More on that later.

Education is always the top issue debated in any budget and rightfully so; education spending still remains the single biggest expenditure of tax dollars in the state budget. There was a lot of discussion this spring as the Finance Committee went through its process about how much funding our K-12 schools need. Walker’s budget proposal called for a $127 million cut in K-12 school aid in the first year of the budget, but members of Joint Finance voted to restore that funding and added $69 million more in the second year of the budget.

These increases in categorical school aid (funding on top of general school aids) will provide schools with $150 per pupil in fiscal year 2016 (FY16) and $250 per pupil in FY17. While detractors of the state budget have claimed massive cuts to K-12 education, state funding for public schools actually increases by $203 million in the budget – an increase of 3.9 perent.

The legislature also passed many important reforms for K-12 education.

The Racine Parental Choice Program and the statewide Wisconsin Parental Choice Program will be allowed to grow by mirroring the current arrangement for public school open-enrollment. Any student who transitions from a public school to a private choice school in one of these two choice programs gets to take the state voucher amount from that public school’s state generalization aid to help pay for the private school.

However, the public school district would get to count the student for their revenue limits, and would keep the difference between the voucher and the per pupil generalization aid. That means that public schools get to keep a “bonus” of sorts if a child chooses to switch to a choice school under the new plan. According to one estimate, the open-enrollment-style transition means that any given public school district could receive $20 to $60 dollars more per student if every eligible student in that district switches to one of the school choice programs.

By modeling it after open-enrollment, Wisconsin might finally be heading toward a system where the money follows the students – whether they attend a traditional public school, a public charter school or a private choice school.

The voucher amount granted to school choice participants in the Racine and Statewide programs will be increased by $12 in FY16 and by another $108 in FY17, totaling $7,330 for a K-8 student and $7,976 for a high school student by 2017. By comparison, the average state support for a child attending a public school in the 2013-14 academic year was $12,546.

Enrollment caps will also be removed for the two school choice programs. Currently, the Racine school choice program has no cap on enrollment, but the statewide program has a cap of 1,000 students. Under the new plan, school choice enrollment would be subject to an escalating enrollment ceiling.

Starting in FY18, the statewide enrollment cap is effectively eliminated. However, each public school district, including Racine, may only lose one percent of its students to the Racine and statewide choice program each year. By 2028, the year after 10 percent of a district’s students can enroll in a choice program, all caps would be removed.

Demand for statewide school choice has grown quickly since its inception in 2013. A total of 2,415 students applied for the 2013-14 school year when the cap was set at 500 students. For the upcoming 2015-16 school year, the number of applications has jumped 47 percent from just two year earlier to 3,540 applications, and the cap is set at 1,000 students.

The legislature also took a bold step in reforming Wisconsin’s chronically failing public schools in Milwaukee. In the 2013-14 school year, MPS was the only district in the state to earn a “Fails to Meet Expectations” grade from DPI and more than one in three MPS schools failed to meet Wisconsin standards.

State taxpayers spent half a billion dollars on 66 public schools that “failed to meet expectations” on the State Report Card. In an attempt to reverse this abysmal trend, Rep. Kooyenga and JFC co-chair Sen. Alberta Darling (R-River Hills) introduced a plan called the Opportunity Schools Partnership Program (OSPP). OSPP will require the Milwaukee County Executive to appoint a commissioner who will select one to three schools in the first year and up to five schools starting in 2017 to be part of the program.

The commissioner will choose new operators for the selected schools and attempt to improve student outcomes. Existing staff at these schools would have to reapply for employment and the commissioner would have discretion over employment at the schools.

Additionally, Gov. Walker was hoping to create a statewide charter school authorizing board in the budget that would have approved new charter schools across Wisconsin. However, the legislature trimmed the charter school authorization authority proposal to just five entities instead.

The Office of Educational Opportunity in the UW System, the Gateway Technical College District Board, the College of Menominee Nation, the Lac Courte Oreilles Ojibwa Community College and the County Executive of Waukesha County will now have the ability to authorize charter schools when local school boards refuse to give parents more high-quality education options.

Walker’s plan for school accountability was also altered in the legislature. Instead of Walker’s idea of issuing easy to understand A-F letter grades to schools and school districts to measure proficiency, like a child’s report card, a strange one-star to five-star system will be used. Apparently, school administrators vehemently oppose an A-F system out of fear that a low mark will not be easy to explain away.

Funny, we thought the grading system was for parents and taxpayers, not the educrats.

Finally, another change will allow schoolteachers to take a tax deduction for school supplies and instruction materials that they purchase with their own money for use in their classroom. This is expected to give $2.2 million back to teachers over the next two years.

While K-12 education garnered a lot of attention, higher education may have received even more during this year’s budget debate. That is because Gov. Walker suggested cutting state funding to the UW System by $300 million over the biennium and to “spin-off” the System to operate as its own public authority.

For some background, UW has done little to gain the trust of Wisconsin’s taxpayers after being caught with a billion dollar slush fund in 2013. That surplus accumulated while the System was raising tuition on students year after year. In response, Walker and the legislature instituted a two-year tuition freeze for in-state undergraduate students. This year’s budget ensures another two-year tuition freeze for in-state undergraduates, as well as for high-demand fields at Wisconsin’s Technical Colleges.

The legislature could not bring itself to grant UW full public authority status, even though UW System President Ray Cross thought it was a good idea. A separate public authority would have taken the UW’s 35,000 employees off the state’s payrolls and allowed the Board of Regents to truly govern their campuses without legislative micromanaging.

Even though the UW System received the two-year tuition freeze and a funding cut in the last budget, recent financial documents show that UW’s slush fund has not gone away. Just one year after the cut and freeze, an end of year balance of nearly $1.2 billion was found at the System. Additionally, two of UW’s non-profit foundations – Wisconsin Alumni Research Foundation (WARF) and University of Wisconsin Foundation (UWF) – have grown their assets to a combined $6 billion, which is about the size of the UW’s entire two-year budget.

Clearly, UW has the resources to absorb Walker’s original cut of $300 million. The legislature was generous, however, and restored $50 million in funding to the System plus an extra $8 million to fund salaries and benefits for UW employees. When the UW System’s total two-year budget is considered, $250 million amounts to a 2.1 percent cut.

The legislature also granted important budget flexibilities that will help UW better manage its finances going forward. The UW will have greater authority over purchasing as well as the ability to introduce merit pay. Unfortunately, Gov. Walker vetoed a provision that would have given the UW exclusive authority over its procurement and leasing. This item was included by the legislature and, according to Cross, would have helped to save tens of millions.

Taxpayers also missed a golden opportunity to make the UW system more transparent and taxpayer-friendly by requiring an annual third-party audit. While the legislature approved the audit, the governor vetoed the provision, claiming that the Legislative Audit Bureau can fill the role of financial watchdog at the System. We hope that will be the case, but a third party audit would only have helped taxpayers given the UW’s recent financial mismanagement.

Lawmakers also missed the chance to require a true comprehensive audit of everything UW by including WARF, UWF and other UW affiliated entities in a financial examination. Taxpayers need a true and complete overview of the UW’s finances and excluding such successful components of the UW system is a disservice.

Another missed opportunity is the failure to institute an open checkbook system at UW, similar to the checkbook transparency offered at Openbook Wisconsin. Openbook Wisconsin allows everyone to view every check that the state writes, showing taxpayers exactly where our tax dollars are being spent. If state government can put its checkbook online, the UW should, too.

This budget was certainly not without problems and controversies. JFC’s 999 motion is a place where special interest provisions and pork-like items get stuck into the budget with little fanfare. This year’s 999 was no exception. It included nearly 70 law changes, most of which frankly does not belong in a budget.

The Joint Committee on Finance used the 999 to slip in troubling open records law exemptions for the legislature. The provision would have essentially blocked the public from obtaining any documents or communications from the legislature or any other elected officials in Wisconsin. Groups from across the ideological spectrum blasted the move as a big step backward in government transparency. Thankfully, the Senate promptly took the open records provision out of the budget during their voting session.

Unfortunately, not every bad decision was caught and eliminated from the budget. Another item that did make it in allows the state to skirt around statutory requirements that make sure the budget ends up in the black. Item 9 of the 999 motion will allow the budget to be passed without actually balancing at the end of FY17. A balanced budget is in the state statutes for a reason and giving the legislature a temporary pass is not good for fiscal responsibility in Wisconsin.

Naturally, there was a great deal of pork in this budget, $34 million in all. Legislators from all over the state used the budget process as an opportunity to slip in funding for their pet projects. Eau Claire residents will get $15 million in GPR-supported borrowing for the Confluence project even though there are growing concerns that the state borrows too much. While high priority transportation projects around the state are being delayed, legislators found a way to send money to the Town of Seneca to replace a bridge and send $1.6 million to Neenah and Menasha to connect a trail. Another $10 million will go to build facilities for Carroll College and Marquette University, both private schools, and to help build a Wisconsin Agricultural Education Center near Sheboygan.

Thankfully, Gov. Walker vetoed $1.25 million worth of pork spending that was initially included by the legislature. As the table shows, however, nearly $33 million in pork spending was signed into law.

Towards the end of the budget debate, we started to see an increase in the amount of questionable or extraordinarily narrow provisions that legislators wanted to include. Most appeared in the 999, but many also found their way into the tax motion, transportation motion and others. Take a look at some of the oddly specific items that are now signed into law.

– Nonemergency Medical Transportation in Southeastern Wisconsin

– Pharmacy Benefit Manager Regulation

– Septic and Well Pump Installer Electrician License Exemption

– Local Electrical and Multifamily Sprinkler Code Ordinances

– Highway Signs for the Wisconsin Basketball Coaches Association

– Exempting deer sold to game farms and hunting preserves from sales tax liability

– Special treatment for the Town of Wyoming to grant one additional liquor license over its quota

Yet another bad inclusion is the decision to delay the full phase-in of the Manufacturing and Agricultural Tax Credit just to grab $16.8 million for other use. Instead of cutting spending to find extra money, delaying this tax credit will take that money away from Wisconsin businesses.

Legislators also missed a few great opportunities to lessen the state’s footprint and save taxpayers money in the budget. Gov. Walker initially suggested that the Knowles-Nelson Stewardship program be frozen until a more sustainable debt ratio is reached. That made a lot of sense considering 70 percent of the Department of Natural Resources’ GPR budget is used to pay off Stewardship debt. These days, that’s equal to $90 million a year. Unfortunately, the legislature decided to let the program continue to acquire land and put Wisconsin in more debt.

The governor was also hoping to take a step towards agency consolidation by merging the Department of Safety and Professional Services and the Department of Financial Institutions as well as combing the Wisconsin Economic Development Corporation and Wisconsin Housing and Economic Development Authority. These agencies are relatively small and have similar missions to their consolidation partners. The legislature could not find a way to follow through, however, foregoing the opportunity to streamline government and find efficiencies.

In what looked to be a great move for taxpayers, the legislature added a requirement that state agencies submit budget requests that assumes zero growth. This provision would have helped to fix the agency “wish-list” budget phenomenon where departments send the Governor their wish list of spending ideas and funding requests without any regard for the taxpayer and our ability to pay for it. If, in addition to a wish list, agencies were forced to submit a no growth or zero percent budget request, taxpayers and lawmakers would have a better idea of what an agency really needs and what of their request is new and unnecessary spending. We say “would have” because Gov. Walker, defying fiscal common sense, vetoed this requirement out of the budget.

Lastly, the legislature came very close to ending the ancient and no longer necessary Local Government Property Insurance Fund (LGPIF). The LGPIF is a program where state government provides insurance for local governments. The LGPIF was started back in 1903 when supposedly there wasn’t a private market to this need and the program has recently run a deficit.

Problem is, nowadays there exists a very robust and healthy insurance market — a PRIVATE insurance market. In fact, the Onalaska School District just recently put out to bid its LGPIF needs and the administrator was pleasantly surprised to find out that Onalaska could save $27,000 premium payments by switching to private insurance. Think how much money taxpayer’s could save statewide if every local unit of government in Wisconsin switches to private insurance.

Gov. Walker continued his efforts to streamline and reform state government operations in this budget.

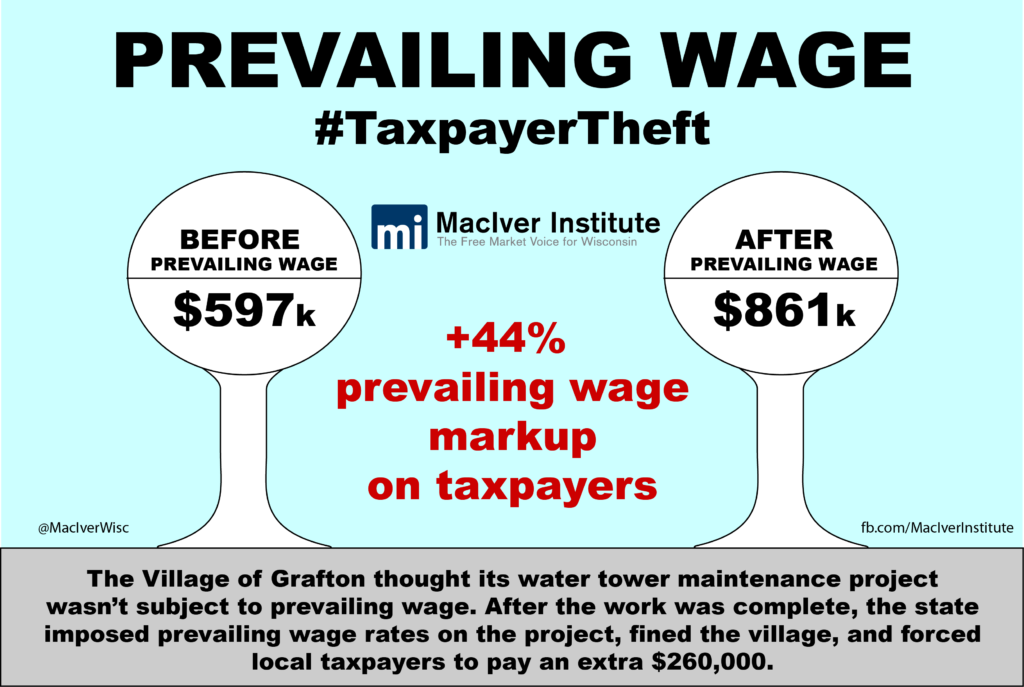

The most significant reform for taxpayers was added late during the budget process amid considerable controversy – significant reform to the state’s prevailing wage law. Perhaps it was so controversial because of the hundreds of millions of dollars it will save taxpayers in the future. Special interests, feeding at the government trough for decades, hate it when the taxpayers score a victory.

As MacIver has pointed out over the last few weeks, prevailing wage repeal and reform plans were being introduced almost daily towards the end of the budget process. Finally Sen. Frank Lasee’s (R-De Pere) plan took hold.

The plan will exempt all local governments and other local jurisdictions from adhering to the cost-inflating wage law. This means that local taxpayers will see their public projects become much more affordable because workers will now be paid their true market rate.

As the example of the Grafton water towers shows, this will help to significantly lower the cost of government construction projects at the local level. According to a recent study published by Wisconsin Taxpayer Alliance, exempting local governments from prevailing wage could possibly save millions and millions of dollars a year.

Unfortunately, Lasee’s plan would maintain prevailing wage requirements for state projects, but wage rates would be taken from the federal Davis-Bacon law, which determines rates for employees working on federal projects. This would eliminate the complicated and inaccurate survey method of determining Wisconsin’s prevailing wage rates currently done by the Department of Workforce Development.

The plan also borrows a few provisions from Assembly Speaker Robin Vos’ prevailing wage plan. It will make it harder for third parties to investigate whether the state is following through on prevailing wage determinations for employees on public projects. Only an employee may make such an investigation, and if a third party does want to inquire, they have to provide a written statement that they do not work for the state. This addresses a concern first brought to light by Media Trackers where third party interest groups were harassing contractors and governments into providing compliance information.

The only setback to the prevailing wage reform plan is that it will not go into effect until 2017. Anything less than immediate reform is simply not soon enough for Wisconsin’s taxpayers. Wisconsinites deserve to realize savings from the prevailing wage changes now.

Another point of emphasis in this budget was tightening up on fraudulent use of Wisconsin’s entitlement programs. To continue to improve the effectiveness of welfare programs in the state, the budget includes drug screening, tests and treatment for Work Experience programs, childless adults on Medicaid and FoodShare, and for Unemployment Insurance.

For the state’s Work Experience Programs, which offer transitional jobs services and benefits for poor adults looking to become self-sufficient, the Department of Children and Families (DCF) would be charged with administering drug screens and tests on certain participants. DCF would be given $500,000 over the biennium to cover the costs. Screening and testing is also required under the FoodShare Employment and Training program.

Drug screening and testing for childless adults who are Medicaid participants was also approved in the budget, which would need a waiver from the federal Center for Medicaid Services. Lastly, drug testing for Wisconsin’s Unemployment Insurance (UI) program was adopted. The Department of Workforce Development, which houses the UI program, will take care of administering the screening and testing process.

Wisconsin’s UI program is no stranger to fraud. Between 2008 and 2010, the amount of fraudulent payments in the system shot up from $21 million to $78 million. The number of cases increased 130 percent. The amount of overpayments over $1,000 that were intentionally concealed went from $9.25 million in 2007 to $40.5 million in 2010, a 338 percent increase. While steps have been taken to stem fraudulent payments, drug screening and testing will make sure that participants are using UI benefits to actually get a job.

It is important to understand that drug screening, testing and treatment is not only to protect taxpayers against fraudulently using their tax money, but it’s also to help the people using the benefits. Welfare participants will be offered drug addiction treatment if they need it, which will help both the individual and taxpayers down the road. MacIver believes that moving Wisconsinites off public assistance to a private sector job is best for the individual and would help to reduce the size of the state budget in the long run.

Other ways that the budget will cause efficiencies in the future include launching a shared services initiative at the Department of Administration (DOA) and eliminating 14 boards and commissions that haven’t met in over a year. The DOA’s shared services pilot will attempt to consolidate administrative work in many state departments and has the potential to reduce overhead.

Health care might be the most challenging policy area for Wisconsin’s lawmakers. Like any government entitlement, Wisconsin’s health care programs for the poor are complicated and expensive. An extra $648 million of precious GPR had to be automatically added to the state’s Medicaid budget just to keep up with projected costs over the 2015-17 biennium.

One of the most significant cost drivers in the Medicaid program is long-term care, a series of programs aimed at providing comprehensive care for the frail elderly and developmentally disabled. Long-term care makes up just seven percent of Medicaid enrollees but accounts for 40 percent of the costs.

In an attempt to “bend the cost curve” of long term care, Gov. Walker initially proposed to change the current fractured, localized system that leads to administrative overlap and higher costs. He proposed going the way of states like Tennessee and Texas by creating a statewide program run by a managed care organization.

The legislature crafted a compromise plan that would keep many of the existing local structures in place but introduces competition by allowing multiple managed care organizations to offer plans in a specified region of the state. The legislature stipulated that no less than five regions would have to be created, but Walker vetoed that requirement, saying that it should be up to the Department of Health Services to decide how many regions are needed.

Popular services such as Family Care and I Respect, I Self-Direct (IRIS) will be preserved under the plan. With little to draw from when it comes to estimates on the fiscal effect of the change, only time will tell whether this plan can actually save money down the road.

SeniorCare – Wisconsin’s drug prescription program for the elderly – was preserved to function as it is currently set up despite Walker’s effort to transition a portion of SeniorCare participants to the federal Medicare Part D program. A partial switch to Medicare Part D would have saved $55 million in the first year, including $10 million GPR.

Many lawmakers may feel they have done much to change the government health care landscape in Wisconsin since Walker took office. They created an innovative and comprehensive BadgerCare plan in 2013 that makes sure every Wisconsinite living at or below the poverty level has access to health care, and they made necessary changes in this budget that may bring down costs. However, lawmakers will need to continue their efforts to deal with the rising costs to taxpayers that health care brings. We hope that new and creative ideas will be brought to the table during the next budget debate in 2017.

Budget deliberations were delayed for four weeks because of one issue: transportation spending. Gov. Walker proposed borrowing $1.3 billion to keep transportation projects around the state on schedule. While legislators publicly balked at the high level of proposed bonding, there was very little discussion on what kinds of projects and spending could be canceled or delayed.

In the end, the legislature decided to approve approximately $850 million for transportation bonding, which includes $350 million to be held in reserve for possible use on road projects that would have to be approved by JFC.

While the DOT bonding sits at $850 million, the legislature and governor eliminated previously approved bonding authority that had yet to be used as well. In effect, the total net authorized new bonding was brought down to $652 million for the biennium. The level of new bonding is the lowest it has been in decades and is a 67 percent decrease from the last budget.

This is good news for future taxpayers who will pay down the debt, but legislators have a long way to go to weed out wasteful and unnecessary spending at the Department of Transportation.

MacIver has identified millions of dollars worth of wasteful projects at the DOT in the past few months. This includes: pedestrian bridges being built less than two blocks away from an existing pedestrian bridge, murals on the bottom of bridges where drivers can’t see them, ripping up existing intersections in the middle of nowhere to build roundabouts and building fishing piers with gas tax money.

Thankfully, the legislature approved measures that would get rid of “Complete Streets” requirements that make sure bicycle lanes and sidewalks are a part of all state funded highway projects. In addition, the wasteful “Community Sensitive Solutions” program is now eliminated, which is responsible for the murals and fancy beautification that taxpayers are billed for.

The legislature also included an audit of the DOT’s State Highway Program in the budget so that the public could see exactly how new project determinations are being done. However, Gov. Walker vetoed this audit, leaving it up to the legislature to spur the LAB to do one. The State Highway Program hasn’t been audited since 2003. Multiple legislators have called for such an audit since the signing of the budget.

Walker and the legislature do deserve credit for not giving into special interests that wanted the gas tax raised and vehicle registration fees increased. No tax increases should be considered until we have analyzed every DOT program for wasteful spending.

While there were many concerns brought up throughout the budget process – some of which still exist – the guts of this budget are a win for Wisconsin taxpayers. It could have been better, but on the whole, it keeps the state moving in the right direction.

There are no new taxes. There are no tax increases. Bonding is at its lowest level in recent memory. Major education reform plans were included. And prevailing wage was repealed at the local level and reformed at the state level.

There were quite a few other small victories too that we mentioned above. Even with the millions in pork, the attempt to undercut the open records law and the increased spending, this budget is still very good for taxpayers and it will keep moving Wisconsin forward. Overall, the MacIver Institute gives the 2015-2017 Wisconsin state budget a “B+.”