By Matt Crumb

Bob Ford’s Waukesha-based construction company was multiple weeks into a local airport project to erect a metal building when he was told by the state that he had been paying his workers the wrong wages the whole time.

Apparently, there was a mix-up in assigning the “prevailing wage” for Ford’s project.

Wisconsin’s prevailing wage law requires contractors working on public projects to pay their workers arbitrarily calculated “prevailing” wages and benefits. State bureaucrats are charged with setting these wage and benefit levels based on a survey sent out to contractors around the state. Instead of paying workers what they are normally paid for private projects, contractors must pay their workers whatever the state says is “prevailing.”

“We get the building half-way up and we’re told by DOT (Department of Transportation) ‘no you’re not supposed to use that rate, you’re supposed to use ironworkers rates,'” explained Ford.

“Well how am I supposed to know that?”

DOT’s response was unsympathetic: “The federal government doesn’t recognize metal buildings, and you should know that, so you should have used ironworkers rates.”

During the bidding process, Wisconsin’s Department of Transportation (DOT) had given Ford a manual of wage rates determined by the state to be “prevailing” for the types of trades performing the work and in the county where the project was being done. Since the project was the construction of a metal building, he logically chose the metal building classification at $23 per hour.

After the call from DOT, Ford was required to pay his workers more than double the initial amount, or $54 an hour. Ford then hired an attorney to sort out the mess, but was only able to lower the rates to $45 an hour, a rate that applies to ceramic tilers.

By the way, there are no ceramic tiles on the project.

Besides being completely antithetical to the way the market sorts out wages, Wisconsin’s methodology for calculating prevailing wages is narrowly focused and badly biased.

Prevailing wages in Wisconsin are calculated from an annual survey sent out to contractors who report wages and benefits paid to workers throughout the year. Unfortunately, only 10 percent of these surveys are correctly returned, and most are from union shops. The “prevailing” wage and benefit rates are then selected from only the highest submissions, further distorting a true market rate.

A recent study by the non-partisan Wisconsin Taxpayers Alliance (WISTAX) on Wisconsin’s prevailing wage methodology provides a perfect example of the convoluted results. Average weekly wages in rural Washburn County are nearly half those in urban Waukesha County, or $569 to $1,119. Despite this regional economic disparity, the prevailing hourly wage for roofers is higher in Washburn County at $30.50 than in Waukesha County where it is $29.40.

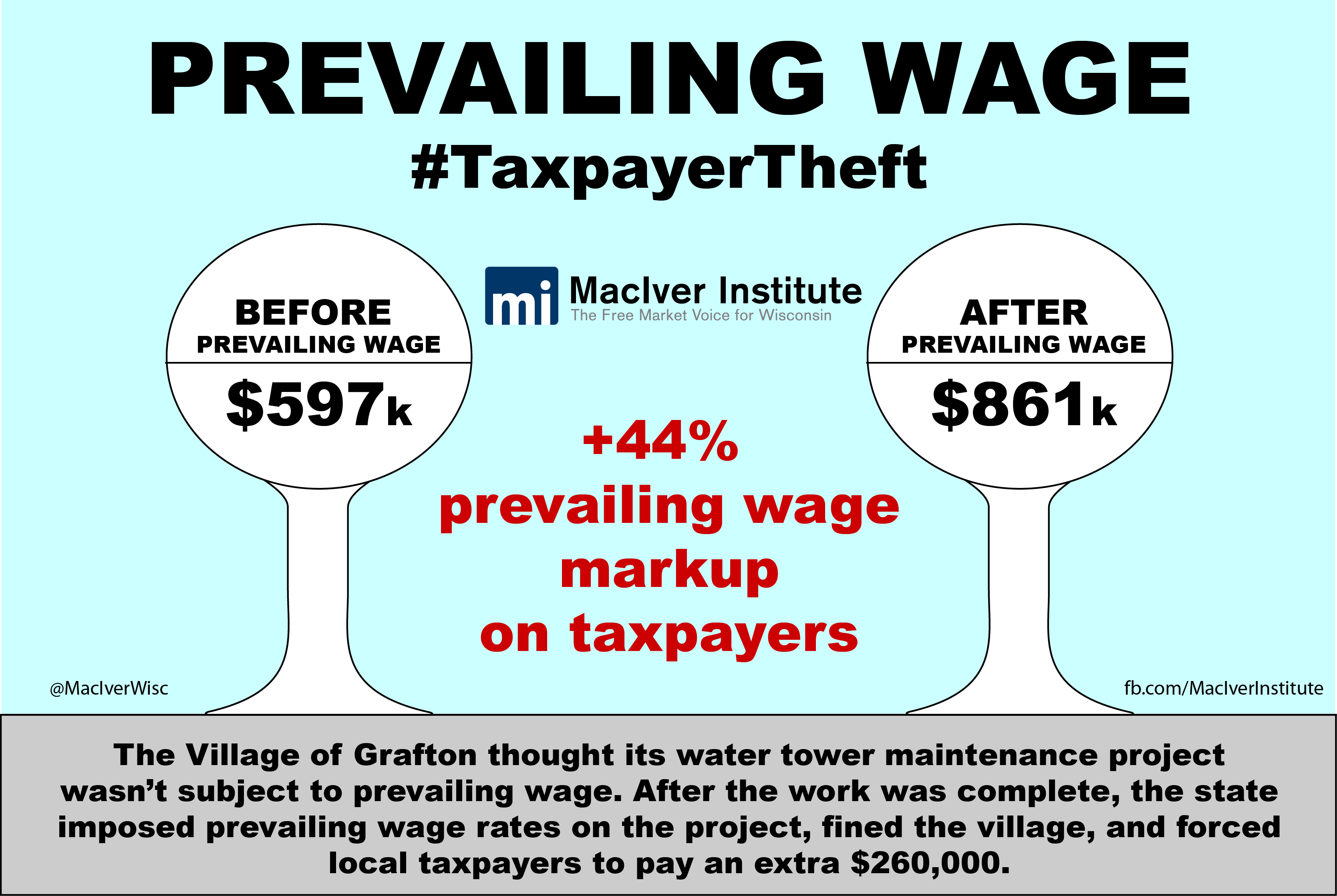

WISTAX’s study reveals that prevailing wages and benefits packages assigned for public projects in Wisconsin are typically 45 percent higher than true market rates for the same Wisconsin workers. That means taxpayers are stuck paying higher prices on public projects.

This overestimation of wage rates cost taxpayers up to $300 million in 2014 on government vertical construction projects alone.

Prevailing wage is not only a burden on taxpayers, it can also keep smaller contractors from bidding on public projects. Bigger, more established firms who already pay high wages benefit from inflated wage rate requirements. This leaves out the little guy who wants to compete for work by offering a more affordable price. A healthy market sure doesn’t operate like that. Smaller, leaner contractors should feel like they have a shot at public projects if they can bid competitively. You know, like how the rest of the world works.

It is no wonder that Wisconsin and other states such as Michigan and Indiana are looking to repeal their prevailing wage equivalents. The prevailing wage law is a nightmare for small businesses and taxpayers alike.

This column was originally carried by Watchdog.org.