January 27, 2015

by James Wigderson

Special Guest Perspective for the MacIver Institute

Governor Scott Walker made an important announcement Tuesday at the Metropolitan Milwaukee Association of Commerce directors meeting. His announcement is the inclusion of the “jock tax” in the state budget to help finance a new arena for the Milwaukee Bucks, as reported by the Business Journal last Friday. However, the new proposal is different than what was originally floated.

In an interview Tuesday morning, Walker explained to me the new plan for financing the arena for the Bucks organization. Instead of diverting all state income tax revenue generated by Milwaukee Bucks and the NBA, the state will continue to receive the $6.52 million annually for the state’s general fund. Future income tax revenue growth above that level will then be diverted to financing bonds to pay for the public share of the arena costs.

Walker said he was concerned if the state did nothing, the state would lose that revenue from the general fund. “Doing nothing is not cost neutral. Doing nothing, as of 2017 on, poses a significant financial risk for the state.”

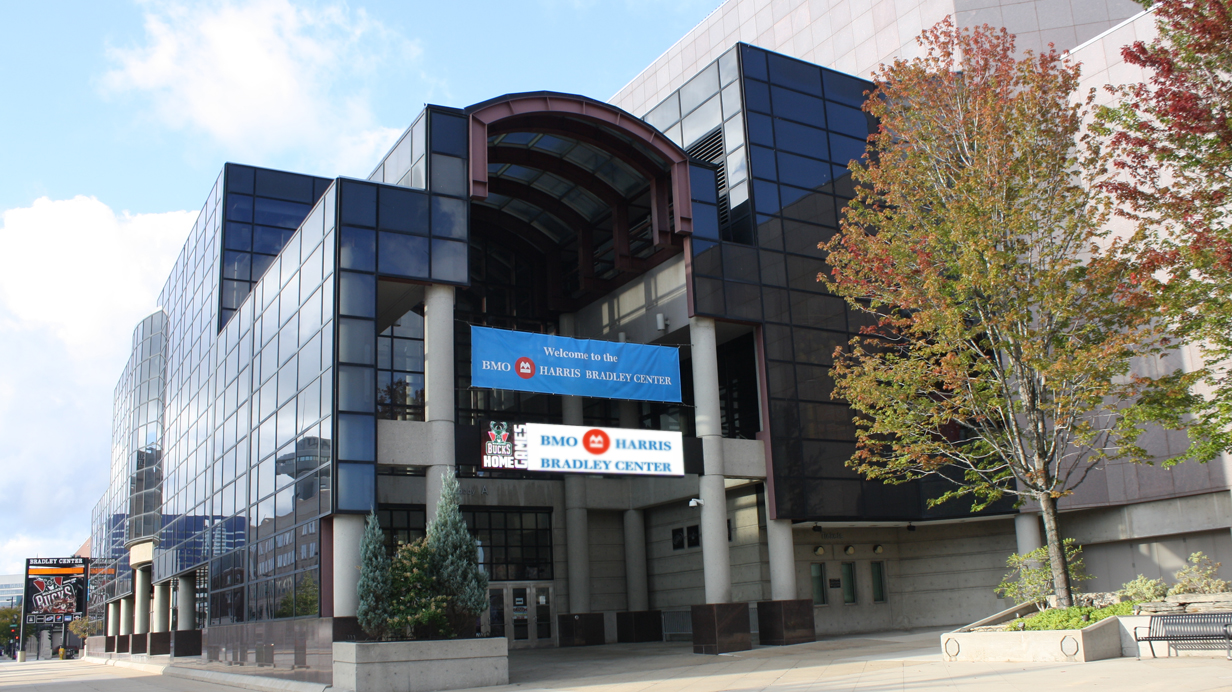

The future of the Bradley Center is also a state responsibility, according to Walker. “Because of the way the Bradley Center was set up years ago, the state is on the hook for that, so we have a big white elephant without the bigger tenant, for which there is about $100 million in deferred maintenance over the next couple of decades.”

But Walker said he was looking for a “fiscally conservative, free market approach.”

“I set as a goal, trying to figure out a way with our team of how we could not only not have any new taxes, but how we could not touch what we currently have in the general fund budget.”

Using what Walker called “very conservative estimates,” the administration calculated the amount of expected increased income tax revenue over the next 25 years.

“The Bucks wanted to include sales tax but we didn’t do that,” Walker said. “Because that’s harder to quantify.”

The estimated cost of a new Milwaukee Bucks arena is approximately $500 million. The revenue from the state income tax diversion would finance the approximately $220 million in bonds for the public financing that supporters of a new arena claim is needed for the project. If the team is sold, the bonds will be the first item to be paid off before the new owners could profit from the sale.

Bucks owners Marc Lasry and Wes Edens, along with former owner Herb Kohl, have promised to contribute $250 million towards a new arena.

It is highly likely that the Milwaukee Bucks team will be forced to move their operation if a new arena is not built. As part of the purchasing agreement, Lasry and Edens have to have a new arena in place in 2017 or the NBA will buy the team (at a profit to Lasry and Edens) and move it.

Or maybe the team won’t move. Seattle Mayor Ed Murray told the Seattle Times that he was told by the NBA commissioner that any move of a NBA franchise was, “not, in their mind, something they see happening.”

If no public financing deal for an arena is reached and the Milwaukee Bucks do move, then the governor is correct that the income tax revenue will be lost to the state. But unlike the Milwaukee Brewers in the 1990s, the Milwaukee Bucks ownership group certainly has the means to pay for their own arena.

Walker said in response that other cities besides Seattle could be a possibility. As for the owners’ ability to self-finance the new arena, “To me putting up $250 million is putting their money where their mouth is.”

Certainly it will be hard to justify setting the precedent for diverting the additional income tax revenue generated by the Milwaukee Bucks from future state budgets at a time when Wisconsin residents and businesses are still paying income taxes at levels set during the Doyle era. The top income tax rate is 7.65 percent which is still higher than Illinois’ highest rate, as well as the rates in Michigan and Indiana.

Wisconsin businesses pay those income taxes, too, and those taxes affect wages and unemployment. According to the Tax Foundation, 56% of Wisconsin’s workforce is employed by “pass-through” businesses, entities that pass the profits through to owners or shareholders who then pay the federal and state income tax.

Legislators will have to weigh whether the continued contribution of income tax revenue from the Milwaukee Bucks organization is worth setting the precedent of the income tax diversion. Legislators will also have to consider whether the $250 million from the past and current owners is enough given that the team has already increased in value from $550 million to $600 million in the short time since the team sale. Given the ghost of George Petak’s recall still haunting the legislature, passing this income tax diversion may not be a slam dunk.