MacIver News Service | June 2, 2013

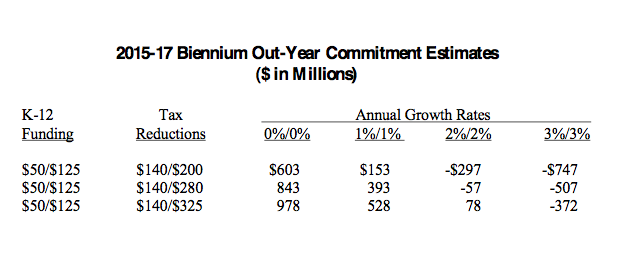

[Madison, Wisc…] Under Rep. Dale Kooyenga’s (R-Brookfield) tax reform package and annual economic growth of three percent, the State of Wisconsin would end the 2015-17 biennium with more than a $500 million surplus.According to an analysis from the non-partisan Legislative Fiscal Bureau, the state has averaged three percent annual economic growth over the past decade, a time when Wisconsin has not seen the best financial times.

Sen. Glenn Grothman (R-West Bend) asked LFB to analyze multiple different situations based on the budget decisions already made by the Joint Committee on Finance, and some possibilities for education spending and a tax cut.

With $175 million more invested in K-12 education and Kooyenga’s tax cut, which adds more than $400 million in income tax relief to Governor Scott Walker’s budget proposal, LFB projects a $507 million structural surplus.

Many of Kooyenga’s opponents have said that the tax proposal would create a $1 billion structural deficit, but those claims are based on zero economic growth over the next few years.

The full analysis from LFB can be seen here.